Current Report Filing (8-k)

July 23 2021 - 5:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 19, 2021

AMERICAN WELL CORPORATION

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Delaware

|

|

001-39515

|

|

20-5009396

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

75 State Street, 26th Floor

Boston, MA

|

|

02109

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (617)

204-3500

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

symbol(s)

|

|

Name of each exchange

on which registered

|

|

Class A Common Stock, $0.01 Par Value

|

|

AMWL

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

Item 1.01. Entry Into a Material Definitive Agreement.

The information set forth under Item 5.02 below is incorporated in its entirety herein by reference.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain

Officers.

Resignation of Director

Brendan O’Grady resigned from the Board of Directors of American Well Corporation (the “Company”), effective July 19, 2021.

Mr. O’Grady has served on the Board of Directors with distinction since 2015. Mr. O’Grady’s decision to resign was related to his appointment as our Chief Commercial & Growth officer as described below and did not

involve any disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

Appointment of Chief

Commercial & Growth Officer

On July 19, 2021, the Company entered into an Employment Agreement (the “Employment

Agreement”) with Mr. O’Grady to become the Company’s Chief Commercial & Growth Officer, effective August 16, 2021. Pursuant to the Employment Agreement, Mr. O’Grady will receive an annual base salary of

$485,000 and will be eligible for an annual target bonus of 200% of his annual base salary. In addition, Mr. O’Grady will receive a grant of restricted stock units with a grant date value of $8,000,000 that settle in shares of the

Company’s Class A common stock, with 25% of the restricted stock units being vested on the grant date, and the remaining vesting ratably every 3 months thereafter over a four-year period (beginning on the first calendar day of the month

following the date that is three months following the grant date).

The Employment Agreement provides that if

Mr. O’Grady’s employment is involuntarily terminated (terminated without Cause (as defined in the Employment Agreement) or with Good Reason (as defined in the Employment Agreement)), conditioned on Mr. O’Grady’s

execution and non-revocation of a release of claims, Mr. O’Grady will be entitled to receive the following: Accrued Compensation (as defined in the Employment Agreement) through the date of

termination; any earned but unpaid bonus amounts, including a pro rata bonus for the year in which Mr. O’Grady’s employment terminates (or one year’s target bonus if such termination of employment occurs one month before or

within 24 months following a Change in Control (as defined in the Employment Agreement)); severance payments in an aggregate amount equal to his base salary, to be paid in equal installments over a one-year

period; and COBRA benefits. In addition, if the involuntary termination of employment occurs in connection with a Change in Control, each unvested equity award held by Mr. O’Grady will fully vest at the time of termination. To the extent

applicable, such payments are subject to reduction so that they will not be subject to the excise tax imposed under Section 4999 of the Internal Revenue Code.

The Employment Agreement also includes customary confidentiality and assignment of intellectual property obligations, as well as non-competition and non-solicitation restrictions that continue for 365 days following termination of employment.

The foregoing summary description of the Employment Agreement is not complete and is subject to, and qualified in its entirety by reference

to, the full text of the Employment Agreement, which is filed as Exhibit 10.1 to this Form 8-K and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

Date: July 23, 2021

|

|

|

|

|

AMERICAN WELL CORPORATION

|

|

|

|

|

By:

|

|

/s/ Bradford Gay

|

|

|

|

Bradford Gay

|

|

|

|

Senior Vice President, General Counsel

|

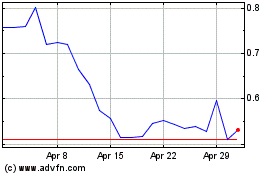

American Well (NYSE:AMWL)

Historical Stock Chart

From Mar 2024 to Apr 2024

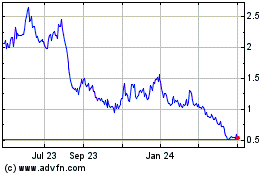

American Well (NYSE:AMWL)

Historical Stock Chart

From Apr 2023 to Apr 2024