UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2021

Commission File Number 001-34837

Luokung Technology Corp.

(Translation of registrant’s name into English)

B9-8, Block B, SOHO Phase II, No. 9, Guanghua Road,

Chaoyang District,

Beijing People’s Republic of China 100020

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form

20-F ☑ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ___

Note: Regulation S-T Rule 101(6)(1) only permits the submission in

paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule l01(b)(7): ____

Note: Regulation S-T Rule 101(6)(7) only permits the submission

in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and

make public’ under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s

“home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as

long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s

security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing

on EDGAR.

Luokung Technology Corp.

Luokung Technology Corp. Reports

The First Six Months of Fiscal Year 2021 Unaudited

Financial Results

Luokung Technology Corp. (Nasdaq: LKCO) (“Luokung,”

“we” or the “Company”), today announced the financial results for the six months ended June 30, 2021. The financial

statements and other financial information included in this Form 6-K are prepared in conformity with generally accepted accounting principles

in the United States of America (“U.S. GAAP”).

Financial Highlights for the Six Months Ended June 30, 2021:

Revenues for the six months ended June

30, 2021 increased 417.1% to $37,826,905 from $7,315,577 for the six months ended June 30, 2020;

Net loss of $26,722,686 for the six

months ended June 30, 2021 as compared to net loss of $18,902,165 for the six months ended June 30, 2020.

Basic and diluted loss per share was $0.09 for the six months

ended June 30, 2021, which remains the same as that for the six months ended June 30, 2020. Weighted average shares outstanding for the

six months ended June 30, 2021 and 2020 were 307,146,263 and 211,365,515, respectively.

“For the first half of the 2021 fiscal year,

our revenue increased to $37.83 million, or 417.1%, from $7.32 million in comparison to the same period of the 2020 fiscal year. Our continued

investment in technology has resulted in what we believe is a superior portfolio of products and a competitive edge in the markets in

which we operate. We are very pleased with our market growth in 2021, which has enabled us to achieve record revenues during this period,

growing revenue to more than five times that of the prior-year period. We completed the acquisition of a 100% equity interest control

in eMapgo Technology (Beijing) Co., Ltd. in March 2021 and quickly began integrating their portfolio of products and technical capabilities

into Luokung. As a result, we believe we have established great competitive advantages in smart transportation (autonomous driving, smart

highway, vehicle-road collaboration), natural resource asset management (carbon neutrality and environmental protection remote sensing

data service) and Location Based Services (‘LBS’) smart industry application spatial-temporal data commercialization. We expect

to build on the positive momentum of the first half of 2021 as additional business orders are executed and delivered in the remainder

of the year.” said Mr. Song Xuesong, Chief Executive Officer.

Results of Operations - Six Months Ended June 30, 2021 Compared

to Six Months Ended June 30, 2020

Revenue

Our revenues primarily comprise of internet LBS

and related smart industry services and smart transportation from our VIEs, Jiangsu Zhong Chuan Rui You Information and Technology Limited

(“Zhong Chuan Rui You”), Beijing Wave Function Culture Development Co., Ltd.(“Wave Function”), SuperEngine Graphics

Software Technology Development (Suzhou) Co., Ltd (“SuperEngine”) and eMapgo Technologies (Beijing) Co., Ltd. (“EMG”).

Internet LBS and related smart industry services

LBS Business

Zhong Chuan Rui You and Wave Function derive revenue

from the provision of user acquisition services to their advertisers on the strength of the LBS services they offer; customers pay them

based on performance, as measured by CPI (Cost Per Install), CPM (Cost Per Mile), and CPC (Cost Per Click). They recognize revenue over

time because customers receive and consume the benefit of their advertising services throughout the contract period.

Software and services

SuperEngine generates revenues primarily in the

form of sale of a software license and provision of technology services. License fees include perpetual license fees, term license fees

and royalties. Technology services primarily consist of fees for providing technology support services and technology solution services

that enable customers to gain real-time operational intelligence by harnessing the value of their data.

Revenue for the sale of software licenses is recognized

at the point in time when the right to use the software is provided to its customers.

