Eldorado Gold Corporation (“Eldorado” or “the

Company”) is pleased to announce second quarter 2021 preliminary

gold production of 116,066 ounces, in-line with the Company’s 2021

annual guidance of between 430,000 and 460,000 ounces of gold.

Detailed production, by asset, is outlined in the table below.

Q2 2021 and Year-to-Date 2021 Preliminary Gold

Production

|

|

Production (oz) |

|

Mine |

Q2 2021 |

Q2 2020 |

Q1 2021 |

|

Kısladag |

44,016 |

59,890 |

46,172 |

|

Lamaque |

35,643 |

33,095 |

28,835 |

|

Efemcukuru |

23,473 |

26,876 |

23,298 |

|

Olympias |

12,934 |

17,921 |

13,437 |

|

Total Gold Production (oz) |

116,066 |

137,782 |

111,742 |

|

|

|

|

|

|

|

Production (oz) |

|

Mine |

YTD 2021 |

YTD 2020 |

Full Year 2021 Guidance |

|

Kısladag |

90,188 |

110,066 |

140,000 – 150,000 |

|

Lamaque |

64,478 |

60,448 |

140,000 – 150,000 |

|

Efemcukuru |

46,771 |

50,115 |

90,000 – 95,000 |

|

Olympias |

26,371 |

33,103 |

55,000 – 65,000 |

|

Total Gold Production (oz) |

227,808 |

253,732 |

430,000 – 460,000 |

Canada

Second quarter gold production at Lamaque

continued on track with both throughput and grade in-line with the

plan to deliver annual guidance of 140,000 to 150,000 ounces. The

decline connecting the Sigma mill with the Triangle underground

mine is progressing ahead of schedule and is expected to be

completed in the fourth quarter. Infill and expansion drilling

continued during the quarter at the recently announced Ormaque gold

resource.

Turkey

Kisladag performed well in the second quarter

with gold production consistent with the plan to deliver 2021

guidance of 140,000 to 150,000 ounces. The two additional CIC

trains that were commissioned in the first quarter have performed

as planned and are now fully operational. The installation of a new

carbon regeneration kiln was completed in the second quarter and is

expected to support improved gold recoveries in the circuit. The

commissioning of the high-pressure grinding roll (HPGR) circuit

remains on track.

At Efemcukuru, gold production, throughput, and

average gold grade were in-line with guidance.

In addition to the current income tax expense

relating to profits from mining operations in Turkey for the

quarter, the Company estimates an additional $14-16 million in

current tax expense in the second quarter. This primarily included

withholding tax and a retroactive adjustment for the previously

announced tax rate increase, effective at the start of the year.

However, these additional taxes are fully offset by the Turkish

investment tax credit used in the second quarter.

Greece

In the second quarter, operations at Olympias

were affected by work slowdowns as progress was made on

transformation efforts in Greece. As previously disclosed, the

Company is implementing a wide-ranging, sustained effort to

optimize the Greek operations that touches every part of the

business in Greece, from employee education and training, to

physical plant and business systems upgrades. Implementing this

scale of change at an existing operation like Olympias is

challenging and entails risk, which is part of the transformation

plan. Eldorado expects this effort will lead to sustainable

continuous improvement over the balance of the year. The long-term

benefits in safety, culture, and productivity will result in a

stronger operation with greatly enhanced economic

opportunities.

Eldorado has been engaged in transparent,

constructive discussions with key stakeholders, including

employees, unions and the government, and is confident that with

their cooperation the Company will make meaningful progress in

building a culture of growth, best practice, and continuous

improvement in Greece. Eldorado’s 2021 production guidance at

Olympias remains unchanged at this time.

Eldorado remains committed to responsibly

developing the Kassandra mines to create value for all stakeholders

including job creation, investment into local communities and

opportunities for local suppliers, while maintaining high

environmental standards.

Depreciation

Eldorado is forecasting full year 2021

depreciation expense to be $200-215 million.

Q2 2021 Financial and Operational

Results Call Details

Eldorado will release its second quarter 2021

Financial and Operational Results after the market closes on

Thursday, July 29, 2021 and will host a conference call on Friday,

July 30, 2021 at 11:30 AM ET (8:30 AM PT). The call will be webcast

and can be accessed at Eldorado Gold’s website:

www.eldoradogold.com, or

via: http://services.choruscall.ca/links/eldoradogold20210730.html

| Conference Call

Details

Date:

July 30,

2021

Time:

11:30 AM ET (8:30 AM PT)Dial

in:

+1 604 638

5340

Toll free: 1

800 319 4610 |

Replay (available until

September 3, 2021)Vancouver:

+1 604 638 9010Toll

Free: 1 800 319

6413Access code: 7013 |

About Eldorado Gold

Eldorado is a gold and base metals producer with

mining, development and exploration operations in Turkey, Canada,

Greece, Romania, and Brazil. The Company has a highly skilled and

dedicated workforce, safe and responsible operations, a portfolio

of high-quality assets, and long-term partnerships with local

communities. Eldorado's common shares trade on the Toronto Stock

Exchange (TSX: ELD) and the New York Stock Exchange (NYSE:

EGO).

Contact

Investor Relations

Lisa Wilkinson, VP, Investor Relations604.757

2237 or 1.888.353.8166 lisa.wilkinson@eldoradogold.com

Media

Louise Burgess, Director Communications &

Government Relations604.616 2296 or

1.888.363.8166

louise.burgess@eldoradogold.com

Cautionary Note about Forward-looking

Statements and Information

Certain of the statements made and information

provided in this press release are forward-looking statements or

information within the meaning of the United States Private

Securities Litigation Reform Act of 1995 and applicable Canadian

securities laws. Often, these forward-looking statements and

forward-looking information can be identified by the use of words

such as "plans", "expects", "is expected", "budget", “continue”,

“projected”, "scheduled", "estimates", "forecasts", "intends",

"anticipates", or "believes" or the negatives thereof or variations

of such words and phrases or statements that certain actions,

events or results "may", "could", "would", "might" or "will" be

taken, occur or be achieved.

