GlaxoSmithKline 3Q Net Profit Fell Slightly But Beat Expectations; Raises 2021 Adjusted EPS View -- Update

October 27 2021 - 8:51AM

Dow Jones News

By Cecilia Butini

GlaxoSmithKline PLC on Wednesday posted a slightly lower net

profit for the third quarter despite higher sales and it raised its

outlook for 2021 adjusted earnings per share.

The British pharma major said net profit for the period was 1.17

billion pounds ($1.61 billion), slightly down from $1.24 billion

the year prior but beating a consensus provided by FactSet which

saw the metric at GBP844 million.

Adjusted earnings per share, a closely-watched metric which

leaves out some one-off items, came in at 36.6 pence for the

period, also beating a FactSet consensus which saw it at 28.63

pence. Adjusted earnings per share in the same quarter the previous

year were 35.60 pence.

Sales rose to GBP9.08 billion in the quarter from GBP8.65

billion the previous year, GSK said.

The company raised its outlook on adjusted earnings per share

for 2021, saying it now expects the metric to decline between 2%

and 4% at constant exchange rates excluding Covid-19 solutions. It

had previously foreseen a mid-to-high single-digit decline.

Looking ahead, it reconfirmed the expectation for meaningful

improvement in revenue and margin in 2022.

GSK also declared a dividend of 19 pence for the third quarter,

continuing to expect 80 pence a share for 2021.

The company said sales in its vaccine business, especially for

its shingles vaccine Shingrix, were affected by a surge in the

delta coronavirus variant, which delayed the expected recovery of

the shot's prescriptions in the second half of the year. Despite

encouraging Shingrix prescription trends in the U.S., GSK said it

revised downward its vaccine revenue guidance for 2021, saying it

now foresees revenue to decline by mid-single digits. It had

previously expected the metric for the division to be broadly

flat.

Revenue in the pharmaceutical business is expected to grow by

low-single digits in 2021, from a previous expectation of flat to

low-single digit growth at constant exchange rates.

Consumer healthcare revenue is expected to grow by low to

mid-single digits at constant exchange rates in 2021 with

above-market growth, GSK said.

The company added that it is making progress toward the planned

demerger of the consumer healthcare business in mid-2022.

Write to Cecilia Butini at cecilia.butini@wsj.com

(END) Dow Jones Newswires

October 27, 2021 08:36 ET (12:36 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

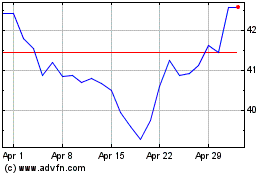

GSK (NYSE:GSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

GSK (NYSE:GSK)

Historical Stock Chart

From Apr 2023 to Apr 2024