Banks Releasing Loan Reserves Face Tricky Accounting Estimates as Economy Improves

May 10 2021 - 8:29AM

Dow Jones News

By Mark Maurer

Banks and other financial institutions are devising how to

release large loan reserves under an accounting rule that

complicates the task of calculating them.

To do so, executives at companies including JPMorgan Chase &

Co. and Citizens Financial Group Inc. are scrutinizing metrics such

as credit quality and loan growth to help estimate the level of

future reserves amid the continuing economic uncertainty.

Many lenders bulked up their loan reserves this time last year

to prepare for potential defaults during the onset of the pandemic,

cutting into profits. Banks' provisions for credit losses totaled

$61.91 billion in the second quarter of 2020, compared with $12.84

billion during the prior-year period, according to the Federal

Deposit Insurance Corp., a federal banking regulator.

Now, investors and analysts are increasingly questioning the

banks on when their reserves will go back to pre-pandemic levels.

But jumping the gun could be dangerous: Lowering reserves too

quickly and then needing to rebuild them could hurt companies'

credibility and reduce income, accountants and advisers say.

Under U.S. accounting standards, companies are required to

forecast expected losses as soon as a loan is issued. The rule,

known as Current Expected Credit Losses, or CECL, went into effect

for large public firms in January 2020, with some of them choosing

to delay implementing it for a year because of the pandemic.

Private and smaller public companies have until 2023 to adopt

CECL.

Companies previously didn't have to book losses until they had

evidence -- such as the default of a borrower -- that the losses

had actually occurred.

CECL particularly impacts financial institutions because loans

comprise a large portion of their assets. The standard also affects

nonfinancial companies with financial assets ranging from loans to

debt securities. Bankers say the rule makes company earnings more

unpredictable. The Financial Accounting Standards Board, which sets

U.S. accounting standards, however, has said the rule more closely

aligns companies' accounting with actual credit risks and provides

investors with more transparency.

The improved economic outlook and soaring markets are leading

banks to slash the funds they held for loan losses, thus boosting

profits. JPMorgan on April 14 said it freed up $5.2 billion in

funds it had allocated to cover soured loans, bringing its reserves

to $25.6 billion. The bank's loan assets totaled $1.01 trillion as

of March 31.

The bank released most of the $5.2 billion in its consumer

credit-card division because certain mortgage delinquencies remain

low and U.S. employment levels have improved, Chief Financial

Officer Jennifer Piepszak said on an earnings call. JPMorgan

declined to comment beyond its filing and the earnings call.

Executives are careful about the amount of reserves they hold

because they are unsure about where the economy is headed, said

Donald Fandetti, a managing director of equity research at Wells

Fargo & Co.'s securities division. The bank on April 14 said it

released about $1.7 billion, bringing its reserves to $18 billion

in the first quarter. "Everybody is leaving a bit of cushion," Mr.

Fandetti said.

Citizens Financial Group also lowered its reserves. The bank on

April 16 said it let out $298 million in the quarter ended March

31, compared with the $463 million it built up during the

prior-year period. Citizens said it made the move because of the

improved economic outlook. The bank's credit-loss provision was

$1.62 billion in 2020, up from an average of $352.3 million during

the previous four years.

The Providence, R.I.-based bank overrode the economic forecasts

it usually relies on from ratings firms and other external

providers to better incorporate economic uncertainty into its

reserve levels, CFO John Woods said. Those forecasts are highly

dependent on factors such as the efficacy of Covid-19 vaccines, Mr.

Woods said.

Citizens is weighing other scenarios to project credit losses,

such as slower vaccination rates and consumer spending, he said.

"That's where the judgment comes in to layer in additional reserve

requirements to deal with some of those contingencies," he

said.

Investors generally like it when banks bring down their reserves

because it frees up capital for lending and investments, said Janet

Pegg, an analyst at research firm Zion Research Group. Continuing

to hold high reserves could signal to the market that a company is

overly pessimistic about its loan book.

The FASB is considering whether to make changes to the standard.

For that, it is consulting companies, investors and other

stakeholders, and plans to host a roundtable discussion on May

20.

Firms that haven't had to implement the rule yet are also

watching closely. Texas Security Bank, a privately held

Dallas-based lender, is studying the techniques that big banks use

to determine their provision for credit losses, CFO Drew Keith

said.

"The big takeaway we have is that you do have to be careful with

the subjective part of it," he said, referring to forecasting

losses under the standard. Mr. Keith said he plans to consider a

mix of different economic forecasts, including those from research

firms Moody's Analytics, a subsidiary of Moody's Corp., and ITR

Economics.

Write to Mark Maurer at mark.maurer@wsj.com

(END) Dow Jones Newswires

May 10, 2021 08:14 ET (12:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

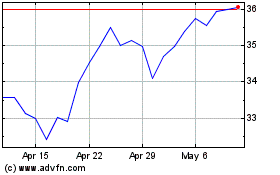

Citizens Financial (NYSE:CFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

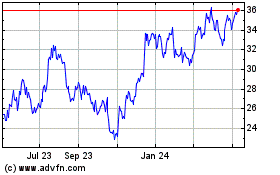

Citizens Financial (NYSE:CFG)

Historical Stock Chart

From Apr 2023 to Apr 2024