Additional Proxy Soliciting Materials (definitive) (defa14a)

May 10 2021 - 5:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☒ Filed by a Party other than the

Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☒

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material Pursuant to §240.14a-12

|

Agenus Inc.

(Name of

Registrant as Specified In Its Charter)

(Name of Person(s)

Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

(set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials:

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the

previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

Explanatory Note

The following information is being filed to amend and supplement the definitive proxy statement filed on Schedule 14A on April 30, 2021.

We have revised the Beneficial Ownership table to include a stockholder inadvertently omitted from the original filing. The revised table is set forth below.

Ownership By Certain Beneficial Owners

This table shows certain information, based on filings with the SEC, about the beneficial ownership of our capital stock as of April 23,

2021 by each person known to us owning beneficially more than 5% of any class of our capital stock. Unless otherwise indicated in a footnote to this table, each person has the sole power to invest and vote the shares of common stock listed opposite

the person’s name.

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Address of beneficial Owner

|

|

Title of

Class

|

|

Number of Shares

|

|

|

Percent

of Class

|

|

|

Brad M. Kelley

1410 Moran

Road

Franklin, TN 37069-6300

|

|

Common

Series A-1

Preferred

|

|

|

1,591,039

31,620

|

(1)

|

|

|

0.9

100

|

%

%

|

|

Incyte Corporation

1801

Augustine Cut-Off

Wilmington, DE 19803

|

|

Common

|

|

|

14,062,227

|

(2)

|

|

|

6.3

|

%

|

|

RTW Investments LP

412 West

15th Street

New York, NY 10011

|

|

Common

Series C-1

Preferred

|

|

|

14,864,677

10,459

|

(3)

|

|

|

6.7

100

|

%

%

|

|

BlackRock, Inc.

55 East

52nd Street

New York, NY 10055

|

|

Common

|

|

|

14,517,609

|

(4)

|

|

|

6.5

|

%

|

|

Oracle Partners

262 Harbor

Drive - 3rd Floor

Stamford, CT 06902

|

|

Common

|

|

|

11,127,372

|

(5)

|

|

|

5.0

|

%

|

|

Gilead Sciences, Inc.

333

Lakeside Drive

Foster City, CA 94404

|

|

Common

|

|

|

11,111,111

|

(6)

|

|

|

5.0

|

%

|

|

(1)

|

Mr. Kelley owns 31,620 shares of our Series A-1 Convertible

Preferred Stock, our only shares of outstanding Series A-1 preferred stock. These shares have an initial conversion price of $94.86 and are currently convertible into 333,333 shares of our common stock. If

Mr. Kelley had converted all 31,620 shares of Series A-1 Convertible Preferred Stock into shares of common stock as of April 23, 2021 he would have held 1,924,372 shares of our common stock, or 0.9%

of the shares outstanding.

|

|

(2)

|

Based solely upon information set forth on Schedule 13G/A filed with the SEC on February 11, 2021 by

Incyte Corporation.

|

|

(3)

|

Based solely upon information set forth on Schedule 13G/A filed with the SEC on February 12, 2021, by RTW

Investments, LP., RTW Master Fund, Ltd., and one or more of its funds, which are managed by RTW Investments, LP, (collectively, “RTW”), RTW owned 12,864,677 shares of our common stock. On March 24, 2021 RTW converted 2,000 of their

Series C-1 shares owned into 2,000,000 shares of our common stock. RTW also owns 10,459 shares of our Series C-1 convertible preferred stock, which are convertible into

common stock on a one-for-one thousand basis, or 10,459,000 shares of our common stock. Under the

|

|

|

Certificate of Designation of preferences and Rights and Limitations of Series C-1 Convertible Preferred Stock, RTW is limited to holding no greater than

9.99% of our shares of common stock, such limitation may be increased to up to 19.99% 60 days after notice by RTW to the Company. If RTW converted all 10,459 shares of Series C-1 Convertible Preferred Stock

into shares of common stock as of April 23, 2021, it would have held 25,323,677 shares of our common stock, or 10.8% of the shares outstanding.

|

|

(4)

|

Based solely upon information set for the on Schedule 13G filed with the SEC on January 29, 2021 by

BlackRock Inc.

|

|

(5)

|

Based solely upon information set forth on Schedule 13G/A filed with the SEC on February 16, 2021 by

Oracle Partners, LP, a Delaware limited partnership (“Oracle Partners”), Oracle Ten Fund, LP, a Delaware limited partnership (“Oracle Ten Fund”), Oracle Institutional Partners, LP, a Delaware limited partnership

(“Institutional Partners” and, collectively with Oracle Partners and Oracle Ten Fund, the “Oracle Partnerships”), Oracle Investment Management, Inc. Employees’ Retirement Plan, an employee benefit plan organized in

Connecticut (the “Retirement Plan”), Oracle Associates, LLC, a Delaware limited liability company and the general partner of the Oracle Partnerships (“Oracle Associates”), Oracle Investment Management, Inc., a Delaware

corporation and the investment manager to the Oracle Partnerships and the plan administrator to the Retirement Plan (the “Investment Manager”), The Feinberg Family Foundation, a foundation organized in Connecticut (the

“Foundation”), and Larry N. Feinberg, the managing member of Oracle Associates, the sole shareholder, director and president of the Investment Manager and the trustee of the Foundation

|

|

(6)

|

Based solely upon information set forth on Schedule 13G filed with the SEC on January 29, 2019 by Gilead

Sciences, Inc.

|

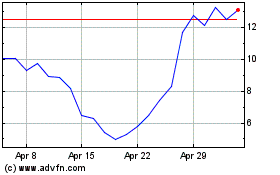

Agenus (NASDAQ:AGEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

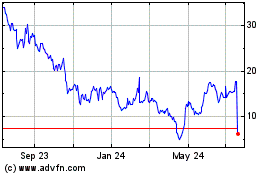

Agenus (NASDAQ:AGEN)

Historical Stock Chart

From Apr 2023 to Apr 2024