PROSPECTUS SUPPLEMENT

(To Prospectus dated January 29, 2021)

$25,000,000 of Common Stock

Pangaea Logistics Solutions Ltd.

We have entered into an At Market Issuance Sales Agreement (the “Sales Agreement”) with both B. Riley Securities, Inc. (“B. Riley”) and Fearnley Securities Inc. (“Fearnley,” and, together with B. Riley, the “Sales Agents”, and each a “Sales Agent”) as our sales agents or/and principal, relating to our common stock, par value $0.0001 per share (“Common Stock”), offered by this prospectus supplement and the accompanying prospectus. In accordance with the terms of Sales Agreement, we may, through our sales agent, offer and sell from time to time our Common Stock, having an aggregate offering amount of up to $25,000,000 (the “Aggregate Offering Amount”).

Sales of our Common Stock, if any, under this prospectus supplement and the accompanying prospectus may be made in sales deemed to be “at-the-market offerings” as defined in Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), including by sales made directly on or through the Nasdaq Capital Market (“Nasdaq”) or another market for our Common Stock, sales made to or through a market maker other than on an exchange or otherwise, in negotiated transactions at market prices prevailing at the time of sale or at negotiated prices, or as otherwise agreed with the Sales Agent. Subject to the terms and conditions of the Sales Agreement, the Sales Agent will use its commercially reasonable efforts to sell on our behalf all of the designated shares. We may instruct the Sales Agent not to sell any shares if the sales cannot be affected at or above the price designated by us in any such instruction.

We will pay the applicable Sales Agent a commission in an amount up to 2.5% of the Aggregate Offering Amount sold by the Sales Agents under the Sales Agreement. In connection with the sale of our Common Stock on our behalf, the Sales Agents may be deemed to be “underwriters” within the meaning of the Securities Act, and the compensation paid to the Sales Agents may be deemed to be underwriting commissions or discounts.

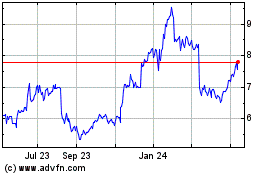

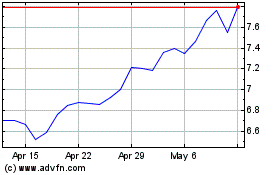

Our Common Stock is listed on Nasdaq under the symbol “PANL.” On July 1, 2021 the last reported sale price of our Common Stock on Nasdaq was $4.86 per share.

Investing in our Common Stock involves a high degree of risk and uncertainty. See "Risk Factors" beginning on page S-3 of this prospectus supplement, and page 6 of the accompanying base prospectus, and in our annual report on Form 10-K for the fiscal year ended on December 31, 2020, filed with the U.S. Securities and Exchange Commission on March 15, 2021, or our "Annual Report", which is incorporated by reference herein, to read about the risks you should consider before purchasing our Common Stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

|

|

|

|

|

B. Riley Securities, Inc.

|

Fearnley Securities Inc.

|

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

Page

|

|

|

|

|

|

|

|

|

|

|

|

S-i

|

|

|

S-ii

|

|

|

S-iii

|

|

|

S-1

|

|

|

S-3

|

|

|

S-3

|

|

|

S-4

|

|

|

S-5

|

|

|

S-5

|

|

|

S-5

|

|

|

S-6

|

|

|

S-6

|

|

|

S-7

|

|

|

S-7

|

|

|

S-7

|

|

|

S-8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WHERE YOU CAN FIND ADDITIONAL INFORMATION

|

|

|

|

|

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus are part of the registration statement that we filed with the U.S. Securities and Exchange Commission (the “Commission” or the “SEC”), utilizing a “shelf” registration process.

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of common stock and the concurrent underwritten public offering and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus.

The second part, the accompanying prospectus, gives more general information about securities we may offer from time to time, some of which does not apply to this offering or the concurrent registered underwritten public.

If the description of this offering varies between this prospectus supplement and the accompanying prospectus, you should rely on the information in this prospectus supplement. This prospectus supplement, the accompanying prospectus and the documents incorporated into each by reference include important information about us, the common stock being offered and other information you should know before investing. You should read this prospectus supplement and the accompanying prospectus together with additional information described under the heading, “Incorporation of Certain Documents by Reference” and “Where You Can Find Additional Information” in this prospectus supplement before investing in our Common Stock.

We have authorized only the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus and any free writing prospectus prepared by or on behalf of us or to which we have referred you. We have not, and the underwriters in the concurrent underwritten public offering have not, authorized anyone to provide you with information that is different. We and the underwriters in the concurrent underwritten public offering take no responsibility for and can provide no assurance as to the reliability of, any information that others may give you. This prospectus supplement and the accompanying prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction to any person to which it is unlawful to make an offer or solicitation in that jurisdiction, and do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the securities described in this prospectus supplement. See “Plan of Distribution.” The information contained in or incorporated by reference in this document is accurate only as of the date such information was issued, regardless of the time of delivery of this prospectus supplement or any sale of our common stock.

You should not consider any information in this prospectus supplement or the accompanying prospectus to be investment, legal or tax advice. You should consult your own counsel, accountants and other advisors for legal, tax, business, financial and related advice regarding the purchase of our securities.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Our disclosure and analysis in this Prospectus Supplement pertaining to our operations, cash flows and financial position, including, in particular, the likelihood of our success in developing and expanding our business, include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates,” “projects,” “forecasts,” “may,” “should” and similar expressions are forward-looking statements.

All statements in this Prospectus Supplement that are not statements of either historical or current facts are forward-looking statements. Forward-looking statements include, but are not limited to, such matters as:

•our future operating or financial results;

•our ability to charter-in vessels and to enter into Contract of Affreightment (“COAs”), voyage charters, time charters and forward freight agreements, and the performance of our counterparties in such contracts;

•our financial condition and liquidity, including our ability to obtain financing in the future to fund capital expenditures, acquisitions and other general corporate activities;

•our expectations of the availability of vessels to purchase, the time it may take to construct new vessels, and vessels’ useful lives;

•competition in the drybulk shipping industry;

•our business strategy and expected capital spending or operating expenses, including drydocking and insurance costs and the ability to expand our presence in logistics trades and custom supply chain management;

•the affect on COVID-19 on the shipping industry and global economics;

•global and regional economic and political conditions, including piracy; and

•statements about shipping market trends, including charter rates and factors affecting supply and demand.

Many of these statements are based on our assumptions about factors that are beyond our ability to control or predict and are subject to risks and uncertainties that are described more fully under the “Risk Factors” section of this Prospectus Supplement. Any of these factors or a combination of these factors could materially affect our future results of operations and the ultimate accuracy of the forward-looking statements. Factors that might cause future results to differ include, but are not limited to, the following:

•changes in governmental rules and regulations or actions taken by regulatory authorities;

•cybersecurity threats, including the potential misappropriation of assets or sensitive information, corruption of data or operational disruption;

•changes in economic and competitive conditions affecting our business, including market fluctuations in charter rates and charterers’ abilities to perform under existing time charters;

•potential liability from future litigation and potential costs due to environmental damage and vessel collisions;

•the length and number of off-hire periods; and

•other factors discussed under the “Risk Factors” section of this Prospectus Supplement.

