Advanced Micro Devices Trades at Record Levels After Xilinx's Strong Earnings Report

July 29 2021 - 3:16PM

Dow Jones News

By Maria Armental

Advanced Micro Devices Inc. is on track for a record closing

Thursday, a day after Xilinx Inc. reported stronger-than-expected

quarterly results, including profit more than doubling from the

year earlier despite industry-wide supply chain challenges.

Chip-maker AMD is buying Xilinx in a deal that is expected to

close by year's end.

AMD recently traded around $104.29, up 6.5% for the day, and on

track to beat yesterday's record closing of $97.93. Xilinx recently

traded around $146.26, up 5.6%.

Both are among the top five best performers by daily percentage

gain on the S&P 500, according to FactSet.

The two companies have highlighted strong data-center demand as

more companies transition back to the office.

California-based Xilinx pointed to a 14% sequential revenue

increase from the data-center group, driven by hyperscale cloud

customers and the fintech market.

AMD, which also reported a better-than-expected financial

performance in the latest period, said overall data-center revenue

nearly doubled from the year earlier and increased sequentially

from a high-teens percentage of overall revenue in the first

quarter to more than 20% in the second quarter.

AMD raised its projection for revenue growth to about 60%, from

about 50%, and said that the data-center business is expected to

remain a strong driver into the second half of the year.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

July 29, 2021 15:02 ET (19:02 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

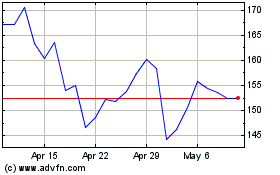

Advanced Micro Devices (NASDAQ:AMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Advanced Micro Devices (NASDAQ:AMD)

Historical Stock Chart

From Apr 2023 to Apr 2024