SMCP Parent Defaults on Bonds; Operations Safe, Company Says

September 23 2021 - 3:07AM

Dow Jones News

By Joshua Kirby

SMCP SAS said Thursday that it has been notified of a credit

default by its controlling shareholder, but stressed that the

situation doesn't put the company at risk.

The French fashion group said bond trustee GLAS had notified it

of a failure by European TopSoho, a subsidiary of struggling

Chinese apparel conglomerate Shandong Ruyi Technology Group, to

redeem bonds worth 250 million euros ($292.2 million) by their

maturity date on Tuesday. The Luxembourg-based holding company has

until Sept. 30 to remedy the default, SMCP said.

The bonds, which are exchangeable into SMCP shares, are

underwritten by shares representing 37% of the group's share

capital, according to SMCP. European TopSoho holds around 53% of

the group's shares.

The development doesn't put into question SMCP's financing and

operations, the company said.

Last week, shareholders represented by business-ethics group

Gouvernance en Action wrote to the company setting out their

concerns over what would happen in the case of such a default by

the controlling shareholder.

"The situation is alarming for the future of SMCP, its minority

shareholders, its employees and all other stakeholders," GeA's

Fabrice Remon said in the letter, which was also sent to the French

capital-markets authority.

European TopSoho and Shandong Ruyi did not respond to requests

for comment.

Write to Joshua Kirby at joshua.kirby@wsj.com;

@joshualeokirby

(END) Dow Jones Newswires

September 23, 2021 02:52 ET (06:52 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

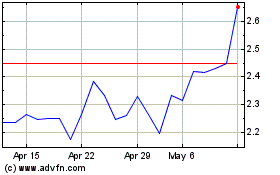

SMCP (EU:SMCP)

Historical Stock Chart

From Mar 2024 to Apr 2024

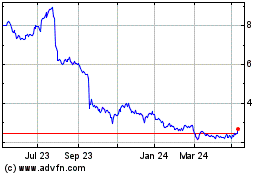

SMCP (EU:SMCP)

Historical Stock Chart

From Apr 2023 to Apr 2024