As filed with the Securities and Exchange Commission on September 28, 2021

Registration No. 333-257501

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

PRE-EFFECTIVE AMENDMENT NO. 1

TO

FORM S-3/A

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

|

UNITED HEALTH PRODUCTS, INC.

|

|

(Exact name of Registrant as specified in its charter)

|

|

Nevada

|

|

84-1517723

|

|

(State or other jurisdiction of

|

|

(I.R.S. Employer

|

|

Incorporation or organization)

|

|

Identification No.)

|

10624 S Eastern Ave, STE A209

Henderson, NV 89052

(877) 358-3444

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Brian Thom

Chief Executive Officer

10624 S Eastern Ave, STE A209

Henderson, NV 89052

(877) 358-3444

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Gavin Grusd

Ruskin Moscou Faltischek, P.C.

1425 RXR Plaza

East Tower, 15th Floor

Uniondale, New York 11556-1425

(516) 663-6514

(516) 663-6714 (Facsimile)

Approximate date of commencement of proposed sale to the public:

From time to time after the Registration Statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this form is a post-effective amendment to a registration statement filed pursuant General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer

|

☐

|

Accelerated Filer

|

☐

|

|

Non-Accelerated Filer

|

☒

|

Smaller Reporting Company

|

☒

|

|

|

|

Emerging Growth Company

|

☐

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities

to be Registered

|

|

Amount

to be

Registered

|

|

|

Proposed

Maximum

Offering

Price

Per Share

|

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

|

Amount of

Registration

Fee

|

|

|

Common Stock, $0.001 par value

|

|

|

6,788,866

|

(1)

|

|

$

|

0.8838

|

(2)

|

|

$

|

6,000,000

|

|

|

$

|

654.60

|

(3)

|

|

(1)

|

The Registrant is hereby registering the disposition of 4,525,911 shares of its common stock purchased by the selling security holder from the Registrant pursuant to a Common Stock Purchase Agreement (“CSPA”), and 2,62,955 shares of its common stock issuable upon exercise of a purchase option granted to the selling security holder under the CSPA, or an aggregate of 6,788,866 shares. Pursuant to Rule 416, the securities registered also include such number of shares of common stock as may be issued pursuant to the anti-dilution and adjustment provisions of such securities (stock splits, stock dividends or similar transactions).

|

|

|

|

|

(2)

|

Estimated solely for purposes of determining the registration fee pursuant to Rule 457(o) under the Securities Act, based on the proposed maximum aggregate offering price.

|

|

|

|

|

(3)

|

Previously paid in connection with the initial filing of this Registration Statement.

|

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THESE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, DATED SEPTEMBER 28, 2021

PRELIMINARY PROSPECTUS

UNITED HEALTH PRODUCTS, INC.

6,788,866 Shares of Common Stock of United Health Products, Inc.

This prospectus relates to the offer and resale of up to 6,788,866 shares of our Common Stock, par value $0.001 per share, comprised of: (i) 4,525,911 shares, or the Purchase Shares, purchased by Triton Funds LP pursuant to the Common Stock Purchase Agreement dated June 25, 2021, or CSPA, between the Company and Triton Funds LP; and (ii) 2,262,955 shares, or the Option Shares, issuable to Triton Funds LP upon their exercise of a two-year purchase option granted to them pursuant to the CSPA. Triton Funds LP is also sometimes referred to in this prospectus as the selling security holder.

Our common stock is quoted on the OTCPK marketplace under the symbol “UEEC.” On September 23, 2021, the closing price of our common stock on OTCPK marketplace was $0.99 per share.

The shares of common stock may be offered by the selling security holder in negotiated transactions, at either prevailing market prices or negotiated prices. The selling security holder in its discretion may also offer the shares of common stock from time to time in ordinary brokerage transactions in the OTCPK marketplace or otherwise. The selling security holder can offer all, some or none of its shares of common stock, thus we have no way of determining the number of shares of common stock it will hold after this offering. See our discussion in the “Plan of Distribution” section of this prospectus.

The selling security holder and any brokers executing selling orders on behalf of the selling security holder may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended, and commissions received by a broker executing selling orders may be deemed to be underwriting commissions under the Securities Act.

These are speculative securities. See “Risk Factors” beginning on page 5 for the factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission or other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus _________, 2021.

TABLE OF CONTENTS

This prospectus does not contain all of the information included in the registration statement. For a more complete understanding of the offering of the securities, you should refer to the registration statement, including its exhibits. The prospectus may also add, update or change information contained or incorporated by reference in this prospectus. This prospectus and the documents incorporated by reference into this prospectus, includes all material information relating to the offering of securities under this prospectus. You should carefully read this prospectus, the applicable prospectus supplement, the information and documents incorporated herein by reference and the additional information under the headings “Where You Can Find More Information” and “Incorporation of Documents by Reference” before making an investment decision.

You should rely only on the information we have provided or incorporated by reference in this prospectus. We have not authorized anyone to provide you with information different from that contained or incorporated by reference in this prospectus. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained or incorporated by reference in this prospectus. You must not rely on any unauthorized information or representation. This prospectus is an offer to sell only the securities offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information in this prospectus or any prospectus supplement is accurate only as of the date on the front of the document and that any information we have incorporated herein by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of a security.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Unless the context indicates otherwise in this prospectus, the terms “UHP,” the “Company,” “we,” “our” or “us” in this prospectus refer to United Health Products, Inc. unless otherwise specified.

PROSPECTUS SUMMARY

This summary highlights selected information about our Company, the offering of our securities under this prospectus and information appearing elsewhere in this prospectus and in the documents we incorporate by reference. This summary is not complete and does not contain all the information that you should consider before investing in our securities. You should read this entire prospectus carefully, including “Risk Factors” contained in this prospectus beginning on page 3, and the more detailed financial statements, notes to the financial statements and other information incorporated by reference from our filings with the SEC or included in any applicable prospectus supplement. Investing in our securities involves risks. Therefore, carefully consider the risk factors set forth in any prospectus supplement and in our most recent annual and quarterly filings with the SEC, as well as other information in this prospectus and any prospectus supplements and the documents incorporated by reference into this prospectus or prospectus supplement, before purchasing our securities. Each of the risk factors could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our securities.

