Current Report Filing (8-k)

July 20 2021 - 7:33AM

Edgar (US Regulatory)

false000010768700001076872021-07-192021-07-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 19, 2021

|

|

|

|

|

|

|

|

|

|

|

Winnebago Industries, Inc.

|

|

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Iowa

|

001-06403

|

42-0802678

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

P.O. Box 152

|

Forest City

|

Iowa

|

|

50436

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant's telephone number, including area code: 641-585-3535

______________________________________________________________________

(Former Name or Former Address, if Changed Since Last Report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.50 par value per share

|

WGO

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On July 19, 2021, Winnebago Industries, Inc. (the "Company") entered into a definitive Equity Purchase Agreement (the "Purchase Agreement") with Falcon Family, Inc., Ronald J. Fenech, William C. Fenech, Donald Clark, Donald Clark Family, LLC (collectively, the “Sellers,” and each a “Seller”) and William C. Fenech, in his capacity as the representative for the Sellers, to acquire all the equity interests of Barletta Boat Company, LLC, an Indiana limited liability company (“Barletta”), and Three Limes, LLC, an Indiana limited liability company (“Three Limes”). Ronald Fenech and Donald Clark were owners of Grand Design RV, which was acquired by the Company in 2016 and, as such, they are shareholders of the Company. In addition, Donald Clark is currently an executive officer of the Company serving as the President of Grand Design RV, a wholly-owned subsidiary of the Company. William Fenech will continue as the President of Barletta, which will become a wholly-owned subsidiary of the Company.

Pursuant to the Purchase Agreement, attached hereto as Exhibit 10.1, the Company has agreed to purchase 100% of the entity interests of Barletta and Three Limes (collectively, the “Acquired Companies”) for a fixed purchase price of approximately $255 million, subject to working capital and other adjustments, and contingent consideration subject to earnout provisions. The fixed purchase price includes an upfront payment at closing of approximately $255 million to be funded with $230 million of cash on hand and $25 million in common stock to be issued to the Sellers. The contingent consideration includes both a potential stock payout as well as a potential cash payment based on achievement of certain financial performance metrics over the next few years. The maximum payout under the earnout is $50 million in cash and $15 million in stock if all metrics are achieved. The purchase price will be allocated to the Sellers as set forth in the Purchase Agreement. The final amount of shares to be issued for both the fixed purchase price and contingent consideration is subject to a weighted average share price calculation.

The Purchase Agreement contains representations, covenants and agreements as are customary for a transaction of this size and nature. Closing of the contemplated transaction will be contingent upon, among other things, the accuracy of representations and the satisfaction of regulatory and other customary closing conditions. The Company expects that the sale process will be completed during the first quarter of the Company's 2022 fiscal year and will result in a newly created Marine reportable segment that will include the Acquired Companies, as well as the Company’s existing Chris-Craft operating segment.

Each of the Sellers have agreed to certain covenants pursuant to the terms of a standstill agreement. The standstill agreements provide that for a period of up to one year after closing, the Sellers are each prohibited from taking certain hostile actions with respect to the Company. Each of the Sellers have also agreed to a lock-up letter agreement that, subject to certain limited exceptions, restricts such Sellers from transferring their shares of the Company’s common stock for one year from closing.

The foregoing description of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the Purchase Agreement itself, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference. The benefits of the representations set forth in the Purchase Agreement are intended to be relied upon by the parties to the Purchase Agreement only, and do not constitute continuing representations and warranties of the Company to any other party or for any other purpose.

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth in Item 1.01 above is incorporated by reference into this Item 3.02. The number of shares of the Company’s common stock to be issued pursuant to the Purchase Agreement will be determined by dividing the applicable value above by the volume weighted average share price of the Company’s common stock for the 10 business days prior to (i) the date of the Purchase Agreement, in the case of the shares issued at closing, and (ii) the date of issuance, in the case of shares issued as part of the contingent consideration. The shares of the Company’s common stock will be issued to the Sellers in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended.

Item 7.01 Regulation FD Disclosure.

On July 20, 2021, Winnebago issued a press release announcing the Purchase Agreement. This press release is attached as Exhibit 99.1 hereto. The information contained in Exhibit 99.1 is being furnished pursuant to Item 7.01 of this Form 8-K and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liability under Section 18 of the Exchange Act. Furthermore, the information contained in Exhibit 99.1 shall not be deemed to be incorporated by reference into the filings of Winnebago under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit Number

|

Description

|

|

|

|

Equity Purchase Agreement, dated July 19, 2021, by and among Winnebago Industries, Inc., Falcon Family, Inc., Ronald J. Fenech, William C. Fenech, Donald Clark, and Donald Clark Family, LLC, and William C Fenech in his capacity as Representative*

|

|

|

|

|

|

|

104

|

Cover Page Interactive Data File (formatted as Inline XBRL)

|

*Certain exhibits and schedules have been omitted in accordance with Regulation S-K Item 601(a)(5). The Company agrees to furnish to the SEC a copy of any omitted exhibits or schedules upon request of the SEC.

Cautionary Statement Regarding Forward-Looking Information

This Form 8-K and the exhibits included contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that forward-looking statements are inherently uncertain and involve potential risks and uncertainties. A number of factors could cause actual results to differ materially from these statements, including, but not limited to risks relating to the Company’s proposed acquisition of the Acquired Companies, including the possibility that the closing conditions to the contemplated transaction may not be satisfied or waived, including that a governmental entity may prohibit, delay or refuse to grant antitrust approval; delay in closing the transaction or the possibility of non-consummation of the transaction; the occurrence of any event that could give rise to termination of the Purchase Agreement; risks inherent in the achievement of expected financial results and cost synergies for the acquisition and the timing thereof; risks that the pendency, financing and efforts to consummate the transaction may be disruptive to the Company or the Acquired Companies or their respective management teams; the effect of announcing the transaction on the Acquired Companies’ ability to retain and hire key personnel and maintain relationships with customers, suppliers and other third parties; risks related to integration of the two companies and other factors. Additional information concerning other risks and uncertainties that could cause actual results to differ materially from that projected or suggested is contained in the Company’s filings with the SEC over the last 12 months, copies of which are available from the SEC or from the Company upon request. The Company disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained in this Form 8-K or the exhibits included or to reflect any changes in the Company’s expectations after the date of this Form 8-K or any change in events, conditions or circumstances on which any statement is based, except as required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WINNEBAGO INDUSTRIES, INC.

|

|

|

|

|

|

|

|

|

Date:

|

July 20, 2021

|

By:

|

/s/ Bryan L. Hughes

|

|

|

|

|

|

Bryan L. Hughes

|

|

|

|

|

|

Chief Financial Officer and Senior Vice President

|

|

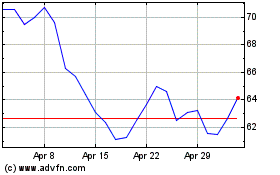

Winnebago Industries (NYSE:WGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

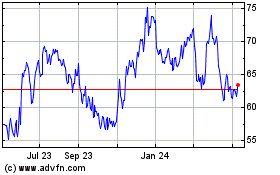

Winnebago Industries (NYSE:WGO)

Historical Stock Chart

From Apr 2023 to Apr 2024