Shell 3Q Adjusted Earnings Fell as Hurricane Ida Hurt Business -- Update

October 28 2021 - 4:10AM

Dow Jones News

By Jaime Llinares Taboada

Royal Dutch Shell PLC on Thursday reported that its earnings

fell 25% in the third quarter after Hurricane Ida hurt its

operations in the Gulf of Mexico.

The Anglo-Dutch oil-and-gas major said its adjusted earnings

were $4.13 billion for the period, down from $5.53 billion in the

second quarter and below market expectations of $5.31 billion,

provided by Vara Research and averaged from 22 analysts'

estimates.

Shell said lower earnings reflected one-off tax impacts, lower

production volumes partly due to the effect of Hurricane Ida, and

lower contributions from trading and optimization. Overall, Shell

estimates that the hurricane had an adverse effect of around $400

million on adjusted earnings.

This was partly offset by stronger oil, liquefied natural gas

and gas prices.

Total production available for sale in the quarter fell 6% to

3.07 million oil-equivalent barrels a day.

However, cash flow from operations rose 27% to $16.03 billion,

mainly driven by a positive impact of $4.0 billion from commodity

derivatives.

The company reported a net loss of $447 million for the quarter,

which included noncash charges of $5.2 billion due to the fair

value accounting of commodity derivatives, swinging from a $3.43

billion net profit for the second quarter.

"Not the cleanest set of results this morning given a number of

one-offs impacting earnings, however from a CFFO [cash flow from

operations] perspective, Shell reported strong results," RBC

Capital Markets analyst Biraj Borkhataria said in a note.

Looking forward, Shell forecast capital expenditure to be around

$20 billion for the whole of 2021.

In the fourth quarter, production from the integrated gas

division is expected to average 940,000-980,000 oil-equivalent

barrels a day, while LNG liquefaction volumes are projected at 8.0

million-8.6 million metric tons, benefiting from lower maintenance

activities. Upstream production is seen at 2.10 million-2.35

million oil-equivalent barrels a day.

The oil products business is expected to deliver sales volumes

of 4.20 million-5.20 million barrels a day, with refinery

utilization of 68%-76%. As for the chemicals division, fourth

quarter plant utilization is expected at 73%-81%, and sales volumes

at 3.50 million-3.90 million tons.

Shell declared a quarterly dividend of $0.24 a share, unchanged

from the second quarter.

Shares at 0739 GMT were down 1.8% at 1,733.8 pence.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

October 28, 2021 03:55 ET (07:55 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

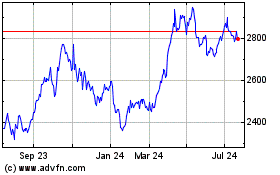

Shell (LSE:SHEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

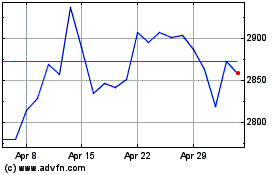

Shell (LSE:SHEL)

Historical Stock Chart

From Apr 2023 to Apr 2024