Company Overview

United Health Products, Inc. develops, manufactures, and markets a patented hemostatic gauze for the healthcare and wound care sectors. Our gauze product, HemoStyp®, is a neutralized, oxidized, regenerated cellulose (“NORC”) derived from cotton and designed to absorb exudate/drainage from superficial wounds and help control bleeding.

Our HemoStyp hemostatic gauze is a collagen-like natural substance created from chemically treated cellulose derived from cotton. It is an effective hemostatic agent registered with the U.S. Food & Drug Administration, or FDA, for superficial use under a 510k approval to help control bleeding from open wounds and body cavities. The HemoStyp hemostatic material contains no chemical additives, thrombin or collagen, and is hypoallergenic. When the product comes in contact with blood it expands slightly and quickly converts to a gel that subsequently breaks down into glucose and salts. Because of its benign impact on body tissue and the fact that it degrades to non-toxic end products, HemoStyp does not impede the healing of body tissue as do certain competing hemostatic products. Laboratory testing has shown HemoStyp to be 100% absorbable in the human body within 24 hours compared to days or weeks with competing organic regenerated cellulose products.

HemoStyp gauze is a flexible, silk-like material that is applied by placing the gauze onto the bleeding tissue. The supple material can be easily folded and manipulated as needed to fit the size of the wound or incision. In surface bleeding and surgical situations, the product quickly converts to a translucent gel that allows the physician or surgeon to monitor the coagulation process. The gel maintains a neutral pH level which avoids damaging the surrounding tissue. In superficial bleeding situations, HemoStyp gauze can be bonded to an adhesive plastic bandage or integrated into a traditional cotton gauze component to address a broad range of needs, including traumatic bleeding injuries and prolonged bleeding following hemodialysis.

In the fourth quarter of 2020 the Company submitted to the FDA an application for Pre-Market Approval (“PMA”) to market certain HemoStyp gauze products for Class III human surgical applications. On April 6, 2021 we submitted a revised PMA application to the FDA. On May 4, 2021 the FDA confirmed administrative acceptance of this application and the commencement of a period of substantive review of the application. There can be no assurance that our application, once reviewed, will lead to a successful FDA decision regarding a PMA and give us access to the U.S. Class III human surgical market.

Corporate Information

United Health Products, Inc. is incorporated under the laws of the State of Nevada. Our principal executive office is located at 10624 S Eastern Ave, Suite A209, Henderson, NV 89052 and our corporate telephone number is (877) 358-3444. Our website is www.unitedhealthproductsinc.com. Information on our website does not constitute a part of this prospectus. The information contained on, connected to or that can be accessed via our website is not part of this prospectus. We have included our website address in this prospectus as an inactive textual reference only and not as an active hyperlink.

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of charge through the investor relations page of our internet website as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

Additional Information

For additional information related to our business and operations, please refer to the reports incorporated herein by reference, including our Quarterly Reports on Form 10-Q for the quarter ended June 30, 2021 and the quarter ended March 31, 2021 and our Annual Report on Form 10-K for the year ended December 31, 2020, as described under the caption “Incorporation of Documents by Reference” on page 10 of this prospectus.

About This Offering

This prospectus relates to the offer and resale of up to 6,788,866 shares of our common stock, par value $0.001 per share, comprised of: (i) 4,525,911 Purchase Shares purchased by Triton Funds LP pursuant to the CSPA, between the Company and Triton Funds LP; and (ii) 2,262,955 Option Shares issuable to Triton Funds LP upon their exercise of a purchase option granted to them pursuant to the CSPA. All of the shares, when sold, will be sold by this selling security holder. The selling security holder may sell their shares of common stock from time to time at prevailing market prices. We will not receive any proceeds from the sale of the shares of common stock by the selling security holder. However, we may receive the sale price of the Option Shares we issue to the selling security holder upon their exercise of the purchase option.

|

Common Stock Offered:

|

|

Up to 6,788,866 shares of our common stock comprised of (i) 4,525,911 shares purchased by Triton Funds LP under the CSPA, and (ii) 2,262,955 shares issuable upon the exercise of the two-year purchase option granted to Triton Funds LP under the CSPA.

|

|

|

|

|

|

Common Stock Outstanding at September 23, 2021:

|

|

226,835,524

|

|

|

|

|

|

Use of Proceeds:

|

|

We will not receive any proceeds from the sale of the 6,788,866 shares of common stock subject to resale by the selling security holder under this prospectus. However, we may receive the sale price of the Option Shares we issue to the selling security holder upon their exercise of the purchase option.

|

|

|

|

|

|

Risk Factors:

|

|

An investment in the common stock offered under this prospectus is highly speculative and involves substantial risk. Please carefully consider the “Risk Factors” section and other information in this prospectus for a discussion of risks. Additional risks and uncertainties not presently known to us or that we currently deem to be immaterial may also impair our business and operations.

|

|

|

|

|

|

OTCPK Marketplace Symbol:

|

|

UEEC

|

RISK FACTORS

Before making an investment decision in our securities, you should carefully consider the risks described under ”Risk Factors” in the applicable prospectus supplement and in our most recent Annual Report on Form 10-K, and in our updates to those Risk Factors in our Quarterly Reports on Form 10-Q and our other filings with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act filed after that annual report, together with all of the other information appearing in this prospectus or incorporated by reference into this prospectus, the prospectus supplement or any applicable pricing supplement, in light of your particular investment objectives and financial circumstances. In addition to those risk factors, there may be additional risks and uncertainties of which management is not aware or focused on or that management deems immaterial. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. The trading price of our securities could decline due to any of these risks, and you may lose all or part of your investment.

Risks Relating to Our Stock and this Offering

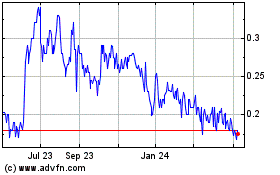

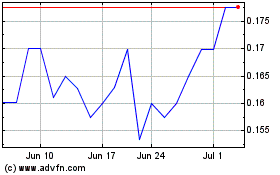

The market price of our stock has been and may continue to be highly volatile.

