Aviva Plans to Shrink in Order to Grow in Investment Management -- Financial News

June 21 2021 - 5:39AM

Dow Jones News

By David Wighton

Of Financial News

What is Aviva PLC going to do about its underperforming Aviva

Investors asset management arm, demanded Philip Meadowcroft at the

insurance giant's annual meeting last month. Given its lack of

scale and tiny contribution to group profits, shouldn't Aviva just

sell it, asked the campaigning private investor, who has been

harrying Aviva's management for years.

Now Mr. Meadowcroft has got an answer. Of sorts. Aviva has

confirmed that it is cutting back the equities operation, with

David Cumming, the high-profile chief investment officer for

equities, the first of several heads to roll. Eight to 10 funds are

expected to be closed.

Yet Aviva has also reaffirmed its strategic commitment to the

business and expressed its "full confidence" that it can deliver

further growth in the areas it has retained.

Mr. Meadowcroft is unconvinced. And he isn't alone. Senior

industry figures believe something more radical is required. Some

suggest Aviva should emulate Dutch insurer NN Group NV, which is

"reviewing strategic options" for its 300 billion euros ($355.9

billion) asset investment manager and is reported to have received

offers from UBS Group AG, Allianz SE, Assicurazioni Generali SpA

and DWS Group GmbH & Co. KGaA.

The move comes as NN is under pressure to boost shareholder

value from Elliott Management Corp., the activist investor that

revealed a stake last year. Aviva is also under fire from an

activist, Cevian, which has just revealed a 5% stake and is

pressing for big cost reductions.

However, it seems unlikely that any changes at Aviva Investors

will be the result of pressure from Cevian, if only because the

business is such a small part of the group. It contributed only 3%

of group profits last year--or less than 2% if you strip out the

French operation, which is being sold. So even radical changes at

Aviva Investors would make little difference in group terms.

Some observers believe its relative size may partly explain why

Aviva Investors' performance has been as disappointing as its

parent's in recent years.

The challenge has been to attract more assets from external

clients alongside the business it does for Aviva companies. Many

insurer-owned asset managers have found this difficult, not least

because the safety-first approach of investing for insurers can be

tricky to translate into the more freewheeling world of third-party

investment management. "The DNA is very different," says Jonathan

Doolan, European head of asset management at consultant Casey

Quirk.

The gathering of external assets has tended to be more

successful when the investment manager is a big part of the group,

such as at Allianz. Where it is relatively small, efforts to

diversify are sometimes hampered by group management, who fear it

will divert attention from its core job of serving the insurance

company in return for potential growth that wouldn't "move the

needle" in group terms.

It is unclear whether this has been a factor in the Aviva case,

though former boss Euan Munro is known to have had a few struggles

with the board. He left in January after seven years during which

the business made much progress but ultimately delivered

disappointing results.

On the surface, Aviva Investors has a lot going for it. It has a

good line-up of products in sought-after areas, and it was a

pioneer of environmental, social and governance investing,

introducing the U.K.'s first ethical fund range back in 1984. It

also has the opportunity to cross-sell its products into the huge

insurance customer base, a strategy being pursued effectively by

rival M&G PLC/Prudential PLC.

Yet Mr. Munro never got close to the target of 30% of assets

from external clients. At the end of last year, the proportion was

a little over 20% of 366 billion pounds ($505.19 billion). From

these, it generated operating profits of GBP85 million, of which

GBP33 million (after tax) came from the French business. About

GBP105 billion of assets will go with the French sale, leaving

Aviva Investors with about GBP260 billion.

Mr. Meadowcroft claims that part of the reason Aviva Investors'

profits are so meager is that it charges internal clients roughly

half the rate it would get in the open market, a figure the company

disputes. What isn't in doubt is that Aviva would have to pay a

great deal more if it had to buy asset management services from a

third party, so hiving off Aviva Investors wouldn't help it meet

the cost cutting demands of Cevian.

In any case, Aviva's Chief Executive Amanda Blanc has made it

clear that Aviva Investors is a core business. It is conceivable

that to achieve the greater scale that is seen as so important in

asset management these days, Aviva could try to put Aviva Investors

into a joint venture with another insurer. But the likelihood is

that Aviva Investors' new boss, Mark Versey, will just be expected

to succeed where Mr. Munro failed--with a much smaller

business.

It won't be easy. And he can certainly expect more waspish

interventions from Mr. Meadowcroft along the way.

Website: www.fnlondon.com

(END) Dow Jones Newswires

June 21, 2021 05:26 ET (09:26 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

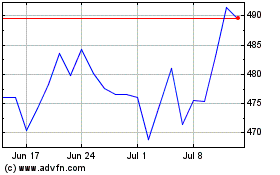

Aviva (LSE:AV.)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aviva (LSE:AV.)

Historical Stock Chart

From Apr 2023 to Apr 2024