Technology support service revenue is recognized

over time as the services are performed because the customer receives and consumes the benefit of its performance throughout the contract

period. Technology solution service revenue is recognized at the point in time when the service is completed. It bills for the services

it has performed in accordance with the terms of the contract. It recognizes the revenues associated with these professional services

as it delivers the services to the customers.

Smart transportation

Map data licensing

EMG provides perpetual map data licenses to customers

and collects one time license fees from customers. Revenue are recognized at the point in time when customers obtain the right to use

the map data.

Autonomous driving simulation & verification test

EMG provides data collection and desensitization

for compliance with legal requirements to system manufacturers and automobile manufacturers for autonomous driving simulation and verification

testing. Revenues are derived from the provision of data collection and desensitization service for compliance with legal requirements.

Revenues are recognized over time as the services are performed because the customer receives and consumes the benefit of its performance

throughout the contract period.

Map service platform local deployment

Through local deployment, EMG provides a one-time

map service platform license or a map service platform license for a certain period with timely updates to the map service platform during

such contract to certain public sectors and enterprises to support their location-based application. The map service platform includes

map data and software that support certain map applications such as display, search, routing and others. Revenues from a map data license

for a certain period are recognized ratably over time because the customer receives and consumes the benefit of the Group’s map

services throughout the contract period.

For the six months ended June 30, 2021, we had

revenue of $37,826,905, as compared to revenue of $7,315,577 for the six months ended June 30, 2020, an increase of $30,511,328, or 417.1%.

For the six months ended June 30,

2021, revenue from the LBS business was $31,633,177, an increase of $24,555,015, or 346.9%, from $7,078,162 for the

six months ended June 30, 2020. The increase was mainly due to the integration and continuous improvement of geographic information

points of interest (POI), characteristic areas of interest (AOI) and other data with AI algorithms, which subsequently improved advertising

conversion to meet a growing customer base and increased demand.

Platform Software and Services For the

six months ended June 30, 2021, revenue from sales of remote sensing and GIS data management service platform software and services

increased to $4,388,912, from $237,415 for the six months ended June 30, 2020.

EMG,

a leading provider of navigation and electronic map services in China, contributed revenue of approximately $1,804,816 during

the period since the acquisition of the control of EMG closed on March 17, 2021. This revenue was mainly driven by HD Map data services

provided to auto makers in connection with autonomous driving.

Operating costs and expenses

Our operating costs and expenses consist of cost of revenues, selling,

general and administrative expenses, and research and development expenses.

Cost of Revenues

Cost of revenues increased by 414.4% to $34,341,999

for the six months ended June 30, 2021 from $6,676,517 for the six months ended June 30, 2020.

The cost of revenues primarily consists of traffic

acquisition costs and salary and benefit expenses. Our traffic acquisition costs may vary due to a number of factors, including scale,

targeted audience and the geography of traffic.

Salary and benefit expenses for employees directly

involved in data collection and processing, direct production costs, which are primarily comprised of field survey-related costs and hard

disk materials costs, and depreciation of facilities and equipment used in data collection and processing.

Selling and marketing expense

Our selling and marketing expense mainly includes

promotional and marketing expenses and compensation for our sales and marketing personnel.

Selling expense totaled $2,343,601 for the six

months ended June 30, 2021, as compared to $617,839 for the six months ended June 30, 2020, an increase of $1,725,762 or 279.3%. The increase

was primarily attributable to an increase in salaries of approximately $528,000 due to an increase in number of marketing personnel and

an increase in marketing and advertising expenses of approximately $1,116,000.

General and administrative expense

Our general and administrative expenses consist

primarily of salaries and benefits for our general and administrative personnel, rent, fees and expenses for legal, accounting and other

professional services.

General and administrative expense totaled $14,866,329

for the six months ended June 30, 2021, as compared to $12,561,785 for the six months ended June 30, 2020, an increase of $2,304,544 or

18.3%. The increase was primarily attributable to an increase in consulting fees of approximately $4,906,000, an increase in legal and

professional fees of approximately $1,620,000, an increase in salary expenses of approximately $729,000 and an increase in professional

fees of approximately $393,000, offset by a decrease in impairment for goodwill of approximately $3,620,000 and a decrease in impairment

loss of accounts and other receivables of approximately $3,048,000.

