October 11, 2021 -- InvestorsHub NewsWire -- via Prime Time

Profiles --

Benzinga

ClickStream Corp (OTC

Other: CLIS) is in the right market at the right time. And

being there at a time when digital apps and online gaming are

surging in popularity could bode well for CLIS in the near and long

term.

In fact, recent moves to add compelling and engaging assets

could put its properties and stock into play. Better still, while

the ongoing pandemic brought almost every industry to a grinding

halt, the digital and online gaming sectors have seen a boom in new

interest. Thus, the trajectory at ClickStream could be decidedly

higher.

Actually, that trend is already in place. Last week, CLIS

announced its subsidiary Nebula Software Corp.’s HeyPal™, a

language learning app focused on “language exchanging” between

users around the world, has been downloaded more than 367,000 times

since its beta-launch less than eight months ago. And that’s only

from the iOS App Store, which, by the way, posted a 16% surge in

downloads since last month.

User Adoption Spikes

Still, while those numbers are impressive, expect them to get

even better once the HeyPal™ app is served on the Android platform,

which is on target to happen by the middle of November. Hence, this

current $0.08 stock, which trades roughly 750K shares per day,

could be presenting a compelling opportunity to investors liking to

trade ahead of expected catalysts. And the HeyPal™ launch on the

Android platform is indeed a value-creating event.

Moreover, while the percentage growth is impressive, so is the

number of users downloading the app. Between September 5th and

October 5th, there were 85,055 new downloads, a jump of roughly

12,000 users from the month before. And that growth is not by

coincidence. The gains are coming after CLIS launched a series of

new marketing campaigns in several geographic areas using a variety

of digital creatives that are attracting attention. Of course, in a

competitive industry, being attractive is a plus. But so is user

loyalty.

ClickStream is doing well there, too. In fact, an update showed

loyalty for HeyPal™ surged from 68% to 91% during the comparable

period, an increase of over 33%. And that “stickiness” is what app

developers and owners strive for to drive ad revenues higher. The

stickier the site, the better the rates.

The measure also indicates how involved users are, with

“loyalty” described as the percentage of users who downloaded the

app and opened it 3 times within 24 hours. It’s even better when

that loyalty is matched with accelerating downloads. And that’s

happening for HeyPal™, demonstrated by its spike in downloads month

over month. Better yet, all metrics are improving.Across

The Board Increases

In fact, the app is seeing substantial improvement in key

metrics across the board as users become more comfortable with the

platform and share it organically with their friends. The better

news is that while its most up-to-date numbers are impressive, it’s

only the start of a plan to drive user growth and stickiness in the

weeks and months ahead.

Moreover, with its Q4 product development roadmap in place that

includes several exciting new app features, downloads could

accelerate faster than expected. And its subsidiary Nebula is not

only positioning the app to enhance learning, improve connections

among users, and increase community safety, but also to drive key

engagement metrics in a meaningful way. Those numbers are what can

translate to dollars. Combine those initiatives with the planned

launch of HeyPal™ on Android next month; the pieces are in place

for a potentially exponential year of growth starting in the coming

weeks.

Know this, too. The launch of HeyPal™ through Android is a

catalyst in and of itself. Immediately, it makes the app available

to users across the globe. And with an 87% market share on

smartphones and devices, the Android addition can be a

revenue-generating game-changer for the company. Remember, even

though CLIS has done exceptionally well through the iOS platform,

it only reaching about 13% of smart device users. Therefore, the

opportunity for growth is extraordinary. The most excellent news is

that there’s much more in the ClickStream portfolio to drive value.

And with their intent to develop apps and digital platforms that

disrupt conventional industries, that intention can be met with

immediate and long-term success.

Best of all, it has the digital assets to make that happen.

Engaging Digital Assets Expand User Reach

WinQuik™ is another example of how innovation and

industry-changing user platforms can attract user adoption. This

free-to-play synchronized mobile app and digital gaming platform

combine the best of everything, with specific design features

enabling WinQuik™ users to have fun, interact and compete in order

to win real money and prizes.

Even better, it’s a real-time mobile AND web gaming platform

that offers players not only the opportunity to win cash but also

provides an entertaining visit through up to 5 daily games of

multiplayer quizzes. Adding more firepower to the proposition is

that Prime Time quizzes are run by well-known hosts with a wide

range of new and exciting topics for players to compete in. It’s

fun, engaging, and somewhat addictive. In the digital app space,

it’s a perfect combination of inherent assets.

Its Nifter™ app, made available through its subsidiary Rebel

Blockchain Inc., is a music NFT marketplace that allows artists to

create, sell and discover unique music and sound NFTs on the

Nifter™ marketplace. This is an exciting space indeed. Moreover,

it’s a sector that is exploding in popularity, with recent video

and music NFT’s selling well into the hundreds of thousands.

Topping the list, though, is the sale of The First 5000 Days, which

grabbed $69.3 million on the open market.

Why the interest? Because these NFT’s can generate substantial

returns. And from an investor’s perspective in CLIS, the word NFT

can be impactful, with its Nifter™ app enabling users to create,

sell and discover unique music NFTs on its Nifter™ Marketplace.

With the pace of growth in that sector, the app can be a

revenue-creating giant for the company. And there’s still more to

like.

