UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☐ Filed by a Party other than the

Registrant ☒

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☐

|

|

Definitive Additional Materials

|

|

|

|

|

☒

|

|

Soliciting Material Pursuant to § 240.14a-12

|

SOUTHWEST

GAS HOLDINGS, INC.

(Name of Registrant as Specified In Its Charter)

CARL C. ICAHN

ICAHN

PARTNERS LP

ICAHN PARTNERS MASTER FUND LP

ICAHN ONSHORE LP

ICAHN

OFFSHORE LP

ICAHN CAPITAL LP

IPH GP LLC

ICAHN

ENTERPRISES HOLDINGS L.P.

ICAHN ENTERPRISES G.P. INC.

BECKTON CORP.

NORA MEAD

BROWNELL

MARCIE L. EDWARDS

ANDREW W. EVANS

H.

RUSSELL FRISBY, JR.

WALTER M. HIGGINS III

RINA JOSHI

HENRY P.

LINGINFELTER

JESSE A. LYNN

RUBY SHARMA

ANDREW J.

TENO

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11.

|

|

|

|

|

|

|

|

1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

1)

|

|

Amount Previously Paid:

|

|

|

|

2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

3)

|

|

Filing Party:

|

|

|

|

4)

|

|

Date Filed:

|

On November 24, 2021, Carl C. Icahn and affiliated entities released a presentation regarding Southwest

Gas Holdings, Inc., a copy of which is filed herewith as Exhibit 1.

SECURITY HOLDERS ARE ADVISED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS RELATED

TO THE SOLICITATION OF PROXIES BY CARL C. ICAHN AND HIS AFFILIATES FROM THE STOCKHOLDERS OF SOUTHWEST GAS HOLDINGS, INC. FOR USE AT ITS 2022 ANNUAL MEETING OF STOCKHOLDERS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION,

INCLUDING INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION. WHEN COMPLETED, A DEFINITIVE PROXY STATEMENT AND A FORM OF PROXY WILL BE MAILED TO STOCKHOLDERS OF SOUTHWEST GAS HOLDINGS, INC. AND WILL ALSO BE AVAILABLE AT NO CHARGE AT

THE SECURITIES AND EXCHANGE COMMISSION’S WEBSITE AT HTTP://WWW.SEC.GOV. INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION IS CONTAINED IN THE SCHEDULE 14A FILED BY CARL C. ICAHN AND HIS AFFILIATES WITH THE SECURITIES AND

EXCHANGE COMMISSION ON NOVEMBER 15, 2021.

Introduction SOUTHWEST GAS

(“SWX”) IS IN A PUBLIC DISPUTE WITH ICAHN ENTERPRISES L.P. (“IEP”). THIS PRESENTATION DISCUSSES THE IMPACT TO CUSTOMERS. Situation Overview The “Status Quo” and “Why this Matters to Customers” Poor

management + bad decisions = higher costs over the long term for customers IEP Believes its Board of Director Slate Can Fix the Mess New oversight + good decisions = lower costs over the long term for customers Why is IEP Doing This? We believe we

can increase the value of our investment by improving the board and management of SWX, which should result in better decision making and greater alignment of investor interests with those of SWX’s customers

Situation Overview IEP HAS LAUNCHED A PROXY

CONTEST TO REPLACE SWX’S BOARD. IEP HAS ALSO LAUNCHED A TENDER OFFER TO BUY ANY AND ALL SHARES. Southwest Gas Corp. (“SWG”) is a subsidiary of Southwest Gas Holdings, Inc. (“SWX”) Icahn Enterprises L.P.

