UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

Filed

by the Registrant ☒ Filed by a Party other than the Registrant

☐

Check

the appropriate box:

☒ Preliminary

Proxy Statement

☐ Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive

Proxy Statement

☐ Definitive

Additional Materials

☐ Soliciting

Material Pursuant to §240.14a-12

AMERAMEX

INTERNATIONAL, INC.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

☒ No

fee required.

☐ Fee

computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

(1)

Title of each class of securities to which transaction applies:

(2)

Aggregate number of securities to which transaction applies:

(3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule

0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4)

Proposed maximum aggregate value of transaction:

(5)

Total fee paid:

☐ Fee

paid previously with preliminary materials.

☐ Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee

was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1)

Amount Previously Paid:

(2)

Form, Schedule or Registration Statement No.:

(3)

Filing Party:

(4)

Date Filed:

AMERAMEX

INTERNATIONAL, INC.

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

December

[●], 2021

TO

THE STOCKHOLDERS OF AMERAMEX INTERNATIONAL, INC:

NOTICE

IS HEREBY GIVEN that, pursuant to the call of its Board of Directors, the Annual Meeting of Stockholders (the “Meeting”)

of AmeraMex International, Inc. (the “Company”) will be held on December [●], 2021 at 2:00 p.m. Pacific Time, at 3930

Esplanade, Chico, California 95973 for the following purposes:

1. Election

of Directors. To elect the following five (5) nominees to the Board of Directors: Lee Hamre, Marty Tullio, J. Jeffery Morris,

Brian Hamre, and Michael Maloney, to serve until the 2022 Annual Meeting of Stockholders and until their successors are duly elected

and qualified.

2. Ratification

of Independent Registered Public Accounting Firm. To ratify the selection of dbbmckennon, CPAs, as the Company’s

independent registered public accounting firm for the fiscal year ending December 31, 2021.

3. Amendment

to Articles of Incorporation. To amend the Company’s Amended and Restated Articles of Incorporation to permit stockholder

action by written consent by stockholders holding not less than the minimum number of votes that would be necessary to authorize or take

such action at a meeting at which all shares entitled to vote on the action were present and voted.

4.

Other Business. To transact such other business as may properly come before the Meeting and

any and all postponements or adjournments thereof.

As

an accommodation to our stockholders in light of the challenges presented by the COVID-19 virus, the Company has decided to provide a

call-in number for those stockholders who would prefer not to attend the stockholder meeting in person but would still like to listen

to the proceedings. Although you will not be able to cast your votes, change any votes you may have already made by proxy, or ask any

questions via the call-in number, we are pleased to be able to provide this remote opportunity to our stockholders. To access the stockholder

meeting remotely, please dial 1-201-689-8560 on [●], 2021 at 2:00 p.m. California time. For those who do attend the meeting in

person, we will observe proper social-distancing protocol to the extent required by local and state officials.

The

Board of Directors has fixed the close of business on [●], 2021 as the record date for determination of stockholders entitled to

notice of, and to vote at, the Meeting and any and all postponements or adjournments thereof.

|

|

|

BY

ORDER OF THE BOARD OF DIRECTORS

|

|

|

|

|

|

Dated: [●], 2021

|

|

|

|

|

|

Lee Hamre

President

& CEO

|

PLEASE

SIGN AND RETURN THE ENCLOSED PROXY CARD (“PROXY”) AS PROMPTLY AS POSSIBLE AND INDICATE IF YOU WILL ATTEND THE MEETING IN

PERSON. ALTERNATIVELY, A STOCKHOLDER CAN CHOOSE TO VOTE BY USING THE INTERNET AS INDICATED ON THE PROXY. IF YOU VOTE ELECTRONICALLY THROUGH

THE INTERNET, YOU DO NOT NEED TO RETURN THE PROXY. PLEASE REFER TO THE PROXY STATEMENT AND PROXY FOR A MORE COMPLETE DESCRIPTION OF THE

PROCEDURES FOR INTERNET VOTING.

AMERAMEX

INTERNATIONAL, INC.

PROXY

STATEMENT

FOR

ANNUAL

MEETING OF STOCKHOLDERS

[●],

2021

INTRODUCTION

This

proxy statement (“Proxy Statement”) is furnished in connection with the solicitation of proxies for use at the 2021 Annual

Meeting of Stockholders (the “Meeting”) of AmeraMex International, Inc. (the “Company”) to be held on [●],

2021, at 2:00 p.m. Pacific Time, at 3930 Esplanade, Chico, California 95973 for the following purposes and at any and all postponements

or adjournments thereof. Only stockholders of record on [●], 2021 (the “Record Date”) will be entitled to notice of

the Meeting and to vote at the Meeting. At the close of business on the Record Date, the Company had outstanding and entitled to be voted

[●] shares of the Company’s common stock having a par value of $0.001. Directions to the Meeting can be found later in this

Proxy Statement. The approximate date on which this Proxy Statement together with our Annual Report for 2020 and the proxy card are first

being made available to stockholders at AMMX.net is [●], 2021.

Revocability

of Proxies

A

proxy for voting your shares at the Meeting is enclosed. Any stockholder who executes and delivers such proxy has the right to and may

revoke it at any time before it is exercised by filing with the Secretary of the Company an instrument revoking it or a duly executed

proxy bearing a later date. In addition, a proxy will be revoked if the stockholder executing such proxy is in attendance at the Meeting

and such stockholder votes in person. Subject to such revocation, all shares represented by a properly executed proxy received in time

for the Meeting will be voted by the proxyholders in accordance with the instructions specified on the proxy.

Unless

otherwise directed in the accompanying proxy, the shares represented by your executed proxy will be voted “FOR” the nominees

for election of directors named herein, “FOR” the ratification of the selection of dbbmckennon, CPAs, as the Company’s

independent registered public accounting firm for the 2021 fiscal year, and “FOR” approval of amending the Company’s

Articles of Incorporation. If any other business is properly presented at the Meeting and at any and all postponements or adjournments

thereof, the proxy will be voted in accordance with the recommendations of management.

