By Dave Michaels and Alexander Osipovich

WASHINGTON -- The electronic-trading firms Citadel Securities

and Virtu Financial Inc. have become pillars of the stock market in

recent years, rivaling the role played by stock exchanges.

Wall Street's new top regulator is putting pressure on them by

questioning a key service they provide: executing the orders of

millions of ordinary investors whose trades go to their black

boxes, instead of being routed to public exchanges.

Testifying before Congress last week, Securities and Exchange

Commission Chairman Gary Gensler criticized the system that funnels

orders to Citadel Securities and Virtu, which pay for the

opportunity to trade with retail stock and options orders. Mr.

Gensler said such incentives -- called payment for order flow --

represent a conflict of interest for online brokerages, which

collectively make billions of dollars a year from the practice. He

voiced concern that the trading firms handling most individual

investors' orders control too much of the business.

In an interview with CNBC on Friday, Mr. Gensler went further,

comparing the retail wholesalers unfavorably with public exchanges

whose prices are considered "lit" because they appear publicly for

all traders to see.

"A lot of these are really just going to the wholesalers, they

are not as lit, they're not as competitive," he said. "So it's not

as clear we are actually getting best execution in an unlit,

internalized wholesaler as contrasted to the lit markets."

It is unclear whether the SEC would go as far as banning payment

for order flow. Doing so would make it harder for brokerages to

offer zero-commission trading, and the agency has reviewed the

practice several times in the past without prohibiting it. Brokers

and traders say routing orders to wholesalers benefits

investors.

People close to Mr. Gensler said his regulatory instincts come

from his long experience in markets, including years at Goldman

Sachs Group Inc. Mr. Gensler puts more trust in regulated trading

venues that post prices publicly and is generally skeptical of

less-transparent systems that give intermediaries more power to set

prices.

"He is certainly looking at it more critically than the SEC has

in recent years," said Larry Harris, a University of Southern

California professor and former SEC chief economist. "Gary has

correctly identified a serious conflict of interest between the

interests of the broker and of its clients."

In the first three months of 2021, Citadel Securities paid more

than $475 million to brokers for handling their customers' stock

and option orders, making it the biggest source of payment for

order flow, according to Bloomberg Intelligence. Among the largest

recipients of such payments were TD Ameritrade, owned by Charles

Schwab Corp., and Robinhood Markets Inc.

Payment for order flow has surged as day trading has grown more

popular during the Covid-19 pandemic and as U.S. brokerages have

dropped upfront commissions, making them lean more on selling order

flow to generate revenue. The practice has also drawn fresh

scrutiny after social-media-fueled trading frenzies in stocks such

as GameStop Corp. earlier this year.

Wholesalers pay brokers for the orders, but also offer slightly

better trading prices than the brokers would get on exchanges,

benefiting investors. Citadel Securities, the largest wholesaler,

said it provided individual investors with nearly $1.1 billion in

such "price improvement" on equities and options trades in the

first quarter. The firm recently floated proposals that could help

exchanges win back a greater share of volume that is currently

executed on less-transparent venues.

The SEC has long allowed payment for order flow, considering it

beneficial for investors, and its use coincides with a drop in

retail trading costs.

Payment for order flow can offer less transparency than exchange

trading, and its importance becomes even more apparent during bouts

of extreme volatility. During one day at the peak of the GameStop

frenzy in January, Citadel Securities executed 7.4 billion shares

on behalf of individual investors -- more than the average daily

volume of the entire U.S. stock market in 2019. On some recent

days, more than 50% of equities trading volume has taken place

outside of public stock exchanges. That threshold was crossed for

the first time in December, largely because of the growing role of

retail wholesalers.

Some have said payment for order flow poses conflicts of

interest for brokerages such as Robinhood, whose revenue from

selling orders is partially offset by how much price improvement

goes to their customers. That means they can either choose more

revenue for themselves or better prices for their customers' stock

trades.

The SEC typically addresses conflicts of interest by requiring

clear disclosure about potential problems. Retail brokerages

already report how much money they earn from payment for order

flow. Robinhood reported $331 million in revenue from the practice

in the first quarter of 2021, more than triple the level from a

year earlier.

Mr. Gensler said Friday on CNBC that "disclosure alone may not

do it." Some countries, such as Canada and the United Kingdom, ban

payment for order flow, he added.

To address the conflict of interest, the regulator could require

brokerages to pass the payments they receive from wholesalers to

their customers, said Mr. Harris, who is on the board of

Interactive Brokers Group Inc. Alternatively, banning the payments

would force wholesalers to compete for orders through offering more

price improvement, he added.

Mr. Gensler has suggested that lack of competition might hamper

how payment for order flow works. Citadel Securities executes 47%

of all retail trades in listed securities, while Virtu has about

25% to 30% of that market share.

"We are going to take a close look at how the market structure

can work best, be most efficient and protect investors," Mr.

Gensler said on CNBC on Friday.

Citadel Securities was a beneficiary of Mr. Gensler's regulatory

moves when he served as chairman of the Commodity Futures Trading

Commission from 2009 to 2014. At the CFTC, Mr. Gensler pushed most

trading of swaps -- derivatives that emulate exposure to assets

such as bonds and currencies -- onto electronic trading platforms

where multiple parties can compete to offer lower prices, instead

of having the contracts arranged privately by big banks.

"Competition and transparency is contrasted to darkness and

concentration," Mr. Gensler said Friday. "That is the balancing.

Bring transparency and competition into markets -- that is good for

investors, that is good for issuers."

Write to Dave Michaels at dave.michaels@wsj.com and Alexander

Osipovich at alexander.osipovich@dowjones.com

(END) Dow Jones Newswires

May 09, 2021 12:14 ET (16:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

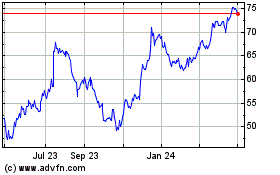

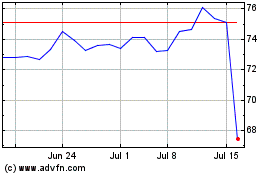

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024