Filed Pursuant to Rule 424(b)(5)

Registration No. 333-240265

Prospectus Supplement

(To Prospectus dated August 12, 2020)

8,900,000 Common Shares

Warrants to Purchase up to 10,000,000 Common

Shares

Pre-Funded Warrants to Purchase up to 1,100,000

Common Shares

Globus Maritime Limited

We are offering 8,900,000

of our common shares, par value $0.004 per share, and warrants to purchase up to 10,000,000 common shares, which we refer to in this prospectus

supplement as the “Purchase Warrants,” pursuant to this prospectus supplement and the accompanying prospectus, directly to

a small number of institutional investors. Each common share is being sold to each investor together with a Purchase Warrant to purchase

one additional common share. The exercise price of each Purchase Warrant will equal $5.00 per share. Each Purchase Warrant will be immediately

exercisable for a five and a half year period after the date of issuance. Our common shares and the Purchase Warrants will be issued separately,

but will be purchased together in this offering.

We are also offering pre-funded

warrants to purchase an aggregate of 1,100,000 common shares, or the “Pre-Funded Warrants,” in lieu of common shares. Each

Pre-Funded Warrant exercisable to purchase one common share is being sold together with a Purchase Warrant to purchase one common share.

The purchase price of each Pre-Funded Warrant and accompanying Purchase Warrant is equal to the price at which a common share and accompanying

Purchase Warrant is sold in this offering, minus $0.01, and the exercise price of each Pre-Funded Warrant is $0.01 per share. The Pre-Funded

Warrants are immediately exercisable and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. In this

prospectus supplement, we refer to the Purchase Warrants and the Pre-Funded Warrants together as the “Warrants.” This prospectus

supplement also relates to the offering of common shares issuable upon exercise of such Warrants.

Our

common shares are listed on The Nasdaq Capital Market, or Nasdaq, under the symbol “GLBS.” There is no established

trading market for any of the Warrants, and we do not expect a market to develop. We do not intend to apply for a listing for any of the

Warrants on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of

the Warrants will be limited.

Investing

in our common shares involves a high degree of risk. See “Risk Factors” beginning on page S-7 of this prospectus

supplement and page 4 of the accompanying prospectus and in our annual report on Form 20-F for the fiscal year ended December 31, 2020,

which is incorporated by reference herein, to read about the risks you should consider before purchasing our common shares.

We have retained Maxim Group

LLC (whom we refer to herein as the Placement Agent) as our exclusive placement agent to use its reasonable best efforts to solicit offers

to purchase our common shares in this offering. The Placement Agent is not selling any of our common shares pursuant to this prospectus

supplement or the accompanying prospectus. We expect that delivery of our common shares being offered pursuant to this prospectus supplement

will be made to the investors in this offering on or about June 29, 2021, subject to customary closing conditions.

|

|

|

Per Share and Accompanying Purchase Warrant

|

|

|

Per Pre-Funded Warrant and Accompanying Purchase Warrant

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

5.00

|

|

|

|

4.99

|

|

|

$

|

49,989,000

|

|

|

Placement Agent’s fees (1)

|

|

$

|

0.35

|

|

|

|

0.35

|

|

|

$

|

3,408,125

|

|

|

Proceeds, before expenses, to the Company

|

|

$

|

4.65

|

|

|

|

4.64

|

|

|

$

|

46,580,875

|

|

|

|

(1)

|

We have agreed to compensate the Placement Agent by paying them a cash fee equal to a percentage of the

gross proceeds from this offering (and to include the amounts payable upon exercise of the Pre-Funded Warrants in calculating such fee).

If we had a pre-existing relationship with an investor in this offering prior to the public offering consummated by the Company pursuant

to that certain Underwriting Agreement dated June 18, 2020, then we have agreed to pay the Placement Agent a cash fee equal to 3.5% of

the funds received by us from such investors, or $0.175 per share (or Pre-Funded Warrant) and accompanying purchase warrant, but if we

did not have such a pre-existing relationship, then we have agreed to pay the Placement Agent a cash fee to 7.0% of the funds received

by us from such investors with whom we did not have a pre-existing relationship, or $0.35 per share (or Pre-Funded Warrant) and accompanying

purchase warrant. In addition, we have agreed to pay certain expenses and advances of the Placement Agent, as discussed under “Plan

of Distribution.”

|

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy

or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

MAXIM GROUP LLC

The date of this prospectus supplement is June

25, 2021

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

Page

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement

and the accompanying prospectus are part of a registration statement that we filed with the Commission utilizing a “shelf”

registration process. This document is in two parts. The first part is this prospectus supplement, which describes the specific terms

of this offering and the securities offered hereby and also adds to and updates information contained in the accompanying prospectus and

the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. The second part, the accompanying

base prospectus, gives more general information and disclosure about the securities we may offer from time to time, some of which does

not apply to this offering of common shares. When we refer to the prospectus, we are referring to both parts combined, and when we refer

to the accompanying prospectus, we are referring to the base prospectus.

If the description of this

offering varies between this prospectus supplement and the accompanying prospectus, you should rely on the information in this prospectus

supplement. This prospectus supplement, the accompanying prospectus, any free writing prospectus and the documents incorporated into each

by reference include important information about us and the common shares being offered and other information you should know before investing.

You should read this prospectus supplement and the accompanying prospectus together with the additional information described under the

heading, “Where You Can Find Additional Information” in this prospectus supplement and the accompanying prospectus before

investing in our common shares.

Any statement made in this

prospectus or in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified

or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus supplement or in any other subsequently

filed document that is also incorporated by reference into this prospectus modifies or supersedes that statement. Any statement so modified

or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

You should rely only on the

information contained in or incorporated by reference in this prospectus supplement, the accompanying prospectus and any free writing

prospectus. We have not authorized anyone to provide you with information that is different from the foregoing. If anyone provides you

with different or inconsistent information, you should not rely on it. We are offering to sell our securities only in jurisdictions where

offers and sales are permitted. You should not assume that the information contained in this prospectus supplement, the accompanying prospectus,

any free writing prospectus or incorporated by reference in this prospectus supplement or the accompanying prospectus is accurate as of

any date other than the date of such document. Our business, financial condition, results of operations and prospects may have changed

since those dates.

Unless otherwise indicated,

all references to “$” and “dollars” in this prospectus supplement are to United States dollars, and financial

information presented in this prospectus is derived from financial statements that are incorporated by reference and were prepared in

accordance with International Financial Reporting Standards (IFRS). We have a fiscal year end of December 31.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus supplement

includes “forward-looking statements,” as defined by U.S. federal securities laws, with respect to our financial condition,

results of operations and business and our expectations or beliefs concerning future events. Forward-looking statements provide our current

expectations or forecasts of future events. Forward-looking statements include statements about our expectations, beliefs, plans, objectives,

intentions, assumptions and other statements that are not historical facts or that are not present facts or conditions. Forward-looking

statements and information can generally be identified by the use of forward-looking terminology or words, such as “anticipate,”

“approximately,” “believe,” “continue,” “estimate,” “expect,” “forecast,”

“intend,” “may,” “ongoing,” “pending,” “perceive,” “plan,” “potential,”

“predict,” “project,” “seeks,” “should,” “views” or similar words or phrases

or variations thereon, or the negatives of those words or phrases, or statements that events, conditions or results “can,”

“will,” “may,” “must,” “would,” “could” or “should” occur or be

achieved and similar expressions in connection with any discussion, expectation or projection of future operating or financial performance,

costs, regulations, events or trends. The absence of these words does not necessarily mean that a statement is not forward-looking. Forward-looking

statements and information are based on management’s current expectations and assumptions, which are inherently subject to uncertainties,

risks and changes in circumstances that are difficult to predict.