Solicitation

of Proxies

This

solicitation of proxies is being made by the Board of Directors of the Company. The expenses of preparing, assembling, printing, and

mailing this Proxy Statement and the materials used in this solicitation of proxies will be borne by the Company. It is contemplated

that proxies will be solicited principally through the use of the mail, but directors, officers, and employees of the Company may solicit

proxies personally without receiving special compensation. The Company will reimburse banks, brokerage houses and other custodians, nominees

and fiduciaries for their reasonable expenses in forwarding the Proxy Statement and materials to stockholders whose stock in the Company

is held of record by such entities. In addition, the Company may use the services of individuals or companies it does not regularly employ

in connection with this solicitation of proxies, if management determines it advisable.

Important

Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on [●], 2021.

The

Company’s Proxy Statement and Annual Report on Form 10-K for the fiscal year ended December 31, 2020 are available free of charge

at https://ammx.net/investor-relations/sec-filings/. We are furnishing materials to our stockholders primarily via the internet instead

of mailing printed copies of those materials to our stockholders. By doing so, we save costs and reduce the environmental impact of the

Meeting. On [●], 2021, the Company mailed a Notice of Internet Availability of Proxy Materials (“Notice”) to stockholders.

The Notice contains instructions about how to access our proxy materials and vote online. If you would like to receive a paper copy of

our proxy materials, please follow the instructions included in the Notice.

Voting

Securities

On

any matter submitted to the vote of the stockholders, each holder of common stock will be entitled to one vote, in person or by proxy,

for each share of common stock held of record on the books of the Company as of the Record Date.

A

majority of the stock issued and outstanding and entitled to vote, present in person or represented by proxy, will constitute a quorum

at the Meeting. If, by the time scheduled for the Meeting, a quorum of stockholders of the Company is not present or represented at the

meeting, the stockholders entitled to vote thereat, whether present in person or represented by proxy, will have power to adjourn the

meeting from time to time, without notice other than announcement at the meeting, until a quorum shall be present or represented.

Votes

cast will be counted by the Inspector of Election for the Meeting. When a quorum is present or represented at any meeting, the vote of

the holders of a majority of the stock having voting power present in person or represented by proxy will be sufficient to elect directors

or approve any proposal brought before such meeting. Shares represented by proxies that reflect abstentions or “broker non-votes”

will be treated by the Inspector of Election as shares present and entitled to vote for purposes of determining the presence of a quorum;

however, broker non-votes will not be treated as shares voted on any proposal and therefore will have no effect upon the outcome of any

proposal. Abstentions will not be treated as affirmative votes on any proposal at the Meeting and will have the same effect as a vote

“against” a proposal if the affirmative votes in favor of a proposal are less than a majority of the required quorum. “Broker

non-votes” means shares held by brokers or nominees as to which instructions have not been received from the beneficial owners

or persons entitled to vote and the broker or nominee does not have discretionary voting power under applicable rules of the stock exchange

or other self-regulatory organization of which the broker or nominee is a member.

Any

stockholder may choose to vote shares of common stock electronically by using the Internet, as indicated on the proxy. Internet voting

procedures are designed to authenticate the identity of a stockholder and to confirm that instructions have been properly recorded. These

procedures are consistent with the requirements of Nevada law. If a stockholder votes electronically by using the Internet, there is

no need to return the proxy.

If

you vote by Internet, your vote must be received by 11:59 p.m., Pacific Time, on [●], 2021 to ensure that your vote is counted.

PROPOSAL

NO. 1

ELECTION

OF DIRECTORS

The

Company’s Bylaws (the “Bylaws”) provide that the number of directors of the Company shall not be less than three (3)

nor more than nine (9) until changed by an amendment to Article III, Section 3.2 of the Bylaws duly adopted by the vote or written

consent of a majority of the Board of Directors or holders of a majority of the outstanding shares entitled to vote. The Board of Directors

is presently comprised of five (5) individuals.

The

Board of Directors has nominated the following individuals for re-election as directors of the Company, each to serve a one-year term

beginning at the Meeting and expiring at the 2022 Annual Meeting of the Stockholders, and until either they are re-elected or their successors

are elected and qualified or until their earlier death, resignation or removal:

Lee

Hamre

Marty

Tullio

J.

Jeffery Morris

Brian

Hamre

Michael

Maloney

Vote

Required

Under

the Company’s Bylaws, when a quorum is present or represented at any meeting, the vote of the holders of a majority of the stock

having voting power present in person or represented by proxy will be sufficient to elect a director. If you hold your shares in your

own name and abstain from voting on this matter, your abstention will have the same effect as a negative vote. If you hold your shares

through a broker and you do not instruct the broker on how to vote on this proposal, your broker will not have the authority to vote

your shares. Broker non-votes will have no effect.

Recommendation

of Board of Directors

The

Board of Directors recommends a vote “FOR” each of the five (5) nominees listed above.

DIRECTORS

AND EXECUTIVE OFFICERS

The

following table sets forth the names and ages of our current directors and executive officers and includes the principal offices and

positions held by each person and the year each person began in his or her role. Our executive officers were appointed by our Board of

Directors. Our directors serve until the earlier occurrence of the election of his or her successor at the next Annual Meeting of Stockholders

or their earlier death, resignation, or removal.

|

|

|

|

|

Name

|

|

Age

|

|

Position

|

|

Date

|

|

|

|

|

|

|

|

|

|

Lee

Hamre

|

|

70

|

|

President

and Chairman

|

|

2006

|

|

Marty

Tullio

|

|

73

|

|

Secretary

and Director

|

|

2012

|

|

Hope

Stone

|

|

50

|

|

Chief

Financial Officer

|

|

2018

|

|

J.