Research and development expenses

Research and development expenses primarily consist

of salaries and benefits for research and development personnel.

Research and development expenses totaled $11,379,986 for the six months

ended June 30, 2021, as compared to $4,343,682 for the six months ended June 30, 2020, an increase of $7,036,304 or 162.0%. The increase

was primarily attributable to an increase in salaries of approximately $1,362,000 due to an increase in number of staff in the R&D

department, an increase in amortization of intangible assets of approximately $2,418,000 as a result of the acquisition of a 100% equity

interest in EMG and an increase in software developments expenses of approximately $2,868,000.

Loss from operations

As a result of the factors described above, for

the six months ended June 30, 2021, loss from operations amounted to $25,105,010 as compared to loss from operations of $16,884,246 for

the six months ended June 30, 2020, an increase of $8,220,764, or 48.7%.

Other income/expense

Other income/expense primarily includes interest

expenses from other loans and foreign currency gains/losses.

For the six months ended June 30, 2021, other

expense, net, amounted to $1,901,065 as compared to other expense, net, of $2,017,919 for the six months ended June 30, 2020, a decrease

of $116,854, or 5.8%, which was primarily attributable to a decrease in foreign currency transaction loss of approximately $366,000 and

a decrease in other income of approximately $318,000, offset by an increase in interest expenses of approximately $567,000.

Net loss

As a result of the factors described above, our

net loss was $26,722,686 for the six months ended June 30, 2021, compared to net loss of $18,902,165 for the six months ended June 30,

2020, an increase of $7,820,521 or 41.4%.

Foreign currency translation adjustment

Our reporting currency is the U.S. dollar. The

functional currency of our parent company and subsidiaries of LK Technology, MMB and Mobile Media is the U.S. dollar and the functional

currency of the Company’s subsidiaries incorporated in China is the Chinese Renminbi (“RMB”). The financial statements

of our subsidiaries incorporated in China are translated to U.S. dollars using period end rates of exchange for assets and liabilities,

and average rates of exchange (for the period) for revenue, costs and expenses. Net gains and losses resulting from foreign exchange transactions

are included in the consolidated statements of operations and comprehensive loss. As a result of foreign currency translations, which

are a non-cash adjustment, we reported a foreign currency translation gain of $61,902 for the six months ended June 30, 2021, as compared

to a foreign currency translation gain of $462,022 for the six months ended June 30, 2020. This non-cash gain had the effect of decreasing

our reported comprehensive loss.

Comprehensive loss

As a result of our foreign currency translation

adjustment, we had comprehensive loss for the six months ended June 30, 2021 of $26,660,784, compared to comprehensive loss of $18,440,143

for the six months ended June 30, 2020.

Liquidity and Capital Resources

Liquidity is the ability of a company to generate

funds to support its current and future operations, satisfy its obligations and otherwise operate on an ongoing basis. We historically

relied on cash flow provided by operations and financing to provide our working capital. At June 30, 2021 and December 31, 2020, we had

cash balances of approximately $14,497,628 and $71,793, respectively. A significant portion of these funds are located in financial institutions

located in the PRC and will continue to be indefinitely reinvested in our operations in the PRC.

The following table sets forth a summary of changes in our working

capital from December 31, 2020 to June 30, 2021:

|

|

|

|

|

|

|

|

|

December 31,

2020

to June 30,

2021

|

|

|

|

|

June 30,

2021

|

|

|

December 31,

2020

|

|

|

Change

|

|

|

Percentage

Change

|

|

|

Working capital deficit:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current assets

|

|

$

|

30,613,519

|

|

|

$

|

12,049,113

|

|

|

$

|

18,564,406

|

|

|

|

154.1

|

%

|

|

Total current liabilities

|

|

|

81,831,365

|

|

|

|

73,613,138

|

|

|

|

8,218,227

|

|

|

|

11.2

|

%

|

|

Working capital deficit:

|

|

$

|

(51,217,846

|

)

|

|

$

|

(61,564,025

|

)

|

|

$

|

10,346,179

|

|

|

|

(16.8

|

)%

|

Our working capital deficit decreased by $10,346,179

to a working capital deficit of $51,217,846 at June 30, 2021 from $61,564,025 at December 31, 2020. This decrease in working capital deficit

is primarily attributable to an increase in cash of approximately $14,426,000 due to the financing activities in February 2021, an increase

in accounts receivable of approximately $4,897,000, an increase in notes receivable of approximately of $245,000 and a decrease in amounts

due to related parties of approximately $310,000, offset by decrease in other receivables of approximately $1,003,000, an increase in

accounts payable of approximately $1,406,000, an increase in accrued liabilities and other payables of approximately $6,131,000, an increase

in deferred revenue of approximately $896,000 and an increase in lease liability of approximately $96,000.