The forward-looking statements

in this prospectus supplement are based upon various assumptions, many of which are based, in turn, upon further assumptions, including

without limitation, management’s examination of historical operating trends, data contained in our records and other data available

from third parties. Although we believe that these assumptions were reasonable when made, because these assumptions are inherently subject

to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, we cannot assure

you that we will achieve or accomplish these expectations, beliefs or projections. As a result, you are cautioned not to rely on any forward-

looking statements.

In addition to these important

factors and matters discussed elsewhere herein and in the documents incorporated by reference herein, important factors that, in our view,

could cause actual results to differ materially from those discussed in the forward-looking statements include among other things:

|

|

·

|

changes in shipping industry trends, including charter rates, vessel values and factors affecting vessel

supply and demand;

|

|

|

·

|

changes in seaborne and other transportation patterns;

|

|

|

·

|

changes in the supply of or demand for dry bulk commodities, including dry bulk commodities carried by

sea, generally or in particular regions;

|

|

|

·

|

the inability or unwillingness of counterparties to deliver ships to us that we have contracted to purchase;

|

|

|

·

|

the strength of world economies;

|

|

|

·

|

the stability of Europe and the Euro;

|

|

|

·

|

fluctuations in interest rates and foreign exchange rates;

|

|

|

·

|

changes in the number of newbuildings under construction in the dry bulk shipping industry;

|

|

|

·

|

changes in the useful lives and the value of our vessels and the related impact on our compliance with

loan covenants;

|

|

|

·

|

the aging of our fleet and increases in operating costs;

|

|

|

·

|

changes in our ability to complete future, pending or recent acquisitions or dispositions;

|

|

|

·

|

changes to our financial condition and liquidity, including our ability to pay amounts that we owe and

obtain additional financing to fund capital expenditures, acquisitions and other general corporate activities;

|

|

|

·

|

risks related to our business strategy, areas of possible expansion or expected capital spending or operating

expenses;

|

|

|

·

|

changes in the availability of crew, number of off-hire days, classification survey requirements and insurance

costs for the vessels in our fleet;

|

|

|

·

|

changes in our relationships with our contract counterparties, including the failure of any of our contract

counterparties to comply with their agreements with us;

|

|

|

·

|

loss of our customers, charters or vessels;

|

|

|

·

|

potential liability from future litigation and incidents involving our vessels;

|

|

|

·

|

our future operating or financial results;

|

|

|

·

|

our ability to continue as a going concern;

|

|

|

·

|

acts of terrorism, other hostilities, pandemics or other calamities (including, without limitation, the

ongoing worldwide COVID-19 outbreak);

|

|

|

·

|

risks associated with the length and severity of the ongoing COVID-19 outbreak, including its effects

on demand for dry bulk products, crew changes and the transportation thereof;

|

|

|

·

|

changes in global and regional economic and political conditions;

|

|

|

·

|

volatility in the market price of our common shares;

|

|

|

·

|

our ability to continue as a going concern;

|

|

|

·

|

potential exposure or loss from investment in derivative instruments;

|

|

|

·

|

potential conflicts of interest involving our Chief Executive Officer, the Chairman of our board of directors,

or their family and other members of our senior management;

|

|

|

·

|

changes in governmental rules and regulations or actions taken by regulatory authorities, particularly

with respect to the dry bulk shipping industry; and

|

|

|

·

|

other factors listed from time to time in this prospectus supplement, registration statements, reports

or other materials that we have filed with or furnished to the Commission, including our most recent annual report on Form 20-F, which

is incorporated by reference into this prospectus supplement.

|

These factors could cause

actual results or developments to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable

factors also could harm our results or developments. Consequently, there can be no assurance that actual results or developments anticipated

by us will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, us. Given

these uncertainties, prospective investors are cautioned not to place undue reliance on such forward-looking statements.

We undertake no obligation

to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except

as required by law. If one or more forward-looking statements are updated, no inference should be drawn that additional updates will be

made with respect to those or other forward-looking statements.

ENFORCEABILITY OF CIVIL LIABILITIES

We a Republic of the Marshall

Islands corporation and our principal executive offices are located outside the United States. The majority of the directors, officers

and our independent registered public accounting firm reside outside the United States. In addition, substantially all of our assets and

the assets of certain of our directors, officers and our independent registered public accounting firm are located outside the United

States. As a result, it may not be possible for you to serve legal process within the United States upon us or any of these persons. It

may also not be possible for you to enforce, both in and outside the United States, judgments you may obtain in United States courts against

us or these persons in any action, including actions based upon the civil liability provisions of U.S. federal or state securities laws.

Furthermore, there is substantial

doubt that courts of such jurisdictions would enforce judgments of U.S. courts obtained in actions against us, our directors or officers

and such experts based upon the civil liability provisions of applicable U.S. federal and state securities laws or would enforce, in original

actions, liabilities against us, our directors or officers and such experts based on those laws.

SUMMARY

This summary highlights

certain information that appears elsewhere in this prospectus supplement or in documents incorporated by reference herein, and this summary

is qualified in its entirety by that more detailed information. This summary may not contain all of the information that may be important

to you. We urge you to carefully read this entire prospectus supplement, the accompanying prospectus and the documents incorporated by

reference herein and therein, including our financial statements and the related notes and the information in the section entitled “Management’s

Discussion and Analysis of Financial Condition and Results of Operations.” As an investor or prospective investor, you should also

review carefully the sections entitled “Cautionary Statement Regarding Forward-Looking Statements” and “Risk Factors”

in this prospectus supplement, the accompanying prospectus and in our annual report on Form 20-F for the year ended December 31, 2020,

which is incorporated by reference herein.

Unless the context otherwise

requires, as used in this prospectus supplement, the terms “Company”, “Globus”, “we”, “us”,

and “our” refer to Globus Maritime Limited and all of its subsidiaries, and “Globus Maritime Limited” refers only

to Globus Maritime Limited and not to its subsidiaries. We use the term deadweight ton, or dwt, in describing the size of our vessels.

Dwt, expressed in metric tons each of which is equivalent to 1,000 kilograms, refers to the maximum weight of cargo and supplies that

a vessel can carry. Our reporting currency is the U.S. dollar and all references in this prospectus to “$” or “dollars”

are to U.S. dollars and financial information presented in this prospectus is derived from the financial statements incorporated by reference

in this prospectus that were prepared in accordance with international financial reporting standards, or IFRS.

