By Corrie Driebusch

The U.S. IPO market, unstoppable for nearly a year, has hit a

speed bump.

Shares of rapidly growing companies have fallen increasingly out

of favor with investors. Many newly listed firms, whose stocks rose

after their initial public offerings, have dropped below their IPO

prices. At least three companies, leery of jumping into a volatile

stock market, postponed their IPOs after the S&P 500 started

the week with its biggest three-day swoon in nearly seven

months.

Some investors and bankers think next week could be a turning

point. If the stock market calms and the public debuts of

celebrity-backed Swedish oat-milk maker Oatly Group AB and software

company Squarespace Inc. go well, that could shore up confidence in

IPOs, they say. If volatility continues and those offerings sputter

or get postponed, the IPO market could pump the brakes.

"Volatility makes deals more harrowing to launch," said Eddie

Molloy, co-head of equity capital markets for the Americas at

Morgan Stanley. "Ultimately what we'd like to see is stability in

the markets and see deals perform and hold their performance.

Investors making money off of the latest deal is always helpful for

the next deal."

For the past 11 months, that has been the case. The IPO market,

which raised a record $168 billion in 2020, has already raised a

staggering $158 billion in 2021, according to Dealogic data through

Thursday, the latest available. But the tides turned recently as

fears of inflation came into focus and caused investors to seek

havens outside of growth companies.

Shares of Honest Co., the consumer-goods business co-founded by

Jessica Alba, jumped 44% to $23 in their first day of trading

earlier this month. But the company closed Friday below its $16 IPO

price. Dating-app operator Bumble Inc., whose stock slid 26% this

week, also sits below its IPO price. The biggest IPO of the year by

money raised, South Korean e-commerce giant Coupang Inc., dipped

below its IPO price this week before recovering as markets rose

Friday.

Cryptocurrency exchange Coinbase Global Inc. went public through

a direct listing this year, an increasingly popular way for

companies to go public that sidesteps the traditional IPO process.

Though direct listings don't have an IPO price, Coinbase trades 21%

below where it landed at the end of its first day in the

market.

On average, U.S.-listed IPOs this year -- not including

nontraditional methods like direct listings or special-purpose

acquisition companies -- were up 2.1% from their IPO prices through

Thursday's close, according to the latest data available from

Dealogic. By comparison, the S&P 500 had risen 9.5% this year

through Thursday's close. The Nasdaq Composite, known for being

stacked with growth companies similar to those looking to go

public, was up just 1.8% this year through Thursday. Both indexes

posted sharp gains Friday.

"You had this flood of IPOs and SPACs, and there was a period

when you could do no wrong," said Rick de los Reyes, co-portfolio

manager of the T. Rowe Price Multi-Strategy Total Return Fund.

"It's a tough market now, with really high-growth companies out of

favor."

A healthy IPO market is important to pave the way for some big

potential debuts later this year, including trading app Robinhood

Markets Inc. and grocery-delivery company Instacart Inc. SPACs also

are a huge part of the picture: Hundreds of them, managing more

than $100 billion, also have mandates to merge with private

companies to bring them public. A market where investors are wary

of participating in deals will make that task much more difficult,

too, bankers and fund managers say.

So far in May, 13 SPACs have unveiled mergers, and of those,

only one is trading above its IPO price. Many fund managers heavily

invested in technology companies have watched their portfolios fall

sharply in recent weeks, making them less willing to take chances

on IPOs or private investments in public equity, known as PIPEs,

which are sometimes critical for completing SPAC mergers.

It has been a swift cool-down for the burgeoning market. Heading

into 2021, the U.S. IPO market was on fire, with companies rushing

to launch IPOs after years of eschewing the public markets. They

were quickly rewarded: The average first-day pop for an IPO last

year was a robust 17%, and many kept rising sharply from there.

Squarespace and Oatly are on deck next week to test investor

appetite for sizable, name-brand companies tapping the public

markets. Oatly, backed by celebrities such as Oprah Winfrey and

Natalie Portman as well as private-equity juggernaut Blackstone

Group Inc. and lead investor Verlinvest, is seeking to raise

roughly $1.35 billion in its IPO and targeting a valuation of about

$10 billion.

Squarespace, which is planning a direct listing, boasted an

enterprise value of $10 billion in a March fundraising round.

Oatly is set to begin trading on Thursday, while Squarespace's

listing is planned for Wednesday, according to people familiar with

the matter. While investors will get a health check on the IPO

market in the form of those debuts, Tim Creedon, director of global

equity research at Neuberger Berman, said the issue of inflation is

unlikely to be resolved so quickly.

"The question everyone is trying to get their arms around is

inflation, and what are we willing to pay for growth going

forward," Mr. Creedon said.

Write to Corrie Driebusch at corrie.driebusch@wsj.com

(END) Dow Jones Newswires

May 14, 2021 17:24 ET (21:24 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

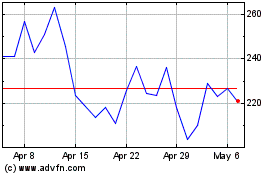

Coinbase Global (NASDAQ:COIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coinbase Global (NASDAQ:COIN)

Historical Stock Chart

From Apr 2023 to Apr 2024