Our common stock is quoted on the OTCPK marketplace under the ticker symbol “UEEC”. The market price of our stock has been and may continue to be highly volatile, and announcements by us or by third parties may have a significant impact on our stock price. These announcements may include:

|

|

·

|

our operating results falling below the expectations of public market analysts and investors;

|

|

|

·

|

developments in our relationships with or developments affecting our customers or suppliers;

|

|

|

·

|

negative regulatory action or regulatory non-approval with respect to our products;

|

|

|

·

|

government regulation, governmental investigations, or audits related to us or to our products;

|

|

|

·

|

developments related to our patents or other proprietary rights or those of our competitors; and

|

|

|

·

|

changes in the position of securities analysts with respect to our stock.

|

The stock market has from time to time experienced extreme price and volume fluctuations, which have particularly affected the market prices for the medical technology sector companies, and which have often been unrelated to their operating performance. These broad market fluctuations may adversely affect the market price of our common stock.

In addition, future sales by existing stockholders, or any new stockholders receiving our shares in any financing transaction may lower the price of our common stock, which could result in losses to our stockholders. Future sales of substantial amounts of common stock in the public market, or the possibility of such sales occurring, could adversely affect prevailing market prices for our common stock or our future ability to raise capital through an offering of equity securities. Substantially all of our common stock is freely tradable in the public market without restriction under the Securities Act, unless these shares are held by our “affiliates”, as that term is defined in Rule 144 under the Securities Act.

The low trading volume of our common stock may adversely affect the price of our shares and their liquidity.

Our common stock has generally experienced low trading volume. Limited trading volume may subject our common stock to greater price volatility and may make it difficult for investors to sell shares at a price that is attractive to them.

We may in the future seek to raise funds through equity offerings, which could have a dilutive effect on our common stock.

In the future we may determine to raise capital through offerings of our common stock, securities convertible into our common stock or rights to acquire these securities or our common stock. The result of sales of such securities, the exercise of any warrants issued in connection with any such offering or the triggering of anti-dilution provisions in such securities would ultimately be dilutive to our common stock by increasing the number of shares outstanding. We cannot predict the effect this dilution may have on the price of our common stock. In addition, we may in the future issue shares of preferred stock which may have rights which are senior or superior to those of the common stock, such as rights relating to voting, the payment of dividends, redemption or liquidation.

Sales of a significant number of shares of our common stock in the public markets, or the perception that such sales could occur, could depress the market price of our common stock.

Sales of a substantial number of shares of our common stock in the public markets could depress the market price of our common stock and impair our ability to raise capital through the sale of additional equity securities. We cannot predict the effect that future sales of our common stock would have on the market price of our common stock.

We do not intend to pay any cash dividends on our common stock in the foreseeable future and, therefore, any return on your investment in our common stock must come from increases in the fair market value and trading price of our common stock.

At present time, we intend to use available funds to finance our operations. Accordingly, we have no present intention of paying any cash dividends on our common stock in the foreseeable future. Therefore, any return on your investment in our common stock must come from increases in the fair market value and trading price of our common stock.

The Securities and Exchange Commission has notified us that it has made a preliminary determination to recommend that an enforcement action be filed relating to a private investigation regarding our Company, the resolution or outcome of which cannot be predicted with any certainty.

The Securities and Exchange Commission has been conducting a private investigation concerning the Company since November 2018, in which the Company has been fully cooperating. The basis of the Commission’s inquiry relates to our original accounting revenue recognition treatment of the following two events in 2017:

|

|

·

|

The first event involved an order which the Company earmarked to fill from an in-bound shipment of product that got lost in transit. The Company recognized $130,725 in revenue from this event in the first quarter of 2017. The lost in-bound product was never recovered and the product could not be shipped to fill the order, and the customer canceled the order in the second quarter of 2017. This event was subsequently corrected to back out the revenue and exclude it from the audited 2017 annual financial statements which were included in our 2017 Annual Report on Form 10-K. The Company’s prior interim period financial statements for 2017 were not restated to reflect the correction.

|

|

|

|

|

|

|

·

|

The second event related to a shipment of product which the Company commenced processing for a customer without a purchase order at the end of December 2017. The product was shipped from our warehouse in December 2017 to our third-party sterilization-contractor and ultimately shipped to the customer in January 2018 and received by the customer on February 2, 2018. The Company recognized $438,596 in revenue from this event in its 2017 audited annual financial statements. The Company’s customer disputed the shipment and did not pay the Company for this product. The Company, in consultation with its then auditor, Haynie & Company, ultimately wrote off the recorded receivable in the third and fourth quarters of 2018 as a bad debt expense. Those write-offs were reflected in the Company’s Quarterly Report on Form 10-Q for the period ended September 30, 2018 and Company’s Annual Report on Form 10-K for the year ended December 31, 2018. In February 2020, we commenced a lawsuit against our customer to recover payment for the products they received and which we allege they have marketed and sold, which is currently pending in the U.S. District Court for the Southern District of Texas. Due to uncertainty inherent in litigation, we cannot predict the outcome of this action.

|

On December 17, 2019, Haynie & Company, the auditors of our 2017 and 2018 annual financial statements, advised us that they were resigning as our independent registered accountant, as we reported in a Current Report on Form 8-K that we filed with the Commission on December 23, 2019. As we disclosed in that Current Report, Haynie & Company orally advised the Company that they were ceasing as the Company’s accountant because they did not want to take on the additional work of performing the internal control audit of the Company in connection with the 2019 fiscal year audit. The internal control audit was required due to the increased market capitalization of the Company. The Company engaged MAC Accounting Group, LLP as its independent registered accountant on December 20, 2019, which was also disclosed in that Current Report.

Four months later, on March 24, 2020, Haynie & Company delivered a letter to the Company claiming: that they had discovered inaccurate and incomplete information relating to the amount for revenue and inventory for the 2017 interim periods; that based on investigation and new information of which they became aware, the Company’s annual financial statements for 2017 and 2018 and the interim periods in 2017, 2018 and 2019 were materially inaccurate, incomplete and should be withdrawn, restated or corrected where appropriate; and that it was withdrawing its reports on the Company’s 2017 and 2018 financial statements. The Company disclosed the foregoing in a Current Report on Form 8-K filed with the Commission on March 31, 2020, as amended on Form 8-K/A filed with the Commission on April 2, 2020.