Forward-looking statements or information

contained in this release include, but are not limited to,

statements or information with respect to: our preliminary first

quarter 2021 gold production, the Company’s 2021 annual guidance,

including at our individual mine production; construction of the

decline connecting Sigma mill with the Triangle underground mine,

including the timing of completion and anticipated benefits;

continued drilling at the Ormaque gold resource, completion of the

HPGR circuit, including the timing of completion, and the benefits

of the carbon column regeneration kiln at Kisladag; expected tax

expense in Turkey; the optimization of Greek operations, including

the benefits and risks thereof; development of the Kassandra mines,

including expected benefits thereof; expected depreciation expense

for 2021; our expectation as to our future financial and operating

performance, including expectations around generating free cash

flow; working capital requirements; debt repayment obligations; use

of proceeds from financing activities; expected metallurgical

recoveries and improved concentrate grade and quality; gold price

outlook and the global concentrate market; risk factors affecting

our business; our strategy, plans and goals, including our proposed

exploration, development, construction, permitting and operating

plans and priorities and related timelines; and schedules and

results of litigation and arbitration proceedings. Forward-looking

statements and forward-looking information by their nature are

based on assumptions and involve known and unknown risks, market

uncertainties and other factors, which may cause the actual

results, performance or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements or information.

We have made certain assumptions about the

forward-looking statements and information, including assumptions

about: our preliminary gold production and our guidance, timing of

construction of the decline between Sigma mill and the Triangle

underground mine; results from drilling at Ormaque; benefits of the

improvements at Kisladag; how the world-wide economic and social

impact of COVID-19 is managed and the duration and extent of the

COVID-19 pandemic; timing and cost of construction and exploration;

the geopolitical, economic, permitting and legal climate that we

operate in; the future price of gold and other commodities; the

global concentrate market; exchange rates; anticipated costs,

expenses and working capital requirements; production, mineral

reserves and resources and metallurgical recoveries; the impact of

acquisitions, dispositions, suspensions or delays on our business;

and the ability to achieve our goals. In particular, except where

otherwise stated, we have assumed a continuation of existing

business operations on substantially the same basis as exists at

the time of this release.

Even though our management believes that the

assumptions made and the expectations represented by such

statements or information are reasonable, there can be no assurance

that the forward-looking statement or information will prove to be

accurate. Many assumptions may be difficult to predict and are

beyond our control.

Furthermore, should one or more of the risks,

uncertainties or other factors materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those described in forward-looking statements or information.

These risks, uncertainties and other factors include, among others:

inability to meet production guidance, inability to complete

construction of the decline between Triangle mill and the Triangle

underground mine on time or to meet expected timing thereof, poor

results from drilling at Ormaque; inability to complete

improvements at Kisladag or to meeting expected timing thereof, or

to achieve the benefits thereof; inability to assess taxes in

Turkey or depreciation expenses; global outbreaks of infectious

diseases, including COVID-19; timing and cost of construction, and

the associated benefits; recoveries of gold and other metals;

geopolitical and economic climate (global and local), risks related

to mineral tenure and permits; gold and other commodity price

volatility; information technology systems risks; continued

softening of the global concentrate market; risks regarding

potential and pending litigation and arbitration proceedings

relating to our business, properties and operations; expected

impact on reserves and the carrying value; the updating of the

reserve and resource models and life of mine plans; mining

operational and development risk; financing risks; foreign country

operational risks; risks of sovereign investment; regulatory risks

and liabilities including environmental regulatory restrictions and

liability; discrepancies between actual and estimated production;

mineral reserves and resources and metallurgical testing and

recoveries; additional funding requirements; currency fluctuations;

community and non-governmental organization actions; speculative

nature of gold exploration; dilution; share price volatility and

the price of our common shares; competition; loss of key employees;

and defective title to mineral claims or properties, as well as

those risk factors discussed in the sections titled

“Forward-Looking Statements” and "Risk factors in our business" in

the Company's most recent Annual Information Form & Form 40-F.

The reader is directed to carefully review the detailed risk

discussion in our most recent Annual Information Form filed on

SEDAR and EDGAR under our Company name, which discussion is

incorporated by reference in this release, for a fuller

understanding of the risks and uncertainties that affect the

Company’s business and operations.

The inclusion of forward-looking statements and

information is designed to help you understand management’s current

views of our near- and longer-term prospects, and it may not be

appropriate for other purposes.

There can be no assurance that forward-looking

statements or information will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, you should not place

undue reliance on the forward-looking statements or information

contained herein. Except as required by law, we do not expect to

update forward-looking statements and information continually as

conditions change.

Except as otherwise noted, scientific and

technical information contained in this press release was reviewed

and approved by Simon Hille, FAusIMM and VP Technical Services for

the Company, and a "qualified person" under NI 43-101.

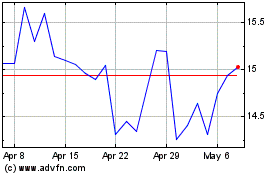

Eldorado Gold (NYSE:EGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

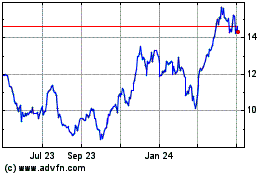

Eldorado Gold (NYSE:EGO)

Historical Stock Chart

From Apr 2023 to Apr 2024