Overview

We are an integrated international

owner and operator of dry bulk vessels, focusing on the Panamax, Kamsarmax, and Supramax sectors, providing marine transportation services

on a worldwide basis. We currently own seven dry bulk vessels consisting of one Panamax, two Kamsarmaxes and four Supramaxes. In addition,

we are under contract to acquire an additional Kamsarmax dry bulk vessel. The weighted average age of the vessels we own (excluding the

additional ship that we have agreed to acquire) had an average age of 10.2 years as of June 23, 2021, and their carrying capacity is 463,765

dwt. We own each of our vessels through separate, wholly owned subsidiaries, one of which is incorporated in Malta, and the rest of which

are incorporated in the Marshall Islands. All of our Supramax vessels are geared. Geared vessels can operate in ports with minimal shore-side

infrastructure. Due to the ability to switch between various dry bulk cargo types and to service a wider variety of ports, the day rates

for geared vessels tend to have a premium. Our vessels can carry the majority of dry bulk commodities such as, coal, finished steel products,

as well as minerals such as, iron ore, chromium ore, and nickel ore. In addition, we are also engaged in the carriage of agribulks such

as grains, soy bean, rice, and sugar. Our fleet operates on a worldwide basis with presence in both the Pacific and Atlantic oceans.

Our operations are managed

by our Attica, Greece-based wholly owned subsidiary, Globus Shipmanagement Corp., which we refer to as our Manager, which provides in-house

commercial and technical management for our vessels and provided consulting services for an affiliated ship-management company. Our Manager

has entered into a ship management agreement with each of our wholly owned vessel-owning subsidiaries. Virtually all aspects of our vessels

are managed in-house including managing day-to-day vessel operations, such as supervising the crewing, supplying, maintaining of vessels

and other services. We believe that by having these critical management functions in-house provides efficiency, fast reaction times, good

communication among departments and effective cost management.

We intend to grow our fleet

through timely and selective acquisitions of modern vessels in a manner that we believe will provide an attractive return on equity and

will be accretive to our earnings and cash flow based on anticipated market rates at the time of purchase. Additionally, we may target

asset divestitures in line with our strategy as we look to grow and modernize our fleet. There is no guarantee however, that we will be

able to find suitable vessels to purchase or that such vessels will provide an attractive return on equity or be accretive to our earnings

and cash flow.

Our company was incorporated

in 2006 in Jersey, and in 2010 we redomiciled into the Republic of the Marshall Islands.

Our Fleet

Employment of our Fleet

Our long-term strategy to maximize the value of

our fleet is to employ our vessels on a mix of all types of charter contracts, including in the spot market and on bareboat charters and

time charters. We believe this strategy provides the cash flow stability, reduced exposure to market downturns and high utilization rates

of the charter market, while at the same time enabling us to benefit from periods of increasing spot market rates. But our short-term

strategy at any given point in time is dictated by a multitude of factors and the chartering opportunities before us. We may, for example,

seek to employ a greater portion of our fleet on the spot market or on time charters with longer durations, should we believe it to be

in our best interests. We generally prefer spot or short term contracts in order to be versatile, to be able to move quickly to capture

a market upswing, and to be more selective with the cargos we carry. Long term charters, however, provide desirable cash flow stability,

albeit at the cost of missing upswings in cargo rates. Accordingly, our mix between spot charters and longer-term charters changes from

time-to-time.

When our ships are not all on the spot market,

we generally seek to stagger the expiration dates of our charters to reduce exposure to volatility in the shipping cycle when our vessels

come off of charter. We also continually monitor developments in the dry bulk shipping industry and, subject to market demand, will adjust

the number of vessels on charters and the charter periods for our vessels according to market conditions.

We and our Manager have developed relationships

with a number of international charterers, vessel brokers, financial institutions, insurers and shipbuilders. We have also developed a

network of relationships with vessel brokers who help facilitate vessel charters and acquisitions.

Our Current Fleet

|

Vessel

|

|

Year Built

|

|

Flag

|

|

Direct Owner

|

|

Shipyard

|

|

Vessel Type

|

|

Type of

Employment

|

|

Delivery Date

|

|

Carrying

Capacity

(dwt)

|

|

|

m/v River Globe

|

|

2007

|

|

Marshall Islands

|

|

Devocean Maritime

Ltd.

|

|

Yangzhou Dayang

|

|

Supramax

|

|

Spot

|

|

December 2007

|

|

|

53,627

|

|

|

m/v Sky Globe

|

|

2009

|

|

Marshall Islands

|

|

Domina Maritime

Ltd.

|

|

Taizhou Kouan

|

|

Supramax

|

|

Spot

|

|

May 2010

|

|

|

56,855

|

|

|

m/v Star Globe

|

|

2010

|

|

Marshall Islands

|

|

Dulac Maritime S.A.

|

|

Taizhou Kouan

|

|

Supramax

|

|

Spot

|

|

May 2010

|

|

|

56,867

|

|

|

m/v Moon Globe

|

|

2005

|

|

Marshall Islands

|

|

Artful

Shipholding S.A.

|

|

Hudong-Zhonghua

|

|

Panamax

|

|

Spot

|

|

June 2011

|

|

|

74,432

|

|

|

m/v Sun Globe

|

|

2007

|

|

Malta

|

|

Longevity Maritime Limited

|

|

Tsuneishi Cebu

|

|

Supramax

|

|

Spot

|

|

September 2011

|

|

|

58,790

|

|

|

m/v Galaxy Globe

|

|

2015

|

|

Marshall Islands

|

|

Serena Maritime Limited

|

|

Hudong-Zhonghua

|

|

Kamsarmax

|

|

Spot

|

|

October 2020

|

|

|

81,167

|

|

|

m/v Diamond Globe

|

|

2018

|

|

Marshall Islands

|

|

Argo Maritime Limited

|

|

Jiangsu New Yangzi Shipbuilding Co.

|

|

Kamsarmax

|

|

Spot

|

|

June 2021

|

|

|

82,027

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ave. Age:

10.2*

|

|

|

Total dwt: 463,765

|

|

*As of June 23, 2021

Our fleet is currently comprised

of a total of seven dry bulk vessels consisting of one Panamax, two Kamsarmaxes and four Supramaxes. In addition, we are under contract

to acquire an additional Kamsarmax dry bulk vessel. The weighted average age of the vessels we own (excluding the additional ship that

we have agreed to acquire) had an average age of 10.2 years as of June 23, 2021, and their carrying capacity is 463,765 dwt.

M/V Sky Globe, Star Globe,

River Globe, Sun Globe are Supramax vessels that primarily trade in the Far East, Indian Ocean, South America and the Persian Gulf. The

vessels are engaged in the coal, ore and agribulk trades.

M/V Moon Globe is a Panamax

and trades primarily in the East Coast of South America, the Far East and the Mediterranean. The vessel is primarily engaged in ore and

agribulk trading.

