By Jared S. Hopkins

AbbVie Inc.'s pricing practices for some of its top-selling

medicines faced fresh scrutiny from federal lawmakers Tuesday, the

latest effort by members of Congress probing the cost of

prescription drugs.

Democratic members of the U.S. House Committee on Oversight and

Reform have been investigating how AbbVie sets the prices of some

of its products, including its top-selling immunology drug,

Humira.

At the hearing, committee members questioned AbbVie Chief

Executive Richard Gonzalez about price increases for Humira as well

as AbbVie's patents and other efforts to protect the drug from

competition from lower-priced copies known as biosimilars.

Mr. Gonzalez said lowering drug prices alone wouldn't increase

access to prescription drugs for patients, including some Medicare

patients. He said AbbVie provides medications to some patients who

can't afford them at no-cost or through co-pay assistance.

"Overall, most Americans have access to affordable medicines,"

he said. "As we tackle the issues of drug pricing and access, it's

important that we focus on what's working and what needs to change

to make sure that patients get the medicines they need."

The company "seeks to overwhelm potential competitors with the

sheer number of patents on Humira regardless of whether individual

patents were properly granted under U.S. law," committee Democrats

wrote in a report released before the hearing. "If one patent is

invalidated, AbbVie has another patent waiting."

Mr. Gonzalez defended AbbVie's approach on patents, saying the

company continued to study the drug after its initial approval,

which led to its use for multiple diseases.

"We patent innovation that we believe is meaningful and that we

invested in," he said.

AbbVie declined to comment beyond Mr Gonzalez's testimony, a

spokesman said.

Republican members of the committee didn't issue a report

related to AbbVie's pricing of its products.

Patents on Covid-19 vaccines have emerged as an issue in the

coronavirus pandemic, as some governments push for intellectual

property rights to be temporarily waived to spur additional

production.

The Biden administration recently lent its support for

temporarily waiving the vaccine patents.

Humira, which treats a range of immune conditions including

rheumatoid arthritis and gut disorders, is the top-selling drug in

the U.S. with more than $16.1 billion in sales last year.

AbbVie has raised Humira's price 27 times since it launched in

2003, with a year's supply now costing $77,586 before insurance and

rebates, according to the report by committee Democrats. Humira's

current price is 470% higher than from when the drug launched in

2003, according to the report.

The initial U.S. patent for Humira expired in December 2016, but

the company has been taking out additional patents covering its

formulation and manufacturing, among other things.

AbbVie executives in 2014 forecast Humira biosimilars would

arrive in the U.S. in 2017 and decrease sales by $1.5 billion that

year, according to the report, citing company documents.

The drugmaker, based in the suburbs of Chicago, has obtained or

applied for at least 257 Humira patents, 90% of which were filed

after the drug was launched, according to the report.

Mr. Gonzalez testified that AbbVie has a high number of Humira

patents partly because the federal government's patent office

sometimes asks patents not to be too broad. He also said that

companies are able to challenge patents in court.

"Everyone gets somewhat hung up on the number of patents," he

said.

The company obtained eight patents under a law designed by

Congress to encourage development of drugs for rare diseases

affecting fewer than 200,000 people in the U.S., according to the

report.

In one instance, AbbVie split the patient population of a rare

skin condition into two, a general one and one for patients at

least 12 years old. The maneuvers extended Humira's patent

protection beyond the seven years intended by the federal

orphan-drug law, according to the report.

AbbVie viewed the U.S. patent system as more permissive than

other countries' intellectual-property systems, the Democrats on

the committee said, citing company documents.

Europe's patent system precluded many patents obtained in the

U.S., according to one of the company documents, an AbbVie white

paper, that the committee Democrats cited. In Europe, several

biosimilars to Humira have been available since 2018 at a reduced

price.

The first lower-priced alternatives to Humira, known as

biosimilars, aren't scheduled to hit the U.S. market until

2023.

AbbVie staved off biosimilar competition by reaching deals with

companies that agreed to delay launches of their lower-priced

copies, according to the report and the companies.

Some of these biosimilars have been approved for several years.

A biosimilar from Amgen Inc., which is scheduled to launch in 2023

under an agreement with AbbVie, was approved by regulators in

2016.

The House committee's chairwoman, Rep. Carolyn Maloney (D.,

N.Y.) and two other Democrats, David Cicilline (D., R.I.) and Jerry

Nadler (D., N.Y.), asked the Federal Trade Commission on Tuesday to

investigate whether AbbVie violated the law in trying to keep

biosimilars to Humira from launching, according to a copy of the

letter.

AbbVie didn't respond to a request for comment about the letter.

An FTC spokesman said the agency doesn't publicly comment on

investigation requests.

Write to Jared S. Hopkins at jared.hopkins@wsj.com

(END) Dow Jones Newswires

May 18, 2021 15:55 ET (19:55 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

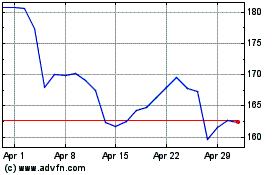

AbbVie (NYSE:ABBV)

Historical Stock Chart

From Mar 2024 to Apr 2024

AbbVie (NYSE:ABBV)

Historical Stock Chart

From Apr 2023 to Apr 2024