London Stock Exchange Group to Acquire Quantile for up to GBP274 Million

December 06 2021 - 2:47AM

Dow Jones News

By Joe Hoppe

London Stock Exchange Group PLC said Monday that it will buy

Quantile Group Ltd., a portfolio, margin and capital optimization

and compression services provider, for up to 274 million pounds

($362.7 million).

The stock-exchange and financial-information company, also known

as LSEG, said the money will be paid to Quantile's shareholders,

and will be provided from existing cash balances and facilities.

The acquisition is expected to close in 2022, subject to antitrust

and other financial approvals.

LSEG said the acquisition of Quantile and its optimization

engine will allow it to expand its range of post-trade

risk-management solutions, and complement the company's global

over-the-counter derivatives clearing services, which provide

risk-management and capital efficiencies to customers.

Quantile and LSEG's services will be available on an open-access

basis offering customers choice, and Quantile will remain a

standalone entity in LSEG's post trade division.

"[The acquisition] significantly enhances LSEG's multi-asset

class customer offering across the transaction lifecycle by

providing more sophisticated tools and infrastructure for customers

to optimize their financial resources and drive greater operational

efficiencies in [over-the-counter] derivatives," said Daniel

Maguire, LSEG group head of post trade.

Write to Joe Hoppe at joseph.hoppe@wsj.com

(END) Dow Jones Newswires

December 06, 2021 02:32 ET (07:32 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

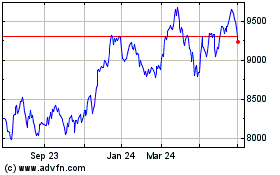

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

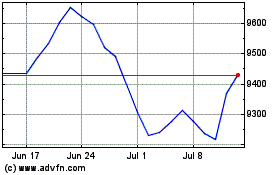

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Apr 2023 to Apr 2024