M/V Galaxy Globe and Diamond

Globe are Kamsarmax vessels and are fixed on charter that sail worldwide.

All

the above-mentioned vessels are operating in the spot market or on short period charters (under 12 months long).

Recent Developments

On May 7, 2021, we announced

that we entered into a term loan facility with CIT Bank, N.A., relating to the refinancing of, and secured by, six of our ships, the River

Globe, Sky Globe, Star Globe, Moon Globe, Sun Globe, and Galaxy Globe. The loan agreement was for the lesser of $34,250,000 and 52.5%

of the aggregate market value of our ships. We drew an aggregate of $34,250,000 at closing and used a significant portion of the proceeds

to fully repay the amounts outstanding under our loan agreement with EnTrust. We also entered into a swap agreement with respect to LIBOR

and paid CIT Bank an upfront fee in the amount of 1.25% of the total commitment of the loan.

On March 23, 2021, we announced

the contract to acquire a 2018-built “Eco” (i.e., with certain fuel efficiency design features) Kamsarmax vessel built by

the Jiangsu New Yangzi Shipbuilding yard, for $27 million. We took delivery of the vessel, which we renamed m/v Diamond Globe, in June

2021.

In March 2021, we

entered into a stock purchase agreement and issued 10,000 of our Series B Preferred Shares, par value $0.001 per share, to

Goldenmare Limited, a company controlled by our Chief Executive Officer, Athanasios Feidakis, in return for $130,000, which amount

was settled by reducing, on a dollar for dollar basis, the amount payable by the Company to Goldenmare Limited pursuant to a

consultancy agreement. The issuance of the Series B preferred shares to Goldenmare Limited was approved by an independent committee

of the Board of Directors of the Company, which received a fairness opinion from an independent financial advisor that the

transaction was for a fair value.

On February 18, 2021, we announced

the contract to acquire a 2011-built Kamsarmax vessel built by the Universal Shipbuilding Corporation, Japan. We have not yet taken delivery

of this vessel, and the delivery and contract is subject to customary closing conditions. The price for the vessel is $16.5 million if

the ship is delivered on or before May 31, 2021 and $16.2 million if the ship is delivered between June 1, 2021 and August 15, 2021, with

the date of delivery to be determined by the seller.

On February 12, 2021, we entered

into a securities purchase agreement with certain unaffiliated institutional investors to issue in a registered direct offering 3,850,000

of our common shares, pre-funded warrants to purchase 950,000 Common Shares, and common share purchase warrants (the “February 2021

Warrants”) to purchase 4,800,000 Common Shares with an exercise price of $6.25 per share, which may be exercised at any time prior

to 5:00 PM New York time on August 17, 2026. The pre-funded warrants were all exercised prior to the date of this prospectus. No February

2021 Warrants have been exercised as of the date hereof.

On January 27, 2021, we entered

into a securities purchase agreement with certain unaffiliated institutional investors to issue (a) 2,155,000 common shares, (b) pre-funded

warrants to purchase 445,000 common shares, and (c) warrants (the “January 2021 Warrants”) to purchase 1,950,000 common shares

at an exercise price of $6.25 per share, which may be exercised at any time prior to 5:00 PM New York time on July 29, 2026. The pre-funded

warrants were all exercised prior to the date of this prospectus. No January 2021 Warrants have been exercised as of the date hereof.

Corporate Information

We originally incorporated

as Globus Maritime Limited on July 26, 2006 pursuant to the Companies (Jersey) Law 1991 (as amended) and re-domiciled into the Marshall

Islands on November 24, 2010. Our registered address is Ajeltake Road, Ajeltake Island, Majuro, Marshall Islands MH 96960. Our registered

agent in the Republic of the Marshall Islands is The Trust Company of the Marshall Islands, Inc., Trust Company Complex, Ajeltake Road,

Ajeltake Island, Majuro, Marshall Islands MH 96960. Our principal executive office is located at 128 Vouliagmenis Avenue, 3rd Floor,

166 74 Glyfada, Attica, Greece. Our telephone number is +30 210 960 8300. Our corporate website address is http://www.globusmaritime.gr.

The information contained on or accessed through our website does not constitute part of, and is not incorporated into, this prospectus.

The Commission maintains a website that contains reports, proxy and information statements, and other information that we and other issuers

file electronically at http://www.sec.gov.

THE OFFERING

|

Issuer

|

Globus Maritime Limited

|

Common shares outstanding as of the

date of this prospectus supplement

|

10,574,135 common shares

|

|

Common Shares offered by us

|

8,900,000 common shares

|

|

Purchase Warrants offered by us

|

We are also offering Purchase Warrants to purchase up to 10,000,000 common shares. The exercise price of each Purchase Warrant will be $5.00 per share. Each Purchase Warrant will be immediately exercisable for a 5.5 year period after the date of issuance. This prospectus supplement also relates to the offering of the common shares issuable upon exercise of such Purchase Warrants. See “Description of Securities We Are Offering” for a discussion on the terms of the Purchase Warrants.

|

|

Pre-Funded Warrants offered by us

|

In lieu of common shares, we are also offering Pre-Funded Warrants to purchase up to 1,100,000 common shares to certain investors whose purchase of shares in this offering would otherwise result in the institutional investor, together with its affiliates, beneficially owning more than 4.99% (or, upon election by the investor prior to the issuance of any Warrants or Pre-Funded Warrants, 9.99%) of the number of Common Shares outstanding (the “Beneficial Ownership Maximum”). The purchase price of each Pre-Funded Warrant is equal to the price at which the share of common stock is being sold in this offering, minus $0.01, and the exercise price of each Pre-Funded Warrant is $0.01 per share. The Pre-Funded Warrants are exercisable immediately and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. This offering also relates to the shares of common stock issuable upon exercise of the Pre-Funded Warrants sold in this offering. See “Description of Securities We Are Offering” for a discussion on the terms of the Pre-Funded Warrants.

|

|

Common Shares outstanding after this offering(1)

|

20,574,135 common shares (assuming the full exercise of the Pre-Funded Warrants and before exercise of any Purchase Warrants).

|

|

Trading Market

|

Our common shares are listed on the Nasdaq Capital Market under the symbol “GLBS.” There is no established public trading market for the Purchase Warrants or the Pre-Funded Warrants, which we collectively call the Warrants, and we do not expect a market to develop. We do not intend to apply for listing of the Warrants on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the Warrants will be limited.

|

|

Use of Proceeds

|

We intend to use all of the net proceeds of this offering for general corporate purposes which may include, among other things, prepaying debt or partially funding the acquisition of modern dry bulk vessels in accordance with our growth strategy. However, we do not currently have definitive plans for any debt prepayments nor have we identified any potential acquisitions (other than the contract to acquire a 2011-built Kamsarmax described above that we announced on February 18, 2021), and we can provide no assurance that we will be able to complete any debt prepayment or the acquisition of any vessel that we are able to identify. We expect that the net proceeds of this offering will be approximately $46.4 million net of the Placement Agent’s fees and other estimated offering expenses.