In July 2020, in consultation with our current auditor, MAC Accounting Group, LLP, and in light of the information available to us at that time, we determined that no revenue should have been recognized in 2017 or 2018 from the second event described above in 2017 or 2018 as it did not meet all of the revenue recognition criteria under ASC 605 which was in effect at the time of the event, nor under and ASC 606, which we adopted on January 1, 2018.

In order to reflect a correction to the revenue recognition treatment from the two events, we included restatements of our audited annual financial statements for 2017 and 2018 and unaudited financial statements for certain quarterly periods during 2017, 2018 and 2019 in our 2019 Annual Report on Form 10-K which we filed with the Commission on July 9, 2020.

In August 2020, we commenced a lawsuit against our former auditor Haynie & Company which is currently pending in Utah State Court, asserting claims related to, among other things, professional negligence – accounting malpractice, and breach of fiduciary duty, in connection with the Company’s audited financial statements for 2017 and quarterly periods during 2017. Due to uncertainty inherent in litigation, we cannot predict the outcome of this action.

On September 13, 2021, the SEC Staff notified us that it has made a preliminary determination in their 34-month investigation to recommend that the Commission file an enforcement action against our Company, our director and former CEO, Douglas Beplate, and our director and Chief Operating Officer, Louis Schiliro. The action would allege certain violations of the federal securities laws stemming from the original accounting treatment of the two events mentioned above and conduct relating to that, including violations of Sections 10(b), 13(a), 13(b)(2)(A) and 13(b)(2)(B) of the Securities Exchange Act of 1934 and Rules 10b-5, 12b-20, 13a-1, and 13a-13 thereunder, and Section 17(a) of the Securities Act of 1933. The SEC Staff informed the Company and Messrs. Beplate and Schiliro that their recommendation would involve a civil injunctive action and would seek remedies that may include injunctions, disgorgement, pre-judgment interest and civil money penalties. Remedies may also include debarment from serving as a director or officer of any SEC registrant and restrictions from engaging in certain activities involving “penny stocks” as defined under the Exchange Act, the latter known as the Penny Stock Bar. The SEC Staff’s notice is neither a formal charge of wrongdoing nor a final determination that the recipient of the notice has violated any law. In accordance with the Commission’s Rules on Informal and Other Procedures, we have the opportunity to respond to the SEC Staff’s position and make a submission to the Commission by October 4, 2021 setting forth reasons as to why the proposed enforcement action should not be filed, or bringing any facts to the attention of the Commission in connection with its consideration of this matter. Messrs. Beplate and Schiliro have each informed the Commission that they will not be making a submission. While we expect to engage in a dialogue with the SEC Staff to work toward a resolution of this matter, we cannot predict whether this matter will be settled without any enforcement action being taken; or if it is not so settled, what the outcome, remedies or the duration of the investigation or any legal proceedings or enforcement actions that may be brought will be.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

We make statements in this prospectus and the documents incorporated into it by reference that are considered “forward-looking statements” which are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements relate to future events or our future financial performance and involve known and unknown risks, numerous assumptions, uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Forward-looking statements are typically identified by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “projects”, “intends” or “continue” or the negative of these terms or other comparable terminology. These forward-looking statements are only predictions. Actual events or results may differ materially. Moreover, neither we nor any other person assumes responsibility.

We have based these forward-looking statements on our current expectations and projections about future events. We believe that the assumptions and expectations reflected in such forward-looking statements are reasonable, based on information available to us on the date of this prospectus, but we cannot assure you that these assumptions and expectations will prove to have been correct or that we will take any action that we may presently be planning. These forward-looking statements are inherently subject to known and unknown risks and uncertainties. We have included important cautionary statements in this prospectus, in the documents incorporated by reference in this prospectus, and in the sections in our periodic reports, including our most recent Annual Report on Form 10-K, entitled “Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operation,” as supplemented by our subsequent Quarterly Reports on Form 10-Q or our Current Reports on Form 8-K, discussing some of the factors that we believe could cause actual results or events to differ materially from the forward-looking statements that we are making including, among others: research and product development uncertainties; regulatory policies and FDA approval requirements and uncertainties; competition from other similar businesses; market acceptance of our products; reliance solely on our hemostatic gauze product; dependence on other parties to market or products; raw material supply chain uncertainties; and market and general economic factors.

In light of these assumptions, risks and uncertainties, the results and events discussed in the forward-looking statements contained in this prospectus or in any document incorporated herein by reference might not occur. Investors are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this prospectus or the date of the document incorporated by reference in this prospectus. We are not under any obligation, and we expressly disclaim any obligation, to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise. All subsequent forward-looking statements attributable to us or to any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section.

USE OF PROCEEDS

The shares of common stock to be offered and sold pursuant to this prospectus will be offered and sold by the selling security holder or their transferees. We will not receive any proceeds from the sale of the shares of common stock by the selling security holder. We will, however, receive the proceeds of any exercise of the purchase option under the CSPA which, if received, would be used in the following order of priority: (i) funding our research & development program and the costs of seeking approval from the FDA and other regulatory agencies to sell our products in the U.S. and other markets; (ii) funding expenses associated with our commercialization strategy targeting the human surgical (if we receive FDA approval to sell to this market) and 510k markets; (iii) paying off short term liabilities and (iv) for working capital and other general corporate purposes. The selling security holder has no obligation to exercise its share purchase option.

SELLING SECURITY HOLDER

This prospectus covers the offering of up to 6,788,866 shares of our common stock being offered by the selling security holder, comprised of: (i) 4,525,911 shares purchased by Triton Funds LP pursuant to the CSPA, between the Company and Triton Funds LP; and (ii) 2,262,955 shares issuable to Triton Funds LP upon their exercise of a purchase option granted to them pursuant to the CSPA. We are registering the shares in order to permit the selling security holder to offer the shares for resale from time to time.