We incurred negative cash flows from operating

activities and net losses for the six months ended June 30, 2021, which raises substantial doubt about the Company’s ability to

continue as a going concern. In order to continue as a going concern and mitigate our liquidity risk, the Company will need additional

capital resources, among other things. Management’s plans to obtain such resources for the Company include (1) obtaining more sales

contracts, (2) increasing proceeds from loans from both unrelated and related parties to provide the resources necessary to fund the development

of our business plan and operations, and (3) increasing proceeds from loans from financial institutions and/or existing investors to increase

working capital in order to meet capital demands. On September 22, 2021, the Company closed a registered direct offering of (i) 27,333,300

ordinary shares and (ii) warrants to purchase 13,666,650 ordinary shares at a combined purchase price of $1.20. The gross proceeds to

Luokung from this offering are approximately $32.8 million. However, management cannot provide any assurance that the Company will be

successful in accomplishing these plans.

Cash flows for the six months ended June 30, 2021 compared to

the six months ended June 30, 20120

The following summarizes the key components of our cash flows for the

six months ended June 30, 2021 and 2020:

|

|

|

Six Months Ended

June 30,

|

|

|

|

|

2021

|

|

|

2020

|

|

|

Net cash used in operating activities

|

|

$

|

(34,266,792

|

)

|

|

$

|

(3,559,914

|

)

|

|

Net cash used in investing activities

|

|

|

(68,302,465

|

)

|

|

|

(18,404,241

|

)

|

|

Net cash provided by financing activities

|

|

|

116,167,114

|

|

|

|

18,533,819

|

|

|

Effect of foreign exchange rate changes

|

|

|

827,979

|

|

|

|

(52,983

|

)

|

|

Net increase (decrease) in cash

|

|

$

|

14,425,836

|

|

|

$

|

(3,483,319

|

)

|

Net cash flow used in operating activities was

$34,266,792 for the six months ended June 30, 2021 as compared to net cash flow used in operating activities of $3,559,914 for the six

months ended June 30, 2020, an increase of $30,706,878.

Net cash flow used in operating activities for

the six months ended June 30, 2021 primarily reflected our net loss of approximately $26,722,686, and the add-back of non-cash items,

primarily consisting of depreciation and amortization expense of approximately $5,682,000, allowance for doubtful receivables of approximately

$4,176,000, foreign currency exchange difference of approximately $73,000, loss on disposal of property, plant and equipment of approximately

$104,000, write off of account payables of approximately $202,000 and changes in operating assets and liabilities primarily consisting

of an increase in accounts receivable of approximately $5,548,000, a decrease in accounts payable of approximately $1,228,000, a decrease

in lease liability of approximately $290,000, a decrease in accrued liabilities and other payables of approximately $11,221,000 and a

decrease in deferred tax liability of approximately $283,000, offset by a decrease in other receivables and prepayments of approximately

$789,000 and an increase in deferred revenue of approximately $612,000.

Net cash flow used in operating activities for

the six months ended June 30, 2020 primarily reflected our net loss of approximately $18,902,000, and the add-back of non-cash items,

primarily consisting of depreciation and amortization expense of approximately $3,024,000, impairment for goodwill of approximately $3,620,000,

allowance for doubtful receivables of approximately $7,224,000, foreign currency exchange difference of approximately $434,000, loss on

disposal of subsidiary of approximately $126,000, gain on derecognition of lease of approximately $41,000, professional fees for common

share issuance of approximately $37,000 and changes in operating assets and liabilities primarily consisting of a decrease in accounts

payable of approximately $1,662,000, a decrease in lease liability of approximately $157,000, an increase in accrued liabilities and other

payables of approximately $938,000 and a decrease in deferred revenue of approximately $2,795,000, offset by a decrease in accounts receivable

of approximately $1,636,000 and a decrease in other receivables and prepayment of approximately $2,957,000.