(“IEP”) is a diversified holding company that is ~90% owned by Carl C. Icahn with seven primary segments: Investment, Energy, Automotive, Food Packaging, Real Estate, Home Fashion and Pharma (Metals segment divestiture pending) In

October 2021, SWX announced its intent to acquire Questar Pipelines for ~$2 billion in a deal structured specifically to avoid shareholder approval As a result of this deal, prior debt-heavy acquisitions, and poor operational results, IEP reached

out to management to voice its concerns IEP attempted to negotiate with SWX but so far has not received a satisfactory response IEP has since launched multiple public proposals. The two most important proposals include: Proxy Contest to replace

SWX’s current Board of Directors Tender Offer to buy any and all shares of SWX’s common stock

What is a Proxy Contest? What is a Tender

Offer? IEP IS PURSUING A PROXY CONTEST AND A TENDER OFFER. WE ARE LOOKING TO INFORM AND RECEIVE INPUT FROM THE STATES AS TO PATH FORWARD. Proxy Contest IEP has nominated ten candidates for election as directors to the Board of Directors of SWX, who,

if elected, would replace the incumbent directors. Eight of the ten are completely independent of IEP SWX shareholders will vote on IEP’s slate of Directors at the 2022 annual meeting (anticipated to occur in May). Some, all or none of

IEP’s directors may be elected Tender Offer IEP has launched a tender offer to purchase any and all shares of SWX’s common stock that are tendered into the offer. Depending on the outcome of that tender, IEP’s stake in SWX may

increase materially. IEP currently owns a 4.8% voting stake Arizona, California and Nevada have guidelines as to when a utility commission would need to approve a transaction. We believe the lowest threshold is in Nevada, where a review is triggered

by ownership of 25% or more The two proposals are independent of each other. For example, some or all of IEP’s slate of Directors could be elected to the Board and the Tender Offer could still be pending

Why Does This Matter to Arizona, California

and Nevada? POOR MANAGEMENT AND BAD DECISIONS INCREASE COSTS FOR CUSTOMERS. SWG’s general and administrative expenses increased 42% under current CEO Hester’s watch. These expenses include million-dollar homes, manicures and golf

memberships. Executive compensation also increased by 25% in 2019 and 27% in 2020 If general and administrative expenses can be cut by $10 million that could lower rates by $4.66 per customer per year SWX management takes on debt to buy expensive

non-utility assets rather than focusing on fixing its core operations. As SWX adds debt, credit ratings decline and the cost of capital increases, including the Summer 2021 downgrade arising from the $855 million Riggs Distler deal, which was

financed entirely with debt We estimate that if SWX’s credit ratings improve back to A-, the rating prior to 2021 downgrade, customers could save an average of $3.98 per year over the next 10 years (this benefit should build over-time from

under $2 in 2022 to over $8 by 2030!) Note: General and administrative expense savings = $10M / current customers. See Appendix for interest saving calculations. Pre-tax basis.

GENERAL AND ADMINISTRATIVE EXEPENSES HAVE

GROWN 42% SINCE HESTER BECAME CEO. THIS SEEMS HIGH! SOME IS LIKELY LEGITIMATE BUT... Status Quo: General and Administrative Costs Are Too High Utility General & Administrative Expenses Hester’s Added Cost

Source: State of Nevada Public Utilities

Commission filings (2018-2020). “Staff believes SWG needs to change its culture to be a better steward of ratepayer money, which begins by holding SWG’s Senior Executives accountable for the including of such invoices, costs and

expenditures without thorough and proper vetting.” “Nevada ratepayers should not be asked to pay for the cost of a District Manager to live in a million-dollar home” “Staff also found expenditures associated with bartender

costs, a golf course membership” “SWG Board of Director having a manicure and pedicure and billing ratepayers” “The Work Order for the purchase of the CEO office furniture is 0057W0004777 and the total amount is

$120,449.71” “SWG Senior Executives incurring a dinner tab in excess of $4,700” “SWG should not have performed the remodel in its existing headquarters since a new Executive Board Room will be constructed at the new SWG

headquarters building on Durango – and SWG’s ratepayers should not pay twice for Executive Board rooms.” Status Quo: Inappropriate Expenses OVER MULTIPLE YEARS, NEVADA STAFF FOUND THAT SWX WAS TRYING TO PASS ON MANICURES, GOLF

