ISG Provider Lens™ report sees a new focus

from companies on tracking cloud spending and increasing efficiency

while using multiple cloud services

Enterprises in the U.S. are increasingly embracing a multicloud

operating model and are looking to cloud service providers to help

them choose the right clouds for the right workloads, according to

a new report published today by Information Services Group (ISG)

(Nasdaq: III), a leading global technology research and advisory

firm.

The 2021 ISG Provider Lens™ Public Cloud – Services &

Solutions Report for the U.S. finds enterprises also looking for

support to operate their multicloud environments in the most

efficient and effective manner possible—especially given the

growing complexity of such environments. Today, enterprises are

running on multiple clouds that need to be interconnected,

integrated and managed, and they are turning to providers for

help.

“Enterprises have recognized that moving to the cloud is

beneficial to their businesses,” said Bernie Hoecker, partner and

global leader of ISG’s enterprise cloud transformation business.

“They are increasingly willing to approach managed services

providers to help them move to the cloud in the right way and

choose the right cloud for a specific workload.”

Demand for cloud-based services is surging in the Americas

region, the 3Q21 ISG Index™ found. Annual contract value (ACV) for

as-a-service solutions soared 51 percent in the third quarter, to a

record $6.9 billion, the fastest growth rate for this segment since

ISG began tracking it in 2014.

The U.S. report notes significant growth for cloud service

providers in the past year, as more and more organizations turn to

remote work during the COVID-19 pandemic. Most managed services are

now virtually and remotely delivered, including cloud

transformation and migration of workloads.

Cloud providers are offering a range of services to help

customers with their public cloud adoption. This includes

consulting services to formulate application transformation

strategies and creating roadmaps that identify whether a workload

needs a lift-and-shift transition or whether it should be

rearchitected or replatformed to improve performance and reduce

operating costs.

Increasingly, providers are entering into value-based deals in

which benefits are shared between the enterprise and the provider,

the report says. They are also embracing platforms and tools, such

as AI and machine learning, to automate cloud operations.

Meanwhile, many enterprises are turning to cloud financial

operations, or FinOps, providers to help them track cloud

expenditures, as they use cloud resources in a dynamic and complex

manner, the report says. Use of FinOps services has skyrocketed in

recent years as cloud adoption has grown.

FinOps can increase the business value of the cloud by bring

together technology, business and finance professionals with a new

set of processes that help organizations efficiently monitor and

track their cloud resources.

The report notes that many service providers have entered into

strategic relationships with public cloud infrastructure providers

such as AWS, Microsoft Azure and Google Cloud Platform. Both sides

are working closely together to co-develop cloud offerings and have

a joint go-to-market strategy.

Providers and hyperscalers are focusing on improving and

strengthening security measures to help enterprises improve

customer experience in a highly secure cloud environment. They are

also sharing best practices to develop cloud solutions for faster

migrations, improved efficiencies in cloud resource management and

increased adoption of next-generation technologies.

Many cloud service providers are also investing to upskill their

talent in the U.S., due to a shortage of skilled professionals in

the market, the report adds. Service providers are working closely

with hyperscalers and third-party training institutes to train and

certify their employees in various cloud technologies.

The 2021 ISG Provider Lens™ Public Cloud – Services &

Solutions Report for the U.S. evaluates the capabilities of 52

providers across six quadrants: Consulting and Transformational

Services for Large Accounts, Consulting and Transformational

Services for the Midmarket, Managed Public Cloud Services for Large

Accounts, Managed Public Cloud Services for the Midmarket,

Hyperscale Infrastructure and Platform Services, and SAP HANA

Infrastructure Services.

The report names Accenture, AWS, Capgemini, Cognizant, Google,

HCL, Hexaware, IBM, Infosys, LTI, Microsoft, Mindtree, Rackspace

Technology, TCS, Tech Mahindra, Unisys and Wipro each as Leaders in

two quadrants. Mphasis was named a Leader in one quadrant.

In addition, Mphasis, Navisite and NTT Ltd. were named Rising

Stars—companies with “promising portfolios” and “high future

potential” by ISG’s definition—in one quadrant each.

ISG has also published a related report covering providers of

FinOps platforms serving the global market. The 2021 ISG Provider

Lens™ Public Cloud – Services & Solutions global report

evaluates the capabilities of 13 providers in one quadrant:

Multicloud FinOps Platforms.

The global report names Apptio (Cloudability), Flexera, NetApp

(Spot) and VMware (CloudHealth) as Leaders in the quadrant. HCL

(MyXalytics FinOps) was named a Rising Star in the quadrant.

Customized versions of the U.S. report are available from AWS,

Hexaware, Navisite and Unisys.

The 2021 ISG Provider Lens™ Public Cloud – Services &

Solutions report for the U.S. and the 2021 ISG Provider Lens™

Public Cloud – Services & Solutions (Multicloud FinOps

Platforms) global report are available to subscribers or for

one-time purchase on the ISG website.

About ISG Provider Lens™ Research

The ISG Provider Lens™ Quadrant research series is the only

service provider evaluation of its kind to combine empirical,

data-driven research and market analysis with the real-world

experience and observations of ISG's global advisory team.

Enterprises will find a wealth of detailed data and market analysis

to help guide their selection of appropriate sourcing partners,

while ISG advisors use the reports to validate their own market

knowledge and make recommendations to ISG's enterprise clients. The

research currently covers providers offering their services

globally, across Europe, as well as in the U.S., Germany,

Switzerland, the U.K., France, the Nordics, Brazil and

Australia/New Zealand, with additional markets to be added in the

future. For more information about ISG Provider Lens research,

please visit this webpage.

A companion research series, the ISG Provider Lens Archetype

reports, offer a first-of-its-kind evaluation of providers from the

perspective of specific buyer types.

About ISG

ISG (Information Services Group) (Nasdaq: III) is a leading

global technology research and advisory firm. A trusted business

partner to more than 700 clients, including more than 75 of the

world’s top 100 enterprises, ISG is committed to helping

corporations, public sector organizations, and service and

technology providers achieve operational excellence and faster

growth. The firm specializes in digital transformation services,

including automation, cloud and data analytics; sourcing advisory;

managed governance and risk services; network carrier services;

strategy and operations design; change management; market

intelligence and technology research and analysis. Founded in 2006,

and based in Stamford, Conn., ISG employs more than 1,300

digital-ready professionals operating in more than 20 countries—a

global team known for its innovative thinking, market influence,

deep industry and technology expertise, and world-class research

and analytical capabilities based on the industry’s most

comprehensive marketplace data. For more information, visit

www.isg-one.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211129005483/en/

Will Thoretz, ISG +1 203 517 3119 will.thoretz@isg-one.com

Erik Arvidson, Matter Communications for ISG +1 617 755 2985

isg@matternow.com

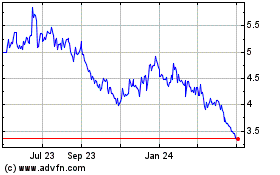

Information Services (NASDAQ:III)

Historical Stock Chart

From Mar 2024 to Apr 2024

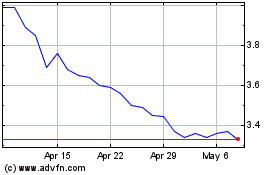

Information Services (NASDAQ:III)

Historical Stock Chart

From Apr 2023 to Apr 2024