Current Report Filing (8-k)

June 25 2021 - 4:11PM

Edgar (US Regulatory)

FALSE000183163100018316312021-02-182021-02-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 8-K

_____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report: June 23, 2021

_____________________

loanDepot, Inc.

(Exact Name of Registrant as Specified in its Charter)

_____________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-40003

|

|

85-3948939

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification Number)

|

26642 Towne Centre Drive

Foothill Ranch, California 92610

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (888) 337-6888

_____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Class A Common Stock, $0.001 Par Value

|

|

LDI

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.01. Entry into a Material Definitive Agreement.

On June 23, 2021, loanDepot.com, LLC, a Delaware limited liability company and an indirect, majority-owned subsidiary of loanDepot, Inc. (the “Company”), as borrower, entered into the Twelfth Amendment (“Amendment 12”) to the Credit and Security Agreement, dated as of October 29, 2014 (as amended, restated, supplemented or otherwise modified from time to time, the “Loan Agreement”) with NexBank, as lender (the “Lender”) pursuant to which the Lender extended a revolving line of credit available to the Company (the “Loan”). The primary purposes of Amendment 12 are to (a) increase the maximum amount of the Loan in an amount equal to $50,000,000, after which the maximum outstanding principal balance of the Loan as of the effective date was $248,000,000, (b) amend the definition of “Maximum Commitment” to be $300,000,000, and (c) enter into a new revolving credit note and amend certain other ancillary agreements.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

|

|

|

10.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

loanDepot, Inc.

|

|

|

|

|

By:

|

/s/ Patrick Flanagan

|

|

Name: Patrick Flanagan

|

|

Title: Chief Financial Officer

|

Date: June 25, 2021

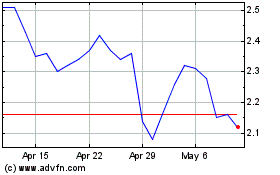

loanDepot (NYSE:LDI)

Historical Stock Chart

From Mar 2024 to Apr 2024

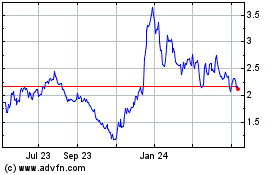

loanDepot (NYSE:LDI)

Historical Stock Chart

From Apr 2023 to Apr 2024