Saratoga Investment Corp. Increases Quarterly Dividend by $0.08 to $0.52 per Share for the Quarter Ended August 31, 2021

August 26 2021 - 8:30AM

Saratoga Investment Corp. (NYSE:SAR) (“Saratoga Investment”

or “the Company”), a business development company, today announced

that its Board of Directors has declared a quarterly dividend of

$0.52 per share for the fiscal quarter ended August 31, 2021,

payable on September 28, 2021, to all stockholders of record at the

close of business on September 14, 2021. This is an increase of

$0.08 per share from $0.44 per share last quarter.

“We are very pleased that our strong track record

and portfolio performance, healthy credit profile, robust deal

pipeline, and ongoing asset growth continue to generate strong,

consistent financial performance in support of a program of paying

and increasing quarterly dividends,” said Christian L.

Oberbeck, Chairman and Chief Executive Officer of Saratoga

Investment. “This positive performance across all metrics has

allowed us to increase our dividend this quarter by $0.08, or 18%,

to $0.52 per share. In concluding on this level of increase, we

also took into consideration our current and projected level of

spillover and ensuring we manage that appropriately. Our dividend

strategy is consistent with our overall approach to managing risk

conservatively, while pursuing long-term growth and credit quality.

We will continue to evaluate dividend payments on a quarterly basis

taking into account portfolio and investment performance, along

with the prospects for continued economic recovery and growth.”

This is the third dividend declared in fiscal year

2022. The Company previously declared a quarterly dividend of $0.44

per share for the quarter ended May 31, 2021 and $0.43 per share

for the quarter ended February 28, 2021. During fiscal year 2021,

the Company declared a quarterly dividend of $0.42 per share for

the quarter ended November 30, 2020, $0.41 per share for the

quarter ended August 31, 2020 and $0.40 per share for the quarter

ended May 31, 2020.

Shareholders will have the option to receive

payment of the dividend in cash or receive shares of common stock

pursuant to the Company’s dividend reinvestment plan (“DRIP”).

Saratoga Investment shareholders who hold their shares with a

broker must affirmatively instruct their brokers prior to the

record date if they prefer to receive this dividend, and future

dividends, in common stock. The number of shares of common

stock to be delivered shall be determined by dividing the total

dollar amount by 95% of the average of the market prices per share

at the close of trading on the ten (10) trading days immediately

preceding (and including) the payment date.

About Saratoga Investment

Saratoga Investment is a specialty finance company

that provides customized financing solutions to U.S. middle-market

businesses. The Company invests primarily in senior and unitranche

leveraged loans and mezzanine debt, and, to a lesser extent, equity

to provide financing for change of ownership transactions,

strategic acquisitions, recapitalizations and growth initiatives in

partnership with business owners, management teams and financial

sponsors. Saratoga Investment’s objective is to create

attractive risk-adjusted returns by generating current income and

long-term capital appreciation from its debt and equity

investments. Saratoga Investment has elected to be regulated

as a business development company under the Investment Company Act

of 1940 and is externally-managed by Saratoga Investment Advisors,

LLC, an SEC-registered investment advisor focusing on credit-driven

strategies. Saratoga Investment owns two SBIC-licensed

subsidiaries and manages a $650 million collateralized loan

obligation (“CLO”) fund. It also owns 52% of the Class F and

100% of the subordinated notes of the CLO. The Company’s

diverse funding sources, combined with a permanent capital base,

enable Saratoga Investment to provide a broad range of financing

solutions.

Forward Looking Statements

Statements included herein contain certain

“forward-looking statements” within the meaning of the federal

securities laws, including statements with regard to the Company’s

Notes offering and the anticipated use of the net proceeds of the

offering. Forward-looking statements can be identified by the use

of forward looking words such as “outlook,” “believes,” “expects,”

“potential,” “continues,” “may,” “will,” “should,” “seeks,”

“approximately,” “predicts,” “intends,” “plans,” “estimates,”

“anticipates” or negative versions of those words, other comparable

words or other statements that do not relate to historical or

factual matters. The forward-looking statements are based on our

beliefs, assumptions and expectations of future events and our

future performance, taking into account all information currently

available to us. These statements are not guarantees of future

events, performance, condition or results and involve a number of

risks and uncertainties. Actual results may differ materially from

those in the forward-looking statements as a result of a number of

factors, including but not limited to the impact of the COVID-19

pandemic and the pandemic’s impact on the U.S. and global economy,

as well as those described from time to time in our filings with

the SEC. Any forward-looking statement speaks only as of the date

on which it is made. Saratoga Investment Corp. undertakes no duty

to update any forward-looking statements made herein, whether as a

result of new information, future developments or otherwise, except

as required by law.

Contact: Henri

SteenkampSaratoga Investment Corp.212-906-7800

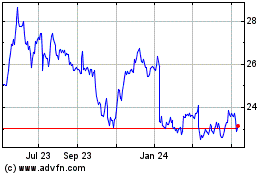

Saratoga Investment (NYSE:SAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Saratoga Investment (NYSE:SAR)

Historical Stock Chart

From Apr 2023 to Apr 2024