Gulf Resources, Inc. (Nasdaq: GURE) ("Gulf Resources", "we," or the

"Company"), a leading manufacturer of bromine, crude salt and

specialty chemical products in China, today announced unaudited

financial results for the second quarter 2021.

Second Quarter 2021 Financial Results

Balance Sheet

Our balance sheet remains extremely strong. Despite continuing

to invest in our new chemical factory, we have over $97 million in

cash. Our current book value per share is $26.56. Based on our

current stock price, Gulf continues to sell at a discount to its

cash, net net cash, and working capital.

|

Balance Sheet Highlights |

|

|

|

|

Total |

|

Cash |

$97,058,027 |

|

Net Net Cash |

$78,735,522 |

|

Current Assets |

$104,955,195 |

|

Working Capital |

$95,745,220 |

|

Book Value |

$278,102,555 |

Income Statement

- Net Revenues for Q2 2021 increased 108% to $11,148,008 compared

to previous year.

- Gross margins increased for Q2 2021 by 1157% from $336,587 to

$4,232,234 compared to the same period of previous year.

- As a percentage of revenues, gross margin for Q2 2021 was 38.0%

compared to 6.3% in the previous year.

- Direct labor and factory overheads for Q2 2021 incurred during

plant shutdown decreased 19.7%. As a percentage of sales, they were

12.5% versus 32.4%.

- G&A expenses for Q2 2021 increased $3,662,999 compared to

the previous year. However, $3,133,140 of the increase was

attributable to the one-time stock awards.

- Net loss before taxes for Q2 2021 declined 19.6% to $2,346,740

compared to previous year.

- Taxes were $(356,408) for Q2 2021 versus a benefit of $672,633

for Q2 2020.

- The Net Loss after Taxes was $2,703,200 for Q2 2021 versus

$2,244,619 for Q2 2020.

- The company had a comprehensive net gain for Q2 2021 of

$2,631,016 versus a net loss of $2,022,750 for Q2 2020.

Cash Flow For the six months, we had cash flow

from operations of $7,025,775. We spent $5,806,435 on property

plant and equipment for our chemical factory. Even with these

expenditures and the interruption in our production for Chinese New

Year in the first quarter, we were still able to generate positive

free cash flow for the six months and the quarter, enabling us to

increase our cash by almost $3 million compared to year-end

levels.

Segment Reporting Bromine

- Bromine revenues for Q2 2021 increased by 123% to $10,025,438

from 4,487,017 in Q2 2020.

- Gross profits in bromine for Q2 2021 increased by 1953% to

$4,471,945 from $217,778 for Q2 2020.

- As a percentage of sales, gross profits in bromine were 45% for

Q2 2021 compared to 5% for Q2 2020.

- Bromine made a profit of $2,682,233 in Q2 2021 compared to a

loss of $1,479,084 in Q2 2020.

- Production of bromine in tonnes increased by 48% to 1,805 in Q2

2021.

- The average selling price increased 51.3% to $5,554 for Q2

2021.

- Bromine prices have continued at a high level. At the end of

Q1, bromine was RMB 35,044. At the end of Q2, it had risen to

record highs of RMB 45,950. Since the end of the quarter, it has

declined slightly to RMB 43,063, still very close to its record

highs. The company expects bromine pricing to remain near its

current levels for the foreseeable future.

Crude Salt

- Net revenue for the crude salt for

Q2 2021 increased 29% to $1,122,570.

- Gross margins for Q2 2021 were loss

21% compared to profit 14% in previous year.

- The loss from operations for Q2

2021 was $578,435 compared to loss from operations of $611,472 in

the same period in 2020.

Chemicals The chemical segment incurred a

loss from operations of $741,312 for the three-month period ended

June 30, 2021, compared to loss from operations of $654,652 in the

same period in 2020.

Natural Gas Loss from operations from our

natural gas segment was $62,850 for the three-month period ended

June 30, 2021, compared to a loss of $53,270 in the same period in

2020.

UPDATE ON OPERATIONS

Factories #2, #8, and #10 The company

expects to receive approvals to reopen factories #2, #8, and #10.

To its knowledge, the government is currently completing its

planning process for all mining areas including that for prevention

of flood. As a result, the Company may be required to make some

modifications to our current wells and aqueducts prior to

commencement of operations of these factories to satisfy the local

government's requirements.

