UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under Rule 14a-12 |

box,

inc.

(Name of Registrant as Specified in Its Charter)

STARBOARD VALUE LP

STARBOARD VALUE AND OPPORTUNITY MASTER FUND LTD

Starboard

Value and Opportunity S LLC

Starboard

Value and Opportunity C LP

Starboard

Value and Opportunity Master Fund L LP

Starboard

Value L LP

Starboard

Value R LP

Starboard

Value R GP LLC

Starboard

x master Fund LTD

STARBOARD VALUE GP LLC

STARBOARD PRINCIPAL CO LP

STARBOARD PRINCIPAL CO GP LLC

JEFFREY C. SMITH

PETER A. FELD

DEBORAH S. CONRAD

JOHN R. MCCORMACK

XAVIER D. WILLIAMS

(Name of Persons(s) Filing Proxy Statement, if

Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

Starboard Value LP, together

with the other participants named herein (collectively, “Starboard”), intends to file a preliminary proxy statement and accompanying

WHITE proxy card with the Securities and Exchange Commission (the “SEC”) to be used to solicit votes for the election of a

slate of highly-qualified director nominees at the 2021 annual meeting of stockholders (the “Annual Meeting”) of Box, Inc.,

a Delaware corporation (the “Company”).

On May 10, 2021, Starboard

issued the following press release and delivered the following letter to the stockholders of the Company. The full text of the letter

is also attached hereto as Exhibit 1 and is incorporated herein by reference.

STARBOARD

NOMINATES SLATE OF HIGHLY QUALIFIED DIRECTOR CANDIDATES FOR ELECTION AT BOX’s 2021 annual MEETING

NEW YORK, NY – May 10, 2021 /PRNewswire/

-- Starboard Value LP (together with its affiliates, “Starboard”), one of the largest stockholders of Box, Inc. (“Box”

or the “Company”) (NYSE: BOX), with an ownership interest of approximately 8% of the Company’s outstanding shares, today

announced in an open letter to Box stockholders that it has nominated a slate of highly qualified director candidates for election to

Box’s Board of Directors at the Company’s 2021 Annual Meeting of Stockholders.

The full text of Starboard’s open letter to Box stockholders

follows and can also be viewed at the following link: https://www.starboardvalue.com/wp-content/uploads/Starboard_Value_LP_Nomination_Letter_to_BOX_Stockholders_05.10.2021.pdf

A LETTER TO THE STOCKHOLDERS OF BOX, INC.

May 10, 2021

Dear Fellow Stockholders,

Starboard Value LP (together with its affiliates,

“Starboard” or “we”) currently owns approximately 8.0% of the outstanding common stock of Box, Inc. (“Box”

or the “Company”), making us one of the Company’s largest stockholders. We have been stockholders for over two years,

and our interests are directly aligned with yours. Our goal is to help drive significant value creation for the benefit of all Box stockholders

following years of substantial underperformance.

Starboard has a long and successful history of

investing in underperforming companies in the technology sector and helping these companies to drive significant operational, financial,

and strategic improvements. We originally invested in Box due to the Company’s strong market position as the best-of-breed solution

in cloud content management, as well as its significant valuation discount to peers due to years of missed expectations, poor results,

and generally poor governance. Our investment thesis focused on a clear opportunity to drive profitable growth, improved capital allocation,

and enhanced governance in order to address the significant valuation gap between Box and its closest peers. Unfortunately, despite repeated

promises by management and the Board to address these issues over the past two years and to create shareholder value, performance has

not sufficiently improved and Box is still deeply undervalued versus its peers. In fact, the valuation gap has further widened during

this time.

We believe opportunities for improvement still

exist today, and our goal is to work with Box to help the Company finally deliver on its promises. As we stated in our May 3rd

letter to stockholders, we have been privately communicating with the Board and management team for the past two years, during which time

we have highlighted our concerns and perspectives regarding a litany of issues and opportunities. Despite our efforts to engage constructively,

not enough progress has been made to put Box on a better path. To make matters worse, the Company has made several poor capital allocation

decisions, including its recent entry into a financing transaction that we believe serves no business purpose and was done in the face

of a potential election contest with Starboard at the 2021 Annual Meeting of Stockholders (the “Annual Meeting”) in order

to “buy the vote” and dilute the voice of common stockholders. This transparent act of entrenchment by the Board should not

go unchecked and we believe indicates a clear need for common stockholders to strongly unite with a louder voice to protect the stockholders.

While last year we were pleased to reach agreement

on the appointment of two new independent director candidates, it is now clear that those appointments have not created enough change.

We believe our continued involvement is critical to ensure that Box has the appropriate oversight to help guide the Company through a

transformation to become a best-in-class software company.