Net cash flow used in investing activities was

$68,302,465 for the six months ended June 30, 2021 as compared to net cash flow used in investing activities of $18,404,241 for the six

months ended June 30, 2020. During the six months ended June 30, 2021, we made payments for the purchase of property, plant and equipment

of approximately $124,000, we made payments for the purchase of other assets of approximately $1,882,000, we made the remaining payment

for the acquisition of EMG of approximately $68,235,931 and we made payments for equity investments of approximately $439,000, offset

by cash received from acquisition subsidiaries of approximately $2,101,000 and proceeds from disposal of property, plant and equipment

of approximately $278,000. During the six months ended June 30, 2020, we made payments for the purchase of property, plant and equipment

of approximately $15,000, we made partial payment for the acquisition of EMG as disclosed in the Form 6K filed on September 13, 2019 of

approximately $18,262,000 and the disposal of subsidiary of approximately $126,000.

Net cash flow provided by financing activities

was $116,167,114 for the six months ended June 30, 2021 as compared to net cash flow provided by financing activities of $18,533,819

for the six months ended June 30, 2020. During the six months ended June 30, 2021, we received proceeds from issuance of common shares

of approximately $123,437,000 and additional capital investment from minority shareholders of approximately $377,000, offset by payment

of dividends on preferred shares of approximately $664,000, redemption of series B preferred stock of approximately $6,641,000 and deposits

of notes of approximately $346,000. During the six months ended June 30, 2020, we received a loan from Hangzhou Maijie Investment Co.,

Ltd., a subsidiary of Geely Technology of approximately $21,180,000, offset by repayment to related parties of approximately $2,647,000.

About Luokung Technology Corp.

Luokung Technology Corp. is a leading spatial-temporal

intelligent big data services company, as well as a leading provider of LBS and HD Maps for various industries in China. Backed by its

proprietary technologies and expertise in HD Maps and related intelligent spatial-temporal big data, Luokung establishes city-level and

industry-level holographic spatial-temporal digital twin systems and actively serves industries including autonomous driving, vehicle-road

collaboration (V2X), smart transportation, smart travel, local business LBS, new infrastructure, smart cities, and smart industries (emergency,

natural resources, environmental protection, water conservancy, energy, smart training, among others). The Company routinely provides

important updates on its website: www.luokung.com/en.

Safe Harbor Statements

This press release contains “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including certain plans, expectations, goals,

and projections, which are subject to numerous assumptions, risks, and uncertainties. These forward-looking statements may include, but

are not limited to, statements containing words such as “may,” “could,” “would,” “plan,”

“anticipate,” “believe,” “estimate,” “predict,” “potential,” “expects,”

“intends”, “future” and “guidance” or similar expressions. These forward-looking statements speak

only as of the date of this press release and are subject to change at any time. These forward-looking statements are based upon management’s

current expectations and are subject to a number of risks, uncertainties and contingencies, many of which are beyond the Company’s

control that may cause actual results, levels of activity, performance or achievements to differ materially from any future results, levels

of activity, performance or achievements expressed or implied by such forward-looking statements. The Company’s actual results could

differ materially from those contained in the forward-looking statements due to a number of factors, including those described under the

heading “Risk Factors” in the Company’s Annual Report for the fiscal year ended September 30, 2017 filed with the Securities

and Exchange Commission. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result

of new information, future events or otherwise, except as required under applicable law.