You should not place undue reliance on forward-looking statements contained in this Prospectus Supplement because they are statements about events that are not certain to occur as described or at all. All forward-looking statements in this Prospectus Supplement are qualified in their entirety by the cautionary statements contained in this Prospectus Supplement. These forward-looking statements are not guarantees of our future performance, and actual results and future developments may vary materially from those projected in the forward-looking statements. Except to the extent required by applicable law or regulation, we undertake no obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date of this Prospectus Supplement or to reflect the occurrence of unanticipated events.

ENFORCEABILITY OF CIVIL LIABILITIES

We are incorporated under the laws of Bermuda. Certain of our directors, and officers reside outside the United States. In addition, a substantial portion of our assets and the assets of such directors and officers are located outside the United States. As a result, you may have difficulty serving legal process within the United States upon any of these persons. You may also have difficulty enforcing, both in and outside the United States, judgments you may obtain in United States courts against us or these persons in any action, including actions based upon the civil liability provisions of United States federal or state securities laws. Furthermore, there is substantial doubt that the courts of Bermuda would enter judgments in original actions brought in those courts predicated on United States federal or state securities laws.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights information that appears elsewhere in this prospectus supplement or in the documents incorporated by reference herein and is qualified in its entirety by the more detailed information, including the financial statements that appear in the documents incorporated by reference. This summary may not contain all of the information that may be important to you. As an investor or prospective investor, you should review carefully the entire prospectus supplement, including the risk factors, and the more detailed information that is included herein and in the documents incorporated by reference herein.

When used in this prospectus supplement, the terms “the Company,” “Pangaea,” “we,” “us” and “our” refer to Pangaea Logistics Solutions Ltd. and its subsidiaries. and/or one or more of its subsidiaries, as the context requires. The financial information of Pangaea included or incorporated by reference into this prospectus supplement represents our financial information and the operations of our subsidiaries. Unless otherwise indicated, all references to “dollars” and “$” in this prospectus supplement are to, and amounts are presented in, United States dollars, and our financial information presented in this prospectus supplement that is derived from financial statements incorporated by reference herein is prepared in accordance with U.S. GAAP.

We provide seaborne drybulk logistics and transportation services. We utilize our logistics expertise to service a broad base of industrial customers who require the transportation of a wide variety of drybulk cargoes, including grains, coal, iron ore, pig iron, hot briquetted iron, bauxite, alumina, cement clinker, dolomite and limestone. We address the logistics needs of its customers by undertaking a comprehensive set of services and activities, including cargo loading, cargo discharge, vessel chartering, voyage planning, and vessel technical management.

We are an exempted company limited by shares incorporated in Bermuda on April 29, 2014. We provide logistics and transportation services to clients utilizing an ocean-going fleet of motor vessels ("m/v") in the Handymax, Supramax, Ultramax and Panamax segments. At any time, our fleet may be comprised of 45-60 vessels that are chartered-in on a short-term basis for operation under our contract business. In addition, during the year 2020, we operated 17 vessels which were wholly-owned or partially-owned through joint ventures. We use this fleet to transport approximately 26 million tons of cargo annually to nearly 300 ports around the world, averaging approximately 49 vessels in service daily in 2020 and 48 during 2019.

Our ocean logistics services provide cargo loading, cargo discharge, vessel chartering, voyage planning, and technical vessel management to vessel and cargo owners. Our logistics capabilities provide a wide array of services which allow our customers to extend their own services, to more efficiently transport their cargo, and to extend relationships with their own suppliers and customers. For some customers, we act as the ocean logistics department, providing scheduling, terminal operations, port services, and marketing functions. For other customers, we transport supplies used in mining or processing in addition to cargo transport. We have worked with other customers on design, construction, and operation of loading and discharge facilities. In addition, we focus on fixing cargo and cargo contracts for transportation on backhaul routes. Backhaul routes position vessels for cargo discharge in typical loading areas. Backhaul routes allow us to reduce ballast days and instead earn revenues at times and on routes that are typically traveled without paying cargo.

We are a leader in the high ice class sector, secured by our control of a majority of the world's large dry bulk vessels with Ice-Class 1A designation. High ice class trading includes service in ice-restricted areas during both the winter (Baltic Sea and Gulf of St. Lawrence) and summer (Arctic Ocean). Trading during the ice seasons have provided superior profit margins, rewarding us for our investment in the specialized ships and the expertise it has developed working in these harsh environments.

We derive substantially all of our revenue from contracts of affreightment, “COAs”, voyage charters, and time charters. We transport a wide range of fundamental global commodities including grains, coal, iron ore, pig iron, hot briquetted iron, bauxite, alumina, cement clinker, dolomite, limestone, and other minor bulk cargo.

Our COAs typically extend for a period of one to five years, although some extend for longer periods. A voyage charter is a contract for the carriage of a specific amount and type of cargo on a load port to discharge port basis, subject to various cargo handling terms. COAs and voyage charters provide voyage revenue to us. A time charter is a contract under which we paid to provide a vessel on a per day basis for a specified period of time. Time charters provide charter revenues to us.

Active risk management is an important part of our business model. We believe our active risk management allows us to reduce the sensitivity of our revenues to market fluctuations and helps our to secure our long-term profitability and lower relative volatility of earnings. We manage market risk by chartering in vessels for periods of less than nine months on average and through a portfolio approach based upon owned vessels, chartered-in vessels, COAs, voyage charters, and time charters. We try to identify routes and ports for efficient bunkering to minimize our fuel expense. We also seek to hedge a portion of our exposure to changes in the price of marine fuels, or bunkers, through fuel swaps; and to fluctuating future freight rates through forward freight agreements. We have also entered into interest rate agreements to fix a portion of our interest rate exposure.

Our Operating Fleet

The following table sets forth certain information regarding our operating fleet as of the date of this prospectus supplement:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vessel Name

|

Type

|

DWT

|

Year Built

|

|

m/v Bulk Endurance

|

Ultramax (Ice Class 1C)

|

59,450

|

2017

|

|

m/v Bulk Destiny

|

Ultramax (Ice Class 1C)

|

59,450

|

2017

|

|

m/v Nordic Oasis

|

Panamax (Ice Class 1A)

|

76,180

|

2016

|

|

m/v Nordic Olympic

|

Panamax (Ice Class 1A)

|

76,180

|

2015

|

|

m/v Nordic Odin

|

Panamax (Ice Class 1A)

|

76,180

|

2015

|

|

m/v Nordic Oshima

|

Panamax (Ice Class 1A)

|

76,180

|

2014

|

|

m/v Nordic Orion

|

Panamax (Ice Class 1A)

|

75,603

|

2011

|

|

m/v Nordic Odyssey

|

Panamax (Ice Class 1A)

|

75,603

|

2010

|

|

m/v Nordic Nuluujaak

|

Post Panamax (Ice Class 1A)