Therefore, in accordance with the Company’s

governance deadlines and in order to preserve our rights as stockholders, we have delivered a formal notice to Box nominating four highly

qualified director candidates (the “Nominees”) for election to the Board at the Annual Meeting.

When evaluating potential director candidates,

we looked to craft a diverse slate of directors who have a set of skills and backgrounds that, in the aggregate, provide expertise that

we believe will be additive to the Board. As you can see from our Nominees’ detailed biographies in the following pages, these extremely

impressive director candidates have backgrounds spanning operations, finance, private equity, engineering, marketing, mergers and acquisitions,

restructuring, strategic transformation, and public company governance.

As a group, our Nominees have substantial and

highly successful experience across the technology industry. Collectively, they have decades of experience as CEOs, senior executives,

board chairs, and directors of well-performing technology companies. We are confident you will find the slate of professionals we are

nominating to be incredibly well-qualified to serve as directors of Box. Most importantly, this group of Nominees, if elected, is prepared

to serve the stockholders of Box and ensure that the interests of all stockholders are of paramount importance.

As we stated in our prior letter, we have attempted

to engage with the Board constructively and in good faith, in hopes of reaching an acceptable outcome so that we can work together to

represent the best interests of all stockholders. While the Board has thus far refused our attempts to work together, we remain open-minded

about reaching a mutually agreeable solution with Box and will continue our dialogue with the Company.

Our goal is to represent the best interests of

all stockholders, and we believe that our Nominees have the experience and track record to drive the much needed oversight and accountability

at Box that will put the Company on a path to significant long-term value creation. Over the coming weeks and months, we intend to share

our detailed views on, and plans for, Box, and we look forward to engaging with you as we approach the Annual Meeting.

Thank you for your consideration and support.

Respectfully,

/s/ Peter A. Feld

Peter A. Feld

Managing Member

Starboard Value LP

BIOGRAPHIES OF THE NOMINEES ARE ON THE FOLLOWING PAGES

Biographies of Starboard’s Nominees

(in alphabetical order):

|

Deborah S. Conrad |

▪ |

Ms. Conrad previously served as Corporate Vice President and Chief Marketing Officer at Intel Corporation. Ms. Conrad had an extensive career spanning 27 years at Intel, where she held senior positions of increasing responsibility across multiple areas, including marketing, communications, brand management, and business development. |

| ▪ |

Ms. Conrad currently serves as the Interim Chief Marketing Officer at NovaSignal, a medical technology company, as an Executive Advisory Board Member for BioIQ, a healthcare technology company, and as a Strategic Advisor at Grand Rounds, a healthcare technology company. |

| ▪ |

Ms. Conrad also has extensive private board experience, having previously served on the

Board of Directors of the Intel Foundation, a private corporate foundation established by Intel, and Samasource (n/k/a Sama), a data

production company for artificial intelligence and machine learning, among others.

|

| |

|

Peter A. Feld |

▪ |

Mr. Feld is a Managing Member and Head of Research at Starboard Value LP. Prior to founding Starboard, he was a Managing Director at Ramius and a Portfolio Manager at Ramius Value and Opportunity Master Fund Ltd. |

| ▪ |

Mr. Feld currently serves as Chair of GCP Applied Technologies and a director of NortonLifeLock and Magellan Health. |

| ▪ |

Mr. Feld previously served as a director of AECOM, Marvell Technology, Brink’s, Insperity, Darden Restaurants, and Integrated Device Technology, among others.

|

| |

|

John R. McCormack |

▪ |

Mr. McCormack previously served as CEO of Websense, both while it was publicly traded and following a take-private transaction by Vista Equity, and led the company through a successful sale to Raytheon. |

| ▪ |

Mr. McCormack previously served as the Chair and CEO of AppRiver and as the Chair and Interim CEO of Fidelis Cybersecurity. |

| ▪ |

Mr. McCormack currently serves as a director of Ping Identity and a director of Forcepoint, a privately held company. He is also an Operating Partner at TELEO Capital Management.

|

| |

|

Xavier D. Williams |

▪ |

Mr. Williams currently serves as CEO and a director of American Virtual Cloud Technologies, a leading publicly traded cloud communications and information technology services provider. |

| ▪ |

Mr. Williams previously had an extensive career spanning almost 30 years at AT&T, culminating in his role as President of AT&T’s Public Sector & First Net. |

| ▪ |

At AT&T, he served in various capacities and positions

of increasing responsibility, across multiple areas, including finance, product management, strategy, sales, human resources, global

operations and customer service, including previous roles as President of Business Operations, President of Global Public Sector &

Wholesale Markets, and President of Government Solutions & National Business, among others.

|

About Starboard Value LP

Starboard Value LP is a New York-based investment

adviser with a focused and fundamental approach to investing in publicly traded U.S. companies. Starboard seeks to invest in deeply undervalued

companies and actively engage with management teams and boards of directors to identify and execute on opportunities to unlock value for

the benefit of all shareholders.