Triton Funds LP

On June 25, 2021, the Company entered into a Common Stock Purchase Agreement (the “CSPA”) with Triton Funds LP, an unrelated third party. Triton Funds LP was founded by and is managed by students from the University of California, San Diego, and backed by scientific and academic advisory boards. According to Triton Funds LP, it is the largest student-run investment fund in the United States and focused on “millennial growth ESG” (Environmental, Social and Governance) opportunities. Triton Funds LP agreed to invest up to $6,000,000 in the Company in the form of common stock purchases. Subject to the terms and conditions set forth in the CSPA, the Company agreed to sell to Triton Funds LP shares of the Company’s common stock having an aggregate value of $4,000,000, and granted Triton Funds LP the option to purchase an additional number of common shares with an aggregate value of $2,000,000. Under the CSPA the Company may, in its sole discretion, and subject to the satisfaction of certain conditions, deliver a purchase notice to Triton Funds LP for the $4,000,000 in value of shares which the Company intends to deliver to Triton Funds LP at the closing. The price of the Purchase Share and Option Shares under the CSPA is determined by dividing $200 Million by the number of our issued and outstanding shares of common stock as disclosed in our most recently filed Annual Report on Form 10-K or Quarterly Report on Form 10-Q. Based on this calculation, the purchase price for the Purchase Shares and Option Shares under the CSPA was fixed at $0.8838 per share. Triton Funds LP’s obligation to close the purchase of the Purchase Shares is conditioned on an effective registration statement for resale of the Purchase Shares and Option Shares being purchased, and Triton Funds LP’s ownership not exceeding 4.99% of the issued and outstanding shares of the Company giving effect to the purchase.

The table below lists the selling security holder and other information regarding the “beneficial ownership” of the shares of common stock by the selling security holder. In accordance with Rule 13d-3 of the Exchange Act, “beneficial ownership” includes any shares of our common stock as to which the selling security holder has sole or shared voting power or investment power and any shares of our common stock the selling security holder has the right to acquire within 60 days.

The selling security holder is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act.

The second column indicates the number of shares of common stock beneficially owned by the selling security holder, based on its ownership as of September 23, 2021. The second column also assumes the purchase of all shares of stock to be acquired under the maximum number of securities to be sold by the Company to the selling security holder, without regard to any limitations on purchase described in this prospectus or in the CSPA.

The third column lists the shares of common stock being offered by this prospectus by the selling security holder.

This prospectus covers the resale of (i) the Purchase Shares, (ii) the Option Shares, and (iii) any securities issued or then issuable upon any full anti-dilution protection, stock split, dividend or other distribution, recapitalization or similar event with respect to the shares of common stock.

Because the issuance price of the common stock may be adjusted, the number of shares of common stock that will actually be issued upon issuance of the common stock may be more or less than the number of shares of common stock being offered by this prospectus. The selling security holder can offer all, some or none of its shares of common stock, thus the number of shares of common stock it will hold after this offering is indeterminate. However, the fourth and fifth columns assume that the selling security holder will sell all shares of common stock covered by this prospectus. See “Plan of Distribution.”

|

Selling Security Holder

|

|

Number of

Shares

Beneficially

Owned

Before

Offering

|

|

|

Number of

Shares

Being

Offered (1)

|

|

|

Maximum Number of Shares

Beneficially Owned

After

Offering (2)

|

|

|

Percentage of Shares

Beneficially Owned

After

Offering

(%)

|

|

|

Triton Funds LP (1)

|

|

|

0

|

|

|

|

6,788,866

|

|

|

|

0

|

|

|

|

0

|

|

|

(1)

|

Consists of up to 6,788,866 shares of common stock to be sold by Triton Funds LP which Triton Funds LP may purchase pursuant to the CSPA. Casey Barraza exercises voting and dispositive power with respect to the shares of our common stock that are beneficially owned by Triton Funds LP.

|

|

|

|

|

(2)

|

Assumes that all shares of the registered common stock are sold.

|

The selling security holder will be limited to purchasing an aggregate amount of 6,788,866 shares of the common stock under the CSPA to the extent that the selling security holder together with its affiliates and attribution parties, would not beneficially own a number of shares of our common stock which would exceed 4.99% of our then outstanding shares of Common Stock following such purchase.

PLAN OF DISTRIBUTION

We are registering the shares of common stock that are issuable to the selling security holder under the CSPA, to permit the resale of these shares of common stock by the selling security holder from time to time after the date of this prospectus. The registered common stock may be sold or distributed from time to time by the selling security holder directly to one or more purchasers or through brokers, dealers, or underwriters who may act solely as agents at market price prevailing at the time of sale, at prices related to the prevailing market prices, at negotiated prices, or at fixed prices, which may be changed. The selling security holder may use any one or more of the following methods when selling securities:

|

|

•

|

ordinary broker’s transactions;

|

|

|

•

|

transactions involving cross or block trades;

|

|

|

•

|

through brokers, dealers, or underwriters;

|

|

|

•

|

in other ways not involving market makers or established business markets, including direct sales to purchasers or sales effected through agents;

|

|

|

•

|

in privately negotiated transactions; or

|

|

|

•

|

any combination of the foregoing.

|

In order to comply with the securities laws of certain states, if applicable, the shares may be sold only through registered or licensed brokers or dealers. In addition, in certain states, the shares may not be sold unless they have been registered or qualified for sale in the state or an exemption from the state’s registration or qualification requirement is available and complied with.

The selling security holder is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act.

Triton Funds LP, the selling security holder, has informed us that it intends to use an unaffiliated broker-dealer to effectuate all sales, if any, of the common stock that it may purchase from us pursuant to the CSPA. These sales will be made at prices and at terms then prevailing or at prices related to the then current market price. Each such unaffiliated broker-dealer will be an underwriter within the meaning of Section 2(a)(11) of the Securities Act. Triton Funds LP has informed us that each such broker-dealer will receive commissions from Triton Funds LP that will not exceed customary brokerage commissions.

Brokers, dealers, underwriters or agents participating in the distribution of the shares as agents may receive compensation in the form of commissions, discounts, or concessions from the selling security holder and/or purchasers of our Common Stock for whom the broker-dealers may act as agent. The compensation paid to a particular broker-dealer may be less than or in excess of customary commissions. Neither we nor Triton Funds LP can presently estimate the amount of compensation that any agent will receive.

