Current Report Filing (8-k)

May 28 2021 - 4:25PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 24, 2021

C2E ENERGY, INC.

(Exact name of registrant as specified in its charter)

|

Florida

|

|

333-106299

|

|

65-1139235

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

1185 Avenue of the Americas 3rd Floor

New York, NY 10036

(Address of principal executive offices) (Zip code)

(646) 768 -8417

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

|

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement

|

On May 24, 2021 (the “Effective Date”), the C2E Energy,

Inc. (the “Company”) entered into a debt exchange agreement (the “Debt Exchange Agreement”) with Custodian Ventures,

LLC a Wyoming limited liability company (“Custodian”).

As previously disclosed in the Company’s Current Report on Form

8-K filed with the SEC on February 16, 2021, on February 10, 2021, as a result of a custodianship in Palm Beach, Florida Nevada, Case

Number 502020CA013695XXXXMB AB, Custodian Ventures LLC was appointed custodian of the Company. In the course of performing

its duties as the custodian of the Company, Custodian had incurred expenses on behalf of the Company in the amount of $29,541 as of May

24, 2021. Pursuant to the Debt Exchange Agreement, the Company agreed to issue Custodian 10,000,000 shares of Series A Convertible Preferred

Stock, par value $0.0001 per share, of the Company (the “Series A Stock”) in lieu of a cash reimbursement of the $29,541 owed

to Custodian.

On the Effective Date, the Company issued the 10,000,000 shares of

Series A Stock to Custodian, and in exchange, Custodian forgave the $29,541 owed to it, and agreed that such amount was deemed to have

been paid in full.

The Debt Exchange Agreement and the transactions contemplated therein

were subject to certain customary terms and conditions, and as inducement to enter to the Debt Exchange Agreement, each party made certain

customary representations and warranties to the other party related to certain factual matters applicable to each party.

The foregoing description of the Debt Exchange

Agreement is subject to, and qualified in its entirety by the Debt Exchange Agreement attached as Exhibit 10.1 to this Current Report

on Form 8-K, which is incorporated herein by reference.

Item 5.01 Changes in Control of Registrant.

As previously disclosed in the Company’s Current Report on Form

8-K filed with the SEC on February 16, 2021, on February 10, 2021, as a result of a custodianship in Palm Beach, Florida Nevada, Case

Number 502020CA013695XXXXMB AB, Custodian was appointed custodian of the Company. On April 21, 2021, the Custodian was discharged

as custodian of the Company pursuant to an Order Accepting Custodian’s Report, Discharging Custodian, Approving Reimbursement of

Plaintiff’s Expenses and Dismissing Case, dated as of April 21, 2022.

On May 24, 2021, as a result of the closing of the Debt Exchange Agreement,

Custodian received 10,000,000 shares of Series A Stock, which provided Custodian with majority voting control of the Company.

|

Item 5.03.

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

On May 21, 2021, the Company filed Articles of

Amendment to its Articles of Incorporation with the Florida Department of State to designate 10,000,000 shares of the Company’s

20,000,000 shares of authorized Preferred Stock, par value $0.0001, as Series A Stock. On May 24, 2021, the Company received notice from

the Florida Secretary of State of the acceptance of the Articles of Amendment by the Florida Department of State.

Each share of Series A Stock is convertible at

the option of the holder into the Company’s common stock, par value $0.0001 per share (the “Common Stock”) at the rate

of 400 shares of Common Stock per share of Series A Stock, which rate will not be adjusted if the Company undergoes any stock split, stock

dividend, stock combination, recapitalization or other similar transaction that results in the outstanding number of shares of Common

Stock of the Company increasing or decreasing. Holders of the Series A Stock have the right at any time following the date of the effectiveness

of an amendment of the Articles of Incorporation of the Company to:

|

|

●

|

increase the number of authorized shares of Common Stock of the Company;

|

|

|

●

|

complete a reverse split of the Common Stock; or

|

|

|

●

|

take any other action or actions, whether pursuant to an amendment of the Company’s Articles of

Incorporation or otherwise to ensure that a sufficient number of authorized but unissued shares of Common Stock is available to permit

the conversion of all of the shares of Series A Stock into Common Stock.

|

A share of Series A Stock may be converted solely

in full, and no fractional conversion of a share of Series A Stock may be completed. If, at any time when the Series A Stock is issued

and outstanding, the Company’s Common Stock is exchanged with another company’s securities, or converted into another class

of securities of the Company or any successor entity to the Company, whether by way of merger, reorganization, re-incorporation or otherwise,

the Series A Stock will be convertible into those exchanged or converted securities on the same terms as if the Series A Stock was converting

into Common Stock of the Company.

The holders of Series A Stock vote together with

the holders of Common Stock, and each share of Series A Stock has a voting power equal to its number of conversion shares (i.e. 400 shares

of Common Stock per share of Series A Stock).

The Series A Stock is entitled to participate

in any dividends, distributions or payments to the holders of the Common Stock on an as-converted basis (i.e., assuming such conversion

but without such conversion being required in order for such participation to occur) The Series A Stock does not have any liquidation

preferences but otherwise participates in any distributions to the holders of the Common Stock on the same basis as such Common Stockholders.

Shares of Series A Stock may be redeemed by the Company only with the prior written consent of the Series A Holder holding the applicable

shares of Series A Stock.

The Company may not amend or repeal any provisions

of the Articles of Amendment for the Series A Stock, the Articles or the Bylaws of the Company which would adversely affect the rights

or obligations of the Series A Holders with respect to the Series A Stock without the prior written consent of Series A Holders holding

a majority of the Series A Stock then issued and outstanding.

The foregoing description of the Articles of Amendment

is subject to, and qualified in its entirety by the Form of Articles of Amendment attached as Exhibit 3.1 to this Current Report on Form

8-K, which is incorporated herein by reference.

Item 9.01 Financial

Statement and Exhibits.

(d) Exhibits

The following exhibits

are filed or furnished with this Current Report on Form 8-K:

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

|

Date: May 28, 2021

|

C2E ENERGY, INC.

|

|

|

|

|

|

|

By:

|

/s/ David Lazar

|

|

|

|

David Lazar

|

|

|

|

Chief Executive Officer and Chief Financial Officer

|

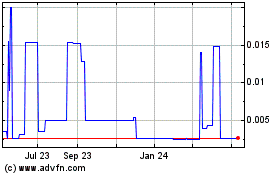

C2E Energy (PK) (USOTC:OOGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

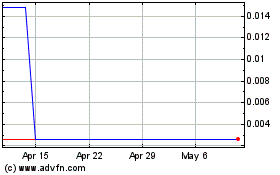

C2E Energy (PK) (USOTC:OOGI)

Historical Stock Chart

From Apr 2023 to Apr 2024