Jeffery Morris

|

|

72

|

|

Director

|

|

2019

|

|

Brian

Hamre

|

|

55

|

|

Director

|

|

2019

|

|

Michael

Maloney

|

|

59

|

|

Director

|

|

2012

|

|

Romeo

Terso

|

|

41

|

|

Vice

President of African Affairs

|

|

2021

|

|

|

|

|

|

|

|

|

|

|

Board

of Directors

The

Board of Directors has nominated the five (5) incumbent directors named below for election as directors of the Company and to apprise

you of their qualifications to serve as directors. The Board of Directors reviews the qualities of the Board members as a group, including

the diversity of the Board’s career experiences, viewpoints, company affiliations, expertise with respect to the various facets

of our business operations and business experiences. The Board of Directors has not adopted a formal policy and did not employ any particular

benchmarks with respect to these qualities, but was mindful of achieving an appropriate balance of these qualities with respect to the

Board of Directors as a whole. Moreover, the Board of Directors considered each nominee’s overall service to us during the previous

term, each nominee’s personal integrity and willingness to apply sound and independent business judgment with respect to our matters,

as well as the individual experience of each director. The following persons are the nominees of the Board of Directors for election

to serve for a one-year term until the 2022 Annual Meeting of Stockholders and until their successors are duly elected and qualified:

Lee

Hamre, Chief Executive Officer and Chairman

Lee

Hamre has been the President and CEO of the Company since 2006. Mr. Hamre has been in the heavy equipment business for over 38 years.

He is also the Vice President of Gazmin International in Dubai and Kuwait City in the United Arab Emirates for the last two years. He

worked for Buehrer Inc. in Berkeley, California for 13 years from 1976 to 1989. He then founded Hamre Equipment Co. as its sole owner

in 1989. In 2006, he merged Hamre Equipment Co. with AmeraMex International after having rented equipment to AmeraMex International for

several years. Mr. Hamre served in the United States Navy Reserves for six years. He earned a B.A. in Business Communications from California

State College, Chico.

Michael

Maloney, Director

Michael

Maloney has been a Director of the Company since 2012. He is currently a self-employed, licensed private investigator and consultant

serving the Greater Northern California area. He previously served as a California peace officer for 32 years, retiring as the Chief

of Police in Chico, California. Concurrent and overlapping with his law enforcement career, Mr. Maloney served as adjunct faculty in

the law enforcement academy at Butte Community College for 25 years, followed by five years as the Director of the Public Safety Education

and Training Center (which included the law enforcement academy, the fire academy, the California Fish and Wildlife Academy and the California

State Parks Academy, as well as a myriad of public safety certificate and degree programs).

In

his cumulative 37 years of public service, Mr. Maloney spent over 20 years in management, with 18 of those in senior or executive management.

Mr. Maloney has significant experience in managing multi-million dollar taxpayer-funded budgets, organizational management, policy development

and implementation, strategic planning, personnel hiring and management, emergency and crisis incident management, among many other areas.

Maloney has over 40 years of community volunteer experience, having served on the boards and as an officer of several non-profit or social

service organizations.

Marty

Tullio, Secretary and Director

Marty

Tullio has been the Secretary and Director of the Company since 2012. She has managed the financial communications programs for a wide

range of public and private companies, providing day-to-day counsel to executive management and coordinating investor relations efforts

for a number of diversified clients. Ms. Tullio is proactive in the planning and execution of investor outreach programs, including road

shows and investor conferences, and in developing strategic communications plans for client organizations. Since 1999, Ms. Tullio has

owned McCloud Communications, LLC, an investor relations and communications consultant for emerging and mid-size public companies.

Ms.

Tullio has more than a decade of in-house agency investor relations management experience, specializing in the targeting and development

of institutional investor and research analyst following, support of fundraising activities, corporate and crisis communications, consulting,

and the introduction and positioning of companies to the investment community.

Prior

to becoming an investor relations professional, Ms. Tullio spent 15 years as a sales and marketing executive in the technology industry,

with companies such as NCR, GTE Telenet, and a division of McDonnell-Douglas. She has held several managerial and executive positions,

including Vice President of Sales and Marketing, Executive Vice President, and General Manager. Marty has a Bachelor of Arts degree and

earned her investor relations certification from the University of California, Irvine.

J.

Jeffery Morris, Director

J.

Jeffery Morris has been a Director of the Company since 2019. Mr. Morris is the president of Global Finance Group located in Newport

Beach, California. Mr. Morris has been in the commercial leasing/finance industry since 1974. Prior to joining Global Finance Group,

Morris started Crocker Capital, a lease invoice financing company, in 1992. In 1980, Morris began Perry Morris Corporation and by 1990,

the company had an annual leasing invoice position of over $100 million. The company was twice named in INC Magazine’s list of

the 500 fastest growing, privately held companies in the U.S. Mr. Morris graduated from USC in 1972 as a finance major. He has been on

the boards of many civic and charitable organizations such as: Southern California Chapter of YPO, Children’s Hospital of Orange

County, USC Associates, and the Orange County YMCA. He also headed a public fundraising campaign for a Children’s Hospital that

raised over $12 million.

Brian

Hamre, Director

Brian

Hamre has been a Director of the Company since 2019. Brian Hamre is the Regional Sales Manager (Northern California and Northern Nevada)

of Ritchie Brothers Auctioneers, which specializes in the acquisition and auction of heavy equipment. Mr. Hamre has over 32 years of

sales and marketing management experience in the heavy equipment industry. Prior to joining Ritchie Brothers in 2008, Mr. Hamre worked

with us for 22 years. While with us, he held a variety of positions and was responsible for successfully expanding our sales and marketing

reach within the Western United States. Brian Hamre is an alumnus of California State University, Chico.

If

any of the nominees should unexpectedly decline or be unable to serve as a director, the proxies may be voted for a substitute nominee

to be designated by the Board of Directors. The Board of Directors has no reason to believe that any nominee will become unavailable

and has no present intention to nominate persons in addition to or in lieu of those named above.

None

of the Company’s directors, nominees for election as directors listed above, or executive officers listed on page 8 of this Proxy

Statement, were selected pursuant to any arrangement or understanding other than with the directors and executive officers of the Company

acting within their capacities as such.

