UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a16 OR 15d16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For July 7, 2021

Harmony Gold Mining Company Limited

Randfontein Office Park

Corner Main Reef Road and Ward Avenue Randfontein, 1759

South Africa

(Address of principal executive offices)

*-

(Indicate by check mark whether the registrant files or will file annual reports under cover of

Form 20 F or Form 40F.)

Form 20F ☒ Form 40F ☐

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g32(b) under the Securities Exchange Act of 1934.)

Yes ☐ No ☒

Harmony Gold Mining Company Limited

Registration number 1950/038232/06

Incorporated in the Republic of South Africa

ISIN: ZAE000015228

JSE share code: HAR

(“Harmony” and/or “the Company”)

Harmony meets its strategic objectives for financial year 2021

Johannesburg, Wednesday, 7 July 2021. Peter Steenkamp, chief executive officer of Harmony Gold Mining Company Limited (“Harmony” and/or “the Company), reflects on the Company’s past financial year which came to an end on 30 June 2021 (“FY21”).

“While the past financial year will be defined and remembered as a year of extremes, our consistency and determination has lifted us and given us all a new sense of hope, compassion and motivation, ensuring that we at Harmony deliver on what we promised to our stakeholders and shareholders.

Safety and health

From the very beginning of the pandemic, we knew we had to focus on the well-being, health and safety of our employees and host communities. At the same time, it was also imperative to steer the company through these unprecedented times to realise our strategic objectives. I am proud to report that we did both.

Not only have our comprehensive health and safety operating procedures resulted in our teams remaining safe, but our commitment to operational excellence has ensured we remained on track to meet our production guidance for FY21. These successes do not happen in isolation and it is due to the unwavering dedication and commitment from our safety and health teams in ensuring our employees’ wellness, as well as the contribution from each and every one of our employees, that we maintained our momentum. We trust that the imbedded COVID-19 preventative and mitigating measures will enable us to continue producing safe, profitable ounces in the year to come.

The company’s COVID-19 vaccination programme is also currently underway following the granting of Harmony accreditation to administer the vaccine by the South African government. Five vaccination sites were certified in Gauteng, the Free State and North West and the company is doing bulk registrations for those who wish to receive the vaccine. In PNG an employee vaccination programme is also being rolled out with support from the National and Provincial Health Departments.

As we celebrate our successes, it is important to acknowledge and address the lowlights. Most tragically, was the loss of 9 of our employees’ lives through safety related incidents, during the course of FY21, while COVID-19 has claimed 55 of our colleagues lives to date. I send my heartfelt condolences to each and every family member and friend of our colleagues who are no longer with us.

As we strive to reach our goal of zero loss of life, we are working day and night to ensure we continue to prioritise the health and safety of our people at all times. We care about our people and we are therefore spending a significant amount of resources to develop our leaders’ capabilities, ensuring we achieve our safety objectives. Embedded practices throughout the company stipulate what is expected of each person, but also challenges unsafe routines and unsafe habits. We are running various safety awareness campaigns throughout the company. Impactful safety days are held, videos are shared on safe behaviour and we are continuously addressing Harmony’s overall culture.

During the last quarter of FY21, Harmony recorded its third fatality-free quarter in the history of the company. Thank you to each and every Harmonite and stakeholder for assisting in achieving this outstanding accomplishment.

Growing quality gold ounces

The successful acquisition and integration of Mponeng and related assets has been a game changer for Harmony. We have managed to grow our gold ounces and de-risk our portfolio while expanding our margins and improve our cash flows well into the future. Not only are we now the largest gold producer in South Africa by volume, but we have a substantial surface source business with an exciting pipeline of both brownfield and greenfield opportunities.

Advancing our copper-gold footprint in Papua New Guinea (“PNG”)

In December last year we obtained approval of the Environmental Permit for our Tier-1 Wafi-Golpu project in PNG, further advancing our copper-gold aspirations. Discussion with the PNG government as it relates to the special mining lease recommenced during the fourth quarter of FY21.

Hidden Valley’s mining lease extension was also granted by the PNG government for a period of 5 years and is valid until March 2030. This will allow for further cutbacks and mine-extension opportunities at the operation and highlights our strong stakeholder relations in PNG.

Environmental, Social and Governance factors (“ESG”) entrenched in our decision-making

From a sustainability perspective, we hosted our inaugural ESG day in the fourth quarter of FY21 under the theme of “Who Cares Wins”. This allowed the management of Harmony to unpack our integrated and risk based sustainable development strategy, further emphasising our commitment towards sustainable mining, transparent governance and our people. In addition, the announcement by the South African President to increase the cap on self-generation to 100MW was especially positive and will further assist us in optimising and decarbonising our business through a significant renewable energy programme.

Achieving our annual production guidance

The continual and unwavering commitment to operational excellence has ensured our mines are hitting their straps, ensuring we deliver on our promises to each of our stakeholders. As such, Harmony has met its annual gold production guidance for FY21 by producing between 1.50Moz to 1.55Moz up to 30 June 2021.