|

95,758

|

2021

|

|

m/v Nordic Oinngua

|

Post Panamax (Ice Class 1A)

|

95,758

|

2021

|

|

m/v Bulk Valor

|

Supramax

|

58,105

|

2013

|

|

m/v Bulk Friendship

|

Supramax

|

58,738

|

2011

|

|

m/v Bulk Independence

|

Supramax

|

56,548

|

2008

|

|

m/v Bulk Pride

|

Supramax

|

58,749

|

2008

|

|

m/v Bulk Trident

|

Supramax

|

52,514

|

2006

|

|

m/v Bulk Freedom

|

Supramax

|

52,454

|

2005

|

|

m/v Bulk Spirit

|

Supramax

|

52,950

|

2009

|

|

m/v Bulk Newport

|

Supramax

|

52,587

|

2003

|

|

m/v Bulk PODS

|

Panamax

|

76,561

|

2006

|

|

m/v Bulk Pangaea

|

Panamax

|

70,165

|

1996

|

|

m/v Bulk Courageous

|

Ultramax

|

61,353

|

2013

|

We have agreed to purchase and expect to take delivery of the following vessels:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vessel Name

|

Type

|

DWT

|

Year Built

|

|

m/v Bulk Promise

|

Panamax

|

78,228

|

2013

|

|

m/v Nordic Siku

|

Post Panamax

|

95,000

|

2021

|

|

m/v Nordic Nukilik

|

Post Panamax

|

95,000

|

2021

|

Management

Our management team consists of senior executive officers and key employees with decades of experience in the commercial, technical, management and financial areas of the logistics and shipping industries. Our co-founder and Chief Executive Officer, Edward Coll, has over 40 years of experience in the drybulk shipping industry. Other members of our management team and key employees, Mark Filanowski, Mads Boye Petersen, Peter Koken, Neil McLaughlin, Robert Seward, Fotis Doussopoulos, and Gianni Del Signore, also have extensive experience in the shipping industry. The Company believes its management team is well respected in the drybulk sector of the shipping industry and, over the years, has developed strong commercial relationships with industrial customers and lenders. The Company believes that the experience, reputation and background of its management team will continue to be key factors in its success.

We provide logistics services and commercially manages our fleet primarily from offices in Newport, Rhode Island, Copenhagen, Denmark and Singapore. Logistics services and commercial management include identifying cargo for transportation, voyage planning, managing relationships, identifying vessels to charter in, and operating such vessels.

Our Ice-Class 1A Panamax and Post Panamax vessels are technically managed by a third-party manager with extensive expertise managing these vessel types and with ice pilotage. The technical management of the remainder of our owned fleet is performed in-house by our 51% owned joint venture, Seamar Management, S.A. Our technical management personnel have experience in the complexities of oceangoing vessel operations, including the supervision of maintenance, repairs,

improvements, drydocking and crewing. The technical management for our chartered-in vessels is performed by each respective ship owner.

Operations and Assets

We are a service business and our customers use the services we provide because we believe we add and create value for them. To add value, our voyage charter and time charter contracts provide a wide range of logistics services beyond the traditional loading, carriage and discharge of cargoes. We work with certain customers to review their contractual delivery terms and conditions, permitting those customers to reduce costs and certain risks. We also have a customer that is heavily dependent upon a port that was insufficiently supported by port pilots for the approach to port. To permit a large expansion of its services for this client, we formed a separate pilots association to increase the number of available pilots and improve access to the port. Another example of value-added services is the formation of a new port in Newfoundland, Canada to load aggregate cargo for export and a temporary port used in Greenland to load dry bulk cargo. As a result of such efforts, we are the de facto logistics department for certain clients.

Our core offering is the safe, reliable, and timely loading, carriage, and discharge of cargoes for customers. This offering requires identifying customers, agreeing on the terms of service, selecting a vessel to undertake the voyage, working with port personnel to load and discharge cargo, and documenting the transfers of title upon loading or discharge of the cargo. As a result, we spend significant time and resources to identify and retain customers and source potential cargoes in its areas of operation. To further expand its customer base and potential cargoes, we have developed expertise in servicing ports and routes subject to severe ice conditions, including the Baltic Sea and the Northern Sea Route. Our subsidiary, Nordic Bulk Carriers A/S (“NBC”), is an adviser to the European Commission on Arctic maritime issues.

Corporate Information

Our principal executives operate from the offices of its wholly-owned subsidiary Phoenix Bulk Carriers (US) LLC, which is located at 109 Long Wharf, Newport, Rhode Island 02840.The phone number at that address is (401) 846-7790. We also have offices in Copenhagen, Denmark, Athens, Greece and Singapore. Our corporate website address is http://www.pangaeals.com.

THE OFFERING

|

|

|

|

|

|

|

|

|

|

|

Issuer

|

|

Pangaea Logistics Solutions Ltd., a Bermuda exempted company.

|

|

|

|

|

|

Securities Offered by Us

|

|

$25,000,000 of shares of Common Stock.

|

|

|

|

|

|

Manner of Offering

|

|

“At-the-market offering” that may be made from time to time through our sales agents, B. Riley and Fearnley . See “Plan of Distribution” on page S-6.

|

|

|

|

|

|

Use of proceeds

|

|

The net proceeds of this offering, after deducting the Placement Agent’s commissions and our estimated offering expenses, will be for general corporate purposes. See “Use of Proceeds.

|

|

|

|

|

|

Risk factors

|

|

Investing in our Common Stock is highly speculative and involves a high degree of risk. See "Risk Factors" beginning on page S-[x] of this prospectus supplement and page [x] of the accompanying base prospectus and in our Annual Report, starting on page [x] thereof, which is incorporated by reference herein, to read about the risks you should consider before purchasing our Common Stock.

|

|

Listing

|

|

Our Common Stock is traded on the Nasdaq Capital Market under the symbol “PANL.”

|

RISK FACTORS

An investment in our securities involves a high degree of risk. You should consider carefully the material risks described below, which we believe represent the material risks related to our business and our securities, together with the other information contained in this Prospectus Supplement, before making a decision to invest in our securities. This Prospectus Supplement also contains forward-looking statements that involve risks and uncertainties. In connection with such forward looking statements, you should also carefully review the cautionary statements referred to under “Special Note Regarding Forward Looking Statements.” Our actual results could differ materially from those anticipated in the forward-looking statements as a result of specific factors, including the risks described below.

These risks and uncertainties are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations. If any of these risks actually occurs, our business, financial condition, results of operations and future growth prospects could be materially adversely affected. In that case, you may lose all or part of your investment in the securities.

Risks Related to this Offering

Investors may experience significant dilution as a result of this offering and future offerings.

Investors in this offering may resell some or all of the shares of our Common Stock we issue to them and such sales could cause the market price of our Common Stock to decline. Under these circumstances, our existing shareholders would experience greater dilution. Purchasers of the Common Stock we sell, as well as our existing shareholders, will experience significant dilution if we sell shares at prices significantly below the price at which they invested. In addition, we may offer additional Common Stock in the future, which may result in additional significant dilution.

