UK Watchdog May Accept S&P Global, IHS Markit Undertakings to Clear Deal

October 26 2021 - 7:45AM

Dow Jones News

By Ian Walker

The U.K. Competition and Markets Authority said Tuesday that the

undertakings provided by S&P Global Inc. and IHS Markit Ltd.

may satisfy its concerns over the deal and be accepted.

The regulator said last week that S&P Global's planned $44

billion acquisition of IHS Markit could harm competition within its

markets and that it was considering whether to accept undertakings

from the companies to address this.

S&P Global and IHS said on Oct. 19 that they had discussed a

number of divestiture options that they believed should satisfy the

U.K. regulator's concerns, and which they planned to formally

submit to the CMA.

They have already agreed to sell IHS Markit's Oil Price

Information Services; Coal, Metals and Mining; and PetroChem Wire

businesses to News Corp., the parent company of Dow Jones &

Co., publisher of the Wall Street Journal and Dow Jones Newswires,

subject to the relevant regulatory approvals.

The companies have also discussed with the CMA the possible sale

of IHS Markit's base chemicals business to address any remaining

concerns.

The CMA said it has until Dec. 30 to decide whether to accept

these undertakings.

On Friday, the European Commission conditionally approved the

deal. It said that the EU executive branch's approval was

conditional on the divestment of some of IHS Markit's

commodity-price assessment services and a number of S&P Global

businesses in the financial data and infrastructure area.

S&P Global in November last year agreed to acquire IHS

Markit, in a deal that would combine two of the largest providers

of data to Wall Street.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

October 26, 2021 07:30 ET (11:30 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

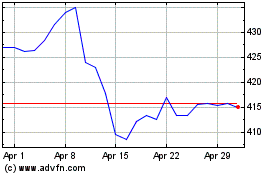

S&P Global (NYSE:SPGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

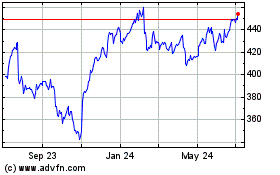

S&P Global (NYSE:SPGI)

Historical Stock Chart

From Apr 2023 to Apr 2024