MEMBERSHIPS AND MILLION-DOLLAR HOMES TO CUSTOMERS…

Status Quo: Management Compensation is

Increasing Rapidly NEO Compensation(1) Excludes “Change in Pension Value and Non-Qualified Deferred Compensation.” … AND MANAGEMENT HAS DECIDED TO PAY THEMSELVES MORE. COMPENSATION INCREASED 25% AND 27% IN 2019 AND 2020. CEO HESTER

WAS PAID $6.5M IN 2020.

Status Quo: Credit Rating Downgrades

INCREASING GENERAL AND ADMINISTRATIVE EXPENSES IS NOT THE ONLY PROBLEM. DEBT-HEAVY ACQUISITIONS IN NON-REGULATED INDUSTRIES HAVE LED TO CREDIT RATING DOWNGRADES. CREDIT DOWNGRADES => HIGHER INTEREST => HIGHER CUSTOMER BILLS. Note: Emphasis

added.

Status Quo: Questar Pipelines Deal THE

QUESTAR DEAL MADE NO SENSE FOR SHAREHOLDERS AND CUSTOMERS. IT ADDS DEBT, RISK AND DISTRACTION. INSTEAD, SWX SHOULD BE PREPARING FOR ENERGY TRANSITION. How does buying a natural gas pipeline from S.W. Wyoming and W. Colorado to Utah benefit the

customers of Arizona, California and Nevada? Do the customers of Arizona, California and Nevada want a utility that is doubling-down on fossil fuels or preparing for the future? How does adding $600 million of holding company debt(1) improve the

ability to invest in renewable natural gas and green hydrogen? What if SWX management decides to use even more debt? How does adding complexity and business risk improve the credit profile of SWG? $1.6 billion of committed deal financing adjusted

for $1 billion of future “equity and equity-linked” implies $600M of holdco debt financing as per SWX financing plan released on 10/5/21.

Status Quo: Current SWX Board Has

Minimal Utility Experience SWX’S BOARD IS TRYING TO COVER UP ITS INABILITY TO HOLD MANAGEMENT ACCOUNTABLE BY MAKING MODEST CHANGES. THIS IS NOT ENOUGH.

Our Plan: Experienced & Independent

Director Slate EXPERIENCED. QUALIFIED. DIVERSE. INDEPENDENT. Ten new directors including former Chairs, CEOs, CFOs, EVPs, GMs, MDs, FERC and State Regulatory Commissioners Eight of the ten directors are independent of IEP. No prior affiliation or

overlapping Boards. No compensation agreements with IEP There are at least three nominees who are qualified to be an interim or permanent CEO The two IEP nominees already serve on another utility board

Our Plan: Commitment to Safety THERE IS

NO HIGHER PRIORITY THAN THE SAFETY OF OUR CUSTOMERS, OUR EMPLOYEES AND THE PUBLIC. Our directors would commit to maintaining existing safety practices (at a minimum) and would bring their combined expertise to ensure that SWG is doing all that it

can to maintain the integrity of the distribution system Our directors would look to hire an independent firm to perform an audit of existing safety practices (paid for by the holding company, not SWG) and make any suggested improvements In addition

to pursuing best practices, we would likely look to aggressively pursue those suppliers whose products and services need to be replaced, including the Driscopipe® 8000. Customers should not endure the entire burden for the mistakes of a

supplier

Our Plan: Likely Steps SIMPLIFY THE

BUSINESS STRUCTURE. OPTIMIZE THE REGULATED UTILITY. We believe our directors will: Act as real fiduciaries to all stakeholders with respect to holding this (or new) management accountable for performance Evaluate IEP’s tender offer and,

assuming they determine the offer to be fair, remove the poison pill so that shareholders can decide for themselves whether to accept the offer Look to separate the services division, Questar pipeline and gas LDC Create a rock-solid balance sheet to

prepare for RNG and green hydrogen investments Bring fresh eyes to lower SWX’s utility cost structure reducing pressure on customers Re-establish regulatory trust by working collaboratively on shared goals, ending the expensive game of

hide-and-seek with expenses Hire counsel who is willing to seek recovery for NV and AZ ratepayers for faulty Driscopipe® 8000 replacement costs Hire and promote best-in-class management Look to add either a new director to the Board of