|

|

Risk factors

|

See “Risk Factors” beginning on page S-7 of this prospectus

supplement, as well as the other information included in or incorporated by reference in this prospectus supplement and the

accompanying base prospectus, for a discussion of risks you should carefully consider before investing in our securities.

|

(1) The number of our common

shares that will be outstanding immediately after this offering as shown above excludes the common shares issuable on exercise of the

Purchase Warrants being offered in this Offering and:

|

|

·

|

388,700 common shares issuable upon the exercise of outstanding Class A Warrants (at an exercise price of

$35 per share) which expire in June 2025;

|

|

|

·

|

458,500 common shares issuable upon exercise of the warrants (at an exercise price of $18 per share) issued

in a private placement that closed on June 30, 2020 which expire in December 2025 (the “June PP Warrants”);

|

|

|

·

|

833,333 common shares issuable upon exercise of the warrants (at an exercise price of at $18 per share)

issued in a private placement that closed on July 21, 2020 which expire in January 2026 (the “July PP Warrants”);

|

|

|

·

|

1,270,587 common shares issuable upon exercise of the warrants (at an exercise price of $6.25 per share)

which expire in June 2026 (the “December 2020 Warrants”);

|

|

|

·

|

1,950,000 common shares issuable upon the exercise of the January 2021 Warrants (at an exercise price of

$6.25 per share) which expire in July 2026;

|

|

|

·

|

4,800,000 common shares issuable upon the exercise of the February 2021 Warrants (at an exercise price of

$6.25 per share) which expire in August 2026.

|

SELECTED HISTORICAL CONSOLIDATED FINANCIAL

DATA

The following tables set forth

certain selected consolidated financial and operating data. The selected consolidated financial data as of and for the years ended December

31, 2020, 2019, 2018, 2017, and 2016 are derived from our audited consolidated financial statements, which have been prepared in accordance

with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB. The data

set forth below should be read in conjunction with “Item 5. Operating and Financial Review and Prospects” and our

audited consolidated financial statements, related notes and other financial information included elsewhere in our annual report on Form

20-F for the year 2020, which is incorporated herein by reference and in our annual reports for the years 2019 and 2018. The data for

the years 2016 and 2017 are included in prior year annual reports on Form 20-F. The unaudited historical

data for the three month period ended March 31, 2021 is derived from our condensed consolidated financial statements, which are incorporated

by reference herein from our Report on Form 6-K reporting operating results for the three month period ended March 31, 2021, filed with

the SEC on June 22, 2021. Results of operations in any period are not necessarily indicative of results in any future period. The

information set forth below should also be read in conjunction with “Capitalization.”

On

October 20, 2016, we effected a four-for-one reverse stock split which reduced the number of outstanding common shares from 10,510,741

to 2,627,674 shares (adjustments were made based on fractional shares). On October 15, 2018, we effected a ten-for-one reverse stock split

which reduced the number of outstanding common shares from 32,065,077 to 3,206,495 shares (adjustments were made based on fractional shares).

On October 21, 2020, we effected a 100-for-one reverse stock split which reduced the number of outstanding common shares from 175,675,671

to 1,756,720 shares (adjustments were made based on fractional shares). As a result of these reverse stock splits, there was no change

in the number of authorized shares or the par value of our common shares. All share and per share amounts disclosed herein give effect

to these reverse stock splits retroactively, for all periods presented, unless otherwise noted.

|

|

|

Three months ended March 30,

|

|

Year Ended December 31,

|

|

|

|

(Expressed in Thousands of U.S. Dollars, except per share data)

|

|

|

|

2021

|

|

2020

|

|

2019

|

|

2018

|

|

2017

|

|

2016

|

|

Consolidated Statement of comprehensive loss

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Voyage revenues(1)

|

|

5,167

|

|

11,753

|

|

15,623

|

|

17,354

|

|

13,852

|

|

8,423

|

|

Management fee income

|

|

-

|

|

-

|

|

-

|

|

-

|

|

31

|

|

278

|

|

Total Revenues

|

|

5,167

|

|

11,753

|

|

15,623

|

|

17,354

|

|

13,883

|

|

8,701

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Voyage expenses(1)

|

|

(78)

|

|

(2,490)

|

|

(2,098)

|

|

(1,188)

|

|

(1,352)

|

|

(954)

|

|

Vessel operating expenses

|

|

(3,077)

|

|

(8,581)

|

|

(8,882)

|

|

(9,925)

|

|

(9,135)

|

|

(8,688)

|

|

Depreciation

|

|

(711)

|

|

(2,398)

|

|

(4,721)

|

|

(4,601)

|

|

(4,854)

|

|

(5,014)

|

|

Depreciation of drydocking costs

|

|

(492)

|

|

(1,335)

|

|

(1,704)

|

|

(1,166)

|

|

(862)

|

|

(1,005)

|

|

Administrative expenses

|

|

(556)

|

|

(1,891)

|

|

(1,583)

|

|

(1,356)

|

|

(1,224)

|

|

(2,094)

|

|

Administrative expenses payable to related parties

|

|

(154)

|

|

(1,915)

|

|

(371)

|

|

(528)

|

|

(514)

|

|

(351)

|

|

Share-based payments

|

|

(10)

|

|

(40)

|

|

(40)

|

|

(40)

|

|

(40)

|

|

(50)

|

|

Impairment loss

|

|

-

|

|

(4,615)

|

|

(29,902)

|

|

-

|

|

-

|

|

-

|

|

Gain from sale of subsidiary

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

2,257

|

|

Other (expenses)/income, net

|

|

14

|

|

89

|

|

29

|

|

2

|

|

83

|

|

(30)

|

|

Operating profit/(loss) before financing activities

|

|

103

|

|

(11,423)

|

|

(33,649)

|

|

(1,448)

|

|

(4,015)

|

|

(7,228)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

1

|

|

16

|

|

47

|

|

-

|

|

3

|

|

5

|

|

Interest expense and finance costs

|

|

(930)

|

|

(4,155)

|

|

(4,703)

|

|

(2,056)

|

|

(2,221)

|

|

(2,676)

|

|

Gain/(Loss) on derivative financial instruments

|

|

-

|

|

(1,647)

|

|

1,950

|

|

(131)

|

|

-

|

|

-

|

|

Foreign exchange gains/(losses), net

|

|

60

|

|

(163)

|

|

4

|

|

67

|

|

(242)

|

|

74

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive loss for the year/period

|

|

(766)

|

|

(17,372)

|

|

(36,351)

|

|

(3,568)

|

|

(6,475)

|

|

(9,825)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic (loss) per share for the year/period(2)

|

|

(0.11)

|

|

(18.11)

|

|

(873.36)

|

|

(111.61)

|

|

(251.83)

|

|

(3,827.26)

|

|

Diluted (loss) per share for the year/period(2)

|

|

(0.11)

|

|

(18.11)

|

|

(873.36)

|

|

(111.61)

|

|

(251.83)

|

|

(3,827.26)

|

|

Weighted average number of common shares, basic(2)

|

|

7,209,657

|

|

959,157

|

|

41,622

|

|

31,972

|

|

25,713

|

|

2,567

|

|

Weighted average number of common shares, diluted(2)

|

|

7,209,657

|

|

959,157

|

|

41,622

|

|

31,972

|

|

25,713

|

|

2,567

|

|

Dividends declared per common share

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

|

-

|

(1) In respect of the election to apply IFRS

15 fully retrospectively, prior year figures have been adjusted in order to present Voyage revenues net of address commissions. Address

commissions prior to the adoption of IFRS 15 were included in Voyage expenses.

