RPT Realty Announces Continued Execution of Its 2021 Strategic Acquisition Plan

September 08 2021 - 4:15PM

RPT Realty (NYSE:RPT) (“RPT” or the “Company”)

announced today that it continues to make substantial progress

towards the execution of its 2021 strategic acquisition plan.

RPT, through its grocery-anchor focused joint

venture platform R2G Venture LLC (“R2G”), is under contract to

acquire the Dedham shopping center located in the Boston market for

a contract price of $131.5 million, or $67.7 million at RPT’s

pro-rata share. Additionally, the Company closed on the previously

announced acquisition of Newnan Pavilion, a grocery-anchored

shopping center in the Atlanta market, for $41.6 million. The

Company has closed or is under contract on nine multi-tenant

open-air shopping centers with a gross acquisition value of

approximately $500 million, or about $350 million at the Company’s

pro-rata share. Net of RPT’s share of expected parcel sales to its

net lease joint venture platform RGMZ Venture REIT LLC (“RGMZ”),

the Company will have deployed $285 million of capital into high

growth, target markets of Boston, Nashville, Tampa and Atlanta.

Boston is expected to become the Company’s third largest market,

while eight of the nine centers are grocery-anchored, demonstrating

the cash flow strength of these acquisitions.

Dedham is a 510,000 square foot grocery-anchored

shopping center located in an affluent and densely populated infill

location inside the 128 loop (Interstate 95) with three-mile

average household income and population density of $136,000 and

109,000, respectively. Dedham is 91.8% occupied and anchored by a

high performing Stop and Shop. The center is also shadow anchored

by Lowe’s and is home to a mix of other thriving retailers and

quick service restaurants including T.J. Maxx, Dick’s Sporting

Goods, Starbucks, and Chipotle. This acquisition is expected to

close in the fourth quarter 2021, subject to customary closing

conditions.

“We continue to drive the dramatic

transformation of our portfolio, highlighted by our expected

acquisition of Dedham in the Boston market,” said Brian Harper,

President and Chief Executive Officer. “The power of our strategic

joint ventures coupled with our wholly owned platform have

positioned RPT to quickly redeploy $500 million of capital into

highly sought after top national markets, which we expect will

allow for accelerated and accretive earnings growth in 2021 and

2022.”

Year-to-date Multi-tenant

Acquisitions

|

Property Name |

Closing Date |

MetroMarket |

GLA |

ContractPrice |

Pro-rataContractPrice |

Platform |

|

|

|

|

(in thousands) |

(in millions) |

(in millions) |

|

|

Northborough Crossing1 |

6/18/2021 |

Boston |

646 |

$104.0 |

$104.0 |

RPT |

|

Village Shoppes of Canton |

7/12/2021 |

Boston |

284 |

$61.5 |

$31.7 |

R2G |

|

South Pasadena Shopping Center |

7/14/2021 |

Tampa |

164 |

$32.7 |

$16.8 |

R2G |

|

Bedford Marketplace |

7/29/2021 |

Boston |

153 |

$54.5 |

$28.1 |

R2G |

|

Bellevue Place |

7/7/2021 |

Nashville |

77 |

$10.4 |

$10.4 |

RPT |

|

East Lake Woodlands |

7/9/2021 |

Tampa |

104 |

$25.5 |

$13.1 |

R2G |

|

Woodstock Square |

7/14/2021 |

Atlanta |

219 |

$37.7 |

$37.7 |

RPT |

|

Newnan Pavilion2 |

8/5/2021 |

Atlanta |

467 |

$41.6 |

$41.6 |

RPT |

|

Dedham |

Under Contract |

Boston |

510 |

$131.5 |

$67.7 |

R2G |

|

Total Closed or Under Contract |

|

|

2,624 |

$499.4 |

$351.1 |

|

1 The Company expects to sell up to $64.6

million of single-tenant, net lease parcels from this property to

RGMZ. 2 The Company expects to sell up to $6.1 million

of single-tenant, net lease parcels from this property to RGMZ.

About RPT Realty

RPT Realty owns and operates a national

portfolio of open-air shopping destinations principally located in

top U.S. markets. The Company's shopping centers offer diverse,

locally-curated consumer experiences that reflect the lifestyles of

their surrounding communities and meet the modern expectations of

the Company's retail partners. The Company is a fully integrated

and self-administered REIT publicly traded on the New York Stock

Exchange (the “NYSE”). The common shares of the Company, par value

$0.01 per share are listed and traded on the NYSE under the ticker

symbol “RPT”. As of June 30, 2021, the Company's property portfolio

consisted of 50 multi-tenant shopping centers (including five

shopping centers owned through a joint venture), 15 net lease

retail properties (all of which are owned through a separate joint

venture) and 13 net lease retail properties that were held for sale

by the Company (the “aggregate portfolio”) which together represent

12.6 million square feet of gross leasable area (“GLA”). As of June

30, 2021, the Company’s pro-rata share of the aggregate portfolio

was 92.5% leased. For additional information about the Company

please visit rptrealty.com.

Contact Information

Vin ChaoSenior Vice President - Finance

vchao@rptrealty.com (212) 221-1752

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. These forward-looking statements represent our

expectations, plans or beliefs concerning future events and may be

identified by terminology such as “may,” “will,” “expect,”

“continue” or similar terms. Although the forward-looking

statements made in this document are based on our good faith

beliefs, reasonable assumptions and our best judgment based upon

current information, certain factors could cause actual results to

differ materially from those in the forward-looking statements.

Many of the factors that will determine the outcome of

forward-looking statements are beyond our ability to predict or

control. These factors include, without limitation, the Company's

ability to satisfy the closing conditions and/or complete the

acquisitions described herein on the terms currently contemplated

or at all, the Company's success or failure in implementing its

business strategy; economic conditions generally and in the

commercial real estate and finance markets specifically; the cost

and availability of capital, which depends in part on the Company's

asset quality and its relationships with lenders and other capital

providers; the effect of the current COVID-19 pandemic on the

financial condition, results of operations, cash flows and

performance of the Company and its tenants; the Company's business

prospects and outlook; and other factors detailed from time to time

in the Company's filings with the Securities and Exchange

Commission, including in particular those set forth under “Risk

Factors” in the Company's latest annual report on Form 10-K and

quarterly report on Form 10-Q, which you should interpret as being

heightened as a result of the numerous and ongoing adverse impacts

of the COVID-19 pandemic. Given these uncertainties, you should not

place undue reliance on any forward-looking statements. Except as

required by law, the Company assumes no obligation to update these

forward-looking statements, even if new information becomes

available in the future.

RPT Realty (NYSE:RPT)

Historical Stock Chart

From Mar 2024 to Apr 2024

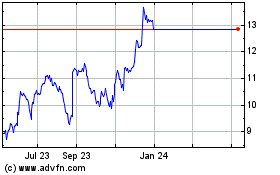

RPT Realty (NYSE:RPT)

Historical Stock Chart

From Apr 2023 to Apr 2024