For investor and media inquiries, please contact:

Mr. Jay Yu

Tel: (+86) 10-6506 5217

Email: yujie@luokung.com

LUOKUNG TECHNOLOGY CORP. AND SUBSIDIARIES

UNAUDITED CONSOLIDATED BALANCE SHEETS

(IN U.S. DOLLARS)

|

|

|

As of

June 30,

|

|

|

As of

December 31,

|

|

|

|

|

2021

|

|

|

2020

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$

|

14,497,628

|

|

|

$

|

71,793

|

|

|

Accounts receivable, net of allowance for doubtful accounts

|

|

|

8,877,983

|

|

|

|

3,980,942

|

|

|

Other receivables and prepayment

|

|

|

6,993,327

|

|

|

|

7,996,378

|

|

|

Notes receivable

|

|

|

244,581

|

|

|

|

-

|

|

|

Total current assets

|

|

|

30,613,519

|

|

|

|

12,049,113

|

|

|

Non-current assets:

|

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

1,554,585

|

|

|

|

514,363

|

|

|

Intangible assets, net

|

|

|

110,405,373

|

|

|

|

42,716,594

|

|

|

Goodwill

|

|

|

83,765,949

|

|

|

|

11,957,839

|

|

|

Investment

|

|

|

436,835

|

|

|

|

196,798

|

|

|

Right-of-use assets

|

|

|

1,069,226

|

|

|

|

369,747

|

|

|

Other assets

|

|

|

1,882,262

|

|

|

|

-

|

|

|

Other receivables, net (long term)

|

|

|

3,892,066

|

|

|

|

61,378,420

|

|

|

Total non-current assets

|

|

|

203,006,296

|

|

|

|

117,133,761

|

|

|

TOTAL ASSETS

|

|

|

233,619,815

|

|

|

|

129,182,874

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

|

7,247,358

|

|

|

|

5,841,511

|

|

|

Accrued liabilities and other payables

|

|

|

72,597,688

|

|

|

|

66,467,084

|

|

|

Deferred revenue

|

|

|

1,553,902

|

|

|

|

657,542

|

|

|

Lease liabilities – current portion

|

|

|

432,417

|

|

|

|

336,537

|

|

|

Amounts due to related parties

|

|

|

-

|

|

|

|

310,464

|

|

|

Total current liabilities

|

|

|

81,831,365

|

|

|

|

73,613,138

|

|

|

Non-current liabilities:

|

|

|

|

|

|

|

|

|

|

Lease liabilities – non-current portion

|

|

|

581,339

|

|

|

|

-

|

|

|

Deferred tax liabilities

|

|

|

10,840,358

|

|

|

|

211,796

|

|

|

Accrued liabilities and other payables (long term)

|

|

|

3,619,086

|

|

|

|

2,663,835

|

|

|

Total non- current liabilities

|

|

|

15,040,783

|

|

|

|

2,875,631

|

|

|

TOTAL LIABILITIES

|

|

|

96,872,148

|

|

|

|

76,488,769

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share capital

|

|

|

|

|

|

|

|

|

|

Preferred stock, $0.01 par value; 22,794,872 shares authorized, issued and outstanding at June 30, 2021; 24,295,182 shares authorized, issued and outstanding at December 31, 2020

|

|

|

227,949

|

|

|

|

242,952

|

|

|

Ordinary shares, $0.01 par value; 500,000,000 shares authorized; 336,082,160 shares issued and outstanding at June 30, 2021; Ordinary shares, $0.01 par value; 239,770,000 shares issued and outstanding at December 31, 2020

|

|

|

3,360,822

|

|

|

|

2,397,701

|

|

|

Additional paid-in capital

|

|

|

274,832,626

|

|

|

|

164,753,586

|

|

|

Accumulated deficit

|

|

|

(141,550,260

|

)

|

|

|

(113,242,512

|

)

|

|

Accumulated other comprehensive income

|

|

|

(1,472,160

|

)

|

|

|

(1,523,978

|

)

|

|

Total equity attributable to owners of the company

|

|

|

135,398,977

|

|

|

|

52,627,749

|

|

|

Non-controlling interest

|

|

|

1,348,690

|

|

|

|

66,356

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Shareholders’ Equity

|

|

|

136,747,667

|

|

|

|

52,694,105

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

$

|

233,619,815

|

|

|

$

|

129,182,874

|

|

LUOKUNG TECHNOLOGY CORP. AND SUBSIDIARIES

UNAUDITED INTERIM CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS

(IN U.S. DOLLARS)

|

|

|

For the Six Months Ended

|

|

|

|

|

June 30,

|

|

|

|

|

2021

|

|

|

2020

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

$

|

37,826,905

|

|

|

$

|

7,315,577

|

|

|

Less: Operating costs and expenses:

