General Mills to Buy Tyson Foods' Pet-Treats Business for $1.2 Billion

May 14 2021 - 7:21AM

Dow Jones News

By Dave Sebastian

General Mills Inc. has agreed to buy Tyson Foods Inc.'s

pet-treats business for $1.2 billion in cash, the companies said, a

deal that would complement General Mills' pet-food unit.

The deal would provide an estimated tax benefit of $225 million,

equating to an effective purchase price of $975 million, General

Mills said Friday. The Tyson unit includes the Nudges, Top Chews

and True Chews brands.

"Pet food is a high-growth category, fueled by the humanization

of pets, a trend that has only increased during the pandemic," said

Bethany Quam, General Mills' group president for the pet

segment.

General Mills said it plans to fund the acquisition with cash on

hand and short-term borrowing. It expects the deal to modestly add

to its earnings in the first year after completion, excluding

transaction and integration expenses.

Tyson said it will continue providing meat ingredients for the

pet-treats business after the deal closes. The pet-treats business

generated more than $240 million for the year ended April 3, the

company said. The business has about 300 employees, who will become

part of General Mills, it added.

Tyson said General Mills is also buying a manufacturing facility

in Independence, Iowa, as part of the deal.

General Mills said it expects the deal to close in its first

quarter of fiscal 2022.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

May 14, 2021 07:06 ET (11:06 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

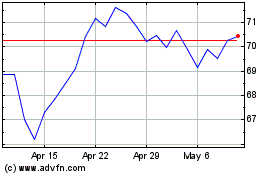

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

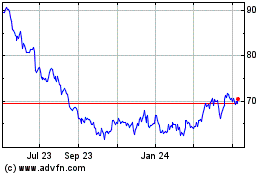

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024