Directors or Ombudsman from Arizona to enhance alignment with regulator and customer interests

Our Plan: Improve the Balance Sheet IF

SWX MONETIZED ITS SOON TO BE ACQUIRED PIPELINE UNIT AND ITS SERVICES UNIT (“CENTURI”), WE ESTIMATE IT COULD RETIRE ALL HOLDCO DEBT AND HAVE $1.1-$2.6 BILLION OF CASH TO FUTURE-PROOF THE BUSINESS. Management’s plan includes

completing the Questar deal and adding $600 million of debt at the SWX holding company We believe our Director slate would likely explore a monetization of both Questar Pipelines and Centuri Assuming a sale of Questar at $1.6 billion and 20% IPO of

Centuri, we believe SWX could repay any holdco debt, leaving $1.1 billion of excess cash to be used as a cushion to fund a combination of accelerated green investments and shareholder returns(1) Assuming a sale of Questar at $1.6 billion and 100%

monetization of Centuri (after-taxes), we believe SWX could repay any holdco debt, leaving $2.6 billion of excess cash to be used as a cushion to fund a combination of accelerated green investments and shareholder returns(1) See Appendix for

calculations.

Our Plan: Affiliate Transactions No

Longer A Worry ASSET SALES WOULD BETTER INSULATE THE BALANCE SHEET, AND WOULD ALSO REMOVE ANY CHANCE THAT CUSTOMERS ARE BEING OVER-CHARGED BY SWX’S SERVICE DIVISION. Centuri provides pipeline maintenance and other modernization services to SWG

and other utilities across the country Centuri completed $135 million of work for SWG in 2020 Even if Centuri follows established principles of separation and open bidding, how do we know that competitors are actively bidding? What percentage of

work is bid out to competition and what percentage is awarded to Centuri? What percentage is won by third parties? It is not hard to see a scenario where competitors may not try as hard when SWG issues an RFP, given SWX’s management

compensation incentives SWG should be engaging the best service provider for the job – which may not be Centuri – and should pass on any savings to its customers

Our Plan: Customer Savings WE ESTIMATE

THAT OUR SLATE COULD DELIVER CUSTOMER SAVINGS OF AT LEAST $9 PER YEAR OVER THE NEXT 10 YEARS WITH THE POTENTIAL FOR MUCH MORE. Simplifying the balance sheet through asset sales would leave residual cash to restore the balance sheet back to its prior

credit rating of A-, which could save ~$4 per year per customer Reducing general and administrative expenses by $10M which could save ~$5 per year per customer If new oversight results in a 2% improvement in the remaining OPEX of ~$270 million per

year, that could result in ~$2.50 of savings per year per customer If new oversight results in a 5% improvement in capital efficiency, that could result in ~$1 of savings per year per customer See Appendix for “remaining opex” and

“capital efficiency” back-up.

Our Plan: Customer Service WE BELIEVE

SWX’S ALREADY HIGH CUSTOMER SERVICE SCORES COULD GO EVEN HIGHER. Currently, SWG’s JD Power Customer Service scores are high vs. industry standards We are committed to maintaining and improving SWG’s already high performing customer

service scores As SWG’s cost structure moves lower, and as an enhanced balance sheet enables additional green investments in renewable natural gas and green hydrogen customer service, SWG’s customer service scores should go even higher