Chemical SegmentThe Company began the

construction on its new chemical facilities located at Bohai Marine

Fine Chemical Industrial Park in June 2020 and basically completed

the civil works by end of June 2021. Equipment installation and

testing is expected to take 6 months or somewhat longer if issues

occur. Trial production should take another six months. The Company

will continue to post photographs on the company website showing

the progress of the construction and installation of equipment.

Natural GasThe Company is continuing to work

with the governments of Tianbao Town, Daying County, and Sichuan

Province on getting approval for our natural gas and brine

projects. We continue to maintain a staff in Sichuan Province and

senior management continues to meet with government officials.

While timing is still uncertain, the Company remains optimistic

that it will be able to proceed with these projects.

Recent DevelopmentsAs disclosed in the

Company’s Current Report on Form 8-K filed with the Securities

Exchange Commission (the “SEC”) on July 7, 2021, the Company’s

former auditors Morrison Cogen LLP (MC) resigned effective June 30,

2021. On July 1, 2021, the Company engaged WWC, P.C. Certified

Public Accountants (“WWC”) to serve as its independent auditor.

Business Outlook“The company is optimistic

about the second half of year 2021. Production lost in the second

quarter is likely to be recouped in the third quarter. Bromine

price remains high. At current levels of production, our bromine

business should be profitable. We have expensed our all of our

annual stock grants, so overhead will be reduced. We believe we

could receive approvals for one or more of our closed factories in

near future. In 2022, we may begin to generate revenues from our

chemical factory. We expect that our chemical business could be

profitable in 2023. We continue to believe that we may be able to

produce both natural gas and bromine products in Sichuan if we are

able to obtain requisite governmental approvals,” said Mr. Xiaobin

Liu, CEO of the Company.

Conference Call

Gulf Resources management will host a conference call on Monday,

August 16, 2021 at 08:00 AM Eastern Time to discuss its Second

Quarter 2021 results ended June 30, 2021.

Mr. Xiaobin Liu, CEO of Gulf Resources, will be hosting the

call. The Company's management team will be available for investor

questions following the prepared remarks.

To participate in this live conference call, please dial +1

(888) 506-0062 five to ten minutes prior to the scheduled

conference call time. International callers should dial +1 (973)

528-0011.The Entry Code is 592817.

The webcasting is also available then, just simply click on the

link below:

http://www.gulfresourcesinc.com/events.html

A replay of the conference call will be available two hours

after the call's completion during 08/16/2021 11:00 AM ET - 09/15

/2021 11:00 AM ET. To access the replay, call +1 (877) 481-4010.

International callers should call +1 (919) 882-2331. The Replay

Passcode is 42535.

About Gulf Resources, Inc.Gulf Resources, Inc. operates through

three wholly-owned subsidiaries, Shouguang City Haoyuan Chemical

Company Limited ("SCHC"), ShouguangYuxin Chemical Industry Co.,

Limited ("SYCI"), and Daying County Haoyuan Chemical Company

Limited (“DCHC”). The Company believes that it is one of the

largest producers of bromine in China. Elemental Bromine is used to

manufacture a wide variety of compounds utilized in industry and

agriculture. Through SYCI, the Company manufactures chemical

products utilized in a variety of applications, including oil and

gas field explorations and papermaking chemical agents, and

materials for human and animal antibiotics. DCHC was established to

further explore and develop natural gas and brine resources

(including bromine and crude salt) in China. For more information,

visit http://www.gulfresourcesinc.com.

Forward-Looking Statements

Certain statements in this news release contain forward-looking

information about Gulf Resources and its subsidiaries business and

products within the meaning of Rule 175 under the Securities Act of

1933 and Rule 3b-6 under the Securities Exchange Act of 1934, and

are subject to the safe harbor created by those rules. The actual

results may differ materially depending on a number of risk factors

including, but not limited to, the general economic and business

conditions in the PRC, the risks associated with the ongoing impact

of COVID-19 pandemic, uncertainties associated with obtaining

governmental approvals, future product development and production

capabilities, shipments to end customers, market acceptance of new

and existing products, additional competition from existing and new

competitors for bromine and other oilfield and power production

chemicals, changes in technology, the ability to make future

bromine asset purchases, and various other factors beyond its

control. All forward-looking statements are expressly qualified in

their entirety by this Cautionary Statement and the risks factors

detailed in the Company's reports filed with the Securities and

Exchange Commission. Gulf Resources undertakes no duty to revise or

update any forward-looking statements to reflect events or

circumstances after the date of this release.

