NextEra to Sell 50% Stake in Renewables Portfolio to Ontario Teachers' Pension Plan

November 30 2021 - 8:27AM

Dow Jones News

By Colin Kellaher

NextEra Energy Inc. on Tuesday said it agreed to sell a 50%

stake in a roughly 2,520-megawatt portfolio of long-term contracted

renewables assets to Ontario Teachers' Pension Plan Board, one of

Canada's largest pension funds.

The Juno Beach, Fla., electric power and energy infrastructure

company said the deal includes total consideration of about $849

million, plus the buyer's share of the portfolio's total tax equity

financings, estimated to be $866 million.

NextEra, which in October announced an agreement to sell the

remaining 50% stake in the portfolio to NextEra Energy Partners LP

on similar terms, said it expects to redeploy the sale proceeds

into new wind, solar and battery storage growth opportunities.

The company said it expects to close the transaction later this

year or in early 2022.

Ontario Teachers' Pension Plan, which invests and administers

the pensions of 331,000 active and retired teachers in the province

of Ontario, has net assets topping $178 billion.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

November 30, 2021 08:12 ET (13:12 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

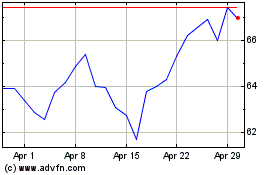

NextEra Energy (NYSE:NEE)

Historical Stock Chart

From Mar 2024 to Apr 2024

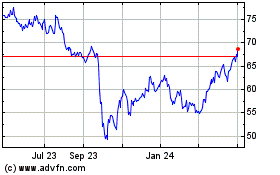

NextEra Energy (NYSE:NEE)

Historical Stock Chart

From Apr 2023 to Apr 2024