Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

June 11 2021 - 4:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2021

Commission File Number: 001-39978

CN Energy Group. Inc.

Building 1-B, Room 303, No. 268 Shiniu Road

Liandu District, Lishui City, Zhejiang Province

323010

The PRC

+86-571-87555823

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x

Form 40-F ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

From

June 8 to June 10, 2021, CN Energy Group. Inc., a British Virgin Islands company (the “Company”), entered into

certain subscription agreements (the “Subscription Agreements”) with six investors (the “Purchasers”).

Pursuant to the Subscription Agreements and in reliance on Rule 902 of Regulation S (“Regulation S”) promulgated under the

Securities Act of 1933, as amended (the “Securities Act”), the Company agreed to sell and the Purchasers agreed to purchase

an aggregate of 4,000,000 ordinary shares, no par value, of the Company (“Ordinary Shares”) at a price of $4.5 per share (the

“Private Placement”). The Purchasers represented that they were not residents of the United States and were not “U.S.

persons” as defined in Rule 902(k) of Regulation S and were not acquiring the Shares for the account or benefit of any U.S. person.

In

connection with the Subscription Agreements, from June 8 to June 10, 2021, the Company also entered into certain Registration

Rights Agreements (the “Registration Rights Agreements”) with the Purchasers. Pursuant to the Registration Rights Agreements,

the Company agreed, among other things, on or prior to the Filing Date for the Initial Registration Statement, to prepare and file with

the Securities and Exchange Commission a Registration Statement covering the resale of all of the Registrable Securities for an offering

to be made on a continuous basis pursuant to Rule 415.

On

June 11, 2021, the Company closed the Private Placement and received gross proceeds, before deducting the Placement Agent’s

fees and other related offering expenses, of $18 million. The Ordinary Shares issued in the Private Placement are not subject to the registration

requirements of the Securities Act, pursuant to Regulation S promulgated thereunder. The management of the Company will have sole

and absolute discretion concerning the use of the proceeds from the Private Placement.

Network

1 Financial Securities, Inc. (the “Placement Agent”) acted as placement agent in the Private Placement, and the Company

paid the Placement Agent a commission equal to 4% of the gross proceeds and 1% of the gross proceeds as non-accountable expenses, pursuant

to a Placement Agency Agreement (the “Placement Agreement”) dated April 20, 2021. The commission and non-accountable expenses

were paid out of an escrow account pursuant to an Escrow Agreement (the “Escrow Agreement”) entered into by and among the

Company, the Placement Agent, and a certain escrow agent on April 20, 2021. The Company also paid the Placement Agent a commitment fee

in the amount of $75,000 upon signing the Placement Agreement.

The capitalized terms used but not defined herein have the meanings

ascribed to them in the Subscription Agreements, Registration Rights Agreements, Placement Agreement, and Escrow Agreement. The foregoing

description of the Subscription Agreements, Registration Rights Agreements, Placement Agreement, and Escrow Agreement does not purport

to be complete and is qualified in its entirety by reference to the full text. Copies of such agreements are attached hereto as Exhibit 10.1,

Exhibit 10.2, Exhibit 1.1, and Exhibit 10.3, respectively, and are incorporated herein by reference.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

CN Energy Group. Inc.

|

|

|

|

|

|

Date: June 11, 2021

|

By:

|

/s/ Kangbin Zheng

|

|

|

Name:

|

Kangbin Zheng

|

|

|

Title:

|

Chief Executive Officer

|

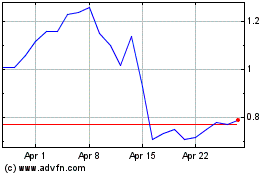

CN Energy (NASDAQ:CNEY)

Historical Stock Chart

From Mar 2024 to Apr 2024

CN Energy (NASDAQ:CNEY)

Historical Stock Chart

From Apr 2023 to Apr 2024