CONTACT: Gulf Resources, Inc.

|

Web: |

http://www.gulfresourcesinc.com |

| |

Director of Investor

Relations |

| |

Helen Xu (Haiyan Xu) |

| |

beishengrong@vip.163.com |

GULF RESOURCES, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE SHEETS(Expressed in U.S.

dollars)

|

|

|

June 30, 2021Unaudited |

|

December 31, 2020 Audited |

|

Current Assets |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

97,058,027 |

|

|

$ |

94,222,538 |

|

| Accounts receivable |

|

|

4,741,259 |

|

|

|

6,521,798 |

|

|

Inventories, net |

|

|

677,418 |

|

|

|

419,609 |

|

|

Prepayments and deposits |

|

|

2,476,867 |

|

|

|

6,146,461 |

|

|

Other receivable |

|

|

1,624 |

|

|

|

559 |

|

|

Total Current Assets |

|

|

104,955,195 |

|

|

|

107,310,965 |

|

| Non-Current Assets |

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

|

153,288,493 |

|

|

|

148,947,689 |

|

|

Finance lease right-of use assets |

|

|

185,276 |

|

|

|

186,272 |

|

|

Operating lease right-of –use assets |

|

|

8,507,190 |

|

|

|

8,868,661 |

|

|

Prepaid land leases, net of current portion |

|

|

10,234,582 |

|

|

|

10,134,004 |

|

|

Deferred tax assets |

|

|

19,254,324 |

|

|

|

18,590,227 |

|

| Total non-current assets |

|

|

191,469,865 |

|

|

|

186,726,853 |

|

|

Total Assets |

|

$ |

296,425,060 |

|

|

$ |

294,037,818 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

|

|

|

|

Accounts, other payable and accrued expenses |

|

$ |

7,071,707 |

|

|

$ |

5,081,701 |

|

|

Taxes payable-current |

|

|

1,506,771 |

|

|

|

1,326,179 |

|

|

Finance lease liability, current portion |

|

|

160,498 |

|

|

|

217,070 |

|

|

Operating lease liabilities, current portion |

|

|

470,999 |

|

|

|

477,350 |

|

|

Total Current Liabilities |

|

|

9,209,975 |

|

|

|

7,102,300 |

|

|

Non-Current Liabilities |

|

|

|

|

|

|

|

|

|

Finance lease liability, net of current portion |

|

|

1,747,385 |

|

|

|

1,888,903 |

|

|

Operating lease liabilities, net of current portion |

|

|

7,365,145 |

|

|

|

8,022,342 |

|

|

Total Non-Current Liabilities |

|

|

9,112,530 |

|

|

|

9,911,245 |

|

|

Total Liabilities |

|

$ |

18,322,505 |

|

|

$ |

17,013,545 |

|

|

Commitment and Loss Contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ Equity |

|

|

|

|

|

|

|

|

| PREFERRED STOCK; $0.001 par

value; 1,000,000 shares authorized; none outstanding |

|

$ |

— |

|

|

$ |

— |

|

| COMMON STOCK; $0.0005 par

value; 80,000,000 shares authorized; 10,515,307 and 10,043,307

shares issued; 10,469,477 and 9,997,477 shares outstanding as of

June 30, 2021 and December 31, 2020, respectively |

|

|

24,375 |

|

|

|

24,139 |

|

|

Treasury stock; 45,830 and 45,830 shares as of June 30, 2021

and December 31, 2020 at cost |

|

|

(510,329 |

) |

|

|

(510,329 |

) |

|

Additional paid-in capital |

|

|

100,569,160 |

|

|

|

97,435,316 |

|

|

Retained earnings unappropriated |

|

|

146,183,012 |

|

|

|

151,388,356 |

|

|

Retained earnings appropriated |

|

|

24,233,544 |

|

|

|

24,233,544 |

|

|

Accumulated other comprehensive loss |

|

|

7,602,793 |

|

|

|

4,453,247 |

|

|

Total Stockholders’ Equity |

|

|

278,102,555 |

|

|

|

277,024,273 |

|

|

Total Liabilities and Stockholders’ Equity |

|

$ |

296,425,060 |

|

|

$ |

294,037,818 |

|

See accompanying notes to the condensed consolidated financial

statements

GULF RESOURCES, INC.AND SUBSIDIARIESCONDENSED

CONSOLIDATED STATEMENTS OF LOSS AND COMPREHENSIVE LOSS(Expressed in

U.S. dollars)(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three-Month Period Ended June 30, |

