Amended Current Report Filing (8-k/a)

August 11 2021 - 2:16PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K/A

(Amendment

No. 2)

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 12, 2021

SUGARMADE,

INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

000-23446

|

|

94-3008888

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

|

750

Royal Oaks Dr., Suite 108

Monrovia,

CA

|

|

91016

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (888) 982-1628

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory

Note

On

May 17, 2021, Sugarmade, Inc. (the “Company”) filed a Current Report on Form 8-K (the “Original Form 8-K”) disclosing

that, on May 12, 2021, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) by and between Carnaby

Spot Bay Corp, a California corporation and a wholly owned subsidiary of the Company (“Merger Sub”), Lemon Glow Company,

a California corporation (the “Lemon Glow”) and Ryan Santiago (the “Shareholder Representative”), pursuant to

which, upon the terms and subject to the conditions set forth in the Merger Agreement, Merger Sub would merge with and into Lemon Glow,

with Lemon Glow being the surviving corporation (the “Merger”).

The

Company further disclosed that, on May 14, 2021, the closing of the Merger (the “Closing”) occurred in accordance with the

terms of the Merger Agreement on May 14, 2021, and that the Merger was consummated on May 14, 2021 by the filing of a Certificate of

Merger with the Secretary of State of the State of California, which was duly filed on May 14, 2021, at which time, the Merger became

effective (the “Effective Time”).

Subsequently,

on May 25, 2021, the Company filed an Amendment on Form 8-K/A (“Amendment No. 1”) to the Original Form 8-K to disclose that,

on May 20, 2021, the Company received a notification from Secretary of State of the State of California stating that the Company’s

May 14, 2021 Certificate of Merger filing had been rejected due to certain technical deficiencies in the filing. In response, the Company

disclosed in Amendment No. 1 that on May 24, 2021, the parties to the Merger Agreement entered into an Amendment to the Merger Agreement,

which contained certain immaterial amendments to the original Merger Agreement in response to the comments from the Secretary of State

of California received by the Company in connection with its original Certificate of Merger filing on May 14, 2021. On May 25, 2021,

the Company re-filed with the Secretary of State of California for the Closing of the Merger.

The

Secretary of State of California accepted the filing, and as a result, the Effective Time of the Merger was May 25, 2021, and the Merger

was effective as of that date.

The

Original Form 8-K and Amendment No. 1 did not include the audited financial statements of Lemon Glow nor the pro-forma unaudited financial

statements as required under Item 9.01 of Form 8-K. This Amendment No. 2 on Form 8-K/A to the Original Form 8-K (“Amendment No.

2”) is filed to include the financial statement information required under Item 9.01 of Form 8-K in connection with the acquisition

of Lemon Glow.

The

description of the Merger Agreement and Amendment to the Merger Agreement found in this Amendment No. 2 is not intended to be complete

and is qualified in its entirety by reference to the Merger Agreement and Amendment to the Merger Agreement filed as Exhibits to the

Original Form 8-K and Amendment No. 1, respectively.

Item

9.01 Financial Statement and Exhibits.

(a)

Financial Statements of Business Acquired.

The audited

combined financial statements of Lemon Glow for the year ended June 30, 2020 and the period ended May 25, 2021 and accompanying

notes are attached hereto as Exhibit 99.1 to this Amendment No. 2 and are incorporated by reference herein.

(b)

Pro Forma Financial Information.

The

unaudited pro forma condensed combined financial statements of the Company as of March 31, 2021 and for the nine months ended March 31,

2021 and the period beginning June 30, 2020 to March 31, 2021 and accompanying notes are attached hereto as Exhibit 99.2 and are incorporated

by reference into this Amendment No. 2.

(c)

Exhibits

The

following exhibits are filed or furnished with this Current Report on Form 8-K:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

SUGARMADE,

INC.

|

|

|

|

|

|

Date:

August 11, 2021

|

By:

|

/s/

Jimmy Chan

|

|

|

Name:

|

Jimmy

Chan

|

|

|

Title:

|

Chief

Executive Officer and Chief Financial Officer

|

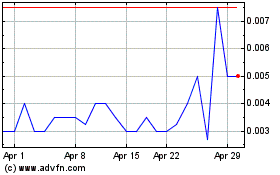

Sugarmade (PK) (USOTC:SGMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

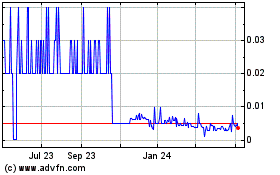

Sugarmade (PK) (USOTC:SGMD)

Historical Stock Chart

From Apr 2023 to Apr 2024