Michael A. Schwartz

Michael A. Schwartz

Chief Legal Officer

Chief Compliance Officer

Corporate Secretary

November 19, 2021

Via EDGAR

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

Re: Newtek Business Services Corp.

File No. 814-01035

Rule 17g-1(g) Fidelity Bond Filing - Amended

Ladies and Gentlemen:

On behalf of Newtek Business Services Corp. (the “Company”), enclosed herewith for filing, pursuant to Rule 17g-1(g) under the Investment Company Act of 1940, are the following:

(a) A copy of the single insured fidelity bond covering the Company and its subsidiaries, including the November 12, 2021 Endorsement thereto increasing the limits of liability; and

(b) A Certificate of Secretary containing (i) the resolutions of the members of the Board of Directors of the Company, including a majority of the Board of the Directors who are not “interested persons” of the Company, approving the form and amount of the Bond and (ii) a statement as to the period for which premiums have been paid.

If you have any questions regarding this submission, please do not hesitate to call me at (212) 273-8170.

Very truly,

/s/ Michael A. Schwartz

Michael A. Schwartz

Chief Legal Officer

Chief Compliance Officer

w/attachments

1981 Marcus Ave., Suite 130, Lake Success, New York 11042

(Direct) 212-273-8170 | (Fax) 516-355-0795

mschwartz@newtekone.com

CERTIFICATE OF SECRETARY

The undersigned, Michael A. Schwartz, Secretary of Newtek Business Services Corp. (the “Company”), a Maryland corporation, does hereby certify that:

1.This Certificate is being delivered to the Securities and Exchange Commission (the “SEC”) in connection with the amended filing of the Company’s fidelity bond (the “Bond”) pursuant to Rule 17g-l of the Investment Company Act of 1940, as amended, and the SEC is entitled to rely on this Certificate for purposes of the filing.

2.The undersigned is the duly elected and qualified Secretary of the Company, and has custody of the corporate records of the Company and is a proper officer to make this Certification.

3.Attached hereto as an Exhibit is a copy of the resolutions approved by the Board of Directors of the Company, including a majority of the Board of the Directors who are not “interested persons” of the Company, approving the form and amount of the Bond.

4.The Bond premiums have been paid for the period September 30, 2021 to September 30, 2022.

IN WITNESS WHEREOF, the undersigned has caused this Certificate to be executed this 19th day of November 2021.

/s/ Michael A. Schwartz

Michael A. Schwartz

Secretary

NEWTEK BUSINESS SERVICES CORP.

BOARD OF DIRECTORS

Resolutions Approving Financial Institution Investment Company

Asset Protection Bond

WHEREAS, Section 17(g) of the 1940 Act and Rule 17g-1(a) thereunder require a BDC, such as the Company, to provide and maintain a bond which has been issued by a reputable fidelity insurance company authorized to do business in the place where the bond is issued, to protect the Company against larceny and embezzlement, covering each officer and employee of the BDC who may singly, or jointly with others, have access to the securities or funds of the BDC, either directly or through authority to draw upon such funds of, or to direct generally, the disposition of such securities, unless the officer or employee has such access solely through his position as an officer or employee of a bank (each, a “covered person”); and

WHEREAS, Rule 17g-1 under the 1940 Act specifies that the bond may be in the form of (i) an individual bond for each covered person, or a schedule or blanket bond covering such persons, (ii) a blanket bond which names the Company as the only insured (a “single insured bond”), or (iii) a bond which names the Company and one or more other parties as insureds (a “joint insured bond”), as permitted by Rule 17g-1 under the 1940 Act; and

WHEREAS, Rule 17g-1 under the 1940 Act requires that a majority of the Non-Interested Directors approve periodically (but not less than once every 12 months) the reasonableness of the form and amount of the bond, with due consideration to the value of the aggregate assets of the Company to which any covered person may have access, the type and terms of the arrangements made for the custody and safekeeping of such assets, and the nature of securities and other investments to be held by the Company, and pursuant to factors contained in Rule 17g-1 under the 1940 Act; and

WHEREAS, under Rule 17g-1 under the 1940 Act, the Company is required to make certain filings with the SEC and give certain notices to each member of the Board of Directors in connection with the bond, and designate an officer who shall make such filings and give such notices;

NOW THEREFORE BE IT RESOLVED, that having considered the expected aggregate value of the securities and funds of the Company to which officers or employees of the Company may have access (either directly or through authority to draw upon such funds or to direct generally the disposition of such securities), the type and terms of the arrangements made for the custody of such securities and funds, the nature of securities and other investments to be held by the Company, the accounting procedures and controls of the Company, the nature and method of conducting the operations of the Company and the requirements of Section 17(g) of the 1940 Act and Rule 17g-1 thereunder, the Board of Directors, including a majority of the Non-Interested Directors, hereby determines that the amount, type, form, premium and coverage of the fidelity bond covering the officers and employees of the Company and insuring the Company against loss

from fraudulent or dishonest acts, including larceny and embezzlement, issued by the Chubb Group of Insurance Companies, having an aggregate coverage of $1,250,000 (the “Fidelity Bond”), are fair and reasonable and the Fidelity Bond be, and hereby is, approved by the Board of Directors of the Company, including a majority of the Non-Interested Directors; and

FURTHER RESOLVED, that the Chief Executive Officer, Chief Compliance Officer and Chief Accounting Officer (the "Authorized Officers") be, and each of them hereby is, authorized, empowered and directed to take all appropriate actions, with the advice of legal counsel to the Company, to provide and maintain the Fidelity Bond on behalf of the Company; and

FURTHER RESOLVED, that the Chief Compliance Officer of the Company be and hereby is, designated as the party responsible for making the necessary filings and giving the notices with respect to such bond required by paragraph (g) of Rule 17g-1 under the 1940 Act; and

FURTHER RESOLVED, that the Authorized Officers be, and each of them hereby is, authorized, empowered and directed to file a copy of the Fidelity Bond and any other related document or instrument with the SEC; and

FURTHER RESOLVED, that the Authorized Officers be, and each of them hereby is, authorized, empowered and directed, in the name and on behalf of the Company, to make or cause to be made, and to execute and deliver, all such additional agreements, documents, instruments and certifications and to take all such steps, and to make all such payments, fees and remittances, as any one or more of such officers may at any time or times deem necessary or desirable in order to effectuate the purpose and intent of the foregoing resolutions; and

FURTHER RESOLVED, that any and all actions previously taken by the Company or any of its directors, Authorized Officers or other employees in connection with the documents, and actions contemplated by the foregoing resolutions be, and they hereby are, ratified, confirmed, approved and adopted in all respects as and for the acts and deeds of the Company.

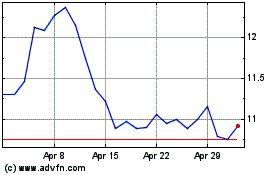

NewtekOne (NASDAQ:NEWT)

Historical Stock Chart

From Mar 2024 to Apr 2024

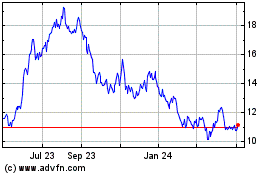

NewtekOne (NASDAQ:NEWT)

Historical Stock Chart

From Apr 2023 to Apr 2024