We know of no existing arrangements between Triton Funds LP or any other stockholder, broker, dealer, underwriter or agent relating to the sale or distribution of the shares offered by this prospectus. At the time a particular offer of shares is made, a prospectus supplement, if required, will be distributed that will set forth the names of any agents, underwriters or dealers and any compensation from the selling security holder and any other required information.

We will pay the expenses incident to the registration, offering, and sale of the shares to Triton Funds LP.

Triton Funds LP has agreed in the CSPA, that no short sale (as such term is defined in Rule 200 of Regulation SHO of the Exchange Act) of our common stock will be permitted by Triton Funds LP or its affiliates.

We have advised Triton Funds LP that it is required to comply with Regulation M promulgated under the Exchange Act. With certain exceptions, Regulation M precludes the selling security holder, any affiliated purchasers, and any broker-dealer or other person who participates in the distribution from bidding for or purchasing, or attempting to induce any person to bid for or purchase any security which is the subject of the distribution until the entire distribution is complete. Regulation M also prohibits any bids or purchases made in order to stabilize the price of a security in connection with the distribution of that security. All of the foregoing may affect the marketability of the securities offered by this prospectus.

This offering will terminate on the date that all shares offered by this prospectus have been sold by Triton Funds LP or the second anniversary of the closing of Triton's purchase of the shares under the CSPA, whichever occurs sooner.

The selling security holder and any broker-dealers or agents that are involved in selling the securities may be deemed “underwriters” within the meaning of the Securities Act in connection with such sales. Any commissions received by such broker-dealers or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. The selling security holder has informed us that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the securities.

Because the selling security holder may be deemed to be an “underwriter” within the meaning of the Securities Act, it will be subject to the prospectus delivery requirements of the Securities Act, including Rule 172 thereunder. In addition, any securities covered by this prospectus which qualify for sale pursuant to Rule 144 under the Securities Act may be sold under Rule 144 rather than under this prospectus. The selling security holder has advised us that there is no underwriter or coordinating broker acting in connection with the proposed sale of the Shares by the selling security holder.

The resale securities will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

DESCRIPTION OF COMMON STOCK

We are authorized to issue 300,000,000 shares of common stock, par value $0.001 per share. As of September 23, 2021 we had 226,835,524 shares of common stock issued and outstanding and approximately 381 common stockholders of record. The following summary of certain provisions of our common stock does not purport to be complete. You should refer to our certificate of incorporation and our bylaws, copies of which are on file with the SEC as exhibits to previous SEC filings. Please refer to “Where You Can Find More Information” below for directions on obtaining these documents. The summary below is also qualified by provisions of applicable law.

General

Holders of common stock are entitled to one vote for each share held on all matters submitted to a vote of stockholders and do not have cumulative voting rights. Holders of common stock are entitled to receive proportionately any dividends as may be declared by our board of directors, out of funds that we may legally use to pay dividends, subject to any preferential dividend rights of any outstanding series of preferred stock or series of preferred stock that we may designate and issue in the future. All shares of common stock outstanding as of the date of this prospectus and, upon issuance and sale, all shares of common stock that we may offer pursuant to this prospectus, will be fully paid and nonassessable.

In the event of our liquidation or dissolution, the holders of common stock are entitled to receive proportionately our net assets available for distribution to stockholders after the payment of all debts and other liabilities and subject to the prior rights of any outstanding preferred stock. Holders of common stock have no preemptive, subscription, redemption or conversion rights. There are no redemption or sinking fund provisions applicable to the common stock.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Pacific Stock Transfer Co. Its address is 6725 Via Austi Pkwy, Suite 300, Las Vegas, NV 89119, United States; Telephone: (800) 785-7782.

Market for Securities

Our Common Stock trades on the OTCPK marketplace under the symbol “UEEC.”

CERTAIN PROVISIONS OF NEVADA LAW AND OF THE COMPANY’S CERTIFICATE OF

INCORPORATION AND BYLAWS

United Health Products, Inc. is incorporated under the laws of the State of Nevada and is generally governed by the Nevada Private Corporations Code, Title 78 of the Nevada Revised Statutes, or NRS.

Section 78.138 of the NRS provides that, unless the corporation’s articles of incorporation provide otherwise, a director or officer will not be individually liable unless it is proven that (a) the director’s or officer’s acts or omissions constituted a breach of his or her fiduciary duties, and (b) such breach involved intentional misconduct, fraud, or a knowing violation of the law. Our articles of incorporation adopt the statutory standard for exculpation of our officers and directors from individual liability for their acts or omissions as an officer or director.

Section 78.7502 of the NRS permits a company to indemnify its directors and officers against expenses, judgments, fines, and amounts paid in settlement actually and reasonably incurred in connection with a threatened, pending, or completed action, suit, or proceeding, if the officer or director (a) is not liable pursuant to NRS 78.138, or (b) acted in good faith and in a manner the officer or director reasonably believed to be in or not opposed to the best interests of the corporation and, if a criminal action or proceeding, had no reasonable cause to believe the conduct of the officer or director was unlawful. Generally, indemnification under Section 78.7502 is discretionary and may be made by the corporation only as authorized in each specific case upon a determination that the indemnification is proper under the circumstances. Section 78.7502 of the NRS precludes indemnification by the corporation if the officer or director has been adjudged by a court of competent jurisdiction, after exhaustion of all appeals, to be liable to the corporation or for amounts paid in settlement to the corporation, unless and only to the extent that the court determines that in view of all the circumstances, the person is fairly and reasonably entitled to indemnity for such expenses.

Section 78.751 of the NRS requires a Nevada company to indemnify its officers and directors to the extent such person is successful on the merits or otherwise in defense of (a) any threatened, pending, or contemplated action, suit, or proceeding, whether civil, criminal, administrative, or investigative, including any action by or in the right of the corporation, by reason of the fact that the person is or was a director, officer, employee, or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee, or agent of another corporation, partnership, joint venture, trust or other enterprise, or (b) any claim, issue or matter therein, against expenses incurred by them in defending the action, including attorney’s fees. Unless restricted by the articles of incorporation, the bylaws, or agreement, the corporation may pay the expenses of officers and directors incurred in defending a civil or criminal action, suit or proceeding as they are incurred and in advance of the final disposition of the action, suit, or proceeding, upon receipt of an undertaking by or on behalf of the director or officer to repay the amount if it is ultimately determined by a court of competent jurisdiction that the director or officer is not entitled to be indemnified by the corporation. The Articles of Incorporation, the Bylaws, or agreement may require the corporation to pay such expenses upon receipt of such an undertaking.

