AB InBev 2Q Net Profit Surged as Sales Recovered -- Update

July 29 2021 - 8:50AM

Dow Jones News

By Adria Calatayud

Anheuser-Busch InBev SA said Thursday that net profit for the

second quarter rose sharply as sales exceeded pre-pandemic levels,

but the Budweiser brewer said it continues to absorb cost headwinds

from tight supply chains in the U.S.

The world's largest brewer, which also houses the Stella Artois

and Michelob Ultra brands in its portfolio, said quarterly net

profit was $1.86 billion compared with $351 million for the

year-earlier period, when its performance was hurt by an impairment

charge against its African business.

Belgium-based AB InBev said revenue for the quarter increased to

$13.54 billion from $10.29 billion a year before. Organic revenue

growth for the quarter was 28%, while organic volumes rose 21%.

This compared with expectations for increases of 24% and 19%,

respectively, according to a company-provided consensus.

AB InBev said its top-line grew 3.2% compared with the second

quarter of 2019.

Normalized earnings before interest, taxes, depreciation and

amortization for the quarter increased 31% on an organic basis,

missing company-provided expectations for a 35% rise. AB InBev's

normalized Ebitda fell in the key U.S. and Brazil markets.

The company said second-quarter momentum and cost discipline

were partially offset by anticipated transactional foreign-exchange

and commodity headwinds, resulting from the effect of currency

devaluations in Mexico and Brazil last year. In the U.S., earnings

were hurt by elevated costs, as the company continued to absorb

headwinds created by tighter supply chains, it said.

Shares at 1206 GMT were down 6.1% at 54.56 euros ($64.62).

The company reiterated its guidance for normalized Ebitda growth

of between 8% and 12% for 2021 as a whole, with revenue growth

ahead of that range.

Chief Financial Officer Fernando Tennenbaum said costs of raw

materials like aluminum and barley are rising, but that AB InBev's

hedging policy gives it time to react and look for ways to mitigate

the hit. The company will decide whether to pass higher costs on

through prices at a local level, he said.

"There are some cost pressures, but it's not a surprise. We were

prepared for it and are trying to find ways to mitigate it," Mr.

Tennenbaum said in an interview.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

July 29, 2021 08:38 ET (12:38 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

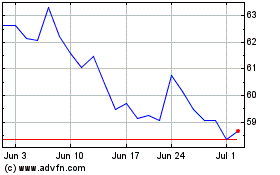

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Mar 2024 to Apr 2024

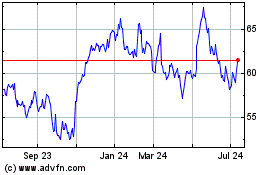

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Apr 2023 to Apr 2024