Current Report Filing (8-k)

August 09 2021 - 2:36PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 6, 2021

Carsmartt, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

333-150820

|

|

81-4837535

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File No.)

|

|

(IRS Employer

Identification No.)

|

2828 Coral Way

Coral Gables FL 33145

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code: (786) 409-7439

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 1.01. ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

The response to this item is included in Item 2.01 below and is incorporated herein by this reference with respect to the acquisition transaction.

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS.

Carsmartt, Inc., acquires Immobilfin S.P.A.

The Acquisition transaction was completed on Agost 06, 2021. Immobilfin S.P.A. is a Real Estate Company with an asset value of $47.6 Million and generates approximately $1.5 Million per year in revenues. The control person of Immobilfin S.P.A. is Fabio Visconti.

Smartt, Inc. has signed an agreement for the acquisition of 100% of the shares of Immobilfin S.P.A., Inc. The company owns a commercial building in the center of Naples Italy. The building is leased to the Italian government, who pays approximately $1.5 million a year. The property is approximately 100,000 square feet with 95 parking spaces. The transaction has closed on August 6, 2021.

The First deposit for the acquisition will be 50,000,000 restricted shares for two years that is equivalent to a value of approximately $1.5 Million. The balance due will be a determinate of the performance of share price during the next two years from future forecasted growth. Smartt, Inc. will have the option to pay in cash before the 2-year restriction has matured.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

Business Purchase Agreement dated August 6, 2021.

|

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: August 9, 2021

|

|

|

CARSMARTT, INC.

|

|

|

|

|

|

|

By:

|

/s/ Roy Capasso

|

|

|

|

Name: Roy Capasso

|

|

|

|

Title: CEO

|

3

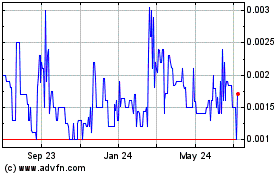

CarSmartt (PK) (USOTC:CRSM)

Historical Stock Chart

From Mar 2024 to Apr 2024

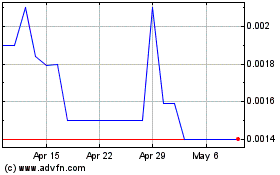

CarSmartt (PK) (USOTC:CRSM)

Historical Stock Chart

From Apr 2023 to Apr 2024