Airbnb's Bookings Improve, Revenue Recovers

May 13 2021 - 4:43PM

Dow Jones News

By Maria Armental

Airbnb Inc. reported more than $10 billion in bookings in the

latest period while revenue recovered from the March 2020 quarter,

when the pandemic devastated the travel industry.

But the company's loss surged to more than $1 billion, driven by

costs related to debt repayment and warrants.

The San Francisco company last year raced to raise money to

weather the crisis, but the warrants it gave investors on those

loans have significantly appreciated, leading to a $292 million

noncash adjustment in the latest period.

Airbnb, whose stock started publicly trading in December,

reported a net loss of $1.17 billion, compared with a $341 million

loss a year ago.

Analysts surveyed by FactSet expected a $717 million loss.

The home-sharing company said the value of all services bought

during the quarter, including cleaning fees and taxes, rose to

$10.29 billion, from $6.77 billion last year. Revenue rose to $887

million from $842 million a year earlier and $839 million in the

comparable 2019 period.

The first quarter is typically the lowest revenue quarter due to

the seasonality of the business, the company said. Still, the

revenue results were better than analysts expected and marked a

significant improvement from the 22% decline in the December

quarter.

Company officials have said they are seeing gradual business

improvement as people appear more willing to book stays, as well as

an uptick in local travel and long-term stays of at least 28

nights, softening the impact from cancellations and falling

bookings as a result of the pandemic.

On Thursday, company officials said that while it was still too

early to give financial projections for the full year, they pointed

to improving trends in April from March in both nights and

experiences booked and gross booking value.

The company said that travel to top cities remains depressed but

noted an increase in family and group travel, especially outside of

cities.

Active listings in nonurban areas rose nearly 30% in the March

quarter from 2019, the company said.

Long-term stays, Airbnb said, accounted for nearly a quarter of

nights booked, before cancellations or alterations, up from 14% in

2019.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

May 13, 2021 16:28 ET (20:28 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

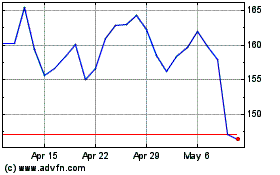

Airbnb (NASDAQ:ABNB)

Historical Stock Chart

From Mar 2024 to Apr 2024

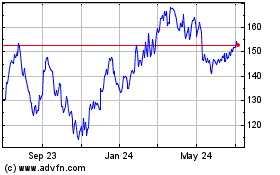

Airbnb (NASDAQ:ABNB)

Historical Stock Chart

From Apr 2023 to Apr 2024