Future issuances or sales, or the potential for future issuances or sales, of our Common Stock may cause the trading price of our securities to decline and could impair our ability to raise capital through subsequent equity offerings.

Shares to be issued in future equity offerings could cause the market price of our Common Stock to decline, and could have an adverse effect on our earnings per share. In addition, future sales of our Common Stock or other securities in the public markets, or the perception that these sales may occur, could cause the market price of our Common Stock to decline, and could materially impair our ability to raise capital through the sale of additional securities.

The market price of our Common Stock could decline due to sales, or the announcements of proposed sales, of a large number of Common Stock in the market, including sales of Common Stock by our large shareholders, or the perception that these sales could occur. These sales or the perception that these sales could occur could also depress the market price of our Common Stock and impair our ability to raise capital through the sale of additional equity securities or make it more difficult or impossible for us to sell equity securities in the future at a time and price that we deem appropriate. We cannot predict the effect that future sales of Common Stock or other equity-related securities would have on the market price of our Common Stock.

Our Bye-law, as amended, authorizes our Board of Directors to, among other things, issue additional shares as common or preferred stock or securities convertible or exchangeable into equity securities, without shareholder approval. We may issue such additional equity or convertible securities to raise additional capital. The issuance of any additional shares of common or preferred stock or convertible securities could be substantially dilutive to our shareholders. Moreover, to the extent that we issue restricted stock units, stock appreciation rights, options or warrants to purchase our Common Stock in the future and those stock appreciation rights, options or warrants are exercised or as the restricted stock units vest, our shareholders may experience further dilution. Holders of shares of our Common Stock have no preemptive rights that entitle such holders to purchase their pro rata share of any offering of shares of any class or series and, therefore, such sales or offerings could result in increased dilution to our shareholders.

It is not possible to predict the actual number of shares we will sell under the Sales Agreement, or the gross proceeds resulting from those sales.

Subject to certain limitations in the Sales Agreement and compliance with applicable law, we have the discretion to deliver a placement notice to the Sales Agents at any time throughout the term of the Sales Agreement. The number of shares that are sold through the Sales Agents after delivering a placement notice will fluctuate based on a number of factors, including the market price of the Common Stock during the sales period, the limits we set with the Sales Agents in any applicable placement notice, and the demand for our Common Stock during the sales period. Because the price per share of each share sold will fluctuate during the sales period, it is not currently possible to predict the number of shares that we will sell or the gross proceeds we will receive in connection with those sales.

The Common Stock offered hereby will be sold in “at the market offerings”, and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares in this offering at different times will likely pay different prices, and so may experience different levels of dilution and different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold in this offering. In addition, there is no minimum or maximum sales price for shares to be sold in this offering. Investors may experience a decline in the value of the shares they purchase in this offering as a result of sales made at prices lower than the prices they paid.

USE OF PROCEEDS

We intend to use the net proceeds from the sale of the securities offered by this prospectus supplement for capital expenditures, working capital funding for payments for vessel, other asset or share acquisitions or for other general corporate purposes, or a combination thereof. Asset acquisitions may be structured as individual assets purchases, the acquisition of the equity interests of vessel owning entities or the acquisition of the equity interests of the direct or indirect owner of one or more vessels or shipping assets.

CAPITALIZATION

The following table sets forth our capitalization as of March 31, 2021:

|

|

|

|

|

|

|

|

|

|

|

|

•

|

on an actual basis; and

|

|

|

|

|

|

|

|

|

|

|

|

|

•

|

on an as adjusted basis, to give effect to events that have occurred between April 1, 2021 and June 29, 2021:

|

|

|

|

|

|

|

|

|

•

|

the drawdown of $53.0 million in respect of the m/v Nordic Oshima, m/v Nordic Olympic, m/v Nordic Odin and m/v Nordic Oasis. The Company used a portion of the proceeds of the loan to repay the outstanding balance of $50.0 million for the Nordic Oshima, Nordic Odin, Nordic Olympic and Nordic Oasis loan facilities which was set to mature on October 1, 2021;

|

|

|

|

|

•

|

the drawdown of a $13.4 million term loan facility, through a separate wholly-owned subsidiary, for the post-delivery financing of the m/v Bulk Valor;

|

|

|

|

|

•

|

in April 8, 2021, the Company acquired the m/v Bulk Courageous and simultaneously entered into a failed sale and leaseback transaction recorded as a finance lease for $12.0 million;

|

|

|

|

|

•

|

the Company took delivery of two new post-panamax dry bulk vessels in May and June of 2021 and simultaneously entered into failed sale and leaseback transactions recorded as finance leases of approximately $ 65.1 million;

|

|

|

|

|

•

|

additional capital contribution of $ 4.6 million from a third party upon delivery of the new-build ice class post panamax vessels which pursuant to ASC 480, Distinguishing Liabilities from Equity, is recorded in Long term liabilities - Other;

|

|

|

|

|

•

|

the Company paid cash dividends of $1.5 million;

|

|

|

|

|

•

|

the issuance 55,000 common shares to employees at $3.17 per share with a grant-date fair value of approximately $174,000; and

|

|

|

|

|

•

|

the issuance 14,205 common shares to a non-employee director at $3.52 per share with a grant-date fair value of approximately $50,000.

|

There have been no significant adjustments to our capitalization since March 31, 2021, other than the adjustments described above. The “Actual” historical data in the table below is derived from, and should be read in conjunction with, our Quarterly Report on Form 10-Q for the period ending March 31, 2021, which is incorporated by reference herein.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(All figures in U.S. dollars, except for share amounts)

|

|

Actual

|

|

As Adjusted

|

|

|

|

|

|

|

|

Debt:

|

|

|

|

|

|

Secured Long-term debt (including current portion)

|

|

$

|

98,938,796

|

|

|

$

|

109,085,498

|

|

|

Finance lease liabilities (including current portion)

|

|

55,768,735

|

|

|

129,028,976

|

|

|

Long-term liabilities - other

|

|

12,906,074

|

|

|

17,527,472

|

|

|

Total debt

|

|

$

|

167,613,605

|

|

|

$

|

255,641,946

|

|

|

|

|

|

|

|

|

Shareholders' equity:

|

|

|

|

|

|

Shareholders' equity:

|

|

|

|

|

|

Common shares, $0.0001 par value; 100,000,000 shares authorized; 45,572,236 shares issued and outstanding on an actual basis, 45,641,441 shares issued and outstanding on an as adjusted basis

|

|

$

|

4,557

|

|

|

$

|

4,564

|

|

|

Additional paid-in capital

|

|

160,399,765

|

|

|

160,349,770

|

|

|

Retained earnings

|

|

29,033,976

|

|

|

27,491,134

|

|

|

Total Pangaea Logistics Solutions Ltd. equity

|

|

$

|

189,438,298

|

|

|

$

|

189,388,310

|

|

|

Non-controlling interests

|

|

52,318,661

|

|

|

52,318,661

|

|

|

Total Shareholders' Equity

|

|

$

|

241,756,959

|

|

|

$

|

241,706,971

|

|

|

|

|

|

|

|

|

Total Capitalization

|

|

$

|

409,370,564

|

|

|

$

|

497,348,917

|

|

DIVIDENDS

Under our Bye-laws, our board of directors may declare dividends or distributions out of contributed surplus and may also pay interim dividends to be paid in cash, shares of the Company’s stock or any combination thereof. Our board of directors’ objective is to generate competitive returns for our shareholders. Any dividends declared will be in the sole discretion of the board of directors and will depend upon earnings, restrictions in our debt agreements described later in this prospectus, market prospects, current capital expenditure programs and investment opportunities, the provisions of Bermuda law affecting the payment of distributions to shareholders and other factors. Under Bermuda law, the board of directors has no discretion to declare or pay a dividend if there are reasonable grounds for believing that the Company is, or would after the payment be, unable to pay its liabilities as they become due or the realizable value of the Company’s assets would thereby be less than its liabilities.

