Amended Statement of Beneficial Ownership (sc 13d/a)

July 02 2021 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 3)

Overseas Shipholding Group, Inc.

(Name of Issuer)

Class A Common Stock, par value $0.01 per share

(Title of Class of Securities)

69036R863

(CUSIP Number)

●

c/o Saltchuk Resources, Inc.

450 Alaskan Way South, Suite 708

Seattle, Washington 98104

(206) 652-1111

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

June 30, 2021

(Date of Event Which Requires Filing of This Statement)

|

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e),

Rule 13d-1(f) or Rule 13d-1(g), check the following box. ☐

|

|

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7(b) for other

parties to whom copies are to be sent.

|

|

*

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter disclosures provided in a prior cover page.

|

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to

the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

1

|

|

Name of Reporting Person

Saltchuk Resources, Inc.

|

|

2

|

|

Check the Appropriate Box if a Member of a Group

(a) ☒ (b) ☐

|

|

3

|

|

SEC Use Only

|

|

4

|

|

Source of Funds (See Instructions)

WC, BK, OO

|

|

5

|

|

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e)

☐

|

|

6

|

|

Citizenship or Place of Organization

Washington

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH:

|

|

7

|

|

Sole Voting Power

15,203,554

|

|

|

8

|

|

Shared Voting Power

0

|

|

|

9

|

|

Sole Dispositive Power

15,203,554

|

|

|

10

|

|

Shared Dispositive Power

0

|

|

11

|

|

Aggregate Amount Beneficially Owned by Reporting Person

15,203,554

|

|

12

|

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

☐

|

|

13

|

|

Percent of Class Represented by Amount in Row (11)

17.5%1

|

|

14

|

|

Type of Reporting Person

CO

|

1 Calculated based on 86,863,651 shares of Class A common stock, $0.01 par value per share (the “Common Stock”), of Overseas Shipholding Group, Inc. (the “Issuer”),

outstanding as of May 5, 2021, comprised of 86,863,651 shares of Common Stock, and excluding penny warrants exercisable for 3,654,795 shares of Common Stock, as

reported in the Issuer’s Quarterly Report on Form 10-Q, as filed with the Securities and Exchange Commission on May 7, 2021.

|

1

|

|

Name of Reporting Person

|

|

2

|

|

Check the Appropriate Box if a Member of a Group

(a) ☒ (b) ☐

|

|

3

|

|

SEC Use Only

|

|

4

|

|

Source of Funds (See Instructions)

WC, BK, OO

|

|

5

|

|

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e)

☐

|

|

6

|

|

Citizenship or Place of Organization

Washington

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH:

|

|

7

|

|

Sole Voting Power

15,203,554

|

|

|

8

|

|

Shared Voting Power

0

|

|

|

9

|

|

Sole Dispositive Power

15,203,554

|

|

|

10

|

|

Shared Dispositive Power

0

|

|

11

|

|

Aggregate Amount Beneficially Owned by Reporting Person

15,203,554

|

|

12

|

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

☐

|

|

13

|

|

Percent of Class Represented by Amount in Row (11)

17.5%1

|

|

14

|

|

Type of Reporting Person

HC

|

1 Calculated based on 86,863,651 shares of Class A common stock, $0.01 par value per share (the “Common Stock”), of Overseas Shipholding Group, Inc. (the “Issuer”),

outstanding as of May 5, 2021, comprised of 86,863,651 shares of Common Stock, and excluding penny warrants exercisable for 3,654,795 shares of Common Stock, as

reported in the Issuer’s Quarterly Report on Form 10-Q, as filed with the Securities and Exchange Commission on May 7, 2021.

The following constitutes Amendment No. 3 to the Schedule 13D filed by the undersigned (“Amendment No. 3”). This Amendment No. 3 amends the Schedule 13D as specifically set forth herein.

|

Item 2.

|

Identity and Background.

|

This Amendment No. 3 is being jointly filed by Saltchuk Resources, Inc. (“Saltchuk Resources”) and Saltchuk Holdings, Inc., its sole shareholder (together with Saltchuk Resources, the “Reporting

Persons”). The Reporting Persons have entered into a joint filing agreement, dated as of July 1, 2021, a copy of which is attached hereto as Exhibit A.

