Statement of Changes in Beneficial Ownership (4)

October 08 2021 - 5:01PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Golden Post Rail, LLC |

2. Issuer Name and Ticker or Trading Symbol

DYNARESOURCE INC

[

DYNR

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director __X__ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

1110 POST OAK PLACE |

3. Date of Earliest Transaction

(MM/DD/YYYY)

10/6/2021 |

|

(Street)

WESTLAKE, TX 76262

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

___ Form filed by One Reporting Person

_

X

_ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Convertible Promissory Note | $2.00 | 10/6/2021 | | J (1) | | | 1250000 (1) | 5/14/2020 | 5/14/2022 | Series D Convertible Preferred Stock | 1250000 (1) | (1) | 0 | D (2)(3) | |

| July 2020 Warrant (Right to Buy) | $2.05 | | | | | | | (5) | 7/1/2022 | Common Stock | 2645992 (4) | | 2645992 | D (2)(3) | |

| 2020 Warrant (Right to Buy) | $0.01 | | | | | | | (5) | 5/14/2030 | Common Stock | 783975 (6) | | 783975 | D (2)(3) | |

| Series C Convertible Preferred Stock | $2.05 (7) | | | | | | | (5) | (8) | Common Stock | 2460315 (7) | | 1734992 | D (2)(3) | |

| 2015 Warrant (Right to Buy) | $2.05 (9) | | | | | | | (5) | 5/13/2027 | Common Stock | 2708 (9) | | 2306 (9) | D (2)(3) | |

| Explanation of Responses: |

| (1) | The convertible promissory note (the "Note") in favor of Golden Post Rail, LLC ("Golden Post") was called for redemption by the issuer in full pursuant to its terms. |

| (2) | Matthew K. Rose is the Manager, President, Secretary and Treasurer of Golden Post and may be deemed to beneficially own the securities held by Golden Post. Mr. Rose disclaims beneficial ownership of these securities, except to the extent of his pecuniary interest therein. Mr. Rose states that neither the filing of this statement nor anything herein shall be deemed an admission that Mr. Rose is, for purposes of Section 16 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise, the beneficial owner of these securities. As a result of certain contractual rights, the reporting persons may be deemed to be a director by deputization with respect to the issuer. |

| (3) | The reporting persons may be deemed to be a member of a group with respect to the issuer or securities of the issuer for purposes of Section 13(d) or 13(g) of the Exchange Act. The reporting persons declare that neither the filing of this statement nor anything herein shall be construed as an admission that such persons are, for the purposes of Section 13(d) or 13(g) of the Exchange Act or any other purpose, a member of a group with respect to the issuer or securities of the issuer. |

| (4) | The common stock purchase warrant issued to Golden Post on July 1, 2020 (the "July 2020 Warrant") is subject to anti-dilution adjustments for stock splits, stock dividends, and similar matters. |

| (5) | Immediately exercisable. |

| (6) | The common stock purchase warrants (the "2020 Warrants") are subject to anti-dilution adjustments for stock splits, stock dividends, and similar matters. |

| (7) | The conversion price, and the number of shares of common stock into which the shares of Series C Senior Convertible Preferred Stock (the "Series C Preferred Stock") is convertible, are subject to anti-dilution adjustments, which generally provide that the shares of Series C Preferred Stock retain their percentage ownership of each of the fully diluted outstanding shares of common stock of the issuer and the equity held by the issuer in one of its subsidiaries. The amount of underlying securities also includes 344,471 shares of common stock that may be issuable upon conversion of the Series C Preferred Stock as a result of accrued and unpaid dividends as of June 30, 2020. Any increase or decrease in the number of shares of common stock issuable upon the conversion of the Series C Preferred Stock as a result of any prior or subsequent increase or decrease in accrued and unpaid dividends is exempt from Section 16 of the Exchange Act pursuant to Rule 16a-9(a) thereunder. |

| (8) | The shares of Series C Preferred Stock have no expiration date. |

| (9) | The number of shares of common stock for which the 2015 Warrants are exercisable is subject to anti-dilution adjustments, which generally provide that the 2015 Warrants will retain their aggregate percentage ownership of each of the fully diluted outstanding shares of common stock of the issuer and the equity held by the issuer in one of its subsidiaries. In connection with any such anti-dilution adjustment, the exercise price per share decreases such that the aggregate exercise price of the warrant remains constant. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Golden Post Rail, LLC

1110 POST OAK PLACE

WESTLAKE, TX 76262 | X | X |

|

|

ROSE MATTHEW K

1110 POST OAK PLACE

WESTLAKE, TX 76262 | X | X |

|

|

Signatures

|

| /s/ Matthew K. Rose, manager | | 10/8/2020 |

| **Signature of Reporting Person | Date |

| /s/ Matthew K. Rose | | 10/8/2020 |

| **Signature of Reporting Person | Date |

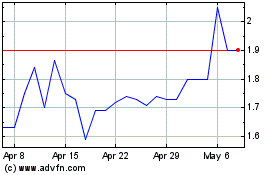

Dynaresource (QX) (USOTC:DYNR)

Historical Stock Chart

From Mar 2024 to Apr 2024

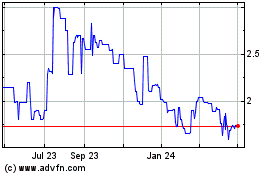

Dynaresource (QX) (USOTC:DYNR)

Historical Stock Chart

From Apr 2023 to Apr 2024