In addition, since we are a holding company with no material assets other than the shares of our subsidiaries through which we conduct our operations, our ability to pay dividends will depend on our subsidiaries’ distributing to us their earnings and cash flows. The Company paid a quarterly cash dividend of $0.035 per share of Common Stock commencing in May 2019. In March 2020 the Company suspended its dividend due to the uncertainty caused by COVID-19 global pandemic, however it declared a quarterly cash dividend of $0.02 per share of Common Stock in December 2020 and declared a quarterly cash dividend of $0.035 per share in May 2021. We cannot assure you that we will be able to pay regular quarterly dividends, and our ability to pay dividends will be subject to the limitations set forth above and in the section of this Prospectus Supplement titled “Risk Factors.” The Company has dividends payable of $1.0 million at December 31, 2020.

DESCRIPTION OF SECURITIES WE ARE OFFERING

The following is a description of the material terms of our Common Stock and includes a summary of specified provisions of our bye-laws. This description is qualified by reference to our bye-laws, which are incorporated herein by reference.

General

Our constitutional documents provide for the issuance of 100,000,000 shares of Common Stock. The holders of our common shares will be entitled to one vote for each share held of record on all matters to be voted on by shareholders.

There is no cumulative voting with respect to the election of directors, with the result that the holders of more than 50% of the shares that vote for the election of directors can elect all of the directors. Directors are elected to a staggered board, which may discourage, delay or prevent a change in control of the Company.

Holders of our Common Stock will not have any conversion, preemptive or other subscription rights and there are no sinking fund or redemption provisions applicable to the Common Stock.

Transfer Agent

Our transfer agent for our Common Stock is Continental Stock Transfer & Trust Company, 17 Battery Place, New York, New York 10004.

Market Listing

Our Common Stock is listed on Nasdaq under the symbol “PANL”.

Holders of Common Stock

As of June 18, 2021 we had approximately 3,931 record holders of our Common Stock, based on information provided by our transfer agent. The foregoing number of record holders does not include an unknown number of stockholders who hold their stock in “street name.”

MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS

The Company is not subject to corporate income taxes on its profits in Bermuda because Bermuda does not impose an income tax.

NBC, a wholly-owned subsidiary of the Company, is subject to a Danish tonnage tax. NBC is not taxed on the basis of their actual income derived from their business but on an alternative income determination based on the net tons carrying capability of their fleet. As the tax is not determined based on taxable income, NBC’s tax expense of approximately $578,000 and $458,000 is included within voyage expenses in the accompanying consolidated statements of income as of December 31, 2020 and 2019, respectively.

Shipping income derived from sources outside the United States is not subject to any Unites States federal income tax. U.S. sourced income from the international operation of ships that is considered qualified income and earned by a qualified foreign corporation can also be considered exempt from U.S. federal income taxation. The exemption requires a number of tests be met including qualifying income earned subject to an equivalent exemption in a qualified country and a qualified foreign corporation meeting the qualified foreign country, qualified income, stock ownership tests and substantiation requirements. The Company believes it meets all of the tests to qualify for an exemption from income under Internal Revenue Code section 883. To the extent the Company is unable to qualify for the exemption, the Company would be subject to U.S. federal income taxation of 4% of its U.S. shipping income on a gross basis without deductions. If certain other conditions are present, as defined in the Code, U.S. source shipping income, net of applicable deductions, may be subject to federal income tax of up to 21% and a 30% branch profits tax. The company believes that none of its U.S. source shipping income is effectively connected with the conduct of a U.S. trade or business.

Since earnings from shipping operations of the Company are not subject to U.S. or foreign income taxation, the Company has not recorded income tax expense, deferred tax assets or liabilities for the years ended December 31, 2020 and 2019.

Where required, the Company complies with income tax filings in its various jurisdictions of operations. As of December 31, 2020 and 2019, the Company is not subject to U.S. federal or foreign examinations by tax authorities for years before 2015.

PLAN OF DISTRIBUTION

We have entered into the Sales Agreement with the Sales Agents under which we may issue and sell shares of our Common Stock from time to time up to $25 million to or through the Sales Agents. The sales of our Common Stock, if any, under this prospectus supplement will be made at market prices by any method deemed to be an “at the market offering” as defined in Rule 415(a)(4) under the Securities Act, including sales made directly on the Nasdaq Capital Market, on any other existing trading market for our Common Stock or to or through a market maker.

Each time that we wish to issue and sell shares of our Common Stock under the Sales Agreement, we will provide the Sales Agents with a placement notice describing the amount of shares to be sold, the time period during which sales are requested to be made, any limitation on the amount of shares of Common Stock that may be sold in any single day, any minimum price below which sales may not be made or any minimum price requested for sales in a given time period and any other instructions relevant to such requested sales. Upon receipt of a placement notice, our Sales Agents will use commercially reasonable efforts, consistent with its normal trading and sales practices and applicable state and federal laws, rules and regulations and the rules of the Nasdaq, to sell shares of our Common Stock under the terms and subject to the conditions of the placement notice and the

Sales Agreement. We or the Sales Agents may suspend the offering of Common Stock pursuant to a placement notice upon notice and subject to other conditions.

Settlement for sales of Common Stock, unless the parties agree otherwise, will occur on the second trading day following the date on which any sales are made in return for payment of the net proceeds to us. There are no arrangements to place any of the proceeds of this offering in an escrow, trust or similar account. Sales of our Common Stock as contemplated in this prospectus supplement will be settled through the facilities of The Depository Trust Company or by such other means as we and the Sales Agents may agree upon.

We will pay the applicable Sales Agent commissions for their services in acting as our sales agent in the sale of our Common Stock pursuant to the Sales Agreement. The applicable Sales Agent will be entitled to compensation at a fixed commission rate up to 2.5% of the Aggregate Offering Amount sold by the Sales Agent under the Sales Agreement. We have also agreed to reimburse the Sales Agents for its reasonable and documented out-of-pocket expenses, including but not limited to $50,000 for legal counsel fees and an additional $2,500 per quarter while the Sales Agreement is in effect.