Why is IEP Doing This? ECONOMICALLY

INCENTIVIZED AND ALIGNED. IEP believes that SWX’s share price is very undervalued. We believe SWX’s share price could increase if SWX simplifies its business into a strictly state-regulated natural gas LDC As a standalone entity, SWX

management will not be distracted by ancillary business lines, and could optimize the utility, resulting in lowest possible costs and maximum alignment with regulators and customers IEP believes a utility should be run working hand-in-hand with

regulators and customers to deploy both operating and capital expenditures at the appropriate pace (could be slower or faster). No expense should be a surprise. All projects should be justifiable. Customers money and rates should be treated with the

utmost care

Appendix: IEP Overview Icahn Enterprises

L.P., a master limited partnership (NASDAQ: IEP), is a diversified holding company engaged in seven primary business segments: Investment, Energy, Automotive, Food Packaging, Real Estate, Home Fashion and Pharma (Metals segment divestiture pending)

Legendary investor Carl C. Icahn owns approximately 90% of IEP As a leading activist shareholder, Mr. Icahn believes his efforts have unlocked literally hundreds of billions of dollars of shareholder and bondholder value by guiding boards and

CEOs to take the mostly obvious steps necessary to greatly increase the value of their companies and have improved the competitiveness of American companies Our strong preference in all of our activist campaigns is to try to work in a friendly,

cooperative manner with the leadership of the companies in which we invest and more often than not we have been successful in avoiding the expense and distraction that conflict brings However, we sometimes do encounter decision-making, such

as that which is occurring now at SWX, that is irrational and not in the best interests of shareholders and are thus forced to take action to protect the value of our investments

Appendix: IEP Overview (Cont.) Mr. Icahn

began his career on Wall Street in 1961 and has become one of the most influential investors in America. He has taken substantial or controlling positions in many companies, including: RJR Nabisco, TWA, Texaco, Phillips Petroleum, Viacom, Marvel,

Revlon, Imclone, Federal Mogul, CVR Energy, XO Communications, Netflix, Forest Laboratories, Apple, Herbalife, eBay/PayPal, Tropicana Entertainment, Caesars, Cheniere Energy, Cloudera, Hain Celestial, BEA Systems, Genzyme, Navistar and Time Warner

Mr. Icahn's investment approach relies on his independent and contrarian views. He focuses on undervalued companies which are frequently poorly managed. By committing long-term capital, and active investment influence, Mr. Icahn provides the

patience and vision often unavailable as companies seek to restructure and realize value enhancement In 2000, IEP began to expand its business beyond traditional real estate activities, and to fully embrace the activist strategy. On January 1, 2000,

the closing sale price of IEP depositary units was $7.625 per depositary unit. On November 1, 2021, IEP depositary units closed at $57.56 per depositary unit — a 2,050% increase since January 1, 2000, which translates to an annualized return

of ~15% (including reinvestment of distributions into additional depositary units and taking into account in-kind distributions of depositary units). Comparatively, the S&P 500, Dow Jones Industrial, and Berkshire Hathaway Inc. Class A shares

increased approximately 377%, 423%, and 668%, respectively, over the same period, which translates to an annualized return of approximately 7%, 8%, and 10%, respectively

Appendix: FirstEnergy (“FE”)

Case Study 02/18/21: FE announced that IEP was a shareholder 03/16/21: FE announced that two Icahn executives (the same two nominated at SWX) had joined the Board. There was no public dispute Since our involvement, FE sold a 20% stake in a business

unit at record valuations, raised $1B of equity, signed a deferred prosecution agreement, agreed to $306M of customer refunds, was upgraded to Investment Grade by S&P, and increased capital spending. There have been no job reduction

programs

Appendix: Proxy and Tender Offer

Timeline Proxy Contest: IEP has provided official notice to SWX management regarding the IEP director slate Election to be held at SWX’s 2022 Annual Meeting, which is expected to occur in May, with elected Board sitting shortly thereafter