Executive

Officers

Below

are the names, ages, and certain other information on each of our current executive officers, other than Lee Hamre and Marty Tullio,

whose information is provided above.

Hope

Stone, Chief Financial Officer

Hope

Stone joined the Company as Chief Financial Officer in June 2018. Ms. Stone is responsible for our overall financial strategy and direction,

as well as human resources. Within finance, she guides our treasury, accounting, tax, and internal and external audit functions.

From

June 2016 to August 2018, Ms. Stone was Controller and acting Chief Financial Officer of Digital Path, Inc., a mid-sized telecommunications

company servicing Northern California, Northern Nevada, and Southern Oregon. From March 2014 to August 2016, Ms. Stone was the Controller

and Human Resources Manager at Moana Nursery, a multi-store organization servicing Northern Nevada’s nursery and landscaping industry

since 1967. Throughout her over 20-year career in accounting, auditing and financial planning, Ms. Stone has established a reputation

for building world-class teams and for aligning financial and business metrics to support business strategy and high-growth. Ms. Stone

has spearheaded multiple SBA loans and equipment and other financing transactions. Stone holds a BS in Finance from Tennessee Baptist

College and an MBA from the University of Devonshire.

Romeo

Terso, Vice President, African Affairs

Romeo

Terso joined the Company as Vice President of African Affairs in January 2021. Mr. Terso is an international businessman from Nigeria

with 15 years of experience in the energy sector, including experience working in a private contract capacity for the Nigeria National

Petroleum Corporation (NNPC). Mr. Terso also organizes private forums where he provides advice, guidelines and other related services

to companies interested in entering the Nigerian energy sector.

Mr.

Terso is involved with several companies including The Petracon International Group, where he currently serves as president. Additionally,

Mr. Terso is actively involved with diverse business sectors including real estate, heavy equipment,

hospitality, finance, civil engineering, construction, consulting, and general trading. Mr. Terso is also an avid investor and shareholder

in several international companies.

OUR

BOARD OF DIRECTORS

Board

Leadership Structure

The

Board of Directors has not formally established any criteria for Board membership. Candidates for director nominees are reviewed in the

context of the current composition of the Board of Directors, our operating requirements, and the long-term interests of our stockholders.

In conducting this assessment, the Board of Directors considers skills, knowledge, diversity, experience, and such other factors as it

deems appropriate given the current needs of the Board of Directors and us, to maintain a balance of knowledge, experience and capability.

The

Board of Directors does not have a policy on whether the roles of Chief Executive Officer and Chairman of the Board should be separate

and, if they are to be separate, whether the Chairman of the Board should be selected from the non-employee directors or be an employee.

The Board of Directors believes that we and our stockholders benefit when the Board of Directors is free to determine the most appropriate

leadership structure in light of the experience, skills and availability of directors and the Chief Executive Officer as well as other

circumstances.

Director

Independence

We

apply the definition of “independent director” provided under the Listing Rules of The NASDAQ Stock Market LLC (“NASDAQ”)

to determine whether members of our Board of Directors are independent. Under NASDAQ rules, the Board of Directors has considered all

relevant facts and circumstances regarding our directors and has affirmatively determined that two of the directors serving on the Board

of Directors, Michael Maloney and J. Jeffery Morris, are independent of the Company. The Board of Directors is also responsible for oversight

of our risk management practices, while management is responsible for the day-to-day risk management processes.

Code

of Ethics

The

Company has a Code of Ethics that is signed off by each employee as part of their initial hiring package. The Company code of ethics

is posted on the company website and can be found at https://ammx.net/investor-relations/corporate-governance/#GovSection|3.

Corporate

Governance Guidelines

We

are not subject to the listing requirements of any national securities exchange or national securities association and, as a result,

we are not at this time required to have formal corporate governance guidelines. However, our Board of Directors and management are dedicated

to the standard of exemplary corporate governance and believe that corporate governance is vital to the continued success of the Company.

Involvement

in Certain Legal Proceedings

There

have been no known events under any bankruptcy act, no criminal proceedings and no judgments, injunctions, orders or decrees material

to the evaluation of the ability and integrity of any director, executive officer, promoter or control person of the Company during the

past ten years.

Certain

Relationships

Brian

Hamre, director, is the nephew of Lee Hamre, Chief Executive Officer and Chairman of our Board of Directors.

Annual

Meeting Attendance

The

Board of Directors held four meetings by teleconference from January through December 2020. All directors attended 100% of such meetings

of the Board of Directors. Although the Board of Directors has not adopted a formal policy, all directors are expected to attend each

annual meeting of stockholders.

BOARD

COMMITTEES

Audit

Committee

Our

separately-designated audit committee (the “Audit Committee”) currently consists of J. Jeffery Morris and Marty Tullio with

J. Jeffery Morris acting as the audit committee financial expert.

The

Company’s audit committee charter requires at least two members of the committee to be independent. Moving forward, our audit committee

will be composed of J. Jeffery Morris, Michael Maloney and Marty Tullio, with J. Jeffery Morris acting as the audit committee financial

expert. Both J. Jeffery Morris and Michael Maloney are independent directors.

Our

Board has adopted a written charter for the Audit Committee, pursuant to which the Audit Committee has, among others, the following duties

and responsibilities:

|

|

•

|

Appoint,

compensate, and oversee all audit and non-audit services performed by auditors, including

the work of any registered public accounting firm employed by the Company;

|

|

|

•

|

Resolve

any disagreements between management and the auditor regarding financial reporting and other

matters; and

|

|

|

•

|

Pre-approve

all auditing and non-audit services performed by auditors.

|

During

2020, the Audit Committee held two meetings. In addition, members of the Audit Committee speak regularly with our independent registered

public accounting firm and separately with the members of management to discuss any matters that the Audit Committee or these individuals

believe should be discussed, including any significant issues or disagreements concerning our accounting practices or financial statements.

For further information, see “Report of the Audit Committee” below.

The

charter of our Audit Committee can be accessed on the “Corporate Governance” section of our website, https://ammx.net/investor-relations/governance/.

