Lazard Releases 2021 Global Healthcare Leaders Study

September 27 2021 - 6:49AM

Business Wire

- Most healthcare industry leaders expect

the pandemic to continue through 2022 and beyond -

Lazard Ltd (NYSE: LAZ) today released its fourth annual in-depth

study of strategic challenges and opportunities in the global

healthcare industry, surveying 200 C-level executives and investors

across three global sectors: Biopharmaceuticals; Medical Devices

and Diagnostics; and Healthcare Services. As the COVID-19 pandemic

continues to evolve, this year’s study focuses on the healthcare

leaders’ pandemic-related challenges and expectations, as well as

the strategic priorities for their businesses.

In last year’s study, there was a high correlation between

healthcare industry leaders’ responses and the subsequent course of

events. This year’s study finds that most healthcare leaders expect

a protracted battle with the global health crisis, with the

majority of respondents expecting the pandemic to continue through

2022 and beyond. They also have significant concerns about

scenarios that could create risk for resurgence, such as vaccine

hesitancy, distribution shortfalls in developing countries, and new

variants. In addition, the majority of respondents expect the

pandemic to have lasting impacts, both positive and negative, on

their industry, the business world and socioeconomic trends

globally.

“Most healthcare industry leaders expect the pandemic to

permanently accelerate the digital revolution, technology and

automation, but a significant number also expect worsening national

and global inequity, worsening political divides and protectionist

trends,” said David Gluckman, Global Head of Lazard’s Healthcare

Group. “In a challenging environment for the healthcare industry,

scientific innovation and advances in digital technologies are seen

as the greatest forces for positive transformation.”

“The need for growth and innovation continues to drive companies

toward strategic transactions, including M&A, alliances and

licensing activity,” said Stephen Sands, Chairman of Lazard’s

Global Healthcare Group. “The majority of respondents predict

increased strategic activity for the remainder of this year and

into 2022 and beyond.”

The study offers a variety of insights, including the following

selected highlights:

- Healthcare leaders expect the pandemic to continue through 2022

and beyond. 90% of respondents expect baseline case loads to

persist at more than minimal levels in 2022, and 58% expect this to

continue in 2023 and beyond. More than 90% expect the same for peak

case loads in 2022, and two thirds expect this trend for peak case

loads to continue in 2023 and beyond.

- 70% of healthcare leaders expect that the flexible, hybrid

working arrangements widely adopted by office workers during the

pandemic will be a permanent shift. Almost half of respondents also

expect a permanent shift in economic activity to virtual channels,

with less in-person interactions, movement and travel.

- 64% of healthcare leaders expect the pandemic to permanently

accelerate the digital revolution, technology and automation.

Almost half expect a permanent shift toward a greater focus on

secure supply chains with domestic supply for key elements.

U.S.-based healthcare services leaders are the most concerned about

the possibility of materially higher taxes following the pandemic,

with 48% expecting a permanent shift in this direction, compared to

28% of all study respondents.

- Almost all healthcare leaders expect significantly greater use

of virtual healthcare delivery, with 61% expecting a permanent

shift. A similar number expect a permanent shift toward increased

usage of remote patient monitoring. In addition, most healthcare

leaders expect increased delivery of healthcare in the home and

other alternate sites, as well as greater use of non-physician

professionals to deliver care. Despite alarming episodes of

overburdened intensive care facilities around the U.S. during the

past 18 months, the majority of respondents do not expect greater

hospital capacities as a result of the pandemic.

- When healthcare leaders focus on the greatest strategic

challenges facing the healthcare industry, pricing and

reimbursement remains at the top of their list by a significant

margin. In this year’s study, 68% cite this as a top three

strategic challenge, compared to 61% in 2019 and 57% in 2017.

Quality, cost of healthcare, and the political and regulatory

environment remain in the top three challenges, as they did in 2019

and 2017.