Investor contacts:

Peter Feld, (212) 201-4878

Gavin Molinelli, (212) 201-4828

www.starboardvalue.com

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Starboard Value LP, together with the other participants

named herein (collectively, "Starboard"), intends to file a preliminary proxy statement and accompanying WHITE proxy card with

the Securities and Exchange Commission ("SEC") to be used to solicit votes for the election of a slate of highly-qualified director

nominees at the 2021 annual meeting of stockholders of Box, Inc., a Delaware corporation (the "Company").

STARBOARD STRONGLY ADVISES ALL STOCKHOLDERS OF

THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN

THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD

BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

The participants in the proxy solicitation are

anticipated to be Starboard Value and Opportunity Master Fund Ltd (“Starboard V&O Fund”), Starboard Value and Opportunity

S LLC (“Starboard S LLC”), Starboard Value and Opportunity C LP (“Starboard C LP”), Starboard Value and Opportunity

Master Fund L LP (“Starboard L Master”), Starboard Value L LP (“Starboard L GP”), Starboard Value R LP (“Starboard

R LP”), Starboard Value R GP LLC (“Starboard R GP”), Starboard X Master Fund Ltd (“Starboard X Master”),

Starboard Value LP, Starboard Value GP LLC (“Starboard Value GP”), Starboard Principal Co LP (“Principal Co”),

Starboard Principal Co GP LLC (“Principal GP”), Jeffrey C. Smith, Peter A. Feld, Deborah S. Conrad, John R. McCormack and

Xavier D. Williams.

As of the date hereof, Starboard V&O Fund

beneficially owns directly 6,872,443 shares of Class A Common Stock, par value $0.0001 per share, of the Company (the “Common Stock”).

As of the date hereof, Starboard S LLC directly owns 1,275,334 shares of Common Stock. As of the date hereof, Starboard C LP directly

owns 746,496 shares of Common Stock. As of the date hereof, Starboard L Master directly owns 652,637 shares of Common Stock. Starboard

L GP, as the general partner of Starboard L Master, may be deemed the beneficial owner of the 652,637 shares of Common Stock owned by

Starboard L Master. Starboard R LP, as the general partner of Starboard C LP, may be deemed the beneficial owner of the 746,496 shares

of Common Stock owned by Starboard C LP. Starboard R GP, as the general partner of Starboard R LP and Starboard L GP, may be deemed the

beneficial owner of an aggregate of 1,399,133 shares of Common Stock owned by Starboard C LP and Starboard L Master. As of the date hereof,

Starboard X Master directly owns 1,336,220 shares of Common Stock. As of the date hereof, 2,130,533 of Common Stock were held in an account

managed by Starboard Value LP (the “Starboard Value LP Account”). Starboard Value LP, as the investment manager of each of

Starboard V&O Fund, Starboard C LP, Starboard L Master and Starboard X Master and the Starboard Value LP Account and the manager of

Starboard S LLC, may be deemed the beneficial owner of an aggregate of 13,013,663 shares of Common Stock directly owned by Starboard V&O

Fund, Starboard S LLC, Starboard C LP, Starboard L Master, Starboard X Master and held in the Starboard Value LP Account. Each of Starboard

Value GP, as the general partner of Starboard Value LP, Principal Co, as a member of Starboard Value GP, Principal GP, as the general

partner of Principal Co and Messrs. Smith and Feld, as members of Principal GP and as members of each of the Management Committee of Starboard

Value GP and the Management Committee of Principal GP, may be deemed the beneficial owner of 13,013,663 shares of Common Stock directly

owned by Starboard V&O Fund, Starboard S LLC, Starboard C LP, Starboard L Master, Starboard X Master and held in the Starboard Value

LP Account. As of the date hereof, Messrs. McCormack and Williams and Ms. Conrad do not own any shares of Common Stock.

4

This regulatory filing also includes additional resources:

nomination_letter.pdf

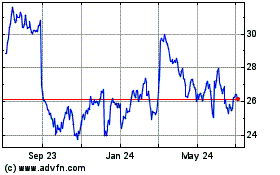

Box (NYSE:BOX)

Historical Stock Chart

From Mar 2024 to Apr 2024

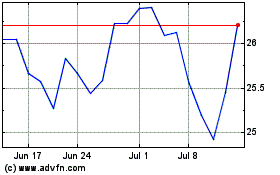

Box (NYSE:BOX)

Historical Stock Chart

From Apr 2023 to Apr 2024