(2) These figures reflect the 4-1 reverse stock

split which occurred in October 2016, the 10-1 reverse stock split which occurred in October 2018 and 100-1 reverse stock split which

occurred in October 2020.

RISK FACTORS

An investment in our common

shares involves a high degree of risk. Before deciding to invest in our common shares, you should carefully consider the risks described

in the accompanying prospectus and under the heading “Risk Factors” beginning on page 8 of our annual report on Form 20-F

for the year ended December 31, 2020, which is incorporated by reference into this prospectus supplement. In addition, you should carefully

consider the other information in the annual report and other documents that are incorporated by reference into this prospectus supplement.

See “Where You Can Find Additional Information.” The risks and uncertainties referred to above are not the only risks and

uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also

impair our business operations. If any of these risks actually occurs, our business, financial condition and results of operations could

be materially adversely affected. In that case, you may lose all or part of your investment in the common shares.

Risks Relating to this

Offering

We have broad discretion

in the use of the net proceeds from this offering and may use the net proceeds in ways with which you disagree.

Our management will have broad

discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that do not improve our results

of operations or enhance the value of our securities. You will be relying on the judgment of our management with regard to the use of

these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the net proceeds are

being used appropriately. The failure by our management to apply these funds effectively could result in financial losses that could have

a material adverse effect on our business, cause the price of our securities to decline. Pending the application of these funds, we may

invest the net proceeds from this offering in a manner that does not produce income or that loses value.

Company Specific Risk

Factors

We may issue additional

common shares or other equity securities without shareholder approval, which would dilute our existing shareholders’ ownership interests

and may depress the market price of our common shares.

We may issue additional common

shares or other equity securities of equal or senior rank in the future without shareholder approval in connection with, among other things,

future vessel acquisitions, the repayment of outstanding indebtedness, and the conversion of convertible financial instruments.

Our issuance of additional

common shares or other equity securities of equal or senior rank in these situations would have the following effects:

|

|

·

|

our existing shareholders’ proportionate ownership interest in us would decrease;

|

|

|

·

|

the proportionate amount of cash available for dividends payable on our common shares could decrease;

|

|

|

·

|

the relative voting strength of each previously outstanding common share could be diminished; and

|

|

|

·

|

the market price of our common shares could decline.

|

In addition, we may be obligated

to issue, upon exercise or conversion of outstanding agreements, warrants and credit facilities pursuant to the terms thereof:

|

|

·

|

388,700 common shares issuable upon the exercise of outstanding Class A Warrants (at an exercise price

of $35 per share) which expire in June 2025;

|

|

|

·

|

458,500 common shares issuable upon exercise of the June PP Warrants (at an exercise price of $18 per

share) issued in a private placement that closed on June 30, 2020 and expire in December 2025;

|

|

|

·

|

833,333 common shares issuable upon exercise of the July PP Warrants (at an exercise price of at $18 per

share) issued in a private placement that closed on July 21, 2020 and expire in January 2026;

|

|

|

·

|

1,270,587 common shares issuable upon exercise of the December 2020 Warrants (at an exercise price of

$6.25 per share) which expire in June 2026;

|

|

|

·

|

1,950,000 common shares issuable upon the exercise of the January 2021 Warrants (at an exercise price

of $6.25 per share) which expire in July 2026;

|

|

|

·

|

4,800,000 common shares issuable upon the exercise of the February 2021 Warrants (at an exercise price

of $6.25 per share) which expire in August 2026; and

|

|

|

·

|

the common shares issuable on exercise of the Warrants being offered in this Offering.

|

Until such time as the warrants

listed above and issued in this offering are exercised, these warrants may artificially limit the amount of money that investors are willing

to pay for our shares.

In addition, we are able to

draw down up to $14.2 million from our $15 million credit facility with Firment Shipping Inc., which facility is permitted to be repaid

in our common shares.

We also issue, on a quarterly

basis, common shares to certain of our directors. In addition, in 2020, we issued an aggregate of 300 of our Series B preferred shares, par

value $0.001 per share, to Goldenmare Limited in return for an aggregate of $300,000, and in March 2021, we issued a further 10,000 Series

B preferred shares for $130,000. The purchase price in each instance as settled by reducing, on a dollar for dollar basis, the amount

payable by the Company to Goldenmare Limited pursuant to a consultancy agreement, and approved by an independent committee of the board

of directors. The maximum voting rights under the Series B preferred shares is 49.99%.

Our issuance of additional

common shares upon the exercise of such warrants and credit facilities would cause the proportionate ownership interest in us of our existing

shareholders, other than the exercising warrant or credit facility holder, to decrease; the relative voting strength of each previously

outstanding common share held by our existing shareholders to decrease; and, depending on our share price when and if these warrants or

notes are exercised, may result in dilution to our shareholders.

Future

issuances or sales, or the potential for future issuances or sales, of our common shares may cause the trading price of our securities

to decline and could impair our ability to raise capital through subsequent equity offerings.

We have issued a significant

number of our common shares and may do so in the future. Shares to be issued pursuant to the exercise of our outstanding warrants, including

the Warrants being issued in this offering, could cause the market price of our common shares to decline, and could have an adverse effect

on our earnings per share. In addition, future sales of our common shares or other securities in the public or private markets, or the

perception that these sales may occur, could cause the market price of our common shares to decline, and could materially impair our ability

to raise capital through the sale of additional securities.

The market price of our common

shares could decline due to sales, or the announcements of proposed sales, of a large number of common shares in the market, including

sales of common shares by our large shareholders, or the perception that these sales could occur. These sales or the perception that these

sales could occur could also depress the market price of our common shares and impair our ability to raise capital through the sale of

additional equity securities or make it more difficult or impossible for us to sell equity securities in the future at a time and price

that we deem appropriate. We cannot predict the effect that future sales of common shares or other equity-related securities would have

on the market price of our common shares.

The market price of our

common shares may be volatile, which could result in substantial losses for investors who purchase our shares; and the volatility in the

stock prices of other companies may contribute to volatility in our stock price.