Item 2 is hereby amended by deleting Schedule I referenced therein and replacing it with Schedules I and II included with this Amendment No. 3.

|

Item 3.

|

Source and Amount of Funds or Other Consideration.

|

Item 3 is hereby amended to add the following:

The Reporting Persons anticipate that approximately $3.00 per share of Common Stock will be expended in acquiring all of the outstanding shares of Common Stock of the Issuer not already owned by the Reporting

Persons. It is anticipated that the funding for the acquisition of the shares would be funded through a combination of equity capital of the Reporting Persons, minority capital provided by third parties, and a

refinancing of the Issuer’s existing debt obligations.

|

Item 4.

|

Purpose of the Transaction.

|

Item 4 is hereby amended and supplemented by the following:

On June 30, 2021, Saltchuk Holdings submitted a preliminary non-binding proposal (the “Proposal”) to the Issuer’s board of directors. In the Proposal, Saltchuk Holdings proposed to acquire all of the outstanding shares of the Issuer not already owned by the Reporting Persons for $3.00 per

share in cash.

Any definitive agreement entered into in connection with the transaction contemplated by the Proposal would be subject to customary closing conditions, including approval by Saltchuk Holdings’ board

of directors and applicable regulatory authorities. No assurance can be given that any definitive agreement will be entered into, that the transaction contemplated by the Proposal will be consummated, or that the transaction will be consummated

on the terms set forth in the Proposal.

If the transaction contemplated by the Proposal is consummated, the Common Stock of the Issuer would be eligible for termination of registration under the Securities Exchange Act of 1934 and

delisting from the New York Stock Exchange.

The descriptions of the Proposal in this Item 4 are not intended to be complete and are qualified in their entirety by reference to the Proposal, a copy of which is attached hereto as Exhibit B and

incorporated herein by reference in its entirety.

Except as indicated above, the Reporting Persons have no plans or proposals which relate to or would result in any of the actions specified in paragraphs (a) through (j) of Item 4 of Schedule 13D.

The Reporting Persons may, at any time and from time to time, formulate other purposes, plans or proposals regarding the Issuer, or any other actions that could involve one or more of the types of transactions or have one or more of the results

described in paragraphs (a) through (j) of Item 4 of Schedule 13D.

|

Item 5.

|

Interest in Securities of the Issuer.

|

Each of Item 5(a), (b) and (c) is hereby amended and restated in its entirety as follows:

The Reporting Persons may be deemed to beneficially own 15,203,554 shares of Common Stock of the Issuer. Based upon information contained in the Issuer’s Quarterly Report on Form 10-Q,

as filed with the Securities and Exchange Commission on May 7, 2021, the shares of Common Stock deemed to be beneficially owned by the Reporting Persons constitute approximately 17.5% of the issued and outstanding shares of Common Stock of the Issuer. The Reporting Persons have sole voting power and sole dispositive power with respect to the 15,203,554 shares of Common

Stock.

None of the persons listed on Schedule I or II hereto have effected transactions in the Common Stock of the Issuer within the past 60 days.

Except as disclosed herein, none of the Reporting Persons or, to their knowledge, any of the persons listed in Schedule I or II hereto, beneficially owns any shares of the Issuer or has the right to acquire any

shares of the Issuer.

Except as disclosed herein, none of the Reporting Persons or, to their knowledge, any of the persons listed in Schedule I or II hereto, presently has the power to vote or to direct the vote or to dispose or direct the disposition of any

shares of the Issuer that they may be deemed to beneficially own.

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

|

Item 6 of the Original Schedule 13D is hereby amended and supplemented by the following:

The descriptions of the principal terms of the Proposal under Item 4 are incorporated herein by reference in their entirety.

|

Item 7.

|

Material to be Filed as Exhibits

|

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: July 1, 2021

|

|

SALTCHUK RESOURCES, INC.

|

|

|

|

|

|

/s/ Steven E. Giese

|

|

|

By: Steven E. Giese

Title: Senior V.P. and CFO

|

|

|

|

|

|

|

|

|

|

|

|

SALTCHUK HOLDINGS, INC.

|

|

|

|

|

|

/s/ Steven E. Giese

|

|

|

By: Steven E. Giese

Title: Senior V.P. and CFO

|

|

|

|

|

|

|

Schedule I

|

SALTCHUK RESOURCES, INC.

