Current Report Filing (8-k)

November 19 2021 - 4:06PM

Edgar (US Regulatory)

false000149376100014937612021-11-182021-11-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: November 18, 2021

(Date of earliest event)

Turtle Beach Corporation

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

001-35465

|

|

27-2767540

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

44 South Broadway, 4th Floor

|

|

10601

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

(888) 496-8001

Registrant's telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

Common Stock, par value $0.001

|

HEAR

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act

of 1934 (§240.12b-2 of this chapter):

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On November 18, 2021, the Board of Directors (the “Board”) of Turtle Beach Corporation (the “Company”) approved the Company’s Amended and Restated Retention Plan

(the “Amended Plan”), which is intended to align those severance benefits to those offered to other executive team employees by peer companies and best practice based on a peer review and assessment report prepared by Compensia, Inc., an

executive compensation consulting firm, for the Compensation Committee, and replaces the prior retention plan. Participation in the Amended Plan is open to any employee of the Company who is designated by the Board as being covered by the

Amended Plan.

The Amended Plan provides that if a participant is terminated by the Company without Cause or a participant terminates his or her employment for Good Reason (as

those terms are defined in the Amended Plan) during the one-year period following a Change in Control, then, subject to the participant’s execution and non-revocation of a general release, the participant will be entitled to: (i) payment of any

portion of the participant’s annual bonus under the Company’s Management Incentive Plan for the calendar year prior to the one in which the Transaction Date occurs that has not been paid prior to the participant’s termination date; (ii) a

lump-sum payment equal to the participant’s Target Bonus for the year of termination multiplied by (x) the greater of 50% or the percentage of such year that the participant was employed by the Company, or (y) 100% if the participant is further

designated by the Board as an “extended participant”; (iii) continuation of the participant’s Base Pay for six (6) months (or twelve (12) months if an extended participant) from the termination date of the participant’s employment in accordance

with the Company’s ordinary payroll practices; (iv) if the participant elects coverage under COBRA, reimbursement for the full amount of premiums for such continuation coverage for a period of six (6) months (or twelve (12) months if an

extended participant); provided, that, if a participant is entitled to severance benefits under such participant’s employment agreement, then the participant will only be entitled to the larger benefit for each of the items above as between the

severance benefits in such employment agreement and under the Amended Plan, but not both.

The Amended Plan defines “Changes in Control” as any of the following events occurring after the date of the Amended Plan: (a) a “person” (as such term in used in

Sections 13(d) and 14(d) of the Exchange Act), other than a trustee or other fiduciary holding securities under an employee benefit plan of the Company or a corporation owned, directly or indirectly, by the stockholders of the Company in

substantially the same proportions as their ownership of stock of the Company, is or becomes the “beneficial owner” (as defined in Rule 13d-3 under the Exchange Act), directly or indirectly, of securities of the Company representing 50% or more

of the combined voting power of the Company’s then outstanding securities; (b) the Company merges or consolidates with any other corporation, other than in a merger or consolidation that would result in the voting securities of the Company

outstanding immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity) directly or indirectly, at least 50% of the combined voting power of the voting

securities of the Company or such surviving entity outstanding immediately after such merger or consolidation; or (c) the sale or other disposition of all or substantially all of the Company’s assets. Notwithstanding anything in the Amended

Plan to the contrary, no event that would be a Change in Control as defined in the Amended Plan shall be a Change in Control unless such event also constitutes a “change in control event” as defined in Section 409A of the Internal Revenue Code

of 1986, as amended, and its corresponding regulations.

The foregoing description of the Amended Plan is qualified in its entirety by reference to the Amended Plan, which is filed herewith as Exhibit 10.1 and

incorporated herein by reference.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory

Arrangements of Certain Officers.

The information included in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 5.02.

On November 19, 2021, the Company entered into a letter agreement (the “Letter Agreement”), with John Hanson, the Company’s Chief Financial Officer, to grant Mr.

Hanson participation in the Amended Plan as an extended participant. Accordingly, the Letter Agreement provides that if Mr. Hanson’s employment is terminated by the Company without Cause or if Mr. Hanson terminates his employment for Good

Reason (as those terms are defined in the Amended Plan) during the one-year period following a Change in Control, then, subject to his execution and non-revocation of a general release, Mr. Hanson will be entitled to: (i) payment of any portion

of his annual bonus under the Company’s Management Incentive Plan for the calendar year prior to the one in which the Transaction Date occurs that has not been paid prior to his termination date; (ii) a lump-sum payment equal his Target Bonus

for the year of termination; (iii) continuation of his Base Pay for twelve (12) from the termination date of his employment in accordance with the Company’s ordinary payroll practices; (iv) if he elects coverage under COBRA, reimbursement for

the full amount of premiums for such continuation coverage for a period of twelve (12) months; provided, that, if he is entitled to severance benefits under his employment agreement, then he will only be entitled to the larger benefit for each

of the items above as between the severance benefits in such employment agreement and under the Amended Plan, but not both.

The foregoing description of the Letter Agreement does not purport to be complete and is subject to, and qualified in its entirety by reference to, the full text

of the Letter Agreement, a copy of which is attached hereto as Exhibit 10.2 and incorporated herein by reference.

Item 9.01 — Financial Statements and Exhibits

(d) Exhibits

|

|

|

|

|

|

Exhibit

No.

|

Description

|

|

|

|

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report

to be signed on its behalf by the undersigned, thereto duly authorized.

Dated: November 19, 2021

|

|

|

TURTLE BEACH CORPORATION

|

|

|

By:

|

/S/ JOHN T. HANSON

|

|

|

|

John T. Hanson

|

|

|

|

Chief Financial Officer, Treasurer and Secretary

|

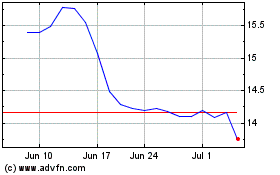

Turtle Beach (NASDAQ:HEAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

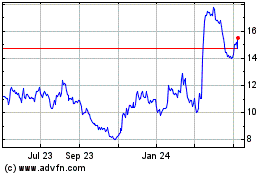

Turtle Beach (NASDAQ:HEAR)

Historical Stock Chart

From Apr 2023 to Apr 2024