Nominating

or Compensation Committee

The

Board of Directors has no standing nominating or compensation committee and acts as its own nominating and compensation committees as

it believes that the functions of such committees can be adequately performed by the Board of Directors.

Stockholder

Communications to the Board

The

Board of Directors does not have a formal process for stockholders to send communications to the Board of Directors, including recommendations

of director candidates. The names of all our directors are available in this Proxy Statement. The Company holds quarterly stockholder

conference calls where stockholders are able to communicate with the Board of Directors. Given both the infrequency of stockholder communications

and that the majority of the common shares is held by members of the Board of Directors, the Board of Directors does not believe a formal

process for stockholder communications is necessary. The Board of Directors will consider, from time to time, whether adoption of a formal

process for such stockholder communications has become necessary or appropriate. Director nominations and other communications may be

submitted by a stockholder by sending such communications to any member of the Board of Directors at 3930 Esplanade, Chico, California

95973 marked to the attention of an individual director’s name or to the Chairman of the Board.

DIRECTOR

COMPENSATION

Our

directors are compensated for their services, and are entitled for reimbursement of expenses incurred in attending Board of Directors

meetings. The following table sets forth the compensation paid to our Board of Directors for the years ended December 31, 2020 and December

31, 2019:

|

Name

|

Fees

Earned or Paid in Cash for 2020

|

Fees

Earned or Paid in Cash for 2019

|

|

Lee

Hamre

|

$

⸺

|

$2,500

|

|

Michael

Maloney

|

$500

|

$2,500

|

|

Marty

Tullio

|

$500

|

$2,500

|

|

J.

Jeffery Morris

|

$500

|

$

⸺

|

|

Brian

Hamre

|

$500

|

$

⸺

|

COMPENSATION

DISCUSSION AND ANALYSIS

Executive

Compensation

All

decisions regarding compensation for our executive officers and executive compensation programs are reviewed, discussed, and approved

by the Board of Directors. All compensation decisions are determined following a detailed review and assessment of external

competitive data, the individual’s contributions to our success, any significant changes in role or responsibility, and internal

equity of pay relationships.

The

Board of Directors has found that compensating our executive officers with a salary only is adequate. The Company does not offer equity

or equity-equivalent awards to executive officers as a form of compensation.

The

following table sets forth the compensation paid to our executive officers from the years ended December 31, 2020 and 2019.

|

Name

and Principal Position

|

Year

|

Salary

($)

|

All

Other Compensation ($)

|

Total

($)

|

|

Lee

Hamre, CEO & Chairman (1)

|

2020

2019

|

150,000

150,000

|

⸺

2,500

|

150,000

152,500

|

|

Hope

Stone,

CFO

|

2020

2019

|

120,000

120,000

|

⸺

⸺

|

120,000

120,000

|

(1)

Lee Hamre received $2,500 in compensation for attending Board of Directors meetings in 2019.

Other

Compensation

As

of the date of this Proxy Statement, we do not have any bonuses, option awards, non-equity incentive plan, nonqualified deferred compensation

plan, annuity, pension, stock options, profit sharing retirement, or other similar benefit plans; however, we may adopt such plans in

the future. In addition, there are no personal benefits available to our officers and directors and we do not currently have any plan

that provides for the payment of retirement benefits (e.g., any tax-qualified defined benefit or contribution plans (401(k)), or any

contract that provides payment to an executive officer in connection with their resignation, retirement or termination.

Outstanding

Equity Awards at Fiscal Year-End

We

do not currently have any arrangements or contracts pursuant to which our officers and directors are compensated for any services, including

any additional amounts payable for committee participation or special assignments.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth, as of the Record Date, the number of shares of common stock owned of record and beneficially by (i)

each of our named executive officers and directors; (ii) each person who owns beneficially more than 5% of each class of our outstanding

equity securities; and (iii) all directors and officers as a group. Beneficial ownership is determined in accordance with the rules of

the Securities Exchange Commission (“SEC”) and generally includes voting or investment power with respect to securities.

Management is not aware of any arrangements which may, at a subsequent date, result in a change of control of the Company.

Unless

otherwise indicated below, the address of each beneficial owner is c/o AmeraMex International, Inc., 3930 Esplanade, Chico, California

95973. Unless otherwise indicated below, we believe that each of the persons listed in the table (subject to applicable community property

laws) has the sole power to vote and to dispose of the shares listed opposite the stockholder’s name. All calculations are based

on [●] shares of common stock outstanding as of the Record Date.

Name

and Address of

Beneficial Owner

|

Number

of Shares of

Common

Stock

|

Percent

of

Class

|

|

Lee

Hamre, President & Chairman

|

6,183,657

|

[42.2]%

|

|

Marty

Tullio, Secretary & Director

|

916,667

|

[6.3]%

|

|

Hope

Stone, Chief Financial Officer

|

-0-

|

-

|

|

Michael

Maloney, Director

|

130,000

|

*

|

|

J.

Jeffery Morris, Director

|

2,000

|

*

|

|

Brian

Hamre, Director

|

60,000

|

*

|

|

All

officers and directors

as

a group (five persons)

|

7,422,324

|

[49.4]%

|

|

Warren

Murphy (1)

12

Meza Luna Court

Henderson,

NV 89011

|

1,358,100

|

[9.3]%

|

*

Less than 1%

(1)

Number of shares is based solely on a Schedule 13G filed with the SEC on August 20, 2019 on behalf of Warren Murphy, as revised to reflect

the effect of the Company’s 1:50 reverse stock split on December 21, 2020.

RELATED

PARTY TRANSACTIONS

Related

Party Transactions

Except

as described below, there were no transactions with any executive officers, directors, 5% stockholders and their families and affiliates

since January 1, 2020. Any related party transactions must be approved by the Board of Directors.

We

lease a building and real property in Chico, California from a trust whose trustee is Lee Hamre, our Chief Executive Officer, for monthly

lease payments of $9,800. We are currently leasing the building and real property on a month-to-month basis. The total rent for 2020

was $139,600 and the total rent for 2019 was $117,600.