Tender Offer: Current Tender Offer expires on December 27, 2021 Tender may be extended from time-to-time, as necessary or appropriate, to allow for conditions to be satisfied Key condition is state regulatory approval Two other significant

conditions (removal of poison pill, waiver regarding the applicability of Article 7(A) of the SWX’s Certificate of Incorporation) are entirely within the control of the incumbent Board of Directors Assuming that the incumbent Board will not

remove the poison pill or make Article 7(A) inapplicable to the offer, IEP is hopeful that the newly elected directors would objectively and fairly evaluate options to remove all-SWX imposed impediments to the offer

Appendix: Selling Non-Utility Assets

Improves Balance Sheet $1.6 billion of committed deal financing adjusted for $1 billion of future “equity and equity-linked” implies $600M of holdco debt financing as per SWX financing plan released on 10/5/21.

Appendix: Interest Savings Calculation

Pre-tax basis. Increase in debt in 2021 and beyond is equal to average of 2018-2020 increase.

Appendix: Remaining OPEX and Capital

Efficiency Savings Pre-tax basis.

Additional Information; Participants in

the Solicitation Additional Information and Where to Find It; Participants in the Solicitation and Notice to Investors SECURITY HOLDERS ARE ADVISED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY CARL

C. ICAHN AND HIS AFFILIATES FROM THE STOCKHOLDERS OF SOUTHWEST GAS HOLDINGS, INC. (“SOUTHWEST GAS”, “SWX” or the “COMPANY”) FOR USE AT THE ANNUAL MEETING OF STOCKHOLDERS OF SOUTHWEST GAS WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION. WHEN COMPLETED, A DEFINITIVE PROXY STATEMENT AND A FORM OF PROXY WILL BE MAILED TO STOCKHOLDERS OF SOUTHWEST GAS AND WILL

ALSO BE AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S (“SEC”) WEBSITE AT HTTP://WWW.SEC.GOV. INFORMATION RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION IS CONTAINED IN THE SCHEDULE 14A FILED BY

CARL C. ICAHN AND HIS AFFILIATES WITH THE SEC ON NOVEMBER 15, 2021. EXCEPT AS OTHERWISE DISCLOSED IN THE SCHEDULE 14A, THE PARTICIPANTS HAVE NO INTEREST IN SOUTHWEST GAS. THE SOLICITATION DISCUSSED HEREIN RELATES TO THE SOLICITATION OF

PROXIES FOR USE AT THE 2022 ANNUAL MEETING OF STOCKHOLDERS OF SOUTHWEST GAS HOLDINGS. THIS COMMUNICATION IS FOR INFORMATIONAL PURPOSES ONLY AND IS NOT A RECOMMENDATION, AN OFFER TO PURCHASE OR A SOLICITATION OF AN OFFER TO SELL SHARES. IEP

UTILITY HOLDINGS LLC, AN AFFILIATE OF ICAHN ENTERPRISES, FILED A TENDER OFFER STATEMENT AND RELATED EXHIBITS WITH THE SEC ON OCTOBER 27, 2021. SOUTHWEST GAS FILED A SOLICITATION/ RECOMMENDATION STATEMENT WITH RESPECT TO THE TENDER OFFER WITH THE SEC

ON NOVEMBER 9, 2021. STOCKHOLDERS OF SOUTHWEST GAS ARE STRONGLY ADVISED TO READ THE TENDER OFFER STATEMENT (INCLUDING THE RELATED EXHIBITS) AND THE SOLICITATION/RECOMMENDATION STATEMENT, AS THEY MAY BE AMENDED FROM TIME TO TIME, BECAUSE THEY CONTAIN

IMPORTANT INFORMATION THAT STOCKHOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SHARES. THE TENDER OFFER STATEMENT (INCLUDING THE RELATED EXHIBITS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ARE AVAILABLE AT NO CHARGE

