|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 12b-25

NOTIFICATION OF LATE FILING

|

OMB APPROVAL

|

|

OMB Number: 3235-0058

|

|

|

|

Estimated average burden hours per response ... 2.50

|

|

|

|

SEC FILE NUMBER

|

|

000-55689

|

|

|

|

CUSIP NUMBER

|

|

91214A108

|

|

(Check one):

|

|

o Form 10-K

o Form 20-F o Form 11-K

☒ Form 10-Q o

Form 10-D o Form N-CEN o

Form N-CSR

|

|

|

|

|

|

|

|

For Period Ended:

|

June 30, 2021

|

|

|

|

|

|

|

|

o Transition Report on Form 10-K

|

|

|

|

|

|

|

|

o Transition Report on Form 20-F

|

|

|

|

|

|

|

|

o Transition Report on Form 11-K

|

|

|

|

|

|

|

|

o Transition Report on Form 10-Q

|

|

|

|

|

|

|

|

For the Transition Period Ended:

|

|

|

|

Read Instruction (on back page) Before Preparing

Form. Please Print or Type.

Nothing in this form shall be construed to imply

that the Commission has verified any information contained herein.

|

|

|

If the notification relates to a portion of the filing checked above,

identify the Item(s) to which the notification relates:

PART I — REGISTRANT INFORMATION

US Lighting Group, Inc.

Full Name of Registrant

Former Name if Applicable

1148 East 222nd Street

Address of Principal Executive Office (Street and Number)

Euclid, Ohio 44117

City, State and Zip Code

PART II — RULES 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort

or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate)

|

☒

|

(a)

|

The reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense;

|

|

|

|

|

|

☒

|

(b)

|

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-CEN, or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report of transition report on Form 10-Q, or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed date; and

|

|

|

|

|

|

¨

|

(c)

|

The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable.

|

PART III — NARRATIVE

State below in reasonable detail the reasons why Forms 10-K, 20-F,

11-K, 10-Q, 10-D, N-SAR, N-CSR, or the transition report portion thereof, could not be filed within the prescribed time period.

US Lighting Group, Inc. (the “Company”)

was unable to file its Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2021 (the “10-Q”) within the

prescribed time period on or before August 16, 2021 without unreasonable effort and expense. The inability of the Company to meet this

filing deadline is the result of several factors relating to the recent arrest of the Company’s former Chief Executive Officer,

Paul Spivak, as previously disclosed in the Company’s Current Report on Form 8-K filed June 11, 2021. As a result of this arrest,

the Company’s computer systems and paper records were confiscated by the Federal Bureau of Investigation (FBI) as part of its investigation,

creating increased difficulty for the Company to timely prepare its financial statements for the 10-Q. Additionally, the arrest of Mr.

Spivak necessitated significant changes in the Company’s management, including a new Chief Executive Officer, President, and Secretary,

and the election of two new directors of the Company, as disclosed in the Company’s Current Report on Form 8-K filed August 12,

2021). While the new management of the Company is diligently working to prepare the disclosure required for the 10-Q, management is unable

to prepare such disclosure by the August 16, 2021 deadline without unreasonable effort or expense.

The registrant anticipates that it will file the

10-Q no later than August 21, 2021. The Company expects to have

a significant change in its results of operations compared to the corresponding period in the prior year.

|

SEC 1344 (03-05)

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

Steven E. Eisenberg

Olga Smirnova

Anthony Corpora

(Attach extra Sheets if Needed)

PART IV — OTHER INFORMATION

|

(1)

|

|

Name and telephone number of person to contact in regard to this notification

|

|

|

Steven E. Eisenberg

|

|

216

|

|

513-5220

|

|

|

(Name)

|

|

(Area Code)

|

|

(Telephone Number)

|

|

(2)

|

|

Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify report(s).

|

|

|

|

Yes ☒ No o

|

|

|

|

|

|

(3)

|

|

Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof?

|

|

|

|

Yes ☒ No

o

|

|

|

|

|

|

|

|

If so, attach an explanation of the anticipated change, both narratively

and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made. See Attachment

A hereto.

|

ATTACHMENT A

to

Form 12b-25

of

US Lighting Group, Inc.

As disclosed in the Company’s Current Report on Form 8-K filed

May 19, 2021, on May 14, 2021, the Company and Intellitronix Corporation, the Company’s majority-owned subsidiary, entered into

an Asset Purchase Agreement with Ohio INTX Cooperative, a State of Ohio cooperative association, to sell certain assets of Intellitronix

Corporation. The Asset Purchase Agreement and related sale was finalized on May 14, 2021 with a sale price of $4,520,000.00.