We

have a note payable to our Chief Executive Officer, Lee Hamre, for funds loaned for our operations. The note is interest bearing at 10%

per annum, unsecured, and payable upon demand. The balance of the note at December 31, 2020 and 2019 was $226,659 and $334,794, respectively.

During the years ended December 31, 2020 and 2019, we repaid $158,675 and $18,849, respectively, on the note. The note incurred $36,936

in interest in 2020 and $29,137 in interest in 2019.

PROPOSAL

NO. 2

RATIFICATION

OF THE SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The

independent registered public accounting firm of dbbmckennon, CPAs, served the Company as its independent registered public accountants

and auditors for the fiscal years ended December 31, 2020 and 2019, at the direction of the Audit Committee and the Board of Directors

of the Company. dbbmckennon, CPAs will not (i) be present at the annual stockholders meeting; (ii) have the opportunity to make

a statement; or (iii) available to respond to questions. dbbmckennon, CPAs does not have any interest, financial or otherwise,

in the Company.

AUDIT

FEES

The

aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the annual

audit of our financial statements and review of financial statements included in our quarterly reports and services that are normally

provided by the accountant in connection with statutory and regulatory filings or engagements for these fiscal periods were as follows:

|

|

|

For

the Fiscal Year Ended

|

|

|

|

2020

|

|

2019

|

|

Audit

Fees

|

|

$

|

132,657

|

|

|

$

|

156,672

|

|

|

Audit-Related

Fees

|

|

$

|

5,213

|

|

|

$

|

5,260

|

|

|

Tax

Fees

|

|

$

|

7,100

|

|

|

$

|

0

|

|

|

All

Other Fees

|

|

$

|

24,657

|

|

|

$

|

15,439

|

|

|

Total

|

|

$

|

169,626

|

|

|

$

|

177,371

|

|

Audit

Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors

Our

Audit Committee pre-approves all audit and permissible non-audit services. These services may include audit services, audit-related services,

tax services and other services. Our Audit Committee approves these services on a case-by-case basis.

Vote

Required

The

ratification of the selection of dbbmckennon, CPAs as the Company’s independent registered public accountants requires approval

of a majority of the total number of shares voting at the Meeting. If our stockholders do not ratify the selection of independent accountants,

the Audit Committee will reconsider the appointment. However, even if our stockholders ratify the selection, the Audit Committee may

still appoint new independent accountants at any time during the year if it believes that such a change would be in the best interests

of the Company. If you hold your shares in your own name and abstain from voting on this matter, your abstention will have the same effect

as a negative vote. If you hold your shares through a broker and you do not instruct the broker on how to vote on this proposal, your

broker will have the authority to vote your shares.

Recommendation

of Board of Directors

The

Board of Directors recommends that stockholders vote “FOR” the ratification of the selection of dbbmckennon, CPAs

as the Company’s independent registered public accountant for the fiscal year ended December 31, 2021.

Report

of the Audit Committee

The

Audit Committee has reviewed the Company’s audited financial statements for the fiscal year ended December 31, 2020 and has discussed

these financial statements with the Company’s management and independent registered public accounting firm.

The

Audit Committee has also received from, and discussed with, dbbmckennon, CPAs, the Company’s independent registered

public accounting firm, various communications that the Company’s independent registered public accounting firm is required to

provide to the Audit Committee, including the matters required to be discussed by Statement on Auditing Standards No. 61, as amended

(AICPA, Professional Standards, Vol. 1. AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T.

The

Company’s independent registered public accounting firm also provided the Audit Committee with the written disclosures required

by Public Company Accounting Oversight Board Rule 3526 (Communication with Audit Committees Concerning Independence). The Audit Committee

has discussed with the independent registered public accounting firm their independence from the Company.

Based

on the reports and discussions described in this report, and subject to the limitations on the role and responsibilities of the Audit

Committee referred to above and in the Audit Committee charter, the Audit Committee recommended to the Board of Directors of the Company

that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020.

By

the Audit Committee of the Board of Directors

J.

Jeffery Morris

Marty

Tullio

PROPOSAL

NO. 3

APPROVAL

OF AMENDMENT TO AMENDED AND RESTATED ARTICLES OF INCORPORATION TO AUTHORIZE STOCKHOLDER ACTION BY WRITTEN CONSENT

Article

11 of our Amended and Restated Articles of Incorporation (“Amended and Restated Articles of Incorporation”) currently authorizes

“any action required or permitted to be taken at a meeting of stockholders of the corporation without a meeting or a vote if either:

(a) the action is taken by written consent of all stockholders entitled to vote on the action; or (b) so long as the corporation is not

a public company, the action is taken by written consent of stockholders holding of record, or otherwise entitled to vote, in the aggregate

not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled

to vote on the action were present and voted.”

The

Board of Directors is recommending that the stockholders enact an amendment to effectuate the following action:

To

authorize stockholder action taken by written consent of stockholders holding of record, or otherwise entitled to vote, in the aggregate

not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled

to vote on the action were present and voted while the Company is public.

The

Board of Directors recommends that the stockholders authorize our Board of Directors, at their election, to file such amendment to the

Amended and Restated Articles of Incorporation. The proposed form of amendment to our Amended and Restated Articles of Incorporation

to effect the above action is attached as Appendix A to this Proxy Statement (the “Amendment”).

If

approved by our stockholders, the Amendment will become effective upon the filing of the amendment with the Nevada Secretary of State,

which filing is expected to occur promptly after the Meeting.

Reasons

for the Proposed Amendment

Currently,

so long as the Company is public, the Amended and Restated Articles of Incorporation require any action to be taken by written consent

of all stockholders entitled to vote on the action if such action is taken without a meeting. Practically, this prevents the stockholders

from acting by written consent without a meeting. The primary benefit of the Amendment to the Amended and Restated Articles of Incorporation

is to allow stockholders to act by written consent, which will help the Company reduce fees associated with holding annual and special

meetings.