ON THE SEC’S WEBSITE AT WWW.SEC.GOV. THE TENDER OFFER STATEMENT AND OTHER DOCUMENTS THAT ARE FILED BY IEP UTLITY HOLDINGS LLC WITH THE SEC WILL BE MADE AVAILABLE TO ALL STOCKHOLDERS OF SOUTHWEST GAS FREE OF CHARGE UPON REQUEST TO THE

INFORMATION AGENT FOR THE TENDER OFFER. THE INFORMATION AGENT FOR THE TENDER OFFER IS HARKINS KOVLER, LLC, 3 COLUMBUS CIRCLE, 15TH FLOOR, NEW YORK, NY 10019, TOLL-FREE TELEPHONE: +1 (800) 326-5997, EMAIL: SWX@HARKINSKOVLER.COM.

Forward-Looking Statements; Special Note

Regarding Presentation Forward-Looking Statements Certain statements contained in this presentation are forward-looking statements including, but not limited to, statements that are predications of or indicate future events, trends, plans or

objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties. Forward-looking statements are not guarantees of future performance or activities and are

subject to many risks and uncertainties. Due to such risks and uncertainties, actual events or results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Forward-looking statements

can be identified by the use of the future tense or other forward-looking words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “should,”

“may,” “will,” “objective,” “projection,” “forecast,” “management believes,” “continue,” “strategy,” “position” or the negative of those

terms or other variations of them or by comparable terminology. Important factors that could cause actual results to differ materially from the expectations set forth in this presentation include, among other things, the factors identified

in the public filings of Southwest Gas. Such forward-looking statements should therefore be construed in light of such factors, and we are under no obligation, and expressly disclaim any intention or obligation, to update or revise any

forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Special Note Regarding this Presentation THIS PRESENTATION CONTAINS OUR CURRENT VIEWS ON THE VALUE OF SOUTHWEST

GAS SECURITIES AND CERTAIN ACTIONS THAT SOUTHWEST GAS’ BOARD MAY TAKE TO ENHANCE THE VALUE OF ITS SECURITIES. OUR VIEWS ARE BASED ON OUR OWN ANALYSIS OF PUBLICLY AVAILABLE INFORMATION AND ASSUMPTIONS WE BELIEVE TO BE REASONABLE.

THERE CAN BE NO ASSURANCE THAT THE INFORMATION WE CONSIDERED AND ANALYZED IS ACCURATE OR COMPLETE. SIMILARLY, THERE CAN BE NO ASSURANCE THAT OUR ASSUMPTIONS ARE CORRECT. SOUTHWEST GAS’ PERFORMANCE AND RESULTS MAY DIFFER MATERIALLY FROM

OUR ASSUMPTIONS AND ANALYSIS. WE HAVE NOT SOUGHT, NOR HAVE WE RECEIVED, PERMISSION FROM ANY THIRD-PARTY TO INCLUDE THEIR INFORMATION IN THIS PRESENTATION. ANY SUCH INFORMATION SHOULD NOT BE VIEWED AS INDICATING THE SUPPORT OF SUCH THIRD PARTY FOR

THE VIEWS EXPRESSED HEREIN. OUR VIEWS AND OUR HOLDINGS COULD CHANGE AT ANY TIME. WE MAY SELL ANY OR ALL OF OUR HOLDINGS OR INCREASE OUR HOLDINGS BY PURCHASING ADDITIONAL SECURITIES. WE MAY TAKE ANY OF THESE OR OTHER ACTIONS REGARDING SOUTHWEST

GAS WITHOUT UPDATING THIS PRESENTATION OR PROVIDING ANY NOTICE WHATSOEVER OF ANY SUCH CHANGES (EXCEPT AS OTHERWISE REQUIRED BY LAW).

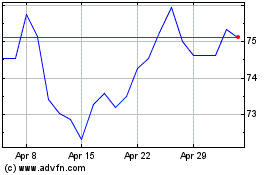

Southwest Gas (NYSE:SWX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Southwest Gas (NYSE:SWX)

Historical Stock Chart

From Apr 2023 to Apr 2024