|

Six-Month Period Ended June 30, |

| |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| |

|

|

|

|

|

|

|

|

| NET REVENUE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net revenue |

|

$ |

11,148,008 |

|

|

$ |

5,359,483 |

|

|

$ |

16,407,251 |

|

|

$ |

5,917,153 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING INCOME

(EXPENSE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of net revenue |

|

|

(6,915,774 |

) |

|

|

(5,022,896 |

) |

|

|

(11,097,163 |

) |

|

|

(5,944,216 |

) |

|

Sales, marketing and other operating expenses |

|

|

(15,625 |

) |

|

|

(10,838 |

) |

|

|

(25,170 |

) |

|

|

(13,081 |

) |

|

Direct labor and factory overheads incurred during plant

shutdown |

|

|

(1,394,717 |

) |

|

|

(1,737,599 |

) |

|

|

(4,008,200 |

) |

|

|

(5,348,022 |

) |

|

General and administrative expenses |

|

|

(5,204,701 |

) |

|

|

(1,541,702 |

) |

|

|

(6,940,951 |

) |

|

|

(2,385,039 |

) |

|

Other operating income (loss) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(15,776 |

) |

|

|

|

|

(13,530,817 |

) |

|

|

(8,313,035 |

) |

|

|

(22,071,484 |

) |

|

|

(13,706,134 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOSS FROM OPERATIONS |

|

|

(2,382,809 |

) |

|

|

(2,953,552 |

) |

|

|

(5,664,233 |

) |

|

|

(7,788,981 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER INCOME (EXPENSE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(39,368 |

) |

|

|

(34,888 |

) |

|

|

(76,230 |

) |

|

|

(70,316 |

) |

|

Interest income |

|

|

75,437 |

|

|

|

71,188 |

|

|

|

147,890 |

|

|

|

145,844 |

|

| LOSS BEFORE TAXES |

|

|

(2,346,740 |

) |

|

|

(2,917,252 |

) |

|

|

(5,592,573 |

) |

|

|

(7,713,453 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME TAX BENEFIT |

|

|

(356,480 |

) |

|

|

672,633 |

|

|

|

387,229 |

|

|

|

1,929,076 |

|

| NET LOSS |

|

$ |

(2,703,220 |

) |

|

$ |

(2,244,619 |

) |

|

$ |

(5,205,344 |

) |

|

$ |

(5,784,377 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COMPREHENSIVE LOSS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET LOSS |

|

$ |

(2,703,220 |

) |

|

$ |

(2,244,619 |

) |

|

$ |

(5,205,344 |

) |

|

$ |

(5,784,377 |

) |

| OTHER COMPREHENSIVE LOSS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Foreign currency translation adjustments |

|

|

5,334,236 |

|

|

|

221,869 |

|

|

|

3,149,546 |

|

|

|

(4,293,490 |

) |

| COMPREHENSIVE LOSS |

|

$ |

2,631,016 |

|

|

$ |

(2,022,750 |

) |

|

$ |

(2,055,798 |

) |

|

$ |

(10,077,867 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOSS PER SHARE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BASIC AND DILUTED |

|

$ |

(0.26 |

) |

|

$ |

(0.24 |

) |

|

$ |

(0.50 |

) |

|

$ |

(0.61 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| WEIGHTED AVERAGE NUMBER OF

SHARES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| BASIC AND DILUTED |

|

|

10,469,477 |

|

|

|

9,517,427 |

|

|

|

10,469,477 |

|

|

|

9,517,427 |

|

See accompanying notes to the condensed consolidated financial

statements.