In conclusion

As we head into financial year 2022, we will further benefit from the many opportunities we have created through our acquisitions. Through careful and strategic capital allocation decisions, we have improved almost all our metrics both financial and non-financial.

We are confident in our ability to deliver long-term positive shareholder and stakeholder returns and remain committed to achieving our strategic objective of safe, profitable ounces.

FY21 was anything but easy, therefore I again thank our over 46,000 employees who have demonstrated resilience and commitment. I would also like to say thank you to our many shareholders and stakeholders for the trust you have placed in us. It is because of this trust that we have a strong foundation on which to further build our business and continue delivering positive shareholder returns through sustainable mining for many years to come.

Please stay safe and healthy. We look forward to sharing more detailed operational and financial information with you as it relates to our FY21 results via a virtual platform on 31 August 2021.”

Ends.

For more details, contact:

Jared Coetzer

Head: Investor Relations

+27 (0) 82 746 4120

Max Manoeli

Investor Relations Manager

+27 (0) 82 759 1775

JSE Sponsor:

JP Morgan Equities South Africa Propriety Limited

FORWARD-LOOKING STATEMENTS

This presentation contains forward-looking statements within the meaning of the safe harbour provided by Section 21E of the Exchange Act and Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), with respect to our financial condition, results of operations, business strategies, operating efficiencies, competitive positions, growth opportunities for existing services, plans and objectives of management, markets for stock and other matters. These forward-looking statements, including, among others, those relating to our future business prospects, revenues, and the potential benefit of acquisitions (including statements regarding growth and cost savings) wherever they may occur in this presentation and the exhibits to this presentation, are necessarily estimates reflecting the best judgment of our senior management and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. As a consequence, these forward-looking statements should be considered in light of various important factors, including those set forth in our Integrated Annual Report. Important factors that could cause actual results to differ materially from estimates or projections contained in the forward-looking

statements include, without limitation: overall economic and business conditions in South Africa, Papua New Guinea, Australia and elsewhere; impact of COVID-19 on our operational and financial estimates and results; estimates of future earnings, and the sensitivity of earnings to the prices of gold and other metals; estimates of future production and sales for gold and other metals; estimates of future cash costs; estimates of future cash flows, and the sensitivity of cash flows to the prices of gold and other metals; estimates of provision for silicosis settlement; estimates of future tax liabilities under the Carbon Tax Act; statements regarding future debt repayments; estimates of future capital expenditures; the success of our business strategy, exploration and development activities and other initiatives; future financial position, plans, strategies, objectives, capital expenditures, projected costs and anticipated cost savings and financing plans; estimates of reserves statements regarding future exploration results and the replacement of reserves; the ability to achieve anticipated efficiencies and other cost savings in connection with past and future acquisitions, as well as at existing operations; fluctuations in the market price of gold; the occurrence of hazards associated with underground and surface gold mining; the occurrence of labour disruptions related to industrial action or health and safety incidents; power cost increases as well as power stoppages, fluctuations and usage constraints; supply chain shortages and increases in the prices of production imports and the availability, terms and deployment of capital; our ability to hire and retain senior management, sufficiently technically-skilled employees, as well as our ability to achieve sufficient representation of historically disadvantaged persons in management positions; our ability to comply with requirements that we operate in a sustainable manner and provide benefits to affected communities; potential liabilities related to occupational health diseases; changes in government regulation and the political environment, particularly tax and royalties, mining rights, health, safety, environmental regulation and business ownership including any interpretation thereof; court decisions affecting the mining industry, including, without limitation, regarding the interpretation of mining rights; our ability to protect our information technology and communication systems and the personal data we retain; risks related to the failure of internal controls; the outcome of pending or future litigation or regulatory proceedings; fluctuations in exchange rates and currency devaluations and other macroeconomic monetary policies; the adequacy of the Company’s insurance coverage; any further downgrade of South Africa’s credit rating and socio-economic or political instability in South Africa, Papua New Guinea and other countries in which we operate.

The foregoing factors and others described under “Risk Factors” in our Integrated Annual Report (www.harmony.co.za) and our Form 20F should not be construed as exhaustive. We undertake no obligation to update publicly or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this annual report or to reflect the occurrence of unanticipated events, except as required by law. All subsequent written or oral forward-looking statements attributable to Harmony or any person acting on its behalf are qualified by the cautionary statements herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on

its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Harmony Gold Mining Company Limited

|

|

|

|

|

Date: July 7, 2021

|

By: /s/ Boipelo Lekubo

|

|

|

Name: Boipelo Lekubo

|

|

|

Title: Financial Director

|

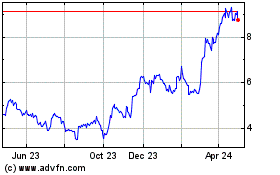

Harmony Gold Mining (NYSE:HMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

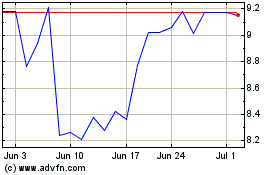

Harmony Gold Mining (NYSE:HMY)

Historical Stock Chart

From Apr 2023 to Apr 2024