We estimate that the total expenses for this offering, excluding compensation payable to the Sales Agents and certain expenses reimbursable to the Sales Agents under the terms of the Sales Agreement, will be approximately $130,000. The remaining sales proceeds, after deducting any expenses payable by us and any transaction fees imposed by any governmental, regulatory, or self-regulatory organization in connection with the sales, will equal our net proceeds for the sale of such Common Stock.

Because there are no minimum sale requirements as a condition to this offering, the actual total public offering price, commissions and net proceeds to us, if any, are not determinable at this time. The actual dollar amount and number of shares of Common Stock we sell through this prospectus supplement will be dependent, among other things, on market conditions and our capital raising requirements.

We will report at least quarterly the number of shares of Common Stock sold through the Sales Agents under the Sales Agreement, the net proceeds to us and the compensation paid by us to the Sales Agents in connection with the sales of Common Stock under the Sales Agreement.

In connection with the sale of the Common Stock on our behalf, the Sales Agents will each be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation of the Sales Agents will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification and contribution to the Sales Agents against certain civil liabilities, including liabilities under the Securities Act.

The Sales Agents will not engage in any market making activities involving our Common Stock while the offering is ongoing under this prospectus supplement if such activity would be prohibited under Regulation M or other anti-manipulation rules under the Securities Act. The Sales Agents will not engage in any transactions that stabilizes our Common Stock.

The offering pursuant to the Sales Agreement will terminate upon the earlier of (i) the sale of all shares of Common Stock subject to the Sales Agreement and (ii) termination of the Sales Agreement as permitted therein. We may terminate the Sales Agreement in our sole discretion at any time by giving 5 days’ prior notice to the Sales Agents. The Sales Agents may terminate the Sales Agreement under the circumstances specified in the Sales Agreement and in its sole discretion at any time by giving 5 days’ prior notice to us.

The Sales Agents and/or their affiliates have provided, and may in the future provide, various investment banking and other financial services for us, for which services they have received and may in the future receive customary fees.

This prospectus supplement in electronic format may be made available on a website maintained by the Sales Agents, and the Sales Agents may distribute this prospectus supplement electronically.

LEGAL MATTERS

The validity of the securities offered by this prospectus will be passed upon for us by Appleby (Bermuda) Limited with respect to matters of Bermuda law and by Seward & Kissel LLP, New York, New York, with respect to matters of U.S. federal law. Morgan, Lewis & Bockius LLP, Palo Alto, California, is representing the Sales Agents in this offering.

EXPERTS

The audited financial statements incorporated by reference in this prospectus and elsewhere in the registration statement have been so incorporated by reference in reliance upon the report of Grant Thornton LLP, independent registered public accountants, upon the authority of said firm as experts in accounting and auditing.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We have filed with the SEC Form S-3 under the Securities Act with respect to the shares of common stock offered by this prospectus supplement. This prospectus supplement and the accompanying base prospectus, which constitutes a part of the registration statement, does not contain all of the information set forth in the registration statement, some of which is contained in exhibits to the registration statement as permitted by the rules and regulations of the SEC. For further information with respect to us and our common stock, we refer you to the registration statement, including the exhibits filed as a part of the registration statement. Statements contained in this prospectus supplement concerning the contents of any contract or any other document are not necessarily complete. If a contract or document has been filed as an exhibit to the registration statement, please see the copy of the contract or document that has been filed. Each statement in this prospectus supplement relating to a contract or document filed as an exhibit is qualified in all respects by the filed exhibit. You may read and copy reports, proxy statements and other information filed by us with the SEC at the SEC public reference room located at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. You may also obtain copies of the materials described above at prescribed rates by writing to the Securities and Exchange Commission, Public Reference Section, 100 F Street, N.E., Washington, D.C. 20549. You may access information on the Company at the SEC web site containing reports, proxy statements and other information at: http://sec.report.

We are subject to the informational and reporting requirements of the Securities Exchange Act of 1934, as amended, and have filed and will file annual, quarterly and current reports, proxy statements and other information with the SEC. These periodic reports, proxy statements and other information will be available for inspection and copying at the SEC's public reference facilities and the website of the SEC referred to above. We also maintain a website at www.pangaeals.com.

You may access these materials free of charge as soon as is reasonably practicably after they are electronically filed with, or furnished to, the SEC. Information contained on our website is not a part of this prospectus and the inclusion of our website address in this prospectus is an inactive textual reference only.

Government Filings

We file annual quarterly and current reports with the Commission. The Commission maintains a website (http://sec.report) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the Commission. Our filings are also available on our website (http://www. pangaeals.com). The information contained in, accessible through or connected to our website is not incorporated by reference into, and does not constitute a part of, this prospectus supplement.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference” into this prospectus certain information that we have filed with the SEC, which means that we can disclose important information to you without actually including the specific information in this prospectus by referring you to those documents. The information incorporated by reference is an important part of this prospectus. You should not assume that the information in this prospectus is current as of any date other than the date of this prospectus, and you should not assume that the information contained in a document incorporated by reference is accurate as of any date other than the date of such document (or, with respect to particular information contained in such document, as of any date other than the date set forth within such document as the date as of which such particular information is provided). We incorporate by reference into this prospectus (i) the documents listed below, (ii) any future filings we make with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act following the date of this prospectus and prior to the termination of the offering covered by this prospectus and any prospectus supplement, and (iii) filings we make with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act after the date of the registration statement of which this prospectus is a part and prior to the effectiveness of such registration statement, in each case, other than information furnished to the SEC (including, but not limited to, information furnished under Items 2.02 or 7.01 of Form 8-K and any corresponding information furnished with respect to such Items under Item 9.01 or as an exhibit) and which is not deemed filed under the Exchange Act:

•our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, filed with the Commission on March 15, 2021;

•all subsequent annual reports on Form 10-K filed with the Commission prior to the termination of this offering;

•our Quarterly Reports on Form 10-Q for the periods ended March 31, 2021 filed with the Commission on May 11, 2021;

•all subsequent Quarterly Reports on Form 10-Q filed with the Commission prior to the termination of this offering;

•our Definitive Proxy Statement on Schedule 14A, filed with the Commission on June 21, 2021;

•our Currently Reports on Form 8-K, filed with the Commission on March 15, 2021 and May 11, 2021;

•All subsequent Current Reports on 8-K filed with the Commission prior to the termination of this offering.

Any statement contained in this prospectus or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded to the extent that a statement contained in any subsequently filed document which is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We will provide without charge to each person, including any beneficial owner, to whom this prospectus is delivered, upon written or oral request, a copy of any document incorporated by reference in this prospectus. Requests for such documents should be directed to:

Pangaea Logistics Solutions Ltd.

109 Long Wharf

Newport, Rhode Island 02840

(401) 846-7790

PROSPECTUS

$100,000,000

Common Shares, Preferred Shares, Debt Securities,

Warrants, Purchase Contracts, Rights and Units

Pangaea Logistics Solutions Ltd

Through this prospectus, we may periodically offer:

(1) our common shares,

(2) our preferred shares,

(3) our debt securities,

(4) our warrants,

(5) our rights,

(6) our purchase contracts, and

(7) our units.

We may also offer securities of the types listed above that are convertible or exchangeable into one or more of the securities listed above.