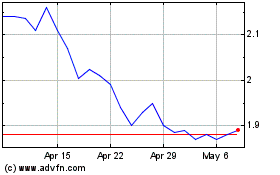

Our common shares have experienced

price and volume fluctuations and may continue to experience volatility in the future. The closing price of our common shares within 2020

ranged from a peak of $109 on January 3, 2020 to a low of $5.68 on December 31, 2020, representing a decrease of 94.8%. Within 2021 to

date, our shares have ranged from a high of $7.46 on February 16, 2021 to a low of $3.93 on April 20, 2021. You may not be able to sell

your shares quickly or at the latest market price if trading in our stock is not active or the volume is low. Some of the factors that

may cause the market price of our common shares to fluctuate include:

|

|

●

|

the trading of our ships, and whether one or more ships are not trading or otherwise offhire;

|

|

|

●

|

regulatory or legal developments in the United States and other countries;

|

|

|

●

|

the recruitment or departure of key personnel;

|

|

|

●

|

the level of expenses related to our business or to comply with changing laws, including in relation to environmental laws;

|

|

|

●

|

actual or anticipated changes in estimates as to financial results or recommendations by securities analysts;

|

|

|

●

|

announcement or expectation of additional financing efforts;

|

|

|

●

|

sales of our common shares by us, our insiders, or other shareholders;

|

|

|

●

|

variations in our financial results or those of companies that are perceived to be similar to us;

|

|

|

●

|

changes in estimates or recommendations by securities analysts, if any, that cover our stock;

|

|

|

●

|

market conditions in the shipping industry and drybulk sector; and

|

|

|

●

|

general economic, industry, and market conditions.

|

On occasion, there has also

been volatility for our intra-day common share price. As a result, there is a potential for rapid and substantial decreases in the price

of our common shares, including decreases unrelated to our operating performance or prospects.

In recent years, the stock

market in general, Nasdaq, and the markets for shipping companies, has experienced significant price and volume fluctuations and depressions

that have often been unrelated or disproportionate to changes in the operating performance of the companies whose stock is experiencing

those price and volume fluctuations. Broad market and industry factors may seriously affect the market price of our common shares, regardless

of our actual operating performance. Following periods of such volatility in the market price of a company’s securities, securities

class action litigation has often been brought against that company. Because of the potential volatility of our stock price, we may become

the target of securities litigation in the future. Securities litigation could result in substantial costs and divert management’s

attention and resources from our business.

A possible “short

squeeze” due to a sudden increase in demand of our common shares that largely exceeds supply may lead to further price volatility

in our common shares.

Investors may purchase our

common shares to hedge existing exposure in our common shares or to speculate on the price of our common shares. Speculation on the price

of our common shares may involve long and short exposures. To the extent aggregate short exposure exceeds the number of common shares

available for purchase in the open market, investors with short exposure may have to pay a premium to repurchase our common shares for

delivery to lenders of our common shares. Those repurchases may in turn, dramatically increase the price of our common shares until investors

with short exposure are able to purchase additional common shares to cover their short position. This is often referred to as a “short

squeeze.” A short squeeze could lead to volatile price movements in common shares that are not directly correlated to the performance

or prospects of our company and once investors purchase the common shares necessary to cover their short position the price of our common

shares may decline.

Our loan agreements

and other financing arrangements contain, and we expect that other future loan agreements and financing arrangements will contain, restrictive

covenants that may limit our liquidity and corporate activities, which could limit our operational flexibility and have an adverse effect

on our financial condition and results of operations. In addition, because of the presence of cross-default provisions in our loan agreements

and financing arrangements, a default by us under one loan could lead to defaults under multiple loans.

Our loan agreements and other

financial arrangements contain, and we expect that other future loan agreements and financing arrangements will contain, customary covenants

and event of default clauses, financial covenants, restrictive covenants and performance requirements, which may affect operational and

financial flexibility. Such restrictions could affect, and in many respects limit or prohibit, among other things, our ability to pay

dividends, incur additional indebtedness, create liens, sell assets, or engage in mergers or acquisitions. These restrictions could limit

our ability to plan for or react to market conditions or meet extraordinary capital needs or otherwise restrict corporate activities.

There can be no assurance that such restrictions will not adversely affect our ability to finance our future operations or capital needs.

As a result of these restrictions,

we may need to seek permission from our lenders and other financing counterparties in order to engage in some corporate actions. Our lenders’

and other financing counterparties’ interests may be different from ours and we may not be able to obtain their permission when

needed. This may prevent us from taking actions that we believe are in our best interests, which may adversely impact our revenues, results

of operations and financial condition.

A failure by us to meet our

payment and other obligations, including our financial covenants and any security coverage requirements, could lead to defaults under

our financing arrangements. Likewise, a decrease in vessel values or adverse market conditions could cause us to breach our financial

covenants or security requirements (the market values of dry bulk vessels have generally experienced high volatility). In the event of

a default that we cannot remedy, our lenders and other financing counterparties could then accelerate their indebtedness and foreclose

on the respective vessels in our fleet. The loss of any of our vessels could have a material adverse effect on our business, results of

operations and financial condition.

In the recent past, we obtained

waivers and deferrals of some major financial covenants under our loan facilities with our lenders until the end of the third quarter

of 2020. (We have not needed to obtain waivers since the end of the third quarter of 2020.) However, there can be no assurance that we

will obtain similar waivers and deferrals from our lenders in the future, if needed, as we have obtained in the past. We are currently

in compliance with all applicable financial covenants under our existing loan facilities. For more information regarding our current loan

facilities, see please see “Item 5. Operating and Financial Review and Prospects – B. Liquidity and Capital Resources –

Loan Arrangements” in our annual report on Form 20-F for the fiscal year ended December 31, 2020, which is incorporated by reference

herein and the Report on Form 6-K that we filed with the SEC on May 14, 2021, which is also incorporated by reference herein.

Because of the presence of

cross-default provisions in our loan agreements, a default by us under a loan and the refusal of any one lender to grant or extend a waiver

could result in the acceleration of our indebtedness under our other loans. A cross-default provision means that if we default on one

loan, we would then default on our other loans containing a cross-default provision.

The superior voting rights of our Series

B preferred shares limits the ability of our common shareholders to control or influence corporate matters, and the interests of the holder

of such shares could conflict with the interests of our other shareholders.

While our common shares have

one vote per share, each of our 10,300 Series B preferred shares presently outstanding has 25,000 votes per share; however, the voting

power of the Series B preferred shares is limited such that no holder of Series B preferred shares may exercise voting rights pursuant

to any Series B preferred shares that would result in the total number of votes a holder is entitled to vote on any matter submitted to

a vote of shareholders of the Company to exceed 49.99% of the total number of votes eligible to be cast on such matter. The Series B preferred

shares, however, have no dividend rights or distribution rights, other than the right upon dissolution to receive a priority payment equal

to the par value of $0.001 per share.

After the offering described

within this prospectus and until such time that we issue a significant number of additional securities, Goldenmare Limited, a company

affiliated with our Chief Executive Officer, can therefore control a significant portion of the voting power of our outstanding capital

stock. Until such time, Goldenmare Limited will have substantial control and influence over our management and affairs and over matters

requiring shareholder approval, including the election of directors and significant corporate transactions, even though Goldenmare Limited

owns significantly less than 50% of the Company economically.