Vote

Required

Under

the Company’s Amended and Restated Articles of Incorporation, an amendment of the Articles of Incorporation must be approved by

a majority of the votes in each voting group entitled to be cast on the matter. If you hold your shares in your own name and abstain

from voting on this matter, your abstention will have the same effect as a negative vote. If you hold your shares through a broker and

you do not instruct the broker on how to vote on this proposal, your broker will not have the authority to vote your shares. Broker non-votes

will have no effect.

Recommendation

of Board of Directors

The

Board of Directors recommends that stockholders vote “FOR” the approval of the Amendment to the Amended and Restated Articles

of Incorporation to authorize stockholder action by written consent.

ANNUAL

REPORT

The

Annual Report of the Company containing audited financial statements for the fiscal year ended December 31, 2020 is being mailed or made

available electronically to stockholders simultaneously with this Proxy Statement.

WEBSITE

Information

regarding the Company may be obtained from the Company’s website at https://ammx.net/investor-relations/sec-filings/#b2iSecScrollTo.

Copies of the Company’s Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and Section 16

reports by Company insiders, including exhibits and amendments thereto, are available free of charge on the Company’s website as

soon as they are published by the Securities and Exchange Commission through a link to the reporting system maintained by the Securities

and Exchange Commission. You may also request, without charge, a copy of the Company’s Annual Report on Form 10-K upon written

request to the Company’s Corporate Secretary, Marty Tullio, AmeraMex International Inc., at 3930 Esplanade, Chico, California 95973.

STOCKHOLDER

PROPOSALS

We

intend to hold our 2022 Annual Meeting of Stockholders on November 4, 2022. The deadline for stockholders to submit proposals for inclusion

in the Proxy Statement and form of proxy for the 2022 Annual Meeting of Stockholders is September 30, 2022. The proposals must be in

a form compliant with our Bylaws and applicable law. Management of the Company will have discretionary authority to vote proxies obtained

by it in connection with any stockholder proposal not submitted on or before the deadline. All proposals should be submitted by Certified

Mail - Return Receipt Requested, to Marty Tullio, Secretary, AmeraMex International Inc., at 3930 Esplanade, Chico, California 95973.

For any proposal that is not submitted for inclusion in next year’s Proxy Statement (as described in the preceding paragraph),

but is instead sought to be presented directly at next year’s annual meeting, SEC rules permit management to vote proxies in its

discretion if the Company (a) receives notice of the proposal before the close of business on [●], 2022 and advises stockholders

in next year’s Proxy Statement about the nature of the matter and how management intends to vote on the matter, or (b) does not

receive notice of the proposal prior to the close of business on [●], 2022.

OTHER

MATTERS

The

Board of Directors knows of no other matters, which will be brought before the Meeting, but if such matters are properly presented to

the Meeting, proxies solicited hereby will be voted in accordance with the discretion of the persons holding such proxies. All shares

represented by duly executed proxies will be voted at the Meeting and at any and all postponements or adjournments thereof in accordance

with the terms of such proxies.

|

Dated:

[●], 2021

|

|

AMERAMEX INTERNATIONAL, INC.

|

|

|

|

|

|

|

By:

|

|

|

|

|

Lee Hamre

|

|

|

|

President & CEO

|

APPENDIX

A

AMENDMENT

TO

AMENDED

AND RESTATED ARTICLES OF INCORPORATION of

ameramex

international, inc.

ARTICLE

11 of the Amended and Restated Articles of Incorporation of AmeraMex International Inc. shall be amended to read in its entirety as follows:

ARTICLE

11. SHAREHOLDER ACTION BY WRITTEN CONSENT

Any

action required or permitted to be taken at a meeting of shareholders of the corporation may be taken without a meeting or a vote if

the action is taken by written consent of shareholders holding of record, or otherwise entitled to vote, in the aggregate not less than

the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote

on the action were present and voted. To the extent the Nevada Revised Statutes requires prior notice of any such action to be given

to nonconsenting or nonvoting shareholders, such notice shall be given before the date on which the action becomes effective. The notice

shall be in the form of a record and shall contain or be accompanied by the same material that, under the Nevada Revised Statutes, would

have been required to be delivered to nonconsenting or nonvoting shareholders in a notice of meeting at which the proposed action would

have been submitted for shareholder action. Such notice shall be provided in the same manner as the Bylaws or these Amended and Restated

Articles of Incorporation require or permit other notices to shareholders to be provided.

|

***

Exercise Your Right to Vote ***

Important Notice Regarding the Availability of Proxy

Materials for the Shareholder Meeting to Be Held on

December [●], 2021.

|

|

Meeting

Information

Meeting

Type: Annual Meeting

For

holders as of: [●], 2021

Date:

December [●], 2021 Time: 2:00 p.m.., Local Time

Location:

3930 Esplanade, Chico, CA 95973

You

are receiving this communication because you hold shares in AmeraMex International, Inc. (the “Company”).

This

is not a ballot. You cannot use this notice to vote these shares. This communication presents only an overview of the more complete

proxy materials that are available to you on the Internet. You may view the proxy materials online at http://annualgeneralmeetings.com/AmeraMex/

or easily request a paper copy.

We

encourage you to access and review all of the important information contained in the proxy materials before voting. Your Proxy Card

will be automatically mailed to you in a separate mailing.

|

Before

You Vote

How

to Access the Proxy Materials

How

to View Online:

Visit:

http://annualgeneralmeetings.com/AmeraMex/

How

to Request and Receive a PAPER or E-MAIL Copy:

If

you want to receive a paper or e-mail copy of these documents, you must request one. There is NO

charge

for requesting a copy. Please choose one of the following methods to make your request:

1)

BY E-MAIL*: info@pacificstocktransfer.com

2)

BY TELEPHONE: 1-800-785-7782

*

If requesting materials by e-mail, please put AmeraMex International, Inc. Annual Meeting in the subject line.

Requests,

instructions and other inquiries sent to this e-mail address will NOT be forwarded to your investment advisor. Please make the request

as instructed above on or before [●], 2021 to facilitate timely delivery.

