Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

November 17 2021 - 2:27PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month

of November, 2021

Commission File

Number: 001-40816

Argo

Blockchain plc

(Translation of registrant’s name into English)

9th

Floor

16 Great Queen Street

London WC2B 5DG

England

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F

x Form 40-F

¨

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

INFORMATION CONTAINED IN THIS REPORT ON FORM 6-K

|

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On November 17, 2021, Argo Blockchain plc (the

“Company”) completed the previously announced offering (the "Offering") of $40,000,000, in the aggregate, of the

Company’s 8.75% Senior Notes due 2026 (the “Notes”).

The Notes were sold pursuant to the Company’s Registration Statement

on Form F-1, as amended (File No. 333-260857), which was declared effective by the Securities

and Exchange Commission (the “Commission”) on November 12, 2021. The Notes were issued pursuant to the First Supplemental

Indenture (the “First Supplemental Indenture”), dated as of November 17, 2021, between the Company and Wilmington Savings

Fund Society, FSB, as trustee (the “Trustee”). The First Supplemental Indenture supplements the Indenture entered into by

and between the Company and the Trustee, dated as of November 17, 2021 (the “Base Indenture” and, together with the First

Supplemental Indenture, the “Indenture”).

The public offering price of the Notes was 96.5% of the principal amount

(i.e., $24.125). The Company received net proceeds after discounts and commissions, but before expenses and payment of the structuring

fee, of approximately $38,600,000. The Company intends to use the net proceeds from this Offering for general corporate purposes, the

construction of, and purchase of mining machines for, its Texas cryptocurrency mining facility and potentially acquisitions of, or investments

in, complementary businesses in the cryptocurrency and blockchain technology industries.

The Notes bear interest at the rate of 8.75% per annum. Interest on

the Notes is payable quarterly in arrears on January 31, April 30, July 31 and October 31 of each year, commencing

January 31, 2022. The Notes will mature on November 30, 2026.

The Company may redeem the Notes for cash in whole or in part at any

time (i) on or after November 30, 2023 and prior to November 30, 2024, at a price equal to 102% of their principal amount,

plus accrued and unpaid interest to, but excluding, the date of redemption, (ii) on or after November 30, 2024 and prior to

November 30, 2025, at a price equal to 101% of their principal amount, plus accrued and unpaid interest to, but excluding, the date

of redemption, and (iii) on or after November 30, 2025 and prior to maturity, at a price equal to 100% of their principal amount,

plus accrued and unpaid interest to, but excluding, the date of redemption. In addition, the Company may redeem the Notes, in whole, but

not in part, at any time at its option, at a redemption price equal to (1) 100.5% of the principal amount plus accrued and unpaid

interest to, but not including, the date of redemption, upon the occurrence of certain change of control events and (ii) 100.0% of

the principal amount plus accrued and unpaid interest to, but not including, the date of redemption, in the event of various tax law changes

after November 17, 2021 and other limited circumstances that requires the Company to pay additional amounts. On and after any redemption

date, interest will cease to accrue on the redeemed Notes. If the Company is redeeming less than all of the Notes, the Trustee will select

the Notes to be redeemed by such method as the Trustee deems fair and appropriate in accordance with methods generally used at the time

of selection by fiduciaries in similar circumstances.

The Indenture also contains customary events of default and cure provisions.

If an uncured default occurs and is continuing, the Trustee or the holders of not less than 25% in aggregate principal amount of the Notes

may declare the Notes to be immediately due and payable.

The Notes are senior unsecured obligations of the Company and rank

equal in right of payment with the Company’s existing and future senior unsecured indebtedness.

The foregoing description of the Indenture and the Notes does not purport

to be complete and is qualified in its entirety by reference to the full text of the Indenture and the form of Note. Copies of the Base

Indenture, the First Supplemental Indenture and the form of Note are attached to this Current Report on Form 6-K as Exhibits

4.1, 4.2 and 4.2.1, respectively, and are incorporated herein by reference.

|

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement

of a Registrant.

|

The information in Item 1.01 above is incorporated herein by reference.

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

|

|

ARGO BLOCKCHAIN PLC

|

|

Date: November 17, 2021

|

|

|

|

By:

|

/s/ Peter Wall

|

|

|

|

Name: Peter Wall

|

|

|

|

Title: Chief Executive Officer

|

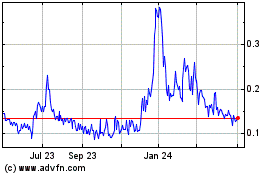

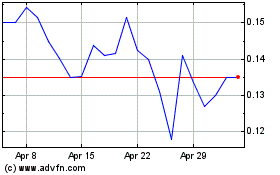

Argo Blockchain (PK) (USOTC:ARBKF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Argo Blockchain (PK) (USOTC:ARBKF)

Historical Stock Chart

From Apr 2023 to Apr 2024