- The top challenges to executing strategic transactions in the

current environment are price level and value expectations,

according to 82% of healthcare leaders. Scarcity of attractive

candidates, and pricing and reimbursement uncertainty are also

mentioned by 49% and 38% of respondents, respectively. One third of

study respondents cite the ready availability of capital for

smaller companies as a top challenge.

- Most healthcare leaders expect private financings, IPOs and

equity follow-ons to stay at the same level or increase for the

balance of 2021 and into 2022. However, the distribution of

responses suggests somewhat more uncertainty about the direction of

IPOs. Private company executives, however, are especially bullish

that IPOs will increase over the remainder of 2021 and into 2022,

with approximately half expecting IPO activity to rise. However,

the majority of healthcare leaders expect SPAC financings to

decrease over this period. Investors in particular have a strong

view that SPAC financings will decrease, with approximately 80%

expecting a decline, compared to approximately 60% of all study

respondents.

- Many biopharmaceutical leaders expect the pandemic to have a

meaningful impact on their sector. The largest number expect

greater use of innovative clinical trial designs, clinical trial

management and use of real-world evidence, with 51% expecting a

moderate impact and 33% expecting a permanent shift in this area.

Very similar numbers expect permanent shifts in other areas, with

greater focus on scientific innovation, increased focus on data

analytics in R&D, and a rise in digital-enabled and virtual

approaches to commercialize products.

- Almost two-thirds of biopharmaceutical leaders say that

oncology is a top therapeutic area priority for the next year,

followed by 53% who cite rare diseases and 48% who cite

autoimmune/inflammation – similar percentages to last year’s study.

Notably, the central nervous system (CNS) has moved up as a

priority therapeutic area, with 42% naming it as their top

priority, compared to 30% last year.

- Immuno-oncology, precision medicine and gene therapy are still

viewed among the top innovative, disruptive technological

priorities for the next 12 months, according to biopharmaceutical

leaders, followed by RNA-based therapeutics, cell therapy and

next-generation antibodies.

The Global Healthcare Leaders Study surveyed 171 C-level

executives and 29 investors across three sectors:

Biopharmaceuticals; Medical Devices and Diagnostics; and Healthcare

Services. These 200 healthcare leaders represent many of the

largest healthcare entities globally, smaller public and private

companies, and prominent investment firms.

The Global Healthcare Leaders Study reflects Lazard’s approach

to long-term thought leadership, commitment to the sectors in which

it participates, and focus on intellectual differentiation. An

executive summary of the Study is posted at

www.lazard.com/perspective.

Lazard’s Global Healthcare Group advises senior executives and

boards of directors on strategic M&A, corporate preparedness,

capital advisory, and other strategic and financial matters. The

group is active in all areas of the healthcare and life sciences

industry, including pharmaceuticals, biotechnology, healthcare

services, and medical devices.

ABOUT LAZARD

Lazard, one of the world's preeminent financial advisory and

asset management firms, operates from 41 cities across 26 countries

in North America, Europe, Asia, Australia, Central and South

America. With origins dating to 1848, the firm provides advice on

mergers and acquisitions, strategic matters, restructuring and

capital structure, capital raising and corporate finance, as well

as asset management services to corporations, partnerships,

institutions, governments and individuals. For more information on

Lazard, please visit www.lazard.com. Follow Lazard at @Lazard.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210927005221/en/

Media: Judi Mackey judi.mackey@lazard.com +1 212 632 1428

Poppy Trowbridge poppy.trowbridge@lazard.com +44 20 7187

2065

Clare Pickett (US) clare.pickett@lazard.com +1 212 632 6963

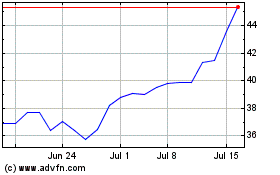

Lazard (NYSE:LAZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

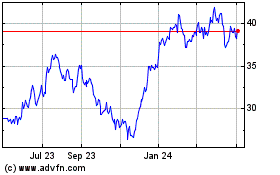

Lazard (NYSE:LAZ)

Historical Stock Chart

From Apr 2023 to Apr 2024