Amended Current Report Filing (8-k/a)

July 20 2021 - 4:02PM

Edgar (US Regulatory)

0001657312

true

00-0000000

0001657312

2021-06-09

2021-06-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event

reported): July 15, 2021 (June 9,

2021)

Verona Pharma plc

(Exact name of registrant as specified in its

charter)

|

United Kingdom

|

|

001-39067

|

|

Not Applicable

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

3 More London Riverside

London SE1 2RE

United Kingdom

(Address of principal executive offices) (Zip

Code)

+44 203 283 4200

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which

registered

|

|

Ordinary

shares, nominal value £0.05 per share*

|

VRNA

|

The Nasdaq Global Market

|

* The ordinary shares are represented by American Depositary Shares

(each representing 8 ordinary shares), which are exempt from the operation of Section 12(a) of the Securities Exchange Act of

1934, as amended, pursuant to Rule 12a-8 thereunder.

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Explanatory Note

On June 11, 2021, Verona Pharma plc (the “Company”)

filed a Current Report on Form 8-K (the “Original 8-K”) reporting the entry into a collaboration and license agreement

(the “Original Agreement”) under Item 1.01, which incorrectly disclosed that the Original Agreement had been entered into

with Nuance Pharma Limited, a Shanghai-based specialty pharmaceutical company (“Nuance Pharma”), rather than Nuance (Shanghai)

Pharma Co Ltd (“Nuance Shanghai”). On July 15, 2021, the Original Agreement was amended and restated to add Nuance Pharma

as a party and to make certain other changes (the “Agreement”). The Company is amending the Original 8-K for the purpose of

amending and restating the disclosures under Item 1.01 of the Original 8-K to reflect the Company’s entry into the Agreement. As

a result of entering into the Agreement, the Original Agreement is deemed null and void ab initio.

Item 1.01. Entry into a Material Definitive Agreement.

On July 15, 2021, the Company, Nuance Pharma and Nuance Shanghai

entered into the Agreement.

Under the terms of the Agreement, the Company granted Nuance Pharma

the exclusive rights to develop and commercialize products containing ensifentrine (the “Licensed Products”) in Greater China

(mainland China, Taiwan, Hong Kong and Macau). Pursuant to the Agreement, Nuance Pharma agreed to make an upfront payment to the Company

of $25 million in cash and grant to the Company an equity interest valued at $15 million as of June 9, 2021, the deemed effective

date of the Agreement, in Nuance Biotech, the parent company of Nuance Pharma. Pursuant to the Agreement, the Company is eligible to receive

future milestone payments of up to $179 million upon achievement of certain clinical, regulatory, and commercial milestones related to

the Licensed Products in Greater China. The Company is also entitled to tiered double-digit royalties as a percentage of net sales of

the Licensed Products in Greater China.

Nuance Pharma will be responsible for all costs related to clinical

development and commercialization of the Licensed Products in Greater China. Under the Agreement, the Company and Nuance Pharma agreed

to establish a joint steering committee to oversee and coordinate the overall conduct of the clinical development and commercialization

of the Licensed Products in Greater China. The Company intends to use the joint steering committee to help ensure the clinical development

of ensifentrine in the region aligns with the Company’s overall global development and commercialization strategy.

Pursuant to the Agreement, at any time until three (3) months

prior to the expected submission of the first New Drug Application for a Licensed Product in Greater China, if (i) a third party

is interested in partnering with the Company, either globally or in territory covering at least the United States or Europe, for the development

and/or commercialization of the Licensed Products, or (ii) the Company undergoes a change of control, the Company will have an exclusive

option right to buy back the license granted to Nuance Pharma pursuant to the Agreement and all related assets, at a price equal to the

aggregate of (i) all prior amounts paid by Nuance Pharma to the Company in cash under the Agreement and (ii) all development

and regulatory costs incurred and paid by Nuance Pharma in connection with the development and commercialization of the Licensed Products

under the Agreement multiplied by a single-digit factor range dependent upon achievement of certain milestones, subject to a specified

maximum amount.

The Agreement will continue on a jurisdiction-by-jurisdiction and product-by-product

basis until the expiration of royalty payment obligations with respect to such product in such jurisdiction unless earlier terminated

by the parties. Either party may terminate the Agreement for an uncured material breach or bankruptcy of the other party. Nuance Pharma

may also terminate the Agreement at will upon 90 days' prior written notice.

Forward-Looking Statements

This

Current Report on Form 8-K/A (the “Form 8-K”) contains forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. All statements contained in this Form 8-K that do not relate to matters of historical fact

should be considered forward-looking statements, including, but not limited to, statements regarding milestone payments, royalties and

other financial terms and activities under the Agreement with Nuance Pharma. These forward-looking statements are based on management's

current expectations. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other

important factors that may cause our actual results, performance or achievements to be materially different from our expectations expressed

or implied by the forward-looking statements, including, but not limited to, the following: the reliance of our business on the success

of ensifentrine, our only product candidate under development; if we, and any collaborators with whom we may enter into

agreements for the development and commercialization of ensifentrine, are unable to commercialize ensifentrine, or experience significant

delays in doing so, our ability to generate revenue and our financial condition will be adversely affected; the lengthy and expensive

process of clinical drug development, which has an uncertain outcome; our reliance on third parties, including clinical research organizations,

clinical investigators, manufacturers and suppliers, and the risks related to these parties’ ability to successfully develop and

commercialize ensifentrine; lawsuits related to patents covering ensifentrine and the potential for our patents to be found invalid or

unenforceable; and our vulnerability to natural disasters, global economic factors and other unexpected events, including health epidemics

or pandemics like the COVID-19 pandemic, which has and may continue to adversely impact our business. These and other important factors

under the caption “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2020, and our

other reports filed with the SEC, could cause actual results to differ materially from those indicated by the forward-looking statements

made in this Form 8-K. Any such forward-looking statements represent management's estimates as of the date of this Form 8-K.

While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if

subsequent events cause our views to change. These forward-looking statements should not be relied upon as representing our views as of

any date subsequent to the date of this Form 8-K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

VERONA PHARMA PLC

|

|

|

|

|

|

Date: July 20, 2021

|

By:

|

/s/ David Zaccardelli, Pharm. D.

|

|

|

Name:

|

David Zaccardelli, Pharm. D.

|

|

|

Title:

|

Chief Executive Officer

|

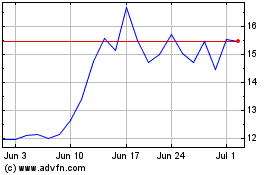

Verona Pharma (NASDAQ:VRNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Verona Pharma (NASDAQ:VRNA)

Historical Stock Chart

From Apr 2023 to Apr 2024