Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

November 04 2021 - 8:31AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2021

Commission file number: 001-38206

TDH HOLDINGS, INC.

(Registrant’s name)

c/o Qingdao Tiandihui Foodstuffs Co. Ltd.,

2521 Tiejueshan Road, Huangdao District, Qingdao,

Shandong Province

People’s Republic of China

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

TDH Holdings, Inc. (the “Company”)

hereby incorporates the information contained in this Report on Form 6-K (the “Report”) by reference into the Company’s

Registration Statement on Form F-3, File No. 333-256402.

Cautionary Note Regarding Forward-Looking Statements

This Report, including the

exhibits included herein, may contain forward-looking statements. We have based these forward-looking statements on our current expectations

and projections about future events. Our actual results may differ materially from those discussed herein, or implied by, these forward-looking

statements. Forward-looking statements are generally identified by words such as “believe,” “expect,” “anticipate,”

“intend,” “estimate,” “plan,” “project” and other similar expressions. In addition, any

statements that refer to expectations or other characterizations of future events or circumstances are forward-looking statements. Forward-looking

statements included in this Report are subject to significant risks and uncertainties, including but limited to: risks and uncertainties

associated with the integration of the assets and operations we have acquired and may acquire in the future; our possible inability to

raise or generate additional funds that will be necessary to continue and expand our operations; our potential lack of revenue growth

and other factors detailed in the Company’s filings with the Securities and Exchange Commission. These forward-looking statements

involve certain risks and uncertainties that are subject to change based on various factors (many of which are beyond the Company’s

control). The Company undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by applicable law.

Entry into a Material

Definitive Agreement.

On November 3, 2021, the Company

and certain investors (the “Investors”) entered into a securities purchase agreement (the “Purchase Agreement”)

in connection with a registered direct offering (the “Registered Direct Offering”), pursuant to which the Company agreed

to sell to the Investors an aggregate of 15,000,000 of its common shares, $0.001 par value per share (the “Common Shares”)

and warrants exercisable for an aggregate of 30,000,000 of its Common Shares (“Warrants”). The Common Share purchase

price is $0.64 per share and Warrant purchase price is $0.01 per Warrant. The Warrants are exercisable immediately as of the date of issuance

at an exercise price of $1.47 per share and expire twenty-four (24) months from the date of issuance. The Warrants may also be exercised

on a cashless basis. The Company may compel the exercise of the Warrants if the closing price of the Company’s Common Shares exceeds

$6.00 for ten (10) consecutive trading days commencing six (6) months after issuance. The exercisability of the Warrants may be limited

if, upon exercise, the holder or any of its affiliates would beneficially own more than 9.99% of the Company’s Common Shares.

Pursuant to a placement agent agreement (the “Placement

Agent Agreement”), dated November 3, 2021, by and between the Company and Boustead Securities, LLC (the “Placement

Agent”) to act as the Company’s Placement Agent in the Registered Direct Offering the Company agreed to pay the Placement

Agent a cash fee equal to 7% of the gross proceeds received by the Company in the Registered Direct Offering and 1% of the gross proceeds

in non-accountable expenses.

The net proceeds to the Company

from the offering, after deducting placement agent fees and estimated offering expenses, will be approximately $8.9 million. The Registered

Direct Offering closed on November 3, 2021.

The Common Shares and Warrants were offered and

issued, pursuant to the prospectus included in the Company’s registration statement on Form F-3 (Registration No. 333-256042), filed

with the Securities and Exchange Commission (the “Commission”) on May 12, 2021, which became effective on May 21, 2021,

as amended by the prospectus supplement filed with the Commission on November 3, 2021.

The foregoing summaries of the

terms of the Warrants, Purchase Agreement and Placement Agent Agreement are subject to, and qualified in their entirety by, such documents

attached hereto as Exhibits 4.1, 10.1 and 10.2 respectively, which are incorporated herein by reference.

Other Events.

On

November 3, 2021, the Company issue press releases announcing the execution of the Purchase Agreement and the closing of the Registered

Direct Offering. A copy of the press releases is attached hereto as Exhibit 99.1 and incorporated by reference herein.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

|

|

TDH HOLDINGS, INC.

|

|

|

|

|

|

|

By:

|

/s/ Dandan Liu

|

|

|

|

Dandan Liu

|

|

|

|

Chair and Chief Executive Officer

|

Dated: November 3, 2021

3

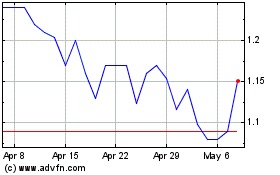

TDH (NASDAQ:PETZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

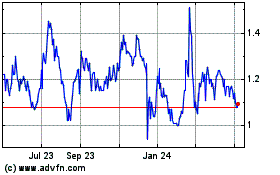

TDH (NASDAQ:PETZ)

Historical Stock Chart

From Apr 2023 to Apr 2024