The following is a narrative and quantitative explanation of the anticipated

change in results of operations from the corresponding periods for the last fiscal year as a result of the transaction described above,

and is being included to provide a reasonable estimation of the Company’s anticipated changes in results of operations. The content

of the Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2021 filed by the Company may differ from the information

below.

Results of Operations for the Three Months

Ended June 30, 2021 Compared to the Three Months Ended June 30, 2020

Sales

Total Sales decreased by $289,000 (35%) to $542,000

for the three months ended June 30, 2021, compared to $831,000 for the three months ended June 30, 2020. The decrease in sales is attributed

to the sale of operational assets of Intellitronix Corp. on May 14, 2021, which resulted in the loss of revenue generated from Intellitronix

Corp. after May 14, 2021 during the three months ended June 30, 2021. The Company does not expect to receive any further revenues from

the operations of Intellitronix Corp. after the sale of its assets on May 14, 2021.

Cost of Goods Sold

Cost of goods sold decreased by $181,000 (49%)

to $190,000 for the three months ended June 30, 2021, compared to $371,000 for the three months ended June 30, 2020. The decrease in costs

of goods sold was primarily attributable to decreased sales, as described above.

Operating Expenses

Operating expenses include selling, general

and administrative expenses, and product development costs.

Selling, general and administrative expenses

increased by $502,000 (111%) to $955,000 for the three months ended June 30, 2021, compared to $453,000 for the three months ended June

30, 2020. The increase in selling, general and administrative expenses is primarily attributable to sales commissions expenses, including

a legal settlement of $150,000 related to a lawsuit against Intellitronix Corporation for alleged nonpayment of manufacturer’s representation

commissions (which was accrued on June 30, 2021 and paid on July 29, 2021) and a commission of $212,000 to a business broker on the sale

of the assets of Intellitronix Corporation and increased legal expenses.

Product development costs decreased by $106,000

(75%) to $36,000 for the three months ended June 30, 2021, compared to $142,000 for the three months ended June 30, 2020. The decrease

in product development costs is primarily attributable a focus on fewer new products with higher margins.

Loss from Operations

Loss from operations increased to approximately

$639,000 during the three months ended June 30, 2021, compared to a loss from operations of $135,000 during the three months ended June

30, 2020. The increase in loss from operations was due to a loss of revenue resulting from the sale of the assets of Intellitronix, which

at the time of the sale was a significant source of revenue generation for the Company, along with increased operating expenses, as discussed

above.

Other Expense

Other income for the three months ended June 30,

2021 was $4,092,000, as compared to other expense of $60,000 for the three months ended June 30, 2020. The large increase in other income

for the three months ended June 30, 2021 compared to the same period in the prior year was the sale of assets of Intellitronix Corporation

to Ohio INTX Cooperative on May 14, 2021 with a sale price of $4,520,000.00. As a result of this transaction, we recognized a gain on

disposal of assets of $3,915,000. During the three months ended June 30, 2021, we recorded lease income of $24,000, including sublease

income from a related party of $15,000, an unrealized gain of $204,000 and dividend and interest income of $2,000. Interest expense for

the three months ended June 30, 2021 was $53,000, as compared to $60,000 for the three months ended June 30, 2020.

Net Loss

Net income was $3,453,000 during the three months

ended June 30, 2020, compared to a net loss of $195,000 for the three months ended June 30, 2020. The change from a net loss to net income

is primarily due to the recognition of other income as discussed above.

Results of Operations for the Six Months

Ended June 30, 2021 Compared to the Six Months Ended June 30, 2020

Sales

Sales decreased by $76,000 (5%) to $1,486,000

for the six months ended June 30, 2021, compared to $1,562,000 for the six months ended June 30, 2020. This decrease in sales is attributed

to the sale of operational assets of Intellitronix Corp. on May 14, 2021, which resulted in the loss of revenue generated from Intellitronix

Corp. after May 14, 2021 during the three months ended June 30, 2021.

Cost of Goods Sold

Cost of goods sold decreased by $14,000 (2%) to

$596,000 for the six months ended June 30, 2021, compared to $610,000 for the six months ended June 30, 2020. The decrease in costs of

goods sold was primarily attributable to decreased sales.

Operating Expenses

Operating expenses include selling, general

and administrative expenses, and product development costs.

Selling, general and administrative expenses

increased by $590,000 (64%) to $1,517,000 for the six months ended June 30, 2021, compared to $927,000 for the six months ended June 30,

2020. The increase in selling, general and administrative expenses is primarily attributable to an increase in sales commissions expenses,

including a legal settlement of $150,000 related to a lawsuit against Intellitronix Corporation for alleged nonpayment of manufacturer’s

representation commissions (which was accrued on June 30, 2021 and paid on July 29, 2021) and a commission of $212,000 to a business broker

on the sale of the assets of Intellitronix Corporation and increased legal expenses.