Through its WOWEE World brand, ClickStream is launching Joey’s

Animal Kingdom™, targeting another massive niche market- children.

But this app is different, creating a children’s entertainment and

education platform that takes kids around the planet to see

incredible animals and creatures. Moreover, its WOWEE World app is

not just a place to watch videos and learn about animals; it has

numerous embedded features, including live quizzes, games, kid

profiles, and VS games.

Even better, it’s an app in motion, with WOWEE World planning to

launch other animated shows in the months to come. Each show, by

the way, Like Joey’s Animal Kingdom™, will pertain to a series of

engaging and valuable topics, including science, history, culture,

sports, and food/nutrition. Hence, it’s an app that can attract

many advertisers in different sectors as well as a substantial user

base. Parent approved, this one can be a considerable value driver

as well.

Combined Power Of Valuable Digital Assets

Still, while each app is expected to be a considerable value

driver heading into the new year, it’s the combination of all that

creates the compelling investment opportunity into the company

making it happen- ClickStream.

And with a market cap of roughly $6.6 million, any of its brands

could generate the download volume to send that valuation

substantially higher. Also, volume in its trading is increasing,

indicating that attention is making its way to the company’s stock.

That’s excellent news as well.

And it’s well-earned. In fact, the intrinsic value of its

subsidiary assets alone is worthy of sending its stock higher.

Further, accounting for expected growth and accelerating download

rates for its flagship products, that disconnect between asset

portfolio and share price could close. That means its 52-week high

of $0.60 is in play from a historical perspective. From current

levels, that’s about a 650% increase. And that’s not wishful

thinking. CLIS has cash in the bank, growing downloads, compelling

digital assets, and the ambition to take its industry-changing apps

to the next level.

Thus, while 2021 may have set up CLIS to do well, 2022 can be

the breakout period of exponential proportions. And with that being

about 90 days away, catching CLIS at undervalued levels could help

create a prosperous new year for investors liking combines that

combine growth with innovation. Indeed, like its other gaming

assets, CLIS may be one to play.

Disclaimers: Shore Thing Media, LLC. (STM, LLC.) is

responsible for the production and distribution of this content.

STM, Llc. is not operated by a licensed broker, a dealer, or a

registered investment adviser. It should be expressly understood

that under no circumstances does any information published herein

represent a recommendation to buy or sell a

security. Our reports/releases are a commercial

advertisement and are for general information purposes ONLY. We are

engaged in the business of marketing and advertising companies for

monetary compensation. Never invest in any stock featured on our

site or emails unless you can afford to lose your entire

investment. The information made available by STM,

Llc. is not intended to be, nor does it constitute, investment

advice or recommendations. The contributors may buy and sell

securities before and after any particular article, report and

publication. In no event shall STM, Llc. be liable to any member,

guest or third party for any damages of any kind arising out of the

use of any content or other material published or made available by

STM, Llc., including, without limitation, any investment losses,

lost profits, lost opportunity, special, incidental, indirect,

consequential or punitive damages. Past performance is a poor

indicator of future performance. The information in this video,

article, and in its related newsletters, is not intended to be, nor

does it constitute, investment advice or recommendations. STM,

Llc. strongly urges you conduct a complete and

independent investigation of the respective companies and

consideration of all pertinent risks. Readers are advised to review

SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports,

Forms 3, 4, 5 Schedule 13D. For some content, STM, Llc., its

authors, contributors, or its agents, may be compensated for

preparing research, video graphics, and editorial content. STM, LLC

has been compensated up to ten-thousand dollars cash via wire

transfer by a third part to produce and syndicate content for

ClickStream Corp for a one-month

period. As part of that content, readers,

subscribers, and website viewers, are expected to read the full

disclaimers and financial disclosures statement that can be found

on our website by visiting

primetimeprofiles.com/disclaimer.

The Private Securities Litigation Reform Act of 1995

provides investors a safe harbor in regard to forward-looking

statements. Any statements that express or involve discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives, goals, assumptions or future events or performance are

not statements of historical fact may be forward looking

statements. Forward looking statements are based on expectations,

estimates, and projections at the time the statements are made that

involve a number of risks and uncertainties which could cause

actual results or events to differ materially from those presently

anticipated. Forward looking statements in this action may be

identified through use of words such as projects, foresee, expects,

will, anticipates, estimates, believes, understands, or that by

statements indicating certain actions & quote; may, could, or

might occur. Understand there is no guarantee past performance will

be indicative of future results.Investing in micro-cap and growth

securities is highly speculative and carries an extremely high

degree of risk. It is possible that an investors investment may be

lost or impaired due to the speculative nature of the companies

profiled.

Source - https://www.benzinga.com/pressreleases/21/10/ab23314923/clickstream-corp-sees-user-growth-for-its-heypal-app-surge-launch-on-android-in-november-could-cr

Other stocks on the move include

PUGE,

ENZC, and

DPLS.

SOURCE: Prime Time Profiles

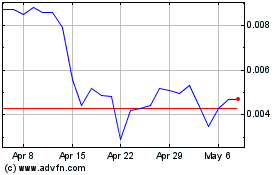

Enzolytics (PK) (USOTC:ENZC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Enzolytics (PK) (USOTC:ENZC)

Historical Stock Chart

From Apr 2023 to Apr 2024