Current Report Filing (8-k)

October 22 2021 - 3:06PM

Edgar (US Regulatory)

0001645260

false

0001645260

2021-10-21

2021-10-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 21, 2021

Todos

Medical Ltd.

(Exact

name of registrant as specified in its charter)

|

Israel

|

|

000-56026

|

|

n/a

|

|

(State

or other jurisdiction

|

|

(Commission

|

|

IRS

Employer

|

|

of

incorporation or organization)

|

|

File

Number)

|

|

Identification

No.)

|

121

Derech Menachem Begin

30th

Floor

Tel

Aviv, 6701203 Israel

Tel:

(011) (972) 8-633-3964

(Address

of principal executive offices)

Registrant’s

telephone number, including area code: + 972 (52) 642-0126

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

|

☐

|

Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Ordinary

Shares

|

|

TOMDF

|

|

n/a

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth

company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

On

October 21, 2021, Todos Medical Ltd. (the “Company”) entered into a Securities Purchase Agreement (the “SPA”)

with an institutional investor (the “Purchaser”) pursuant to which the Company has agreed to issue a promissory convertible

note (the “Note”) to the Purchaser in the principal amount of $1,428,571.43 for proceeds of $1,000,000 (the “Transaction”).

The closing occurred on October 22, 2021 (the “Closing Date”). The Note has a maturity date of one year from the date of

issuance and pays interest at a rate of 4% per annum. The Note is convertible into shares of Common Stock (the “Conversion Shares”)

at a conversion price of $0.0599 (the “Conversion Price). In addition, the Purchaser received a warrant (the “Warrant”)

to purchase up to 3,440,000 shares of Common Stock (the “Warrant Shares”) of the Company with an exercise price equal to

$0.107415 per share. The Warrant is exercisable for 5 years from the date of issuance. The Company intends to use the net proceeds from

this Note to continue funding the ongoing Phase 2 clinical trial of Tollovir® in hospitalized COVID-19 patients, beginningthe initial

marketing campaign for the cPass neutralizing antibody test launch at Provista Diagnostics and general corporate purposes.

The

Company has agreed to file a registration statement with the Securities and Exchange Commission registering for resale the Conversion

Shares and the Warrant Shares (the “Registration Statement). Subsequent to the effective date of the Registration Statement, if

the closing sale price of the Common Stock averages less than the then Conversion Price over a period of ten (10) consecutive trading

days, the Conversion Price shall reset to such average price. If the 10 day volume weighted average price of the Common Stock continues

to be less than the Conversion Price then the Conversion Price should reset to such 10-day average price with a maximum of a 20% discount

from the initial Conversion Price.

The

foregoing descriptions of the SPA, the Note and the Warrant do not purport to be complete and are qualified in their entirety by reference

to the full text of the SPA, Note and Warrant, forms of which are attached as Exhibit 10.1, 10.2 and 10.3, respectively, to this Current

Report on Form 8-K, and are incorporated herein by reference.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information included in Item 1.01 of this Form 8-K is hereby incorporated by reference into this Item 2.03.

Item

3.02 Unregistered Sales of Equity Securities.

The

information included in Item 1.01 of this Form 8-K is hereby incorporated by reference into this Item 3.02.

The

issuance of the securities described in item 1.01 was deemed to be exempt from the registration requirements of the Securities Act of

1933, as amended (the “Securities Act”), by virtue of Section 4(a)(2) and Rule 506 promulgated thereunder.

Item

8.01 Other Events

On

October 21st, 2021, the Company entered into amendment #1 of the lockup agreement (the “Amendment #1 Lock-up”)

previously announced on September 15, 2021 with one of the Company’s institutional shareholders (the “Holder”). Pursuant

to Amendment #1 Lock-up, the institutional investor has agreed to restrict their ordinary share sales by agreeing to sell no more than

10% of the daily trading volume for the term of the Amendment #1 Lock-up.

Item

9.01. Financial Statements and Exhibits

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

October 22, 2021

|

|

TODOS

MEDICAL LTD.

|

|

|

|

|

|

By:

|

/s/

Gerald Commissiong

|

|

|

|

Gerald

Commissiong

|

|

|

|

Chief

Executive Officer

|

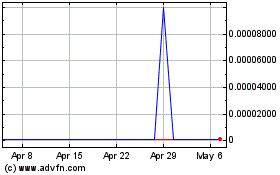

Todos Med (CE) (USOTC:TOMDF)

Historical Stock Chart

From Mar 2024 to Apr 2024

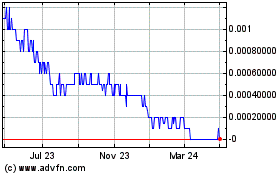

Todos Med (CE) (USOTC:TOMDF)

Historical Stock Chart

From Apr 2023 to Apr 2024