Indemnification pursuant to NRS 78.7502 and advancement of expenses authorized in or ordered by a court pursuant to NRS 78.751 (a) does not exclude any other rights to which a person seeking indemnification or advancement of expenses may be entitled under the articles of incorporation or any bylaw, agreement, vote of stockholders, or disinterested directors or otherwise, for either an action in the person’s official capacity or an action in another capacity while holding office, and (b) continues for a person who has ceased to be a director, officer, employee or agent and inures to the benefit of the heirs, executors and administrators of such a person. The foregoing notwithstanding, indemnification, unless ordered by a court pursuant to NRS 78.7502 or for the advancement of expenses upon undertaking as provided in 78.751(2), may not be made to or on behalf of any director or officer finally adjudged by a court of competent jurisdiction, after exhaustion of any appeals taken therefrom, to be liable for intentional misconduct, fraud, or a knowing violation of law, and such misconduct, fraud or violation was material to the cause of action.

A right to indemnification or to advancement of expenses arising under a provision of the Articles of Incorporation or any Bylaw is not eliminated or impaired by an amendment to such provision after the occurrence of the act or omission that is the subject of the civil, criminal, administrative or investigative action, suit or proceeding for which indemnification is provided.

Section 78.752 of the NRS provides that a Nevada company may purchase and maintain insurance or make other financial arrangements on behalf of any person who is or was a director, officer, employee, or agent of the company, or is or was serving at the request of the company as a director, officer, employee, or agent of another company, partnership, joint venture, trust, or other enterprise, for any liability asserted against him and liability and expenses incurred by him in his capacity as a director, officer, employee, or agent, or arising out of his status as such, whether or not the company has the authority to indemnify him against such liability and expenses.

Our Articles of Incorporation and Bylaws implement the indemnification provisions permitted by Chapter 78 of the NRS by providing that we shall indemnify our directors and officers to the fullest extent permitted by the NRS against expense, liability, and loss reasonably incurred or suffered by them in connection with their service as an officer or director. Our articles of incorporation and bylaws also provide that we may purchase and maintain liability insurance, or make other arrangements for such obligations or otherwise, to the extent permitted by the NRS.

LEGAL MATTERS

The validity of the shares being offered under this prospectus by us will be passed upon for us by Ruskin Moscou Faltischek, P.C., Uniondale, New York.

EXPERTS

The financial statements of United Health Products, Inc. appearing it its Annual Report on Form 10-K for the year ended December 31, 2020, have been audited by MAC Accounting Group, LLP, independent registered public accounting firm, as set forth in their report thereon, including therein, and incorporated herein by reference. Such financial statements are incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the reporting requirements of the Exchange Act and file annual, quarterly and current reports, proxy statements and other information with the SEC. SEC filings are available at the SEC’s website at http://www.sec.gov.

This prospectus is only part of a registration statement on Form S-3 that we have filed with the SEC under the Securities Act and therefore omits certain information contained in the registration statement. We have also filed exhibits and schedules with the registration statement that are excluded from this prospectus, and you should refer to the applicable exhibit or schedule for a complete description of any statement referring to any contract or other document.

The registration statement and the documents referred to below under “Incorporation of Certain Information by Reference” are also available on our website at www.unitedhealthproductsinc.com. We have not incorporated by reference into this prospectus the information on our website, and you should not consider it to be a part of this prospectus.

INCORPORATION OF DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference” information that we file with them. Incorporation by reference allows us to disclose important information to you by referring you to those other documents. The information incorporated by reference is an important part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. We filed a registration statement on Form S-3 under the Securities Act with the SEC with respect to the securities we may offer pursuant to this prospectus. This prospectus omits certain information contained in the registration statement, as permitted by the SEC. You should refer to the registration statement, including the exhibits, for further information about us and the securities we may offer pursuant to this prospectus. Statements in this prospectus regarding the provisions of certain documents filed with, or incorporated by reference in, the registration statement are not necessarily complete and each statement is qualified in all respects by that reference. Copies of all or any part of the registration statement, including the documents incorporated by reference or the exhibits, are available at the SEC’s website at http://www.sec.gov. The documents we are incorporating by reference are:

|

|

●

|

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 filed with the SEC on March 30, 2021;

|

|

|

|

|

|

|

●

|

Our Quarterly Report on Form 10-Q for the quarter ended March 31, 2021 filed with the SEC on May 12, 2021;

|

|

|

|

|

|

|

●

|

Our Quarterly Report on Form 10-Q for the quarter ended June 30, 2021 filed with the SEC on August 16, 2021;

|

|

|

|

|

|

|

●

|

Our Current Reports on Form 8-K filed with the SEC on January 11, 2021, May 5, 2021 and June 28, 2021; and

|

|

|

|

|

|

|

●

|

all reports and other documents subsequently filed by us pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act after the date of this prospectus and prior to the termination of this offering.

|

The SEC file number for each of the documents listed above is 000-27781

In addition, all reports and other documents filed by us pursuant to the Exchange Act after the date of the initial registration statement and prior to effectiveness of the registration statement shall be deemed to be incorporated by reference into this prospectus.

Any statement contained in this prospectus or in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or any other subsequently filed document that is deemed to be incorporated by reference into this prospectus modifies or supersedes the statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We will provide, upon written or oral request, without charge to each person, including any beneficial owner, to whom a copy of this prospectus is delivered, a copy of any or all of the information incorporated herein by reference (exclusive of exhibits to such documents unless such exhibits are specifically incorporated by reference herein). You may request a copy of any or all of these filings, at no cost, by writing or telephoning us at: United Health Products, Inc., 10624 South Eastern Avenue, Suite A209, Henderson, Nevada 89052; telephone number (877) 358-3444.