The aggregate offering price of all securities issued and sold by us under this prospectus may not exceed $100,000,000. The securities issued under this prospectus may be offered directly or through underwriters, agents or dealers. The names of any underwriters, agents or dealers will be included in a supplement to this prospectus.

Our common stock is currently quoted on the Nasdaq Capital Market (“Nasdaq”) under the symbol “PANL”.

The aggregate market value of our outstanding common shares held by non-affiliates as of January 4, 2021 was $21,911,692, based on 45,065,662 common shares outstanding, of which 7,967,888 are held by non-affiliates, and a closing price on the Nasdaq Capital Market of $2.75 on that date. As of the date hereof, we have not offered any securities pursuant to General Instruction I.B.6 of Form S-3 during the twelve calendar month period that ends on and includes the date hereof.

Investing in our common stock involves risk. See “Risk Factors” on page 4 of this Prospectus to read about factors you should consider before investing in our common shares.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus is , 2021

Unless otherwise indicated, all dollar references in this prospectus are to U.S. dollars and financial information presented in this prospectus that is derived from financial statements incorporated by reference is prepared in accordance with accounting principles generally accepted in the United States.

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission, or the SEC, using a shelf registration process. Under the shelf registration process, we may sell the common shares, preferred shares, debt securities, warrants, purchase contracts and units described in this prospectus in one or more offerings up to a total dollar amount of $100,000,000. This prospectus provides you with a general description of the securities we may offer. We will provide updated information if required whenever we offer our securities pursuant to this prospectus. This may include a prospectus supplement that will describe the specific amounts, prices and terms of the offered securities. The prospectus supplement may also add, update or change the information contained in this prospectus. If there is any inconsistency between the information in this prospectus and any prospectus supplement, you should rely on the prospectus supplement. Before purchasing any securities, you should read carefully both this prospectus and any prospectus supplement, together with the additional information described below.

This prospectus and any prospectus supplement are part of a registration statement we filed with the SEC and do not contain all the information in the registration statement. Forms of the indenture and other documents establishing the terms of the offered securities are filed as exhibits to the registration statement. Statements in this prospectus or any prospectus supplement about these documents are summaries and each statement is qualified in all respects by reference to the document to which it refers. You should refer to the actual documents for a more complete description of the relevant matters. For further information about us or the securities offered hereby, you should refer to the registration statement, which you can obtain from the Commission as described below under “Where You Can Find Additional Information.”

You should rely only on the information contained or incorporated by reference in this prospectus and in any prospectus supplement. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We will not make any offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and the applicable supplement to this prospectus is accurate as of the date on its respective cover, and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates.

We have not authorized any dealer, salesperson or other person to give any information or represent anything not contained in this prospectus. You should not rely on any unauthorized information. This prospectus does not offer to sell or buy any shares in any jurisdiction in which it is unlawful. The information in this prospectus is current as of the date on the cover. You should rely only on the information contained or incorporated by reference in this prospectus.

Common shares may be offered or sold in Bermuda only in compliance with the provisions of the Investment Business Act 2003 and the Exchange Control Act 1972, and related regulations of Bermuda which regulate the sale of securities in Bermuda. In addition, specific permission is required from the Bermuda Monetary Authority, or the BMA, pursuant to the provisions of the Exchange Control Act 1972 and related regulations, for all issuances and transfers of securities of Bermuda companies, both local and exempted, involving persons who are non-resident, other than in cases where the BMA has granted a general permission or the company is classified under the Bermuda Monetary Authority (Collective Investment Scheme Classification) regulations 1998 or successor provisions. The BMA, in its policy dated June 1, 2005, provides that where any equity securities, including our common shares, of a Bermuda company are listed on an appointed stock exchange, general permission is given for the issue and subsequent transfer of any securities of a company from and/or to a non-resident, for as long as any equity securities of such company remain so listed. NASDAQ is an appointed stock exchange under Bermuda law. Approvals or permissions given by the Bermuda Monetary Authority do not constitute a guarantee by the Bermuda Monetary Authority as to our performance or our creditworthiness. Accordingly, in granting such permission, the BMA accepts no responsibility for our financial soundness or the correctness of any of the statements made or expressed in this prospectus or any prospectus supplement. Neither this prospectus nor any prospectus supplement needs to be filed with the Registrar of Companies in Bermuda in accordance with Part III of the Companies Act 1981 of Bermuda (the “Bermuda Companies Act”) pursuant to provisions incorporated therein following the enactment of the Companies Amendment Act 2013. Such provisions state that a prospectus in respect of the offer to the public of shares in a Bermuda company does not need to be filed in Bermuda where an

appointed stock exchange (such as NASDAQ) or any competent regulatory authority (such as the SEC) has received or otherwise accepted the prospectus in connection with such offer.

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

PROSPECTUS SUMMARY

|

|

|

RISK FACTORS

|

|

|

FORWARD-LOOKING STATEMENTS

|

|

|

USE OF PROCEEDS

|

|

|

PLAN OF DISTRIBUTION

|

|

|

DESCRIPTION OF SHARE CAPITAL

|

|

|

DESCRIPTION OF DEBT SECURITIES

|

|

|

DESCRIPTION OF WARRANTS

|

|

|

DESCRIPTION OF PURCHASE CONTRACTS

|

|

|

DESCRIPTION OF RIGHTS

|

|

|

DESCRIPTION OF UNITS

|

|

|

LEGAL MATTERS

|

|

|

EXPERTS

|

|

|

WHERE YOU CAN FIND ADDITIONAL INFORMATION

|

|

|

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

|

|

PROSPECTUS SUMMARY

The following summary highlights information contained elsewhere in this prospectus or incorporated by reference into this prospectus from our Annual Report on Form 10-K for the year ended December 31, 2019, and our other filings with the SEC listed in the section of this prospectus entitled “Incorporation of Documents By Reference.” This summary does not contain all of the information that you should consider before investing in our common shares. You should read this entire prospectus, including the section entitled “Risk Factors,” and our financial statements and the notes thereto in our most recent Annual Report on Form 10-K or Quarterly Report on Form 10-Q, which are incorporated by reference herein, before making an investment decision.

Unless otherwise indicated, all references in this prospectus to “The Company,” the “Company,” “we,” “our,” “us” and like terms refer collectively to Pangaea Logistics Solutions Ltd. and its consolidated subsidiaries.

Overview

Pangaea Logistics Solutions Ltd. and its subsidiaries (collectively, “Pangaea” or the “Company”) provides seaborne drybulk logistics and transportation services. Pangaea utilizes its logistics expertise to service a broad base of industrial customers who require the transportation of a wide variety of drybulk cargoes, including grains, coal, iron ore, pig iron, hot briquetted iron, bauxite, alumina, cement clinker, dolomite and limestone. The Company addresses the logistics needs of its customers by undertaking a comprehensive set of services and activities, including cargo loading, cargo discharge, vessel chartering, voyage planning, and vessel technical management.