The superior voting rights

of our Series B preferred shares limit our common shareholders’ ability to influence corporate matters. The interests of the holder

of the Series B preferred shares may conflict with the interests of our common shareholders, and as a result, we may take actions that

our common shareholders do not view as beneficial. Any such conflicts of interest could adversely affect our business, financial condition

and results of operations, and the trading price of our common shares.

We further note that our articles

permit any action which may or is required by the BCA to be taken at a meeting of the shareholders to be authorized by consents in writing

signed by the holders of outstanding shares having not less than the minimum number of votes that would be necessary to authorize or take

such action at a meeting at which all shares entitled to vote thereon were present and voted. Presently and until and unless we issue

a significant number of securities, Goldenmare Limited, a company affiliated with our Chief Executive Officer, holds Series B Preferred

Shares controlling a significant portion of the voting power of our outstanding capital stock. Goldenmare could, together with shareholders

possessing a relatively small number of shares, act by written consent in lieu of a meeting and authorize major transactions on behalf

of the Company, all without calling a meeting of shareholders.

Provisions of our articles of incorporation

and bylaws may have anti-takeover effects, which could depress the trading price of our common shares.

Several provisions of our

articles of incorporation and bylaws, which are summarized below, may have anti-takeover effects. These provisions are intended to avoid

costly takeover battles, lessen our vulnerability to a hostile change of control and enhance the ability of our board of directors to

maximize shareholder value in connection with any unsolicited offer to acquire our company. However, these anti-takeover provisions could

also discourage, delay or prevent the merger or acquisition of our company by means of a tender offer, a proxy contest or otherwise that

a shareholder may consider in its best interest and the removal of incumbent officers and directors, which could affect the desirability

of our shares and, consequently, our share price.

Multi Class Stock.

Our multi-class stock structure,

which consists of common shares, Class B common shares, and preferred shares, can provide holders of our Class B common shares or preferred

shares a significant degree of control over all matters requiring shareholder approval, including the election of directors and significant

corporate transactions, such as a merger or other sale of our company or its assets, because our different classes of shares can have

different numbers of votes.

For instance, while our common

shares have one vote on matters before the shareholders, each of our 10,300 outstanding Series B preferred shares has 25,000 votes on

matters before the shareholders; provided however, that no holder of Series B preferred shares may exercise voting rights

pursuant to any Series B preferred shares that would result in the total number of votes a holder is entitled to vote on any matter submitted

to a vote of shareholders of the Company to exceed 49.99% of the total number of votes eligible to be cast on such matter. No Class B

common shares are presently outstanding, but if and when we issue any, each Class B common share will have 20 votes on matters before

the shareholders.

At present, and until a substantial

number of additional securities are issued, our holder of Series B preferred shares exerts substantial control of the Company’s

votes and is able to exert substantial control over our management and all matters requiring shareholder approval, including electing

directors and significant corporate transactions, such as a merger. Such holder’s interest could differ from yours.

Blank Check Preferred Shares.

Under the terms of our articles

of incorporation, our board of directors has authority, without any further vote or action by our shareholders, to issue up to 100 million

“blank check” preferred shares, almost all of which currently remain available for issuance. Our board could authorize the

issuance of preferred shares with voting or conversion rights that could dilute the voting power or rights of the holders of common shares,

in addition to preferred shares that are already outstanding. The issuance of preferred shares, while providing flexibility in connection

with possible acquisitions and other corporate purposes, could, among other things, have the effect of delaying, deferring or preventing

a change in control of us or the removal of our management and may harm the market price of our common shares.

Classified Board of Directors.

Our articles of incorporation

provide for the division of our board of directors into three classes of directors, with each class as nearly equal in number as possible,

serving staggered, three-year terms beginning upon the expiration of the initial term for each class. Approximately one-third of our board

of directors is elected each year. This classified board provision could discourage a third party from making a tender offer for our shares

or attempting to obtain control of us. It could also delay shareholders who do not agree with the policies of our board of directors from

removing a majority of our board of directors for up to two years.

Election of Directors.

Our articles of incorporation

do not provide for cumulative voting in the election of directors. Our bylaws require parties, other than the chairman of the board of

directors, board of directors and shareholders holding 30% or more of the voting power of the aggregate number of our shares issued and

outstanding and entitled to vote, to provide advance written notice of nominations for the election of directors. These provisions may

discourage, delay or prevent the removal of incumbent officers and directors.

Advance Notice Requirements

for Shareholder Proposals and Director Nominations.

Our bylaws provide that shareholders,

other than shareholders holding 30% or more of the voting power of the aggregate number of our shares issued and outstanding and entitled

to vote, seeking to nominate candidates for election as directors or to bring business before an annual meeting of shareholders must provide

timely notice of their proposal in writing to the corporate secretary.

Generally, to be timely, a

shareholder’s notice must be received at our principal executive offices not less than 150 days or more than 180 days prior to the

first anniversary date of the immediately preceding annual meeting of shareholders. Our bylaws also specify requirements as to the form

and content of a shareholder’s notice. These provisions may impede a shareholder’s ability to bring matters before an annual

meeting of shareholders or make nominations for directors at an annual meeting of shareholders.

Calling of Special Meetings

of Shareholders

Our bylaws provide that special

meetings of our shareholders may be called only by the chairman of our board of directors, by resolution of our board of directors or

by holders of 30% or more of the voting power of the aggregate number of our shares issued and outstanding and entitled to vote at such

meeting.

Action by Written Consent

in Lieu of a Meeting

Our articles permit any action

which may or is required by the BCA to be taken at a meeting of the shareholders to be authorized by consents in writing signed by the

holders of outstanding shares having not less than the minimum number of votes that would be necessary to authorize or take such action

at a meeting at which all shares entitled to vote thereon were present and voted. Presently and until and unless we issue a significant

number of securities, Goldenmare Limited, a company affiliated with our Chief Executive Officer, holds Series B Preferred Shares controlling

a significant portion of the voting power of our outstanding capital stock. Goldenmare could, together with shareholders possessing a

relatively small number of shares, act by written consent in lieu of a meeting and authorize major transactions on behalf of the Company,

all without calling a meeting of shareholders.

Risks Relating to Our

Industry

Pandemics such as the novel coronavirus

(COVID-19) make it very difficult for us to operate in the short-term and have unpredictable long-term consequences, all of which could

decrease the supply of and demand for the raw materials we transport, the rates that we are paid to carry our cargo, and our financial

outlook.

On March 11, 2020, the World

Health Organization declared the spread of a novel coronavirus (COVID-19) to be a global pandemic. In the name of public health, governments

around the world have shuttered workplaces, restricted travel, and put in place other measures which have resulted in a dramatic decrease

of economic activity, including a reduction of goods imported and exported worldwide. While some economies have begun re-opening in limited

capacities, it is impossible to predict the course the virus will take; whether new, more virulent or contagious strains will emerge;

how quickly COVID-19 vaccines will be distributed in all places we do business; for how long the vaccines will provide immunity; whether