How

To Vote

Please

Choose One of the Following Voting Methods

Vote

In Person: Many shareholder meetings have attendance requirements including, but not limited to, the possession of an attendance ticket

issued by the entity holding the meeting. Please check the meeting materials for any special requirements for meeting attendance. At

the meeting, you will need to request a ballot to vote your shares.

Vote

By Internet: To vote by Internet, go to https://ipst.pacificstocktransfer.com/pxlogin. Have the control ID on your Proxy Card ready and

follow the instructions.

Vote

By Mail: You can vote by mail by requesting a paper copy of the materials, which will include a proxy card.

Voting

Items

The

Board of Directors recommends you vote FOR the following:

1.

Election of Directors

2.

Ratification of independent

registered accounting firm, dbbmckennon, CPAs, as the Company’s independent registered public accounting firm for the fiscal

year ending December 31, 2021

3.

To amend the Company’s Amended and Restated Articles

of Incorporation to permit stockholder action by written consent by stockholders holding not less than the minimum number of votes that

would be necessary to authorize or take such action at a meeting at which all shares entitled to vote on the action were present and

voted.

|

AMERAMEX INTERNATIONAL, INC.

3930

ESPLANADE

CHICO,

CA 95973

|

Proxy

for: AMERAMEX INTERNATIONAL, INC.

Meeting

date: December [●], 2021

Voting

Instructions

You

can vote by Internet

Instead of mailing your proxy, you may choose

to vote on the Internet. Validation details including Control ID are located on this form.

Please

vote immediately. Your vote is important.

Log

on to the Internet and go to

https://ipst.pacificstocktransfer.com/pxlogin

See

your Control ID below.

Follow

the steps outlined on this secured Website.

Meeting

Information

The

Annual Meeting of Stockholders of AmeraMex International, Inc. will be held in person at 3930 Esplanade, Chico, CA 95973 and remotely

via telephone at 1-201-689-8560 on December [●], 2021. The notice of materials and proxy card are being mailed to all stockholders

eligible to vote at the Annual Meeting.

|

|

|

|

|

CONTROL

ID: [●]

(For Internet Voting)

PROXY

#: [●]

(For

Mail In Voting)

*REGISTRAR

MUST RECEIVE YOUR VOTING INSTRUCTIONS PRIOR TO 11:59PM PT ON [●]*

PROXY

CARD: RETURN ENTIRE PAGE IF MAILING IN

This

Proxy will be voted in accordance with the directions given herein. If no direction is given, this proxy will be voted per the Board

of Directors' recommendation. VOTING ITEMS CONTINUED ON BACK SIDE OF PROXY CARD.

A.

Voting Items (Fill in only one box per nominee or item in black or blue ink)

*The

Board of Directors recommends a vote FOR each of the matters and nominees listed below.

1.

Election of Directors (see Proxy Statement)

|

|

*Lee Hamre

|

For □

|

Against □

|

|

*J. Jeffery Morris

|

For □

|

Against □

|

|

|

|

|

|

|

|

|

|

|

|

*Marty Tullio

|

For □

|

Against □

|

|

*Brian Hamre

|

For □

|

Against □

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Michael Maloney

|

For □

|

Against □

|

|

|

|

|

|

|

|

|

|

2.

Ratification of the appointment of auditors, dbbmckennon, CPAs, as the Company’s independent registered public accounting

firm for the fiscal year ending December 31, 2021.

For

□ Against □ Abstain □

3.

To amend the Company’s Amended and Restated Articles of Incorporation to permit stockholder action by written consent by stockholders

holding not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all

shares entitled to vote on the action were present and voted.

For

□ Against □ Abstain □

Important

Notice Regarding the Availability of Proxy Materials for the Annual Meeting:

The

Notice, Proxy Statement and Annual Report are available at http://annualgeneralmeetings.com/AmeraMex/

How

to Request and Receive a PAPER or E-MAIL Copy:

If

you want to receive a paper or e-mail copy of these documents, you must request one. There is NO charge for requesting a copy. Please

choose one of the following methods to make your request:

1)

BY E-MAIL: info@pacificstocktransfer.com

2)

BY TELEPHONE: 1-800-785-7782

PROXY

SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

FOR

THE ANNUAL MEETING OF SHAREHOLDERS ON [●], 2021

The

undersigned hereby appoints Lee Hamre and Marty Tullio, agent and proxy, with full power of substitution, to represent the undersigned

and to vote all shares of stock of AmeraMex International, Inc. that the undersigned is entitled to vote at the Annual Meeting of Stockholders

of the Corporation to be held on [●], 2021, and any adjournments thereof, upon all matters that may properly come before the annual

meeting.

This

Proxy, when properly executed, will be voted in the manner herein specified by the undersigned shareholder and at the discretion of the

above-named Proxy upon such other matters as may properly come before the annual meeting. If no direction is made, this Proxy will be

voted “FOR” the election of all proposals.

B.

Authorized Signatures - This section must be completed for your vote to be counted.

Date

and Sign Below.

Please

sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor,

administrator, attorney, trustee or guardian, please give the full titles as such. If the signer is a corporation, please sign full corporate

name by duly authorized officer, giving full title as such. If signer is a partnership, please sign as partnership’s name by authorized

person.

|

Signatures and Date:

|

|

☐ I plan to attend the

meeting on [●], 2021

|

|

|

|

|

|

|

|

|

ADDRESS

CHANGE - This section is to write in an address change.

If

voting by mail, you must complete Sections A & B and mail in the provided envelope.

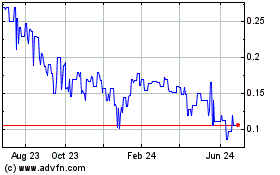

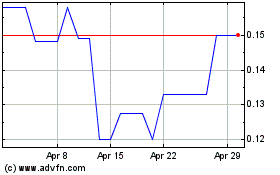

Ameramex (PK) (USOTC:AMMX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ameramex (PK) (USOTC:AMMX)

Historical Stock Chart

From Apr 2023 to Apr 2024