Business

The Company provides logistics and transportation services to clients utilizing an ocean-going fleet of motor vessels ("m/v") in the Handymax, Supramax, Ultramax and Panamax segments. At any time, this fleet may be comprised of 30-50 vessels that are chartered-in on a short-term basis for operation under our contract business. In addition, during most of the year 2019, the Company operated 20 vessels which were wholly-owned or partially-owned through joint ventures. The Company uses this fleet to transport approximately 25 million tons of cargo annually to nearly 250 ports around the world, averaging approximately 48 vessels in service daily in 2019 and 45 during 2018.

The Company’s ocean logistics services provide cargo loading, cargo discharge, vessel chartering, voyage planning, and technical vessel management to vessel and cargo owners. Our logistics capabilities provide a wide array of services which allow our customers to extend their own services, to more efficiently transport their cargo, and to extend relationships with their own suppliers and customers. For some customers, the Company acts as their ocean logistics department, providing scheduling, terminal operations, port services, and marketing functions. For other customers, the Company transports supplies used in mining or processing in addition to cargo transport. The Company has worked with other customers on design, construction, and operation of loading and discharge facilities.

In addition, the Company focuses on fixing cargo and cargo contracts for transportation on backhaul routes. Backhaul routes position vessels for cargo discharge in typical loading areas. Backhaul routes allow us to reduce ballast days and instead earn revenues at times and on routes that are typically traveled without paying cargo.

The Company is a leader in the high ice class sector, secured by its control of a majority of the world's large dry bulk vessels with Ice-Class 1A designation. High ice class trading includes service in ice-restricted areas during both the winter (Baltic Sea and Gulf of St. Lawrence) and summer (Arctic Ocean). Trading during the ice seasons have provided superior profit margins, rewarding the Company for its investment in the specialized ships and the expertise it has developed working in these harsh environments.

The Company derives substantially all of its revenue from contracts of affreightment, “COAs”, voyage charters, and time charters. The Company transports a wide range of fundamental global commodities including grains, coal, iron ore, pig iron, hot briquetted iron, bauxite, alumina, cement clinker, dolomite, limestone, and other minor bulk cargo.

The Company’s COAs typically extend for a period of one to five years, although some extend for longer periods. A voyage charter is a contract for the carriage of a specific amount and type of cargo on a load port to discharge port basis, subject to various cargo handling terms. COAs and voyage charters provide voyage revenue to the Company. A time charter is a contract under which the Company is paid to provide a vessel on a per day basis for a specified period of time. Time charters provide charter revenues to the Company.

Active risk management is an important part of our business model. The Company believes its active risk management allows it to reduce the sensitivity of its revenues to market fluctuations and helps it to secure its long-term profitability and lower relative volatility of earnings. We manage market risk by chartering in vessels for periods of less than nine months on average and through a portfolio approach based upon owned vessels, chartered-in vessels, COAs, voyage charters, and time charters. The Company tries to identify routes and ports for efficient bunkering to minimize its fuel expense. The Company also seeks to hedge a portion of its exposure to changes in the price of marine fuels, or bunkers, through fuel swaps; and to fluctuating future freight rates through forward freight agreements. The Company has also entered into interest rate agreements to fix a portion of our interest rate exposure.

Corporate and Other Information

The Company is a holding company incorporated under the laws of Bermuda as an exempted company limited by shares on April 29, 2014. Bulk Partners (Bermuda) Ltd., which is wholly owned by the Company, is also a holding company that was incorporated under the laws of Bermuda as an exempted company limited by shares on June 17, 2008, the subsidiaries of which provide seaborne drybulk transportation and ancillary services. The Company owns its vessels through separate wholly-owned subsidiaries and through joint venture entities, which we consolidate as variable interest entities. The Company’s wholly-owned subsidiaries are organized in Bermuda, Denmark, British Virgin Islands, Panama, and Delaware.

The Company’s principal executive headquarters is located at 109 Long Wharf, Newport, Rhode Island 02840, and its phone number at that address is (401) 846-7790. The Company also has offices in Copenhagen, Denmark, Athens, Greece and Singapore. The Company’s corporate website address is http://www.pangaeals.com. The information contained on or accessible from its corporate website is not part of this prospectus.

The Securities We May Offer

We may use this prospectus to offer, through one or more offerings, our common shares, preferred shares, debt securities, warrants, purchase contracts, rights and units. We may also offer securities of the types listed above that are convertible or exchangeable into one or more of the securities listed above. The aggregate offering price of all securities issued and sold by us under this prospectus may not exceed $100,000,000. A prospectus supplement will describe the specific types, amounts, prices, and detailed terms of any of these offered securities and may describe certain risks in addition to those set forth below and associated with an investment in the securities. Terms used in the prospectus supplement will have the meanings described in this prospectus, unless otherwise specified.

RISK FACTORS

An investment in our securities involves a high degree of risk. Before making a decision to invest in our securities, you should consider carefully in their entirety the risk factors in the section entitled “Risk Factors” in our most recent Annual Report on Form 10-K and in our Quarterly Reports on Form 10-Q filed subsequent to such Annual Report on Form 10-K, which are incorporated by reference into this prospectus and any prospectus supplement, as the same may be amended, supplemented, or superseded from time to time by our filings under the Securities Exchange Act of 1934, as amended. This Form S-3 also contains forward-looking statements and estimates that involve risks and uncertainties. In connection with such forward looking statements, you should also carefully review the cautionary statements referred to under “Forward Looking Statements.” Our actual results could differ materially from those anticipated in the forward-looking statements as a result of these risks and risks not known to us or that we currently believe are immaterial.

FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, included in this prospectus and the documents incorporated by reference that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates,” “projects,” “forecasts,” “may,” “should” and similar expressions are forward-looking statements.

All statements in this prospectus that are not statements of either historical or current facts are forward-looking statements. Forward-looking statements include, but are not limited to, such matters as:

|

|

|

|

|

|

|

|

•

|

our future operating or financial results;

|

|

•

|

our ability to charter-in vessels and to enter into COAs, voyage charters, time charters and forward freight agreements and the performance of our counterparties in such contracts;

|

|

•

|

our financial condition and liquidity, including our ability to obtain financing in the future to fund capital expenditures, acquisitions and other general corporate activities;

|

|

•

|

our expectations of the availability of vessels to purchase, the time it may take to construct new vessels, and vessels’ useful lives;

|

|

•

|

competition in the drybulk shipping industry;

|

|

•

|

our business strategy and expected capital spending or operating expenses, including drydocking and insurance costs;

|

|

•

|

global and regional economic and political conditions, including piracy; and

|

|

•

|

statements about shipping market trends, including charter rates and factors affecting supply and demand.

|

Many of these statements are based on our assumptions about factors that are beyond our ability to control or predict and are subject to risks and uncertainties that are described in the section of this prospectus entitled “Risk Factors” and elsewhere in this prospectus. Any of these factors or a combination of these factors could materially affect our future results of operations and the ultimate accuracy of the forward-looking statements. Factors that might cause future results to differ include, but are not limited to, the following:

|

|

|

|

|

|

|

|

•

|

changes in governmental rules and regulations or actions taken by regulatory authorities;

|

|

•

|