Current Report Filing (8-k)

November 12 2021 - 7:51AM

Edgar (US Regulatory)

0000093556false00000935562021-11-122021-11-120000093556swk:CommonStockSWKMember2021-11-122021-11-120000093556swk:CorporateUnitsSWTMember2021-11-122021-11-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 12, 2021

Stanley Black & Decker, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

CT

|

1-5224

|

06-0548860

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification No.)

|

1000 STANLEY DRIVE

NEW BRITAIN, CT 06053

(Address of principal executive offices, including Zip Code)

Registrant’s telephone number, including area code: (860) 225-5111

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title Of Each Class

|

|

Trading Symbols

|

|

Name Of Each Exchange On Which Registered

|

|

Common Stock

|

- $2.50 Par Value per Share

|

|

SWK

|

|

New York Stock Exchange

|

|

Corporate Units

|

|

|

SWT

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01 Other Events.

Stanley Black & Decker, Inc. (the “Company”) is changing the calculation of diluted earnings per share with respect to its outstanding Equity Units. The change will include shares underlying the forward stock purchase contracts in the denominator of its diluted earnings per share calculation utilizing the if-converted method, which represents a correction of an error of the previously applied treasury stock method. This change is in response to a comment letter process with the United States Securities and Exchange Commission (‘SEC”). After giving effect to this change, the Company’s diluted GAAP earnings per share, as disclosed in its press release announcing its third quarter results issued on October 28, 2021, would have been $2.51 and $8.17 for the third quarter and year-to-date periods, respectively. Excluding acquisition-related and other charges of $0.20 per diluted share and $0.61 per diluted share, non-GAAP diluted earnings per share would have been $2.71 and $8.78 for the third quarter and year-to-date periods, respectively. The Company does not believe that this change has a material effect on its historical financial statements.

As a result of this change, the Company is updating its EPS outlook to $10.00 to $10.25 on a GAAP basis (From $10.20 to $10.45) and $10.70 to $10.90 on an adjusted non-GAAP basis (from $10.90 to $11.10). The result of this change does not have an impact on the implied non-GAAP 4Q’21 EPS guidance of $1.92 to $2.12 issued on October 28, 2021. A further discussion of this change is included in the Company’s Quarterly Report on Form 10-Q for the quarter ended October 2, 2021.

Additionally, subject to remaining regulatory clearances, the Company expects that within the coming weeks, both the MTD & Excel acquisitions will have closed. As disclosed in the Company's earnings press release on October 28, 2021, GAAP guidance excludes $0.20 - $0.30 per diluted share of charges associated with MTD and Excel which will be incorporated post-closing. The Company does not anticipate any future changes to 2021 non-GAAP EPS guidance related to the closure of these transactions.

Cautionary Statements Regarding Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to certain forward-looking guidance of earnings per share and projections of the anticipated impact of certain pending acquisitions. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, actual results with respect to earnings per share could differ materially from those projected or assumed and the closing of the pending acquisitions are subject to conditions, some of which are outside of the Company's control. The Company’s future financial condition and results of operations, as well as any forward-looking statements, are subject to change and to inherent risks and uncertainties, including those set forth in the Company's Annual Report on Form 10-K and in its Quarterly Report on Form 10-Q, including under the heading “Risk Factors,” “Management's Discussion and Analysis of Financial Condition and Results of Operations,” in the Consolidated Financial Statements and the related Notes and the Company's other filings.

Forward-looking statements in this Current Report on Form 8-K speak only as of the date hereof, and forward-looking statements in documents attached that are incorporated by reference speak only as of the date of those documents. The Company does not undertake any obligation to update or release any revisions to any forward-looking statement or to report any events or circumstances after the date hereof or to reflect the occurrence of unanticipated events, except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stanley Black & Decker, Inc.

|

|

|

|

|

|

|

November 12, 2021

|

|

|

|

By:

|

|

/s/ Janet M. Link

|

|

|

|

|

|

Name:

|

|

Janet M. Link

|

|

|

|

|

|

Title:

|

|

Senior Vice President, General Counsel and Secretary

|

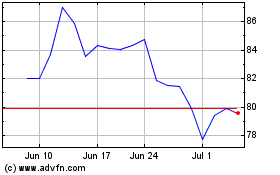

Stanley Black and Decker (NYSE:SWK)

Historical Stock Chart

From Mar 2024 to Apr 2024

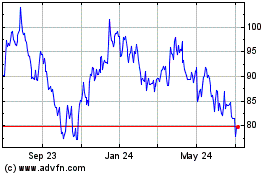

Stanley Black and Decker (NYSE:SWK)

Historical Stock Chart

From Apr 2023 to Apr 2024