CapStar’s Mark Niethammer Selected to Participate in National GGL Leadership Program

July 16 2021 - 6:14PM

Mark Niethammer, Director of Government Guaranteed Lending at

CapStar Bank, was recently selected to participate in the National

Association of Government Guaranteed Lender’s (NAGGL) inaugural

Future Leading Lenders Program (FLLP).

From 50 eligible candidates nationwide, Niethammer is one of

only twelve selected to participate. The interactive FLLP

experience is intended to recognize and develop the next generation

of 7(a) industry leaders who are building or expanding their SBA

teams. The best in class program is geared toward broadening

expertise and deepening engagement.

The curriculum consists of four modules spanning nine months,

including opportunities to attend flagship NAGGL events and

culminating with program graduation during the annual Leadership

Summit in April 2022.

“I am honored by the opportunity to participate in the

industry’s premier leadership program,” said Niethammer. “This

represents a tremendous distinction for both our team and CapStar

as NAGGL recognizes the bank as an emerging national leader in the

SBA space.”

Niethammer joined CapStar in early 2018 from Synovus Bank as one

of a trio of bankers who launched the SBA lending group. He was

promoted to Director of Government Guaranteed Lending in 2020.

Under his leadership, the division has expanded to reach 38 states

and is established as one of Tennessee’s top five 7(a) lenders.

Recently, CapStar was recognized as a statewide PPP leader relative

to asset size, protecting more 26,000 local jobs amid the COVID-19

pandemic.

“We are especially proud of the strides made by our GGL team

since its inception in 2018. CapStar’s foresight in assembling such

expertise has been particularly vital to our communities over the

last year as their leadership in processing PPP and other SBA loans

to benefit Tennessee’s small businesses is unparalleled,” said

Chris Tietz, CapStar’s EVP of Specialty Banking. “In his GGL

leadership role and beyond, Mark is a remarkable talent and

teammate. We are certainly pleased his efforts have been recognized

on a national scale.”

About CapStar

CapStar Bank, with assets of $3.15 billion, provides a

relationship-based and highly personal banking experience to small

to mid-sized private businesses, professionals, and individuals.

Focused on delivering superior flexibility, responsiveness, and

customer service, CapStar serves customers through highly-skilled

employees, digital channels, as well as 22 financial centers across

12 Tennessee counties. For more information about CapStar, please

visit www.capstarbank.com.

About NAGGL

NAGGL is the only national trade association serving the

private-sector lenders that provide access to capital critical to

fueling small businesses - the engine that drives the nation’s

economy and job creation. NAGGL supports lending participants in

the SBA’s flagship 7(a) business loan program. The public policy

goal of the 7(a) business loan program is to provide credit to

small businesses that are unable to secure financing on reasonable

terms through conventional channels.

For more information, contact:Nicole Gibbs, (423)

457-4579nicole.gibbs@capstarbank.com

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/74aeaf94-dbc3-4563-a1f7-255b03772cd8

CapStar Financial (NASDAQ:CSTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

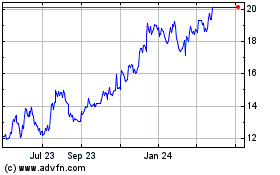

CapStar Financial (NASDAQ:CSTR)

Historical Stock Chart

From Apr 2023 to Apr 2024