|

|

|

|

Directors and

Executive Officers

|

|

|

|

|

Name

|

Position with Reporting Person

|

Citizenship

|

Principal Occupation

|

|

Mark N. Tabbutt

|

President and Chairman; Director

|

United States

|

*

|

|

Steven E. Giese

|

Senior Vice President, Chief Financial Officer & Secretary; Director

|

United States

|

*

|

|

Trevor Parris

|

Vice President, Finance & Treasurer

|

United States

|

*

|

|

Colleen Rosas

|

Senior Vice President Human Resources; Director

|

United States

|

*

|

|

Shannon Girlando

|

Vice President & Controller

|

United States

|

*

|

|

Christopher A. Coakley

|

Vice President of Government Affairs

|

United States

|

*

|

|

Trevor Parris

|

Vice President, Finance & Treasurer

|

United States

|

*

|

|

Christi Harris

|

Vice President, Information Technology

|

United States

|

*

|

|

|

|

|

|

* The present principal occupation for each of these individuals is executive officer and/or director of the Reporting Person and the address for each of these individuals is c/o Saltchuk Resources, Inc., 450 Alaskan Way

South, Suite 708, Seattle, Washington 98104.

Schedule II

|

SALTCHUK HOLDINGS, INC.

|

|

|

|

Executive Officers

|

|

|

|

|

Name

|

Position with Reporting Person

|

Citizenship

|

Principal Occupation

|

|

Mark N. Tabbutt

|

President and Chairman; Director

|

United States

|

*

|

|

Steven E. Giese

|

Senior Vice President, Chief Financial Officer & Secretary

|

United States

|

*

|

|

|

Senior Vice President, Human Resources

|

United States

|

*

|

|

|

Vice President & Controller

|

United States

|

*

|

|

Christopher A. Coakley

|

Vice President of Government Affairs

|

United States

|

*

|

|

|

Vice President, Finance & Treasurer

|

United States

|

*

|

|

Christi Harris

|

Vice President, Information Technology

|

United States

|

*

|

|

|

|

|

|

|

Director

|

|

|

|

|

Name

|

Position with Reporting

Person

|

Citizenship

|

Principal Occupation

|

Mark N. Tabbutt

|

President and Chairman; Director

|

United States

|

*

|

|

Timothy B. Engle

|

Director

|

United States

|

**

|

|

Daniel Stuart Fulton

|

Director

|

United States

|

Retired CEO of Weyerhaeuser Company, a forest products company located at 220 Occidental Avenue South, Seattle, WA 98104

|

|

Leslie Paul Goldberg

|

Director

|

United States

|

Founder & CEO of Pure Audio, an audio recording and production company located at 1151 Fairview Ave North, Unit #103, Seattle, WA 98109

|

|

Stein Kruse

|

Director

|

Norway

|

CEO of Holland America Group, a cruise ship company located at 450 3rd Avenue West, Seattle, WA 98119

|

|

Susan Mullaney

|

Director

|

United States

|

President of Kaiser Permanente Washington, a nonprofit health plan organization located at 601 Union Street, Suite 3100, Seattle WA 98101

|

|

Nicole Piasecki

|

Director

|

United States

|

Retired Vice President and General Manager of the Propulsion Systems Division of Boeing, a commercial aircraft company located at 100 North Riverside Plaza, Chicago, IL 60606

|

|

Denise G. Tabbutt

|

Director

|

United States

|

**

|

|

Mark Sterrett

|

Director

|

United States

|

Principal at Makai Advisory Services, a financial advisory firm for mid-cap sized businesses headquartered in the Pacific Northwest, located at 601 Union St, Ste 2600, Seattle, WA 98101

|

|

Brandon Pedersen

|

Director

|

United States

|

Retired Chief Financial Officer of Alaska Airlines, an airline.**

|

|

|

|

|

|

* The present principal occupation for each of these individuals is executive officer and/or director of the Reporting Person and the address for each of these individuals is c/o Saltchuk Resources, Inc., 450 Alaskan Way

South, Suite 708, Seattle, Washington 98104.

** The present business address for this individual is c/o Saltchuk Resources, Inc., 450 Alaskan Way South, Suite 708, Seattle, Washington 98104.

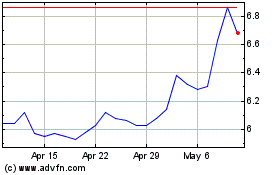

Overseas Shipholding (NYSE:OSG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Overseas Shipholding (NYSE:OSG)

Historical Stock Chart

From Apr 2023 to Apr 2024