GULF RESOURCES, INC.AND SUBSIDIARIESCONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS(Expressed in U.S.

dollars)(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

| |

|

Six-Month Period Ended June 30, |

| |

|

2021 |

|

2020 |

| |

|

|

|

|

| CASH FLOWS FROM OPERATING

ACTIVITIES |

|

|

|

|

| Net loss |

|

$ |

(5,205,344 |

) |

|

$ |

(5,784,377 |

) |

| Adjustments to reconcile net

loss to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

|

|

|

Interest on finance lease obligation |

|

|

71,197 |

|

|

|

70,009 |

|

|

Depreciation and amortization |

|

|

8,224,864 |

|

|

|

7,559,224 |

|

|

Unrealized exchange gain on translation of inter-company

balances |

|

|

594,150 |

|

|

|

(382,331 |

) |

|

Deferred tax asset |

|

|

(387,230 |

) |

|

|

(1,929,553 |

) |

|

Common stock issued for services |

|

|

3,134,080 |

|

|

|

— |

|

|

Issuance of stock options to employee |

|

|

— |

|

|

|

— |

|

| Changes in assets and

liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

1,839,939 |

|

|

|

1,807,547 |

|

|

Inventories |

|

|

(252,995 |

) |

|

|

152,369 |

|

|

Prepayments and deposits |

|

|

(98,992 |

) |

|

|

32,807 |

|

|

Other receivables |

|

|

— |

|

|

|

— |

|

|

Accounts and Other payable and accrued expenses |

|

|

(785,889 |

) |

|

|

(9,284 |

) |

|

Retention payable |

|

|

— |

|

|

|

— |

|

|

Taxes payable |

|

|

190,892 |

|

|

|

298,599 |

|

|

Prepaid land leases |

|

|

— |

|

|

|

(369,066 |

) |

|

Operating lease |

|

|

(298,897 |

) |

|

|

(268,192 |

) |

| Net cash provided by (used in)

by operating activities |

|

|

7,025,775 |

|

|

|

1,177,752 |

|

| |

|

|

|

|

|

|

|

|

| CASH FLOWS USED IN INVESTING

ACTIVITIES |

|

|

|

|

|

|

|

|

| Purchase of property, plant

and equipment |

|

|

(5,806,435 |

) |

|

|

(9,860,142 |

) |

| Net cash used in investing

activities |

|

|

(5,806,435 |

) |

|

|

(9,860,142 |

) |

| |

|

|

|

|

|

|

|

|

| CASH FLOWS USED IN FINANCING

ACTIVITIES |

|

|

|

|

|

|

|

|

| Repayment of finance lease

obligation |

|

|

(296,597 |

) |

|

|

(264,976 |

) |

| Net cash used in financing

activities |

|

|

(296,597 |

) |

|

|

(264,976 |

) |

| |

|

|

|

|

|

|

|

|

| EFFECTS OF EXCHANGE RATE

CHANGES ON CASH AND CASH EQUIVALENTS |

|

|

1,912,746 |

|

|

|

(1,382,029 |

) |

| NET DECREASE IN CASH AND CASH

EQUIVALENTS |

|

|

2,835,489 |

|

|

|

(10,329,395 |

) |

| CASH AND CASH EQUIVALENTS -

BEGINNING OF PERIOD |

|

|

94,222,538 |

|

|

|

100,301,986 |

|

| CASH AND CASH EQUIVALENTS -

END OF PERIOD |

|

$ |

97,058,027 |

|

|

$ |

89,972,591 |

|

| |

|

|

|

|

|

|

|

|

| SUPPLEMENTAL DISCLOSURE OF

CASH FLOW INFORMATION |

|

|

|

|

|

|

|

|

| Cash paid during the periods

for: |

|

|

|

|

|

|

|

|

|

Income taxes |

|

$ |

— |

|

|

$ |

— |

|

| Operating right-of-use assets

obtained in exchange for lease obligations |

|

$ |

— |

|

|

$ |

— |

|

|

SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING AND FINANCING

ACTIVITIES |

|

|

|

|

|

|

|

|

See accompanying notes to the condensed consolidated financial

statements.

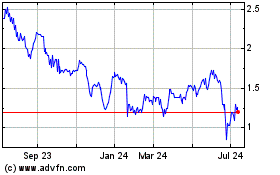

Gulf Resources (NASDAQ:GURE)

Historical Stock Chart

From Mar 2024 to Apr 2024

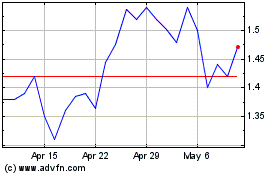

Gulf Resources (NASDAQ:GURE)

Historical Stock Chart

From Apr 2023 to Apr 2024