Product development costs decreased by $100,000

(45%) to $120,000 for the six months ended June 30, 2021, compared to $220,000 for the six months ended June 30, 2020. The decrease in

product development costs is primarily attributable to a shift in the focus of the Company to develop a smaller number of new products

with higher margins.

Loss from Operations

Loss from operations increased to approximately

$747,000 during the six months ended June 30, 2021, compared to a loss from operations of $195,000 during the six months ended June 30,

2020. The increase in loss from operations was due to increased operating expenses, as discussed above.

Other Income / Expense

Other income for the six months ended June 30,

2021 was $4,052,000, as compared to other expense of $98,000 for the six months ended June 30, 2020. During the six months ended June

30, 2021, we recorded a gain on extinguishment of debt of $9,000, sublease income of $39,000, $30,000 of which was from a related party,

an unrealized gain of $204,000, and dividend and interest income of $2,000. Interest expense for the six months ended June 30, 2021 was

$117,000, as compared to $98,000 for the six months ended June 30, 2020. In addition, during the six months ended June 30, 2021, we recognized

a gain on disposal of selected Intellitronix assets of $3,915,000.

Net Loss

Net income was $3,305,000 during the six months

ended June 30, 2020, compared to a net loss of $293,000 for the six months ended June 30, 2020. The change from a net loss to net income

is primarily due to the recognition of other income as discussed above.

US Lighting Group, Inc..

(Name of Registrant as Specified in Charter)

has caused this notification to be signed on its behalf by the undersigned

hereunto duly authorized.

|

Date:

|

August 16, 2021

|

By:

|

/s/ STEVEN E. EISENBERG

|

|

|

|

|

Name: Steven E. Eisenberg

Chief Financial Officer

(Principal Financial Officer and

Principal Accounting Officer)

|

INSTRUCTION: The form may be signed by an executive officer of the

registrant or by any other duly authorized representative. The name and title of the person signing the form shall be typed or printed

beneath the signature. If the statement is signed on behalf of the registrant by an authorized representative (other than an executive

officer), evidence of the representative’s authority to sign on behalf of the registrant shall be filed with the form.

|

|

|

ATTENTION

Intentional misstatements or omissions of fact

constitute Federal Criminal Violations (See 18 U.S.C. 1001)

|

|

|

GENERAL INSTRUCTIONS

|

1.

|

|

This form is required by Rule 12b-25 (17 CFR 240.12b-25) of the General Rules and Regulations under the Securities Exchange Act of 1934.

|

|

|

|

|

|

2.

|

|

One signed original and four conformed copies of this form and amendments thereto must be completed and filed with the Securities and Exchange Commission, Washington, D.C. 20549, in accordance with Rule 0-3 of the General Rules and Regulations under the Act. The information contained in or filed with the form will be made a matter of public record in the Commission files.

|

|

|

|

|

|

3.

|

|

A manually signed copy of the form and amendments thereto shall be filed with each national securities exchange on which any class of securities of the registrant is registered.

|

|

|

|

|

|

4.

|

|

Amendments to the notifications must also be filed on Form 12b-25 but need not restate information that has been correctly furnished. The form shall be clearly identified as an amended notification.

|

|

|

|

|

|

5.

|

|

Electronic filers. This form shall not be used by electronic filers unable to timely file a report solely due to electronic difficulties. Filers unable to submit reports within the time period prescribed due to difficulties in electronic filing should comply with either Rule 201 or Rule 202 of Regulation S-T (§232.201 or §232.202 of this chapter) or apply for an adjustment in filing date pursuant to Rule 13(b) of Regulation S-T (§232.13(b) of this chapter).

|

|

|

|

|

|

6.

|

|

Interactive data submissions. This form shall not be used by electronic filers with respect to the submission or posting of an Interactive Data File (§232.11 of this chapter). Electronic filers unable to submit or post an Interactive Data File within the time period prescribed should comply with either Rule 201 or 202 of Regulation S-T (§232.201 and §232.202 of this chapter).

|

5

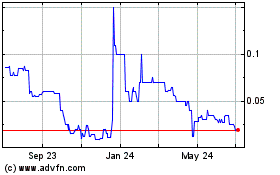

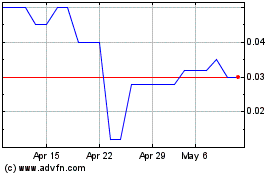

US Lighting (PK) (USOTC:USLG)

Historical Stock Chart

From Mar 2024 to Apr 2024

US Lighting (PK) (USOTC:USLG)

Historical Stock Chart

From Apr 2023 to Apr 2024