Statement of Changes in Beneficial Ownership (4)

September 08 2021 - 4:59PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Moser Christopher |

2. Issuer Name and Ticker or Trading Symbol

NRG ENERGY, INC.

[

NRG

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Exec VP, Operations |

|

(Last)

(First)

(Middle)

804 CARNEGIE CENTER |

3. Date of Earliest Transaction

(MM/DD/YYYY)

9/3/2021 |

|

(Street)

PRINCETON, NJ 08540

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock, par value $.01 per share | 9/3/2021 | | A | | 2089.0000 (1) | A | $0 (2) | 142491.0000 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Relative Performance Stock Units | $0.0000 (3) | 9/3/2021 | | A | | 3446.0000 (4) | | 9/3/2024 | 9/3/2024 | Common Stock, par value $.01 per share | 3446.0000 | $0.0000 | 3446.0000 (5) | D | |

| Explanation of Responses: |

| (1) | On September 3, 2021, the reporting person received a supplemental grant in connection with an increase in equity compensation for eligible plan participants under the NRG Energy, Inc. (the "Company") Long Term Incentive Plan (the "LTIP") as determined by the Compensation Committee (the "Committee"). The adjustment was made following a review by the Committee of the Company's compensation structure as part of the integration of Direct Energy and the continued evaluation of the size and scope of the Company's business. |

| (2) | Each RSU is equivalent in value to one share of NRG's Common Stock, par value $.01 per share. The Reporting Person will receive from NRG one such share of Common Stock for each RSU that will vest ratably over a three year period beginning on the first anniversary of the date of grant. |

| (3) | The Reporting Person was issued 3,446 Relative Performance Stock Units ("RPSUs") by NRG Energy, Inc. under the LTIP on September 3, 2021. The RPSUs will convert to shares of NRG Common Stock on September 3, 2024 only in the event the Company has achieved a certain level of total shareholder return ("TSR") relative to the Peer Group (defined below) over a three-year performance period. The numberof shares of Common Stock that the Reporting Person may receive is interpolated for TSR falling between Threshold, Target, and Maximum levels as described below. |

| (4) | Reporting Person will receive(i) a maximum of 6,892 shares of Common Stock if Company's TSR is ranked at or above the 75th percentile relative to a peer group of companies approved by the Company's Compensation Committee (the "Peer Group") for the performance period (the "Maximum"); (ii) 3,446 shares of Common Stock if Company's TSR is ranked at the 55th percentile relative to the Peer Group for the performance period (the "Target"); provided, however, if TSR is less than negative fifteen percent (-15%), the Company's TSR must be ranked at the 65th percentile relative to the Peer Group for the performance period to receive the Target award; or (iii) 861 shares of Common Stock if Company's TSR is ranked at the 25th percentile relative to the Peer Group for the performance period(the "Threshold"). The Reporting Person will not receive any shares of Common Stock if Company's TSR is below the 25th percentile relative to the Peer Group for the performance period. |

| (5) | The Maximum award that the Reporting Person will receive shall not exceed six (6) times the fair market value of the Target award, determined as of the date of grant. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Moser Christopher

804 CARNEGIE CENTER

PRINCETON, NJ 08540 |

|

| Exec VP, Operations |

|

Signatures

|

| Christine Zoino, by Power of Attorney | | 9/8/2021 |

| **Signature of Reporting Person | Date |

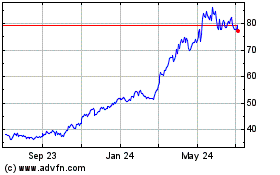

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

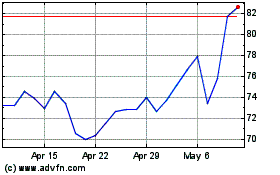

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Apr 2023 to Apr 2024