You should rely only on information contained in, or incorporated by reference into, this prospectus and any prospectus supplement. We have not authorized anyone to provide you with information different from that contained in this prospectus or incorporated by reference in this prospectus. We are not making offers to sell the securities in any jurisdiction in which such an offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make such offer or solicitation.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following table sets forth the various expenses in connection with the sale and distribution of the securities being registered, all of which are being borne by us.

|

Securities and Exchange Commission registration fee

|

|

$

|

654.60

|

|

|

Legal fees and expenses

|

|

|

50,000.00

|

|

|

Accounting fees and expenses

|

|

|

2,500.00

|

|

|

Transfer Agent and Registrar fees

|

|

|

500.00

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

53,654.60

|

|

Item 15. Indemnification of Directors and Officers.

United Health Products, Inc. is incorporated under the laws of the State of Nevada and is generally governed by the Nevada Private Corporations Code, Title 78 of the Nevada Revised Statutes, or NRS.

Section 78.138 of the NRS provides that, unless the corporation’s articles of incorporation provide otherwise, a director or officer will not be individually liable unless it is proven that (a) the director’s or officer’s acts or omissions constituted a breach of his or her fiduciary duties, and (b) such breach involved intentional misconduct, fraud, or a knowing violation of the law. Our articles of incorporation adopt the statutory standard for exculpation of our officers and directors from individual liability for their acts or omissions as an officer or director.

Section 78.7502 of the NRS permits a company to indemnify its directors and officers against expenses, judgments, fines, and amounts paid in settlement actually and reasonably incurred in connection with a threatened, pending, or completed action, suit, or proceeding, if the officer or director (a) is not liable pursuant to NRS 78.138, or (b) acted in good faith and in a manner the officer or director reasonably believed to be in or not opposed to the best interests of the corporation and, if a criminal action or proceeding, had no reasonable cause to believe the conduct of the officer or director was unlawful. Generally, indemnification under Section 78.7502 is discretionary and may be made by the corporation only as authorized in each specific case upon a determination that the indemnification is proper under the circumstances. Section 78.7502 of the NRS precludes indemnification by the corporation if the officer or director has been adjudged by a court of competent jurisdiction, after exhaustion of all appeals, to be liable to the corporation or for amounts paid in settlement to the corporation, unless and only to the extent that the court determines that in view of all the circumstances, the person is fairly and reasonably entitled to indemnity for such expenses.

Section 78.751 of the NRS requires a Nevada company to indemnify its officers and directors to the extent such person is successful on the merits or otherwise in defense of (a) any threatened, pending, or contemplated action, suit, or proceeding, whether civil, criminal, administrative, or investigative, including any action by or in the right of the corporation, by reason of the fact that the person is or was a director, officer, employee, or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee, or agent of another corporation, partnership, joint venture, trust or other enterprise, or (b) any claim, issue or matter therein, against expenses incurred by them in defending the action, including attorney’s fees. Unless restricted by the articles of incorporation, the bylaws, or agreement, the corporation may pay the expenses of officers and directors incurred in defending a civil or criminal action, suit or proceeding as they are incurred and in advance of the final disposition of the action, suit, or proceeding, upon receipt of an undertaking by or on behalf of the director or officer to repay the amount if it is ultimately determined by a court of competent jurisdiction that the director or officer is not entitled to be indemnified by the corporation. The Articles of Incorporation, the Bylaws, or agreement may require the corporation to pay such expenses upon receipt of such an undertaking.

Indemnification pursuant to NRS 78.7502 and advancement of expenses authorized in or ordered by a court pursuant to NRS 78.751 (a) does not exclude any other rights to which a person seeking indemnification or advancement of expenses may be entitled under the articles of incorporation or any bylaw, agreement, vote of stockholders, or disinterested directors or otherwise, for either an action in the person’s official capacity or an action in another capacity while holding office, and (b) continues for a person who has ceased to be a director, officer, employee or agent and inures to the benefit of the heirs, executors and administrators of such a person. The foregoing notwithstanding, indemnification, unless ordered by a court pursuant to NRS 78.7502 or for the advancement of expenses upon undertaking as provided in 78.751(2), may not be made to or on behalf of any director or officer finally adjudged by a court of competent jurisdiction, after exhaustion of any appeals taken therefrom, to be liable for intentional misconduct, fraud, or a knowing violation of law, and such misconduct, fraud or violation was material to the cause of action.

A right to indemnification or to advancement of expenses arising under a provision of the Articles of Incorporation or any Bylaw is not eliminated or impaired by an amendment to such provision after the occurrence of the act or omission that is the subject of the civil, criminal, administrative or investigative action, suit or proceeding for which indemnification is provided.

Section 78.752 of the NRS provides that a Nevada company may purchase and maintain insurance or make other financial arrangements on behalf of any person who is or was a director, officer, employee, or agent of the company, or is or was serving at the request of the company as a director, officer, employee, or agent of another company, partnership, joint venture, trust, or other enterprise, for any liability asserted against him and liability and expenses incurred by him in his capacity as a director, officer, employee, or agent, or arising out of his status as such, whether or not the company has the authority to indemnify him against such liability and expenses.

Our Articles of Incorporation and Bylaws implement the indemnification provisions permitted by Chapter 78 of the NRS by providing that we shall indemnify our directors and officers to the fullest extent permitted by the NRS against expense, liability, and loss reasonably incurred or suffered by them in connection with their service as an officer or director. Our articles of incorporation and bylaws also provide that we may purchase and maintain liability insurance, or make other arrangements for such obligations or otherwise, to the extent permitted by the NRS.

Item 16. Exhibits.

The exhibits to this registration statement are listed in the Exhibit Index to this registration statement, which Exhibit Index is hereby incorporated by reference.

Item 17. Undertakings.

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement; provided, however, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5) That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(b) That, for purposes of determining any liability under the Securities Act:

(i) the information omitted from the form of prospectus filed as part of the registration statement in reliance upon Rule 430A and contained in the form of prospectus filed by the registrant pursuant to Rule 424(b)(1) or (4) or 497(h) under the Securities Act shall be deemed to be part of the registration statement as of the time it was declared effective; and

(ii) each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.