|

|

|

|

|

|

|

|

|

|

Cost of revenues

|

|

|

34,341,999

|

|

|

|

6,676,517

|

|

|

Selling and marketing

|

|

|

2,343,601

|

|

|

|

617,839

|

|

|

General and administrative

|

|

|

14,866,329

|

|

|

|

12,561,785

|

|

|

Research and development

|

|

|

11,379,986

|

|

|

|

4,343,682

|

|

|

Total Operating costs and expenses

|

|

|

62,931,915

|

|

|

|

24,199,823

|

|

|

Loss from operations

|

|

|

(25,105,010

|

)

|

|

|

(16,884,246

|

)

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(2,192,752

|

)

|

|

|

(1,625,821

|

)

|

|

Foreign exchange losses, net

|

|

|

(73,128

|

)

|

|

|

(439,326

|

)

|

|

Other income, net

|

|

|

364,815

|

|

|

|

47,228

|

|

|

Total other expense, net

|

|

|

(1,901,065

|

)

|

|

|

(2,017,919

|

)

|

|

Loss before income taxes

|

|

|

(27,006,075

|

)

|

|

|

(18,902,165

|

)

|

|

Income tax credit

|

|

|

283,389

|

|

|

|

-

|

|

|

Net loss

|

|

$

|

(26,722,686

|

)

|

|

$

|

(18,902,165

|

)

|

|

Less: Net (loss) profit attributable to the non-controlling interest

|

|

|

(920,641

|

)

|

|

|

70,252

|

|

|

Net loss attributable to owners of the Company

|

|

$

|

(27,643,327

|

)

|

|

$

|

(18,831,913

|

)

|

|

Comprehensive loss:

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

|

(26,722,686

|

)

|

|

|

(18,902,165

|

)

|

|

Other comprehensive income:

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment

|

|

|

61,902

|

|

|

|

462,022

|

|

|

Comprehensive loss

|

|

$

|

(26,660,784

|

)

|

|

$

|

(18,440,143

|

)

|

|

Less: Comprehensive loss attributable to the non-controlling interest

|

|

|

(10,084

|

)

|

|

|

(6,134

|

)

|

|

Comprehensive loss attributable to owner of the company

|

|

$

|

(26,670,868

|

)

|

|

$

|

(18,446,277

|

)

|

|

Net loss per ordinary share:

|

|

|

|

|

|

|

|

|

|

Basic and Diluted

|

|

$

|

(0.09

|

)

|

|

$

|

(0.09

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of ordinary shares outstanding Basic and Diluted

|

|

|

307,146,263

|

|

|

|

211,365,515

|

|

LUOKUNG TECHNOLOGY CORP. AND SUBSIDIARIES

UNAUDITED INTERIM CONSOLIDATED STATEMENTS OF

CASH FLOWS

(IN U.S. DOLLARS)

|

|

|

For the Six Months Ended

|

|

|

|

|

June 30,

|

|

|

|

|

2021

|

|

|

2020

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(26,722,686

|

)

|

|

$

|

(18,902,165

|

)

|

|

Depreciation and amortization

|

|

|

5,682,011

|

|

|

|

3,023,748

|

|

|

Foreign currency exchange difference

|

|

|

72,949

|

|

|

|

433,870

|

|

|

Increase in allowance for doubtful accounts

|

|

|

4,175,541

|

|

|

|

7,223,875

|

|

|

Impairment for goodwill

|

|

|

-

|

|

|

|

3,619,968

|

|

|

Loss on disposal of Subsidiary

|

|

|

-

|

|

|

|

126,373

|

|

|

Gain on derecognition of lease

|

|

|

-

|

|

|

|

(40,933

|

)

|

|

Written off of account payables

|

|

|

(202,447

|

)

|

|

|

-

|

|

|

Common stock issuance for professional fee

|

|

|

-

|

|

|

|

37,417

|

|

|

Loss on disposal of property, plant and equipment

|

|

|

(103,604

|

)

|

|

|

-

|

|

|

Changes in assets and liabilities

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

(5,547,577

|

)

|

|

|

1,636,010

|

|

|

Other receivables and prepayment

|

|

|

789,242

|

|

|

|

2,957,066

|

|

|

Deferred revenue

|

|

|

612,040

|

|

|

|

(2,795,260

|

)

|

|

Accounts payable

|

|

|

(1,227,718

|

)

|

|

|

(1,661,641

|

)

|

|

Change in lease liability

|

|

|

(290,359

|

)

|

|

|

(156,647

|

)

|

|

Change in deferred tax liability

|

|

|

(283,389

|

)

|

|

|

-

|

|

|

Accrued liabilities and other payables

|

|

|

(11,220,795

|

)

|

|

|

938,405

|

|

|

Net cash used in operating activities

|

|

|

(34,266,792

|

)

|

|

|

(3,559,914

|

)

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Cash out flow from acquisition subsidiaries

|

|

|

(66,135,104

|

)

|

|

|

-

|

|

|

Proceeds from disposal of property and equipment

|

|

|

278,374

|

|

|

|

-

|

|

|

Purchase of property and equipment

|

|

|

(124,421

|

)

|

|

|

(15,488

|

)

|

|

Purchase of other assets

|

|

|

(1,882,249

|

)

|

|

|

-

|

|

|

Equity investment

|

|

|

(439,065

|

)

|

|

|

-

|

|

|

Payment made for acquisition of a subsidiary

|

|

|

-

|

|

|

|

(18,262,379

|

)

|

|

Disposal of subsidiary

|

|

|

-

|

|

|

|

(126,374

|

)

|

|

Net cash used in investing activities

|

|

|

(68,302,465

|

)

|

|

|

(18,404,241

|

)

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Advance from/(repayment to) related parties

|

|

|

5,369

|

|

|

|

(2,646,638

|

)

|

|

Payment of dividends on preferred shares

|

|

|

(664,421

|

)

|

|

|

-

|

|

|

Additional capital investment from minority shareholders

|

|

|

377,020

|

|

|

|

-

|

|

|

Deposits of notes

|

|

|

(346,117

|

)

|

|

|

|

|

|

Redemption of series B preferred stock

|

|

|

(6,641,328

|

)

|

|

|

|

|

|

Proceeds from issuance of debt

|

|

|

-

|

|

|

|

21,180,457

|

|

|

Proceeds from issuance of common shares

|

|

|

123,436,591

|

|

|

|

-

|

|

|

Net cash provided by financing activities

|

|

|

116,167,114

|

|

|

|

18,533,819

|

|

|

|

|

|

|

|

|

|

|

|

|

Effect of foreign exchange rate changes

|

|

|

827,979

|

|

|

|

(52,983

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net increase (decrease) in cash

|

|

|

14,425,836

|

|

|

|

(3,483,319

|

)

|

|

Cash at beginning of year

|

|

|

71,792

|

|

|

|

3,695,687

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash at end of period

|

|

$

|

14,497,628

|

|

|

$

|

212,368

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental cash flow disclosures:

|

|

|

|

|

|

|

|

|

|

Cash paid for amounts included in the measurement of lease liabilities

|

|

|

290,359

|

|

|

|

-

|

|

|

Interest paid

|

|

|

90,019

|

|

|

|

73,611

|

|

|

Income taxes paid

|

|

|

-

|

|

|

|

-

|

|

|

Non- cash transaction:

|

|

|

|

|

|

|

|

|

|

Right-of-use asset obtained in exchange for new operating lease liabilities

|

|

|

1,906,546

|

|

|

|

-

|

|

|

Share based compensation

|

|

|

-

|

|

|

|

37,417

|

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Luokung Technology Corp.

|

|

|

|

|

Date: November 1, 2021

|

By

|

/s/ Xuesong Song

|

|

|

|

Xuesong Song

|

|

|

|

Chief Executive Officer

|

11

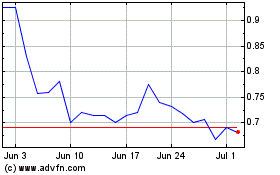

Luokung Technology (NASDAQ:LKCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Luokung Technology (NASDAQ:LKCO